Modern businesses – those with huge in-person offices, those working remotely and every business between the two – are run on the cloud. In the process, a lot of software is used, but none can be considered more important than financial close & consolidation software.

Every organization must produce and file financial results. That process can entail loading data from multiple global entities, consolidating complex ownerships, reconciling thousands of accounts and matching detailed transactions, and more.

But whatever processes are involved, one thing is certain: Choosing the right EPM software with best-in-class capabilities for each process is vital. Why? The right software enables an organization to move away from unreliable, inadequate EPM applications and/or spreadsheets.

In this article, we’ll compare two great options in the financial close & consolidation space: OneStream and Oracle HFM. Now let’s dive in, so you can zero in on the best forward-looking choice for your business.

OneStream vs. Oracle HFM: What Is OneStream?

OneStream is the only solution for EPM delivering end-to-end management of enterprise-wide consolidation, close, financial, and operational planning & forecasting in a uniquely unified platform. With it, Finance and Operations teams can collaborate by creating a single source of truth that eliminates a host of time-consuming or costly aspects of legacy EPM solutions:

- Complexity of multiple solutions, interfaces and integrations

- Cost and duplication of data and metadata,

- Time-consuming processes

- On premise upgrades

OneStream is how Finance teams can stop wrangling data and start making more of an impact on the business. In fact, OneStream is the only Enterprise Finance platform that does all three of the following:

- Unifies all financial and operational data

- Embeds AI for better decisions and productivity

- Allows organizations to keep adding capabilities without adding technical debt

OneStream vs. Oracle HFM: What Is Oracle HFM?

Oracle HFM was originally Hyperion Financial Management. It was launched in 2005 as an on-premise client server solution-based financial consolidation and reporting solution. Globally, HFM was widely adopted by medium to large organizations. Why? It was one of only a few applications that could handle much of the complexity in processes demanded by these organizations. While budgets and forecasts could be loaded to HFM, it couldn’t run some of the more advanced processes – often forcing organizations to purchase a separate budgeting, planning and forecasting tool.

The Oracle HFM user community is declining and this raises questions for the longer term.

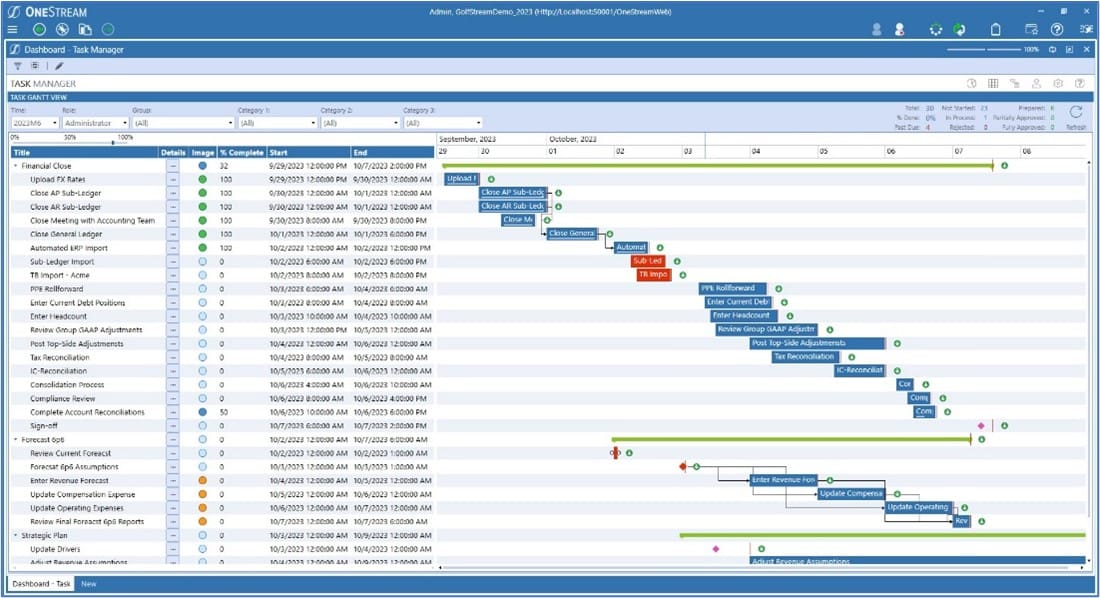

OneStream vs. Oracle HFM: OneStream Features

- Advanced Financial Close Management: Guided Workflow and Task Management solution with Close Calendar

- Superior Dimensional Capability: 10 standard + 8 reusable custom dimensions, Extensible Dimensionality to handle different levels of detail

- Innovation: Modern cloud-based product utilizing latest technology & user experience

OneStream vs. Oracle HFM: Oracle HFM Features

- Strong Dimensional Capability: 8 standard dimensions, plus configurable custom ones

- Advanced Data Integration: Flat file, direct and drill-back through FDM

- Consolidations: Full consolidation logic – proportional, organization by period for ownership changes over time

OneStream vs. Oracle HFM: Which Is Better?

OneStream is the only solution for EPM delivering end-to-end management of enterprise-wide consolidation, close, financial and operational planning & forecasting in a unified platform. This platform helps Finance and Operations teams collaborate by creating a single source of truth. With OneStream, you can thus eliminate the complexity of multiple solutions, interfaces and integrations; cost and duplication of data and metadata; time-consuming processes; and upgrades.

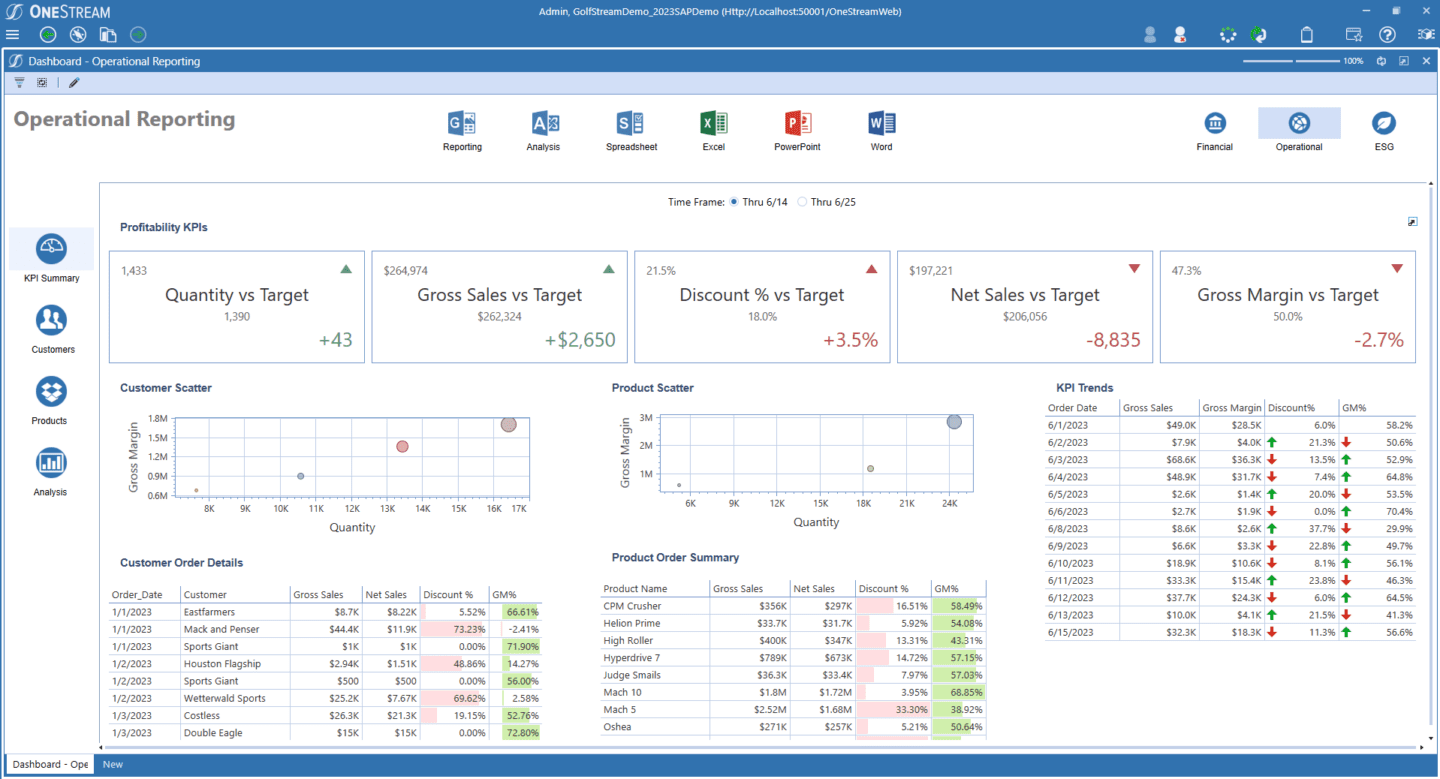

OneStream ultimately puts Finance in full control. How? By providing a strong, flexible foundation for close, consolidation, planning, reporting and analysis with superior data quality that’s ERP and source system agnostic. And the platform delivers it as real-time as needed, with drill down and drill back to any source. With those capabilities, Finance gets not only auditability across all processes but also actionable insights behind every number.

OneStream delivers the following:

- One uniquely unified EPM solution owned by Finance for end-to-end management of enterprise-wide consolidation; close; financial and operational planning and forecasting; reporting; and analysis.

- Built-in data quality engine – providing a strong, flexible foundation in integration and data quality that delivers confidence, trust and a single source of truth.

