With Tax accounting a major cause for financial restatements and reported material weaknesses, CFO’s and Audit committees are demanding innovation. Despite oversight and internal controls required from Sarbanes Oxley (SOX), growing public scrutiny for corporations to pay their “fair share” of taxes has senior executives seeking more transparency into strategic tax planning, provision, and compliance activities to ensure organizational interpretations and practices are defensible.

Additionally, while CFOs create agility and re-deploy resources from the back office directly into the lines of business, leaders are looking at tax departments, who have been traditionally underserved by enterprise performance management solutions, to improve speed and productivity.

However, as many as 90% of companies rely on spreadsheets for the tax provisioning process, adding risk and complexity to the financial close. Gathering data from fragmented solutions, reconciling to source systems, and reviewing detailed tax calculations in large global companies can add as much as 5 days to quarter-end financial reporting.

The financial close cycle impacts almost every function across the sophisticated enterprise. While CFOs push to shorten close cycles to address their own analysis and reporting needs, empowering the business with real-time data and insights is an organization-wide initiative. In fact, modern finance leaders are often tasked to lead efforts to democratize data – enabling business partners in sales, operations, marketing and HR to draw insights, inform plans and make critical decisions.

Aligning Tax Provision with Financial Reporting

Purpose-built software solutions offer strong benefits for tax departments to consider when evaluating options to modernize. Like with any technology investment, there are many important factors to consider. Here are a few considerations:

- Does the tax trial balance data come from a single, unified application?

- Does the solution provide the ability to create unique tax hierarchies with drill through back to source data?

- Does the application include guided workflow and process controls to manage the flow of data, adjustments, and reviews through each phase of the tax provisioning process?

A purpose-built tax provision software can materially decrease accounting close cycles while delivering increased accuracy and transparency — however, aligning tax provision with financial consolidation and reporting can add additional benefits. By leveraging a single, unified platform with guided workflow and process controls, tax teams can mitigate risks associated with using disparate data sources and spreadsheets – and drive a higher return on investment.

OneStream’s Tax Provision Solution

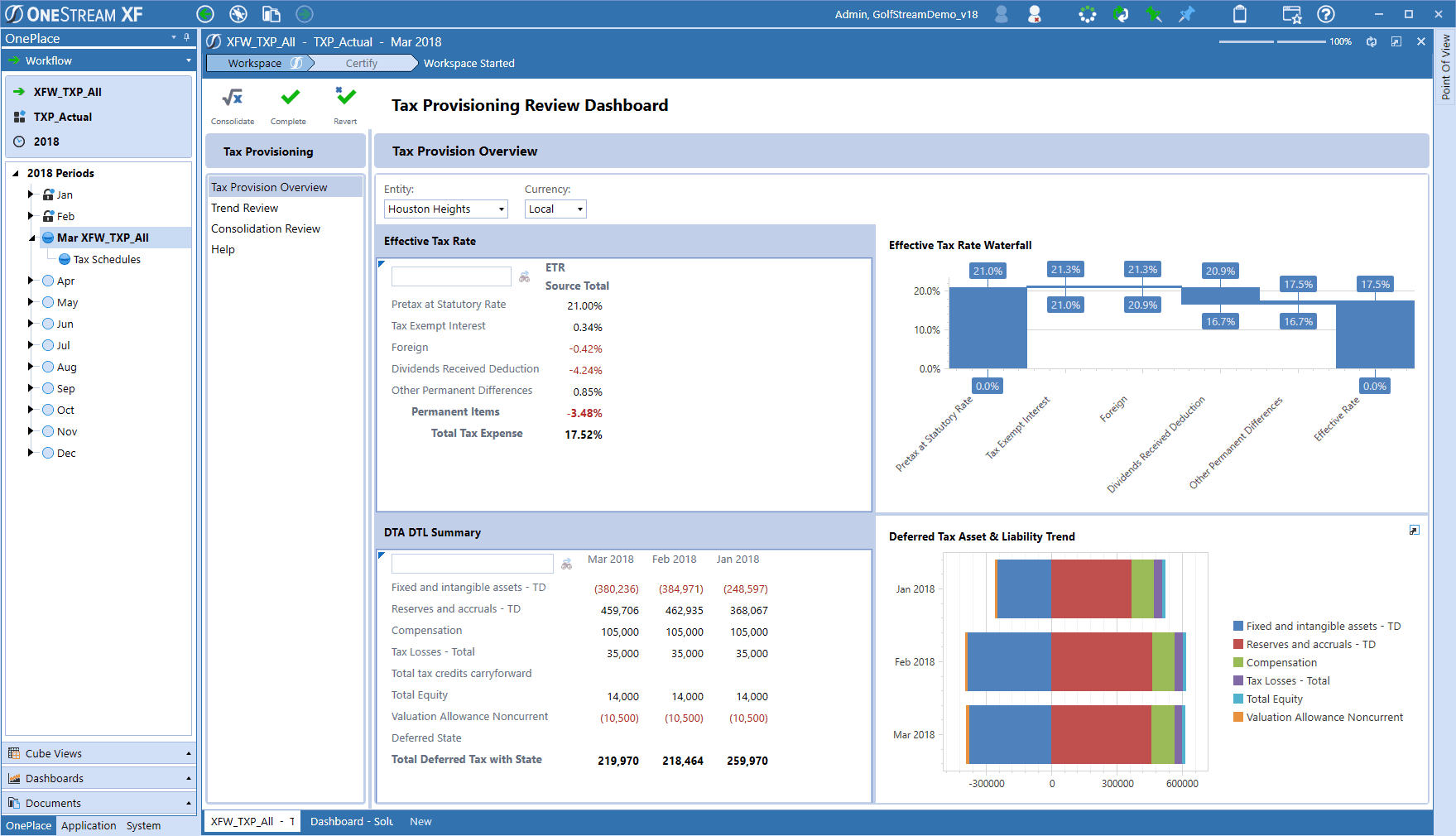

The OneStream XF MarketPlace enables customers to extend the value of their investment with over 50 purpose-built business and productivity solutions to address complex processes across the enterprise. The OneStream Tax Provision Solution accelerates time to value by eliminating spreadsheets and disconnected point solutions from the tax provisioning process, offering several benefits for tax departments:

- Reduce Risk – Automate and streamline tax data collection and validation, and ensure consistency in tax calculations

- Report Transparently – Report consolidated and statutory ETR with full drill-down into supporting details, and generate footnotes and management reporting

- Increase Efficiency – Synchronize data and minimize reconciliation, automate reporting and export data to tax compliance systems

Manage the entire provisioning process with OneStream’s Tax Provision Solution. Recreate and configure tax input forms, manage workpapers, and create executive financial reporting all in one unified application.

Learn More

To learn more about OneStream’s Tax Provision Solution, download our eBook and/or contact your local OneStream Account Executive.

Get Started With a Personal Demo