eXtended Planning & Analysis (xP&A) Software

Unify Fragmented Planning Processes and Solutions

Related Resources

Industry Recognition

FAQ

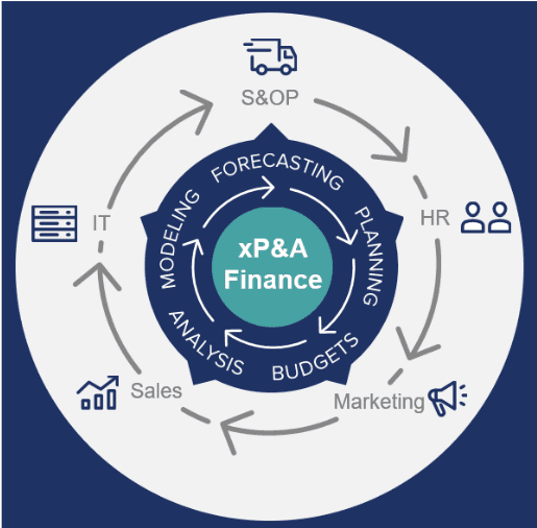

As organizations take steps to inspire a data-driven, performance-based culture, Finance teams are redefining the mission of the Office of Finance by embracing the next evolution of processes and tools. The emergence of xP&A stands to transform traditional FP&A by extending collaboration with business partners and alignment of granular operational plans with financial goals. What does this mean?

- The “lines” between operational and financial planning no longer exist.

- Going forward, Finance teams will now be expected to serve as strategic business partners and help drive plans for Merchandising, Sales and Marketing, and Operations.

- Finance must intelligently align these granular plans with the broader consolidated financial plans – and do it seamlessly and at scale.

CFO Dive defined XP&A as the idea that planning should go beyond traditional finance data to include the kind of data from all functions of the business that align with company goals. The key understanding what each function area is driving towards, how its goals contribute to the overall organization’s success, and then identify the data that measure each function area’s performance against its goals

Traditional FP&A

- Annual Planning/Quarterly Forecasting

- High-Level Financial Plan

- Data Siloes & Disparate Systems

- Top-Down/Bottom-Up

- Dependent on Expertise of Planners

New xP&A

- Continuous, Real-Time Planning & Forecasting

- Granular Operational Models & Solutions

- Unified Platform for Planning

- Driver-Based Simulations, Scenario Planning

- Augmented with Predictive Forecasting & AI/ML

According to Gartner, by 2024, 70% of new financial planning and analysis projects will become extended planning and analysis (xP&A) projects, extending their scope beyond the finance domain into other areas of enterprise planning and analysis. xP&A involves looking at more varied types of data to allow for greater visibility into operations and better organizational decision-making.

For organizations beginning their XP&A journey, now is the perfect time for Finance teams to conquer the complexities of their “connected finance” processes. To move away from siloed decision-making. And to respond rapidly and effectively to the pace of change around them.

An effective XP&A platform also requires a unique set of features to technically enable real-time collaboration between Finance and Operations leaders in order to optimize performance. Here are some of the key features to consider as part of the due-diligence process:

- Extensibility: An extensible platform enables Sales, Product Management, Marketing and Operations to plan at a granular level, such as a business driver, while still adhering to a corporate standard for consolidated reporting.

- Data Blending: Data blending aligns both cube and relational database technology to XP&A processes by enabling users to develop operational plans that dynamically impact financial statements in real-time.

- Financial Data Quality: Financial data quality adds depth to variance analysis and business insights by providing transparency and drill-through back to source systems and guided workflows to ensure accuracy when moving data between source systems.

- Purpose-Built Solutions for Sales, Operations and HR: These solutions generate value for business partners with specific solutions that capture plans at the opportunity level (Sales planning), by capital project (Operations) and with detailed human capital data (HR).

- Flexible Reporting and Analysis: Once detailed plans are complete, Finance and business leaders can build scenarios, conduct sensitivity analysis and leverage dashboards to align financial and business plans for executive reviews.

Get Started With a Personal Demo