- Guided workflows and task management for standard, defined, and repeatable close, planning, and operational processes – simplifying complexity by guiding users through all data management, data collection, verification, approval, certification, locking, reporting and analysis processes.

- Built-in self-service reporting, dashboarding, ad-hoc analysis and deep integration with Microsoft Office in one platform – from balance to transactional details with seamless drill down and drill back to supporting details for transparency, auditability and actionable details behind every number.

To be sure, Oracle HFM excelled when it comes to the consolidated financial results of global organizations. However the HFM user community is declining, and the solution is not a latest generation fully unified EPM platform.

Conclusion

Oracle HFM offered unique features and benefits, catering to the diverse needs of organizations across industries. However, for a current, fully supported solution that streamlines key Finance processes and significantly increases confidence in reporting, OneStream is the best unified EPM software. It’s equipped to handle all your requirements, no matter how complex.

Learn More

To learn more about how organizations are managing the complexity in their EPM processes, check out our whitepaper titled Taking Performance Management to the Next Level with Intelligent Finance.

And if you’re ready to take the leap from spreadsheets or legacy EPM solutions and start your Finance Transformation with OneStream, let’s chat!

Learn MoreIntroduction

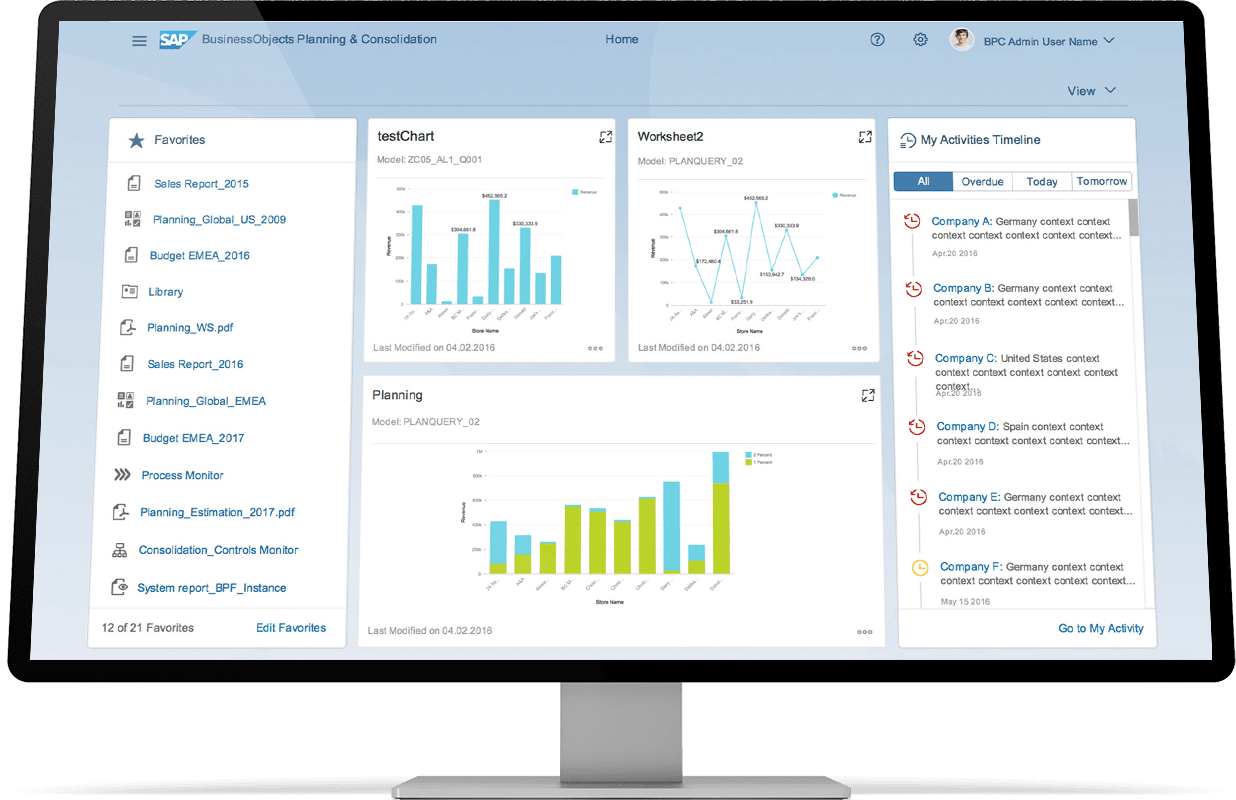

Global organizations have relied on SAP BPC (SAP Business Planning and Consolidation) for their financial consolidation and planning needs. Unfortunately, the end-of-support for SAP BPC has been updated and set for 2030. Organizations are thus exploring modern SAP BPC competitors that offer the same capabilities. Yet those alternatives must also meet the challenges of complex global consolidation requirements, broader close capabilities (e.g., account reconciliations), and financial & operational planning scenarios, with the volumes of data needed to support those processes.

Organizations are looking to finally deliver on the promise of one source of truth. To unify the full consolidation and close lifecycle and financial & operational planning with built-in dashboarding, reporting and analysis, from the balance to the transaction level in one solution. Ultimately, the goal is a single solution that meets the requirements of modern organizations and grows with them to meet future requirements.

In this article, we’ll review SAP BPC competitors to examine the key features, capabilities and pros/cons. We aim to give you the information needed to make an informed decision about the right SAP BPC alternative for your organization.

What Is SAP BPC?

SAP BPC was developed to bring together consolidations and planning into one Excel-based interface to ensure familiarity among Finance professionals. With built-in financial intelligence, SAP BPC helped Finance streamline consolidations and produce consolidated Profit & Loss, Balance Sheet and Cash Flow statements. Because of its Excel-based interface, ability to cover multiple planning scenarios and a common data model, organizations were able to run their planning and forecasting scenarios and reconcile plans to actuals for variance reporting and analysis.

With SAP BPC end-of-support set for 2030, many organizations have either already selected or are currently in various stages of selection processes to find SAP BPC alternatives.

To produce this article, we evaluated numerous reviews and analyst reports, which serve as the typical starting point for selecting the right CPM/EPM platform. We then evaluated alternatives based on five key criteria:

- End-to-end management of enterprise-wide consolidation, close, and financial & operational planning and forecasting

- Built-in data quality engine, in the hands of Finance, to provide a strong, flexible foundation in integration and data quality

- Ultimate agility to adapt to varying levels of granularity in the business and across consolidation, planning and forecasting processes

- Optimized end-user experience to drive efficiency and effectiveness, eliminating time-consuming and error-prone manual processes

- Trusted insights from the balance to transaction level with transparency, auditability and actionable details behind every number

Now let’s dive into an overview of the key features, highlights and benefits of SAP BPC for consolidation and planning. To help you find the right solution for your organization, we’ll cover the pros/cons and alternatives. Looking for more information on other top CPM/BPM software? Check out our review: 5 Best SAP BPC Alternatives for 2024.

What Was SAP BPC Used For?

For decades, global organizations have relied on solutions such as SAP BPC for global consolidations and planning processes. SAP BPC had built-in financial intelligence to streamline consolidations so that Finance could produce consolidated Profit & Loss, Balance Sheet and Cash Flow statements. In addition, SAP BPC had built-in planning capabilities (e.g., spreading) to streamline the planning user input during planning processes.

However, SAP BPC never delivered on the promise of one solution. Most customers needed to manage separate consolidation and planning applications. Then, these applications would need to be integrated. Additional applications were often needed to bring everything together for analysis and variance reporting.

SAP BPC Key Features

SAP BPC is known for several key capabilities:

- Financial Consolidation: Facilitates financial consolidation processes, helping companies streamline reporting, eliminate errors and stay compliant with regulatory requirements

- Financial Planning: Enables business planning to create detailed budgets and forecasts, incorporating various factors (e.g., historical data, market trends and business objectives)

- Workflow: Automates workflow processes related to planning, budgeting and consolidation, reducing manual effort and improving efficiency

- Reporting and Analysis: Delivers reporting and analysis capabilities, allowing users to generate customizable reports, perform ad-hoc analysis and gain insights into financial performance

- Data Integration: Integrates with various data sources – including ERP systems, databases and spreadsheets – bringing all financial data for consolidations, planning, reporting and analysis into one solution

SAP BPC Pros

- One application to manage financial consolidation and planning processes

- Built-in financial intelligence and workflows to streamline consolidation and planning processes

- Flexible deployment and integration options with SAP systems and tools

SAP BPC Cons

- SAP BPC is in end-of-support, set for 2030

- A lack of feature parity in future solutions to replace SAP BPC (Group Reporting for consolidations requiring S/4HANA to be implemented first, SAC for planning)

SAP BPC Alternatives

Enterprises today are looking to replace SAP BPC with more modern, cloud-based approaches to CPM/EPM. Many SAP BPC alternatives take the traditional multi-solution approach to CPM, which still results in complex management of multiple solutions, interfaces and integrations. However, solutions such as OneStream unify consolidation, close, and financial & operational planning, reporting, and analysis in one platform.

Enterprises therefore have options to achieve organizational CPM/EPM goals and, with the right choice, can get closer to that elusive one source of truth. The following solutions are the best alternatives for end-to-end management of enterprise-wide consolidation, close, and financial & operational planning and forecasting:

· OneStream

· SAP EPM

· Oracle EPM

· Wolters Kluwer CCH Tagetik

· Workday Adaptive Planning

Conclusion

With the looming end-of-support for SAP BPC, organizations are actively looking for alternatives. OneStream’s Intelligent Finance Platform is the only CPM/EPM solution that delivers end-to-end management of enterprise-wide consolidation, close, and financial & operational planning and forecasting in a unified platform. This platform enables Finance and Operations teams to better collaborate and finally deliver on a single source of truth.

With over 1,400 customers globally, many successful migrations from SAP BPC to OneStream and a mission to ensure every customer is a reference, OneStream stands as the only truly unified platform for CPM/EPM.

Learn More

Want to know more? Check out OneStream’s video about what comes after SAP BPC/BFC/BCS here.

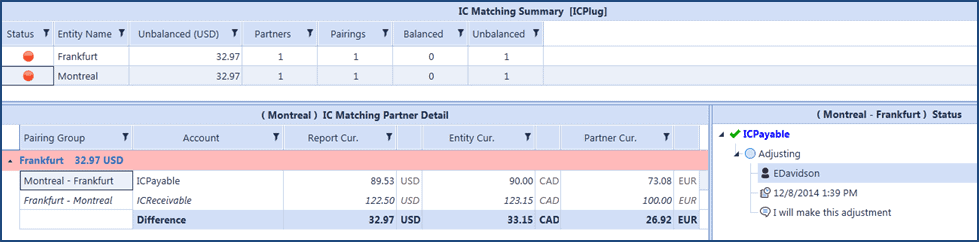

Learn MoreThe consolidation process is critical in driving trusted and effective book of record reporting for an organization. Whether the organization is private or publicly held, reporting for external stakeholders must be accurate, timely and compliant with US GAAP, IFRS or other local regulations. These requirements apply to financial statement reporting, for both tax purposes and statutory reporting/filings for regulatory bodies.

In this blog post, we review the 5 best financial consolidation software solutions for 2024. We only included software that meets the following non-negotiable qualifications:

- Included in the Leaders Quadrant or close to the edge of the leader’s box – Gartner Financial Close & Consolidation 2023.

- Earned at least 4.7/5.0 stars on Gartner Peer reviews.

- Possesses its“own” dedicated financial consolidation capability.

What Is Financial Consolidation Software?

Financial consolidation software gives organizations the capability to automate and streamline the process of combining, summarizing and transforming data from multiple business units, subsidiaries or departments. This complex process ensures the completeness and accuracy of the data to comply with relevant accounting standards and regulatory authorities.

Common features across financial consolidation tool options include the following capabilities:

- Advanced foreign currency translation.

- Powerful, automated intercompany eliminations.

- Flexible organizational ownership structures.

- Audit trails.

- Drill-through analysis.

By leveraging these features and others, organizations can streamline their consolidation process, minimize errors and report with confidence.

This comparative analysis explores the features and functionalities of 5 leading financial consolidation solutions: OneStream, Oracle EPM Cloud, Wolters Kluwer CCH Tagetik, Fluence Technologies and Vena Solutions.

The Best Financial Consolidation Software

1. OneStream

OneStream is the leading solution for complex financial consolidations due to its unified platform, advanced features, real-time insights, streamlined data integration, regulatory compliance support, scalability, user-friendly interface, collaboration tools and cost-effectiveness. As organizations continue to navigate the complexities of the global business landscape, OneStream stands as a reliable partner in achieving efficient, accurate financial consolidations.

Pros:

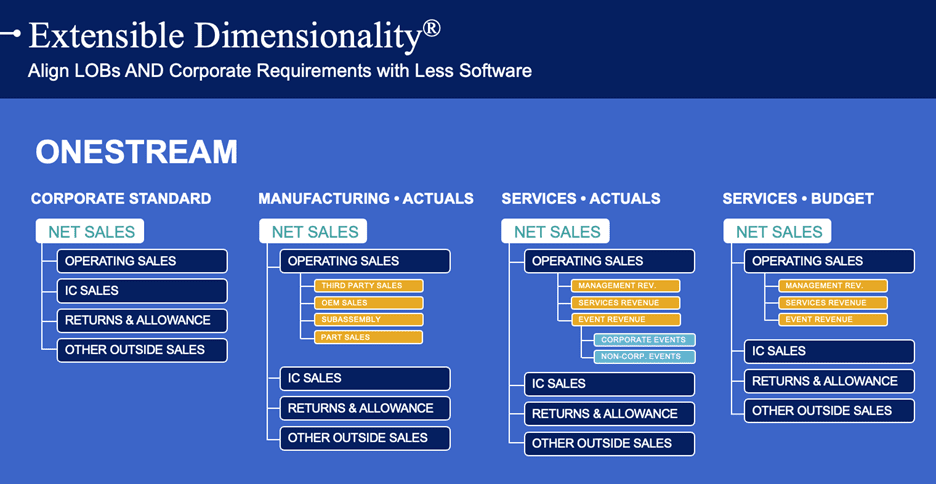

- Capability to handle the most complex global consolidations thanks to Extensible Dimensionality, guided workflow and out-of-the-box advanced financial intelligence capabilities.

- Seamless integrations with ERP systems through a variety of data load options, ensuring data consistency and accuracy.

- Complete audit trails and drill-through/drill-down capabilities for maximum visibility into any number.

Cons:

- OneStream’s tailored implementation process may require additional configuration time to meet customers’ unique business requirements.

- Pricing may be prohibitive for smaller businesses.

OneStream may have a smaller but growing market presence compared to other alternatives – despite growing popularity and having 1,300+ customers across the globe.

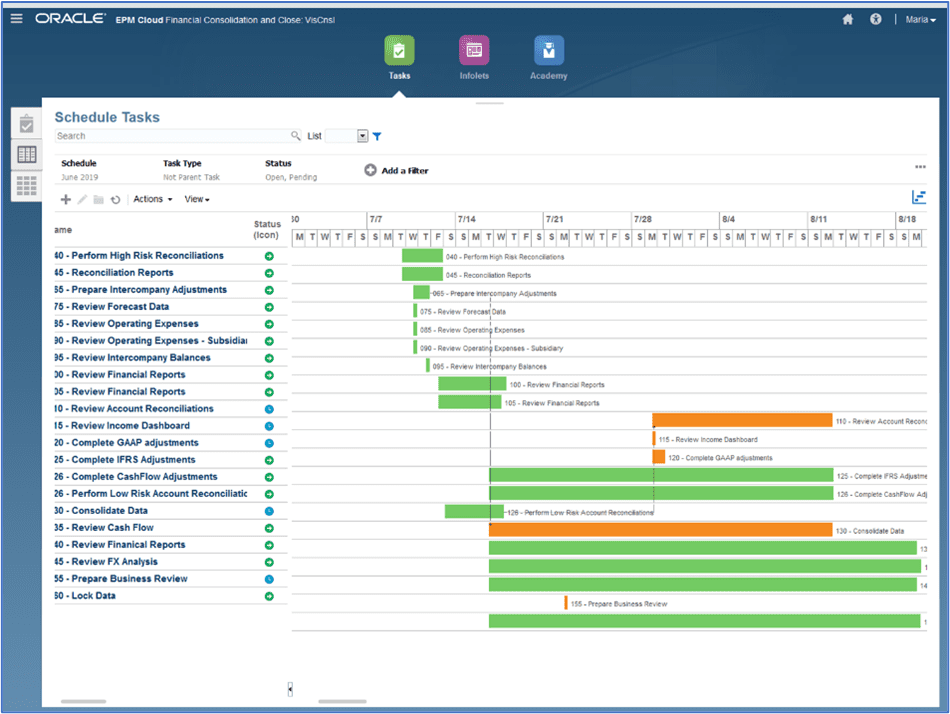

2. Oracle EPM

Oracle EPM is a suite of business applications designed for end-to-end management of enterprise-wide consolidation, close, financial planning and forecasting, and performance reporting. According to Oracle with their Financial Consolidation and Close end-to-end solution, organizations can effectively and efficiently manage the consolidation and close process. Organizations can leverage out-of-box financial consolidations with pre-built cash flow, balance sheet and income statement – accelerating the close.

Pros:

- A large customer base and global network ensure access to a pool of skilled professionals, services, partners and domain expertise.

- Integration with Oracle solutions (ERP, HCM, CRM, etc.) and databases, and a robust solution for master data management, data integration and data quality.

- Some pre-built functionality and out-of-box content may speed up implementations.

Cons:

- Lack of parity in Consolidation & Close solution for consolidation capabilities exists compared to Oracle’s legacy Hyperion HFM solution.

- Fragmented, multiple solutions require multiple complex integrations across solutions to reconcile actuals with plans and to bring in financial and operational data to support the end-to-end consolidation, close, financial and operational planning, and reporting processes.

- Limited live references and few peer reviews/insights are available for the cloud EPM solutions.

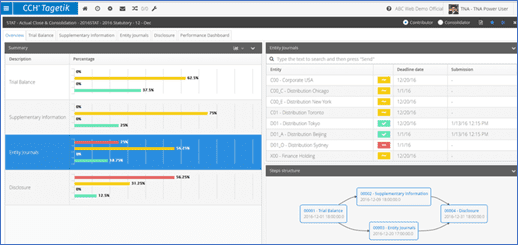

3. Wolters Kluwer CCH Tagetik

CCH Tagetik was originally developed in 2005 to deliver trusted, comprehensive and scalable CPM solutions globally and was acquired by Wolters Kluwer in 2017. As an end-to-end financial close and consolidation solution, CCH Tagetik is marketed to group and entity controllers. The software comprises multiple solutions for financial consolidation and close, account reconciliation and transaction matching, financial and management reporting, disclosure management (via a partnership with CoreFiling), and ESG and sustainability performance management. Plus, the solution is available both on-premises and via the cloud.

Pros:

- Platform approach that differs from multi-solution approaches (e.g., SAP and Oracle).

- Prebuilt connectors for some ERPs and a data integration engine to integrate with ERPs and other data sources, both financial and operational.

- Ability to combine balance and transactional data in one platform.

Cons:

- Limited to one cube/model per application, affecting performance/scalability; most implementations require creating multiple applications to support processes.

- Limitations on data quality, assurance and drill back result in additional steps, time and manual processes to resolve data issues – with no transparency to drill back to the source.

- Customer base is strongest in Europe but lacks the North American footprint of the other Top 5 vendors.

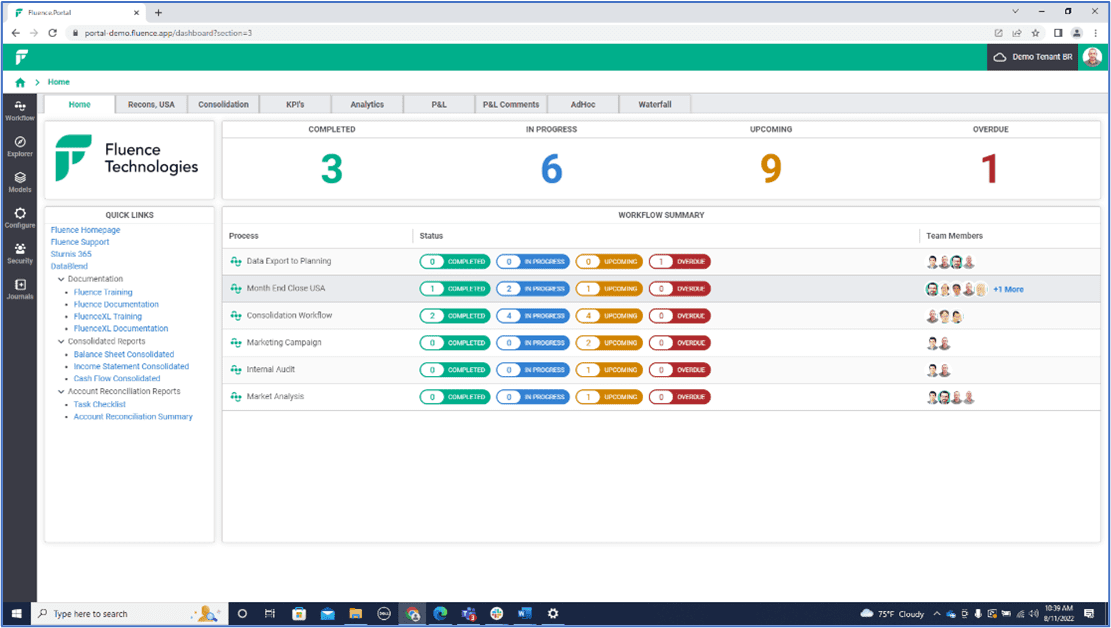

4. Fluence Technologies

Fluence Technologies is a global software company that provides cloud-based financial consolidation, close and reporting solutions marketed as helping Finance teams close faster, report with confidence and do more with less. More specifically, Fluence Technologies markets a no-code midmarket financial consolidation solution purpose-built to be easily owned and maintained by Finance.

Pros:

- Singular focus on consolidation and close.

- Heritage with legacy solutions (BPC/OutlookSoft, Cognos Controller and Longview).

- Excel front-end that provides a familiar environment for Finance and Accounting.

Cons:

- Siloed solution architecture in that the product combines home-grown, acquired and third-party solutions.

- Solution isn’t a complete CPM offering – no planning, no ESG, no tax, inconsistent AI/ML message.

- Data Integration is a user-reported weakness – limited data quality.

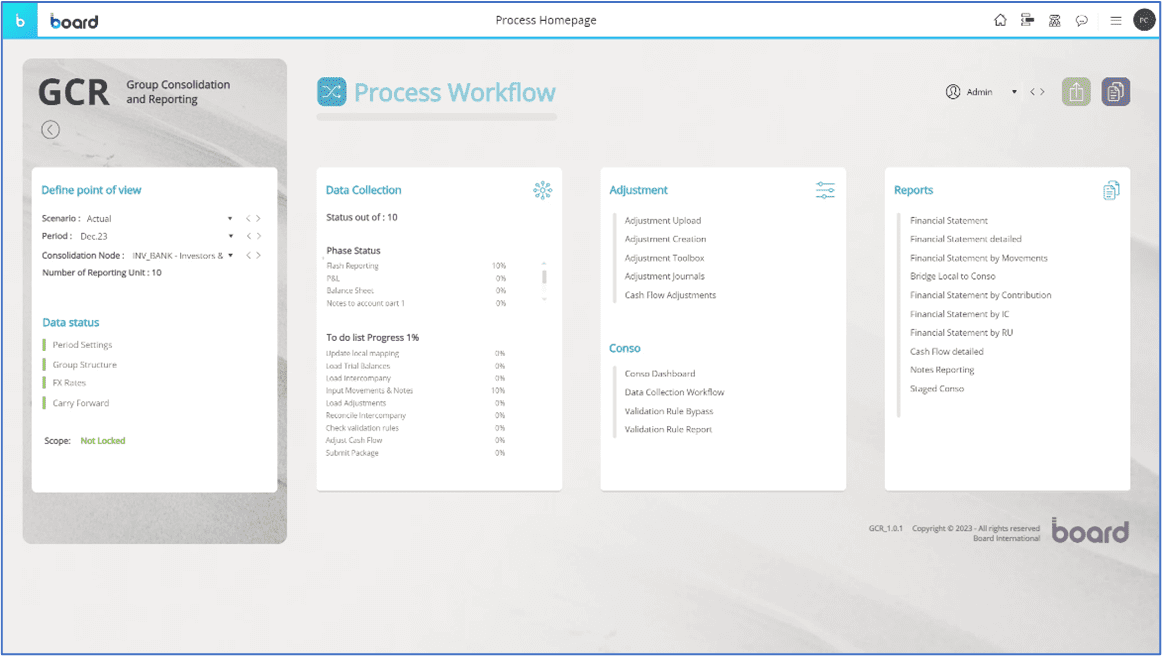

5. Board

Board offers a single solution, Board Group Consolidation and Reporting (GCR). Based in Chiasso, Switzerland, where it was founded in 1994, and Boston, Massachusetts, Board markets its product as integrated business intelligence reporting and analytics with enterprise scalability. Board is a private company with customers worldwide, the highest percentage in Europe.

Pros:

- Prebuilt integrators with ERPs and over 270 APIs to multiple source systems that import GL and transactional information.

- Strong base of reference customers in EMEA region.

- Visually appealing UI with tight connection between presentation layer and the back end.

Cons:

- Board requires a tremendous amount of maintenance as everything must be built, meaning there’s little pre-built functionality.

- Limited out of the box financial intelligence means critical calculations and formulas must be designed and configured for each customer.

- Financial consolidation is a separate module – essentially a pre-built point solution consisting of dashboards and a pre-defined model.

Conclusion

Choosing the right financial consolidation platform is essential for organizations seeking to move away from unreliable, inadequate EPM applications and/or spreadsheets and to instead evolve to a modern EPM solution.

Each of the Top 5 solutions featured in this blog post offers unique features and benefits, catering to the diverse needs of organizations across industries. Ultimately, however, if you’re looking to streamline your key Finance processes and significantly increase confidence in your reporting, OneStream is the best financial consolidation software to handle all your financial reporting, no matter how complex.

Learn More

To learn more about how organizations are managing the complexity in financial consolidation, check out our Close & Consolidation eBook. And if you’re ready to take the leap from spreadsheets or legacy EPM solutions and start your Finance Transformation with OneStream, let’s chat!

You can also check out our comprehensive financial close & consolidation software resource guide.

Download the eBookIntercompany reconciliations are a key step in the creation of consolidated financial statements. The objective is to ensure the consolidated financial statements present an accurate picture of revenues, expenses, assets, liabilities, and equity – ensuring they aren’t inflated due to transactions occurring between subsidiaries or companies in the group.

Several types of intercompany (IC) reconciliations must occur to ensure the accuracy of consolidated financial statements. Some examples are;

- Intercompany revenue and expenses: The intercompany elimination of the sale of goods or services from one entity to another within the enterprise or group. The related revenues, cost of goods sold, and profits must all be eliminated.

- Intercompany debt: The intercompany elimination of any loans made from one entity to another within the enterprise or group since they only result in offsetting notes payable and receivable, and offsetting interest expense and interest income.

- Intercompany stock ownership: The intercompany elimination of the parent company’s ownership interest in its subsidiaries, or ownership across subsidiaries.

For sophisticated organizations, intercompany transaction volume can be significant and difficult to identify. To ensure all this activity is identified, eliminated, and documented correctly for auditors requires a detailed system of controls. Managing and eliminating intercompany activity via Excel spreadsheets and email is not a recommended approach for large global enterprises with a significant number of IC transactions.

Not All Consolidation Software Is Equal

Most financial consolidation software packages provide core functionality to address requirements, such as currency translation, intercompany reconciliations, journal adjustments and partial ownership of entities. But not all packages are created equal – not all of them provide the same level of functionality in each area, and they may utilize different approaches to intercompany reconciliations.

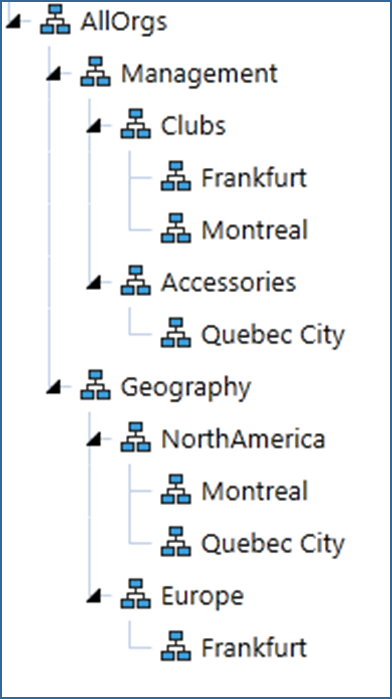

One example is the requirement to write custom business rules to consolidate data vs. using a consolidation hierarchy. Software packages that require custom business rules to consolidate data require more work to set up initially and to maintain going forward. The use of consolidation hierarchies, however, makes the system easier to configure and maintain for both single and multiple consolidation hierarchies.

Another example is the use of “elimination entities” vs. an intercompany dimension to identify and manage intercompany reconciliations across existing entities. Software packages that rely on creating multiple elimination entities to capture IC activity require more work to set up and maintain. The better approach is systems that leverage an IC dimension to identify, match and analyze intercompany transactions between existing entities and an elimination member to capture direct and indirect eliminations to make sure they never disappear as they eliminate up the consolidation hierarchy.

Also, when IC entities are used, users lose visibility into the individual intercompany balances and only see the totals in the IC entities. This makes it difficult to understand the where the out of balance condition resides, and what needs to be addressed and by what party. An IC dimension captures all party-counter-party balances and provides complete visibility into what is in and out of balance. This allows business users to identify and correct the discrepancies quickly and easily.

Another example is systems that actually store consolidated balances and intercompany elimination entries in a database vs. those that only consolidate and expose intercompany eliminations when reports are run.

Systems that store consolidated data and intercompany elimination entries in a database provide a big advantage when auditing financial statements – detailing the original source of the data, currency translations, eliminations and any other adjustments that resulted in the consolidated accounts. Systems that calculate and consolidate data only when reports are run are less trusted by auditors since the numbers can change and there is no record of what the number was previously.

And yet another approach is systems that duplicate base entities and their data vs. those that leverage a single shared base entity that can be rolled up in infinite hierarchies – for example, to consolidate based on a management view of the organization vs. a legal or statutory view. The former approach requires the administrator to identify IC relationships in each entity structure vs. setting this up and managing it in one place. The risk of this approach is that it requires the administrator to ensure the data which has been loaded multiple times is the same each time it is loaded.

If you’re considering a financial consolidation system, you should be asking these questions:

- How simple is it to set up basic intercompany reconciliations?

- Can the system handle complex eliminations?

- How robust is the reporting?

- Are eliminations handled at the first common parent or at some other level?

- How simple is a reorganization?

The OneStream Approach to Intercompany Reconciliations

The good news is, there is a better approach. Enterprise-class consolidation software applications provide intercompany eliminations that are powerful enough to handle sophisticated business needs yet allow for easy reconciliation.

The OneStream team has developed the most advanced financial consolidation, reporting and data quality solution in the market. This includes providing powerful intercompany elimination capabilities that can handle sophisticated business needs yet allow for easy reconciliation.

To improve and streamline the management of complex intercompany reconciliations, OneStream’s Intelligent Finance platform includes:

- Prebuilt and easily configurable dimensions

- Ability to handle the most sophisticated intercompany eliminations

- Ability to dynamically limit entry to avoid mistakes

- Multiple prebuilt and custom report options to help users proactively communicate and resolve issues

Combined with OneStream’s ability to drill down into transactional details and relational blending capabilities, OneStream provides an unmatched ability to see and manage intercompany activity.

With well-designed, pre-built and easily customizable dimensions, OneStream consolidates data based on organizational hierarchies and automatically eliminates intercompany transactions and balances at the first common parent – in all hierarchies (e.g., management, legal, tax, etc.) This is done without the creation of specific intercompany elimination rules or relationships within hierarchies, which makes the system much easier to maintain vs. other systems in the market.

Plus, OneStream has an incredibly powerful rules engine that will address any exceptions or more complex eliminations. Here are some of the common eliminations that require rules:

- Investments in subsidiaries

- Profit in inventory eliminations

- Certain statutory eliminations

The configuration of these eliminations allows for something very powerful if you ever have to reorganize the company structure. You can simply move the entities and reconsolidate – done!

The Secret Sauce in OneStream

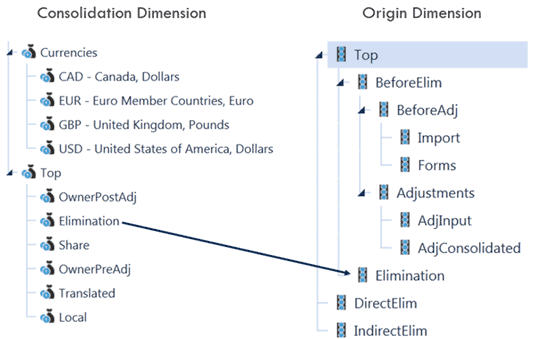

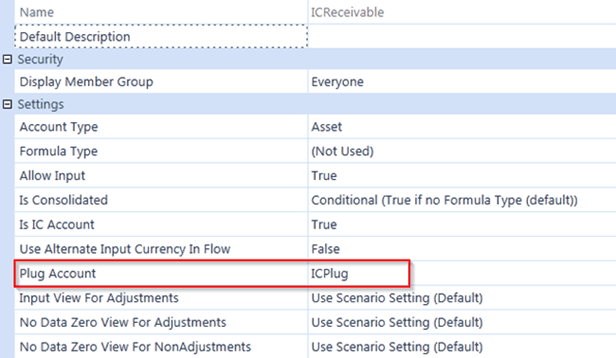

OneStream includes a number of pre-built dimensions that provide the power to handle sophisticated financial consolidation and elimination requirements. Specifically, OneStream uses the Account, the Intercompany and the Origin dimension to process IC matching and eliminations. This functionality does the following:

- Matches values between IC accounts that share a common suspense account (a.k.a. plug account)

- Automatically creates eliminations at the proper entity levels for each IC account

- Writes unresolved differences into the specified suspense account (plug account)

This functionality creates something called the “first common parent rule.” That means the eliminations are calculated at every consolidation point. Each intercompany has an “in and out” – for example, when you match a receivable and payable, they both offset through a common account.

Some consolidation applications will try to calculate IC eliminations at base entities. Others will require users to recreate eliminations for each rollup of entities. The most powerful applications all have “first common parent functionality.” It’s a basic requirement.

For each eliminating IC transaction, OneStream will create both sides of the entry that offsets the data value from the IC account and IC partner. That offsetting amount is written to the plug account. If the entries do in fact match, then the debit and credit for each side of the intercompany match would net to zero.

For example, if you had one entity with an IC payable and one with an IC receivable, when each entity reaches the common parent, when the elimination should take place, there’s an entry in the Origin dimension for that account that offsets the amount in the account that requires eliminating. At the same time, OneStream also writes a value for each offset it created, to the suspense account or plug account.

Setting this up is simple. Each IC account must be flagged for intercompany, each entity that is booking IC activity must be flagged and, finally, each combination of IC matching counts must have a corresponding plug account.

The IC dimension represents the IC Partners, which as an originating entity can post an entry against (for Intercompany flagged accounts). This is a reserved dimension that’s used by OneStream to track and eliminate intercompany details across the Account dimension and related User Defined dimensions.

Some features simplify the process out of the box – for example, the ability to limit the intercompany partner so that they must either enter a partner or not choose themselves.

While the settings address most basic eliminations, OneStream has an incredibly powerful rules engine that will address any exceptions or more complex eliminations. Here are some of the common eliminations that require rules:

- Investments in subsidiaries

- Profit in inventory eliminations

- Certain statutory eliminations

These are often not supported at all in other consolidation applications.

The configuration of these eliminations allows for something very powerful if you ever have to reorganize the company structure. You can simply move the entities and reconsolidate – done! Any system that’s using journals or manual entries or that doesn’t have shared members – will require significant work to accomplish this type of change.

Reporting on Intercompany Activity

In addition to the capabilities described above, there are some great reports that are ready to view “right out of the box” with OneStream. For example, OneStream has a focused intercompany elimination “grid” that appears in the workflow. This allows users to comment and communicate with other users regarding intercompany balances.

The power of these IC system reports is that they ignore security for the intercompany accounts. This feature helps get users to take ownership of the intercompany matching process, by allowing each intercompany trading partner to see matching balances across entities, and in multiple currencies.

The advanced architectural design of OneStream, combined with its reporting and the ability for users to drill down into transactional details, provides an unmatched ability to see and resolve intercompany balances and rapidly close the books at period-end.

Learn More

Are you considering a financial consolidation and reporting platform to help your company manage complex intercompany activity? Check out our video on automating intercompany. To learn how one of our customers is benefiting from these advanced capabilities, check out the Alterra Mountain Company case study.

If you’re ready to learn more about the power of an Intelligent Finance platform, contact us today to take a deeper look at the OneStream approach to handling intercompany reconciliations.

Learn MoreFinancial close, consolidation and reporting are critical processes that most organizations perform on a monthly, quarterly and annual basis to deliver their financial results to internal and external stakeholders. These processes can be challenging to execute, especially in larger enterprises with multiple ERP/GLs to consolidate, complex organizational structures, increasing regulatory compliance requirements, and a limited and mostly remote workforce.

Purpose-built software applications to support these processes have been available for over 25 years, but today’s cloud-based financial close and consolidation software (FCCS) solutions offer new capabilities that can help organizations streamline these processes to ensure more timely and accurate delivery of financial results.

Gartner’s View of the Market

This was the focus of the recently published Gartner® Magic Quadrant™ for Financial Close and Consolidation Solutions1 where OneStream was named as one of only three leaders. (see figure 1).

In the report, the Gartner analyst team recognized our broad capabilities provided through OneStream’s Intelligent Finance Platform as well as additional solutions available from our Solutions Exchange such as Account Reconciliations, Transaction Matching, ESG Reporting Blueprint and Tax Provision.

Key strengths for OneStream that were highlighted in the report include:

- Financial Consolidation – including broad capabilities, Extensible Dimensionality®, guided workflow and advanced financial intelligence.

- Data Integration – with the ability to integrate data from a wide variety of source systems, with error-handing, validations and notifications provided through our built-in Financial Data Quality Management.

- Sales Pricing – with a flexible, user-based pricing model.

Overall, we are pleased to be recognized as a Leader in this Gartner Magic Quadrant report and we believe this is well-deserved based on the breadth and depth of capabilities that we offer, and our strong momentum in the market. Over 1300 organizations globally have chosen OneStream as a replacement for legacy applications such as Oracle HFM, Oracle FCCS, SAP BPC and BFC, IBM/Cognos Controller, Longview and Infor as well as point solutions such as Blackline and Trintech for account reconciliations. And we’ve replaced thousands of Excel spreadsheets as well!

Delivering Positive Business Impact

Organizations that have adopted OneStream for financial close, consolidation and reporting have improved consolidation performance vs. legacy products, while handling much larger data volumes than they could with their prior solutions. They have shortened their period-end close processes by several days and are delivering more timely and accurate financial results to stakeholders. And they have reduced technical debt, saving millions of dollars per year in IT and admin costs.

Here are some examples:

Costco Wholesale: Replaced Oracle HFM and Excel with OneStream for OneStream for financial close, consolidation, reporting, cashflow, and budgeting. Their financial close process was reduced from 2-3 days to 1.5 days and eliminating Excel enabled the Costco team to re-allocate 25% of FTE time to value added work.

Terex: Replaced Oracle HFM, FDMEE, Prophix and Excel with OneStream for financial close, consolidation, reporting and planning. Integrating data from 28 ERPs, full system consolidation time has decreased from up to 20 hours to less than 30 minutes with OneStream. Eliminating multiple point solutions has improved data quality and also yielded significant cost savings.

Lindsay Corp: Replaced Microsoft Excel with OneStream for financial close, consolidation, reporting, planning and forecasting. Their monthly close process was shortened by 25%, and the company is also saving 2 days per month on forecasting.

These and other customer successes have translated to a 4.8 out of 5 rating and 95% “willing to recommend” score for OneStream for financial close and consolidation on Gartner® Peer Insights™.

Key Market Requirements and Evaluation Criteria

For those new to the Magic Quadrant process, Gartner defines FCCS solutions as “applications that enable corporate controllers and their teams to manage the organization’s group close, consolidation and reporting processes.” The most common business challenges, or use cases, that Gartner identifies for FCCS include enabling efficiency, driving regulatory compliance and supporting a complex business environment.

In evaluating the various software solutions available to support FCCS, Gartner identifies the “must-have” capabilities as:

- Financial Close Management

- Financial Consolidation

- Financial Reporting

Additional standard and optional capabilities identified by Gartner include:

- Financial Statement Reconciliation

- Journal Entry Processing

- Financial Reporting Risk Management

- Disclosure Management

To be included in the Gartner FCCS Magic Quadrant, vendors must support all the must-have capabilities mentioned above, and these must-have capabilities should be available within the native vendor solutions and not offered through partnerships with other vendors. In addition, the vendors must operate in at least two global geographies, the software must be deployed as a cloud service and be available as a standalone solution, devoid of any bundling with ERP suites.

Learn More

Financial close, consolidation and reporting are critical processes that shouldn’t be managed with legacy applications, point solutions or spreadsheets that lack the capabilities required to meet today’s complex business requirements. If your organization is ready to make the leap to a modern, cloud-based solution, download the Gartner Magic Quadrant report to learn more about the key market requirements and why OneStream was named as a Leader.

Download the ReportSources: 1 Gartner Magic Quadrant for Financial Close and Consolidation Solutions, Nisha Bhandare, Permjeet Gale, Jeffrin Francis, Renata Viana, 27 November 2023

Gartner Disclaimer

GARTNER is a registered trademark and service mark of Gartner and Magic Quadrant is a registered trademark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and are used herein with permission. All rights reserved.

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

Gartner® and Peer Insights™ are trademarks of Gartner, Inc. and/or its affiliates. All rights reserved. Gartner Peer Insights content consists of the opinions of individual end users based on their own experiences, and should not be construed as statements of fact, nor do they represent the views of Gartner or its affiliates. Gartner does not endorse any vendor, product or service depicted in this content nor makes any warranties, expressed or implied, with respect to this content, about its accuracy or completeness, including any warranties of merchantability or fitness for a particular purpose.

Automation is a well-used word – perhaps even overused. Why? Well, automation is pretty much being mentioned in almost every area of life right now. Digitalisation and changes in technology are bringing ever-increasing opportunities to both reduce time spent and eliminate errors.

Anything repetitive and time-consuming is a clear candidate for automation. Account reconciliations surely fall into both categories! The process is essentially the same every time, and many accounts reconcile the first time without the need to explore any detail. Really? Yep, in fact, according to EY’s 2020 CFO survey, 95% of Finance teams’ efforts are wasted on transactions that already match, rather than spending that time on problem entries that actually require attention.

Automation becomes even more important considering that, according to a 2022 Ventana Research Finance Benchmark survey, still 43% of organisations take longer than 6 days to close the books. Astonishingly, according to Accounting Web in 2021, 30% of survey respondents reported taking 16-19 working days to close the books. The pressure is clearly mounting to reduce close times, get results out to stakeholders faster and make more effective decisions about future direction. Accelerating account reconciliations can really make a huge difference and make it easier to do all of that and more.

In this blog, we examine why a fully integrated account reconciliations capability, along with the ability to load and match transactions, is critical to ensuring a timely financial close.

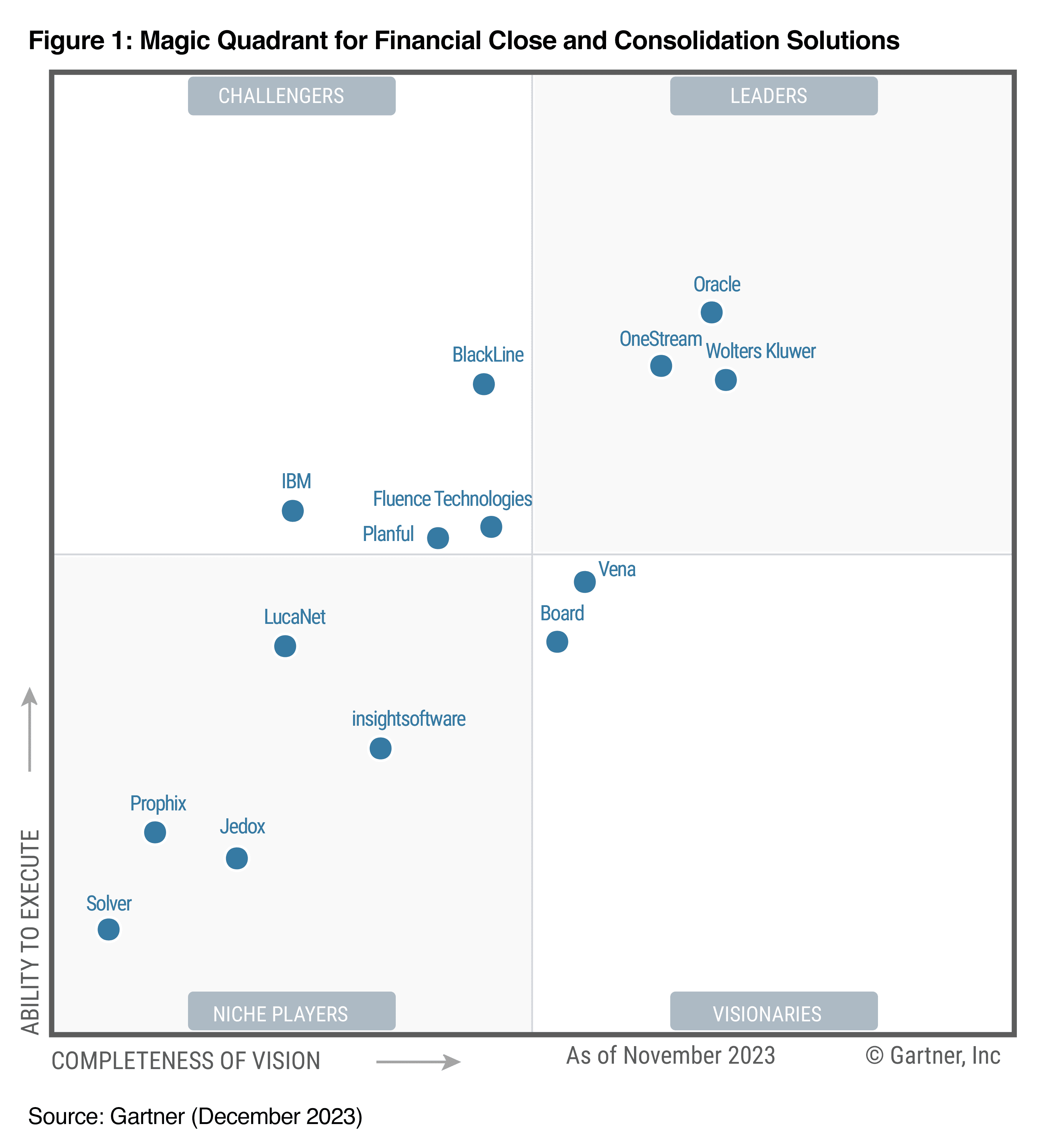

The Challenge

For many organisations, the account reconciliations process not only involves manual, time-consuming work but also causes significant delays in the financial close process. Why? Well, most medium- to large-sized global companies must reconcile hundreds to thousands of accounts during the quarter-end or month-end close across the parent company and various subsidiaries. Also related to this process is the need to reconcile data between multiple software applications used to run the business. The more systems, the more reconciliations required.

Leading Finance departments are attempting to eliminate the risks of manual processes — missing or lost reconciliations, unreconciled accounts, improper use of roll-forwards, and insufficient justification or documentation — to protect their organisations against costly mistakes. Many have adopted standalone account reconciliations software applications to deal with these issues.

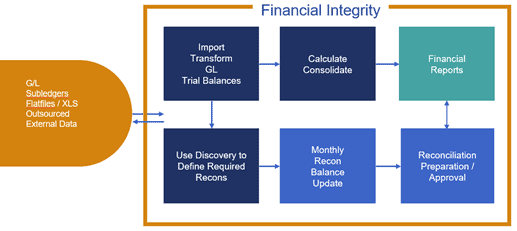

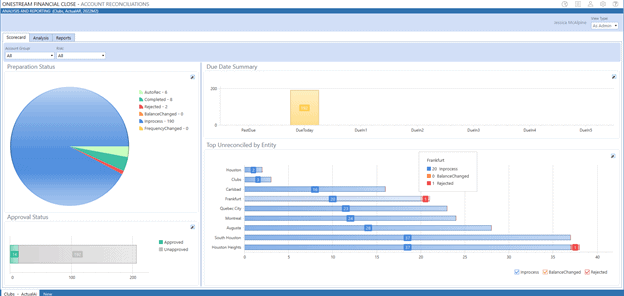

However, that solution is not always the right answer. Why? Well, with standalone account reconciliations applications, a “data integrity gap” (see Figure 1) exists between the account reconciliations and the financial statements. When accounts are reconciled in a system separate from the financial reporting process, out-of-sync data easily occurs, causing delays in the close process and issues with data integrity.

The Solution

The key to more effective account reconciliations is to not only automate the process but also fully unify it with the financial close. If GL trial balances are loaded into a single system for financial consolidation, reporting, and account reconciliations, then the data will always be synchronised, and the close process will be faster and more efficient. Importantly, one single trial balance load can, in parallel, feed all reporting processes, including account reconciliations, from the same source. That ability reduces the risk of differences and speeds the close.

An integrated unified system should include an automated transaction matching capability to help resolve differences and accelerate the account reconciliation process by providing the ability to quickly match transactional data from multiple sources.

Here are several reasons automation is key to such functionality:

- Reduces manual steps

- Avoids error-prone reconciliations in spreadsheets

- Allows matching to use a rule-based approach so that users can focus on the exceptions and drive process efficiencies

If the process is fully automated and unified, then the benefits of leveraging the same trial balances across the close and compliance processes become very clear. How? Well, data often changes constantly in the close process. Such updates, in an automated system, continue to get reflected across processes without having to physically move data between separate connected Finance solutions. And that eliminates the data integrity gap (see Figure 2).

Figure 2 – The Unified Approach – Eliminates the Data Integrity Gap

Why OneStream?

OneStream’s single unified platform approach and financial data quality management capabilities are unique in the market. The Account Reconciliations and Transaction Matching solutions are both available to all customers as free downloads from the OneStream Marketplace, part of the OneStream Solution Exchange which makes available more than 75 other business process solutions. Using these solutions, organisations can then incorporate account reconciliations and transaction-level matching directly into daily, weekly, or monthly tasks and workflows, which are also managed in OneStream.

Delivering 100% Customer Success

It’s this capability to unify financial close processes in parallel and without the complexity that gives OneStream the ability to replace multiple legacies or connected Finance applications and spreadsheets. And it’s a big opportunity for organisations to drive total-cost-of-ownership savings and generate returns from their OneStream investment. Here are a few examples of customers we have worked with and the benefits they have achieved:

The Carlyle Group was looking to simplify its CPM landscape by combining three disparate tools into a single platform. Additionally, they were seeking a modern, extensible platform that was scalable to meet current and future business needs – and one which would provide their business areas with more control of reconciliations.

After implementing OneStream for financial close, consolidation, reporting, budgeting, and people planning, the group successfully adopted OneStream Account Reconciliations, and all areas of the organisation can now reconcile within a single tool, eliminating all offline reconciliations. The group can also now enforce accounting policies, such as thresholds, frequency, and other requirements. Plus, they’ve increased the level of auditability and traceability by having one single source of data for financial reporting and reconciliations.

After implementing OneStream for financial close, consolidation, reporting, and budgeting, AFL replaced Blackline with OneStream’s Account Reconciliations solution. As a result, AFL says OneStream’s approach has sped up their account reconciliations process by 75% and saved them about $100K per year in software licenses.

The dream of ‘one version of the truth is entirely possible with OneStream.

Learn More

To learn more about how you can accelerate the financial close with the unrivalled power of OneStream’s Unified Platform, download our whitepaper. Need help accelerating the financial close and eliminating the integrity gap? Contact OneStream today!

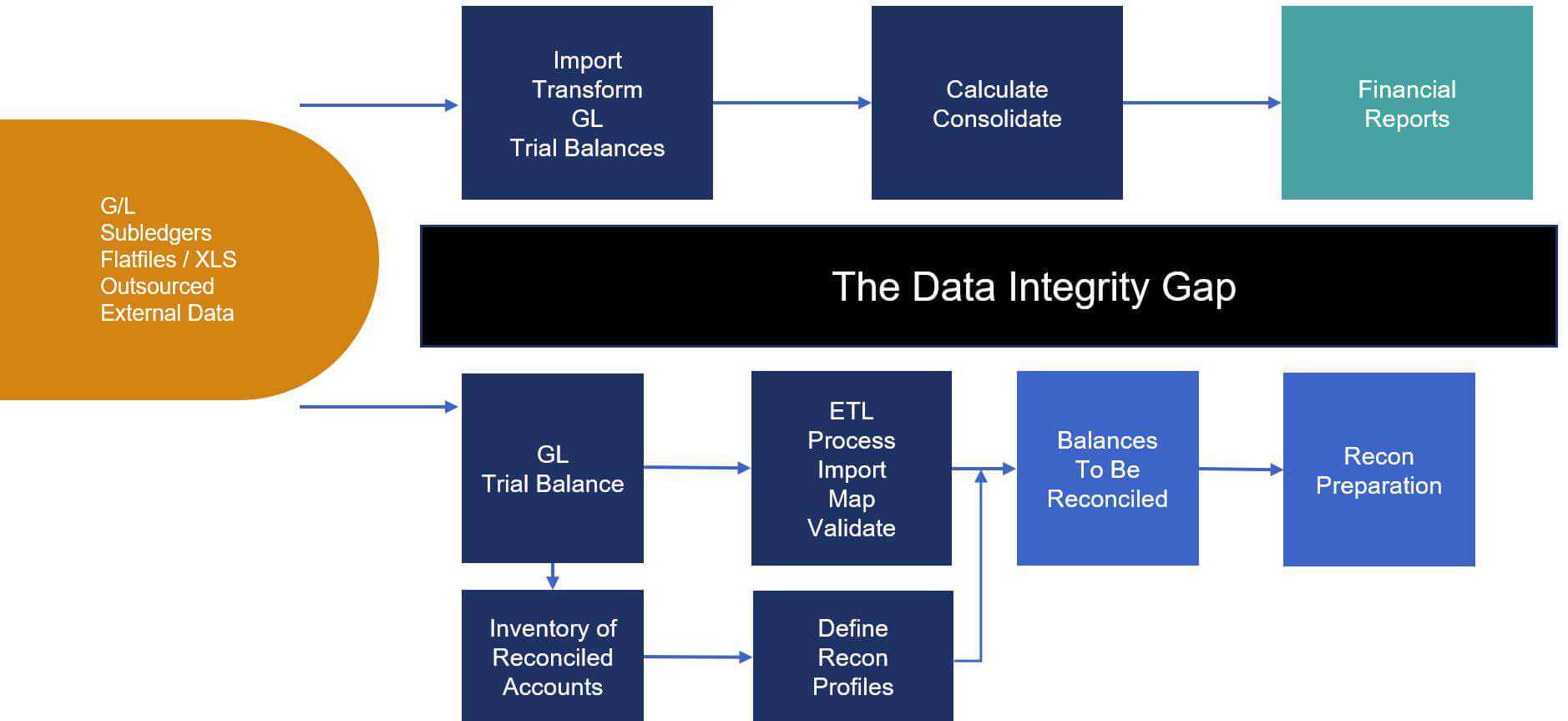

Download the White PaperFor decades, organisations worldwide have relied on a small number of legacy EPM applications for complex financial consolidation needs. Such solutions have provided valuable support by simplifying financial close processes and enabling sophisticated statutory consolidations and reporting. However, vendors are signalling that support for these legacy applications will end in a few years.

Organisations are now proactively exploring advanced solutions that not only match and supersede the capabilities of these legacy systems, but also fully unify consolidations with planning, budgeting, and forecasting. In this blog post, we’ll show why OneStream has emerged as the optimal solution for complex global organisations, focusing especially on consolidations.

Why OneStream Simplifies Financial Consolidation

OneStream is the leading solution for complex financial consolidations, providing organisations with a powerful unified platform that addresses the challenges inherent in managing intricate financial structures. Globally and across industries, over 1,300 mid-sized to large enterprises are using OneStream for planning, financial close & consolidation, reporting and analytics. In fact, 70% of OneStream customers replaced multiple legacy applications (e.g., Oracle Hyperion, SAP BPC and IBM Cognos).

Below are 10 key features and advantages that make OneStream the best choice for complex financial consolidations.

1. Unified Platform:

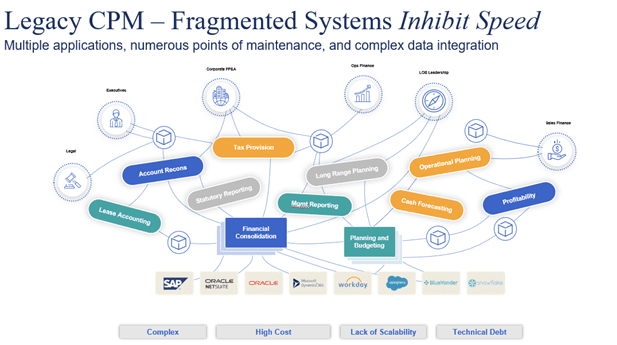

Despite propelling Finance Transformation for over 20 years, connected Finance solutions (see Figure 1) aren’t really designed to help the largest, most complex modern organisations drive performance.

Figure 1: Connected Finance Solutions – Fragmented

Connected Finance solutions are ultimately difficult to scale. Why? Because every traditional departmental and corporate application or model must be connected or integrated – adding risk, cost and complexity to already-taxed Finance teams due to multiple systems and data silos.

Instead, OneStream’s unified platform seamlessly combines financial consolidation, planning, budgeting and reporting processes. This holistic approach eliminates the need for disparate tools, streamlines financial operations and enhances overall efficiency.

2. Advanced Consolidation Features:

Whether private or publicly held, organisations must confidently conquer the consolidation process – which drives the organisational “book of record” reporting. Therefore, the reporting for external stakeholders must be accurate, timely and compliant with regulations. These requirements apply to financial statement reporting, statutory reporting and regulatory filings, including ESG reporting.

Going beyond simply aggregation, a consolidation tool must support the financial consolidation requirements of the largest, most complex organisations globally via inbuilt intelligent capabilities including:

- Statutory consolidation and reporting (US GAAP, IFRS, Multi-GAAP, local requirements)

- Advanced foreign currency translation

- Powerful, automated intercompany eliminations

- Flexible organisational structures with varying ownership percentages

- Base and topside journal entries

- Powerful allocations

- Complete audit trails and drill-through capabilities

- In-system reporting, analysis, dashboards and Excel® integration

OneStream delivers these advanced features for complex financial consolidations – accommodating diverse financial structures, intricate ownership relationships and multiple currencies. This flexibility is crucial for global organisations operating multiple subsidiaries, each having unique financial intricacies.

3. Real-Time Insights:

Real-time alerts help realize the vision of daily close performance reporting by empowering Accounting and Finance teams with daily or weekly insights into key business metrics and drivers. These ‘alerts’ highlight critical opportunities or risks that require action.

Such alerts include viewing potential misstatements in the GL before month end, identifying areas of the close process causing delays or applying flux analysis to highlight problematic areas in the financials. With weekly or daily insights into trends and signals in the data points, managers can immediately act to proactively impact the period-end results.

Figure 2 – OneStream Real-time alerts/Financial Signals KPI dashboard

OneStream provides real-time insights into financial data, enabling organisations to make informed decisions promptly based on the most current information (See Figure 2). This capability is invaluable for complex consolidations, where timely information can make the difference in strategic planning and risk management.

4. Streamlined Data Integration:

At its core, a modern unified EPM platform must have financial data quality management (FDQM) to drive effective transformation across Finance and lines of business. One requirement is 100% visibility from reports to sources – all financial and operational data must be clearly visible and easily accessible. Key financial processes should be automated, and using a single interface allows the enterprise to utilise core financial and operational data with full integration to all ERPs and other systems.

OneStream simplifies the often-challenging task of data integration via the seamless flow of financial data from various sources, reducing the risk of errors from manual data entry. The platform’s robust data integration capabilities enhance accuracy and reliability, crucial factors in complex financial consolidations where precision matters.

5. Regulatory Compliance:

A modern unified platform should support all reporting requirements with standard, defined and repeatable processes for financial data collection and consolidation. After all, producing financial statements that meet GAAP, IFRS and local statutory accounting regulations is a non-negotiable aspect of financial management, especially for organisations dealing with complex consolidations.

Failing to comply with industry standards, laws, rules and regulations set by regulatory and government bodies can result in hefty penalties, reputational losses and expensive legal actions. Even worse, non-compliance can cause organisations to fail or be shuttered.

OneStream is designed to support regulatory compliance, ensuring that financial reporting adheres to all industry standards and legal requirements. This support not only mitigates the risk of penalties but also instils confidence among stakeholders.

6. Flexibility to Support Corporate and Local Requirements:

EPM software solutions are typically purchased, set up and rolled out from the corporate Finance organisation for planning, budgeting, forecasting, reporting and other analytical use cases. In such solutions, the defined meta data structures (e.g., chart of accounts, organisational hierarchies) are usually based on corporate financial and management reporting requirements.

However, due to the need to roll out to the line-of-business level, many divisions, business units and departments find they must plan and report at a lower level of detail vs. corporate. Traditional approaches to handle the different levels usually involve spreadsheets, multiple point solutions and often separate instances of the same EPM application.

Figure 3 – Extensible Dimensionality in OneStream

OneStream offers the first and only solution that delivers corporate standards and controls, with the flexibility for business units to report and plan at additional levels of detail without impacting corporate standards — all through a single application. This unique capability is called Extensible Dimensionality® (See Figure 3).

7. Scalability:

The rigidity and inefficiency of disjointed legacy Finance systems has long been a reality for Finance organisations. But the unprecedented volatility of recent years has shown how an agile, extensible EPM solution can support an organisation through future changes.

Alongside growth, organisations’ financial consolidation needs evolve, so scalability is a significant requirement. An EPM solution should therefore be able to scale up to meet increasing demands – which provides a future-proof solution for organisations with expansion plans.

OneStream’s Intelligent Finance Platform uniquely offers extensibility (i.e., the customer’s ability to extend a system) in 3 ways: application design, platform and implementation. Unlike other systems, OneStream doesn’t utilise ‘smart lists’ or ‘alternate roll-ups’. Rather, something configured for one purpose can be used for other purposes, which makes using OneStream for multiple needs (e.g., actual and budget reporting) both possible and easier to maintain and support vs. alternative systems.

8. Collaboration and Workflow Management:

An effective EPM solution should include guided workflows to protect business users from complexity. How? By uniquely guiding them through all data management, verification, analysis, certification and locking processes.

Complex consolidations often involve multiple stakeholders across different departments. Accordingly, strict process controls are vital, and the system should include the following:

- Data and process certification and sign off.

- Audit trails from 10K/10Q to GL source account and GL trial balance

- Support for SOX 302 and 404 certification questionnaires to identify weaknesses in the financial process.

OneStream facilitates collaboration by providing a centralised platform for financial processes. Its robust workflow management capabilities allow for seamless coordination among team members, enhancing communication and ensuring that consolidation processes run smoothly.

9. Reduced Total Cost of Ownership (TCO):

Finance departments often choose a series of point solutions, believing they will lower overall costs. Initially, a solution might have a lower price tag than a unified EPM platform, but Finance often then ultimately spends more on cross-application integrations to cobble together a fully functioning system.

With a unified EPM platform, however, all processes are handled within a single instance. Plus, data is loaded into one central database and immediately available to all business processes. With no manual data movements or reconciliations to perform, the platform saves valuable time and reduces costs.

OneStream’s unified platform, coupled with its scalability and ease of use, contributes to a lower TCO. Specifically, organisations can achieve cost savings by consolidating various financial functions into a single platform, eliminating the need for multiple tools and reducing maintenance and training costs.

10. Success Stories:

Vendor reference checks are a fundamental aspect of informed decision-making. They offer valuable insights into a potential vendor’s past performance, which helps organisations confidently navigate the complex vendor selection process. By tapping into the real-world experiences of existing customers, Finance teams can gain a complete understanding of what to expect from a vendor. This understanding facilitates better-informed choices, effective risk management and long-term partnerships that benefit the organisation.

Numerous organisations have successfully leveraged OneStream for complex financial consolidations. In fact, many case studies and success stories highlight the platform’s effectiveness in addressing the unique challenges faced by businesses with complex financial structures. These real-world examples serve as a testament to OneStream’s capabilities and its positive impact on organisational performance.

For any organisation considering OneStream, we’ll always happily share multiple suitably matched references when asked to assist with selections.

Conclusion

OneStream is the leading solution for complex financial consolidations due to its unified platform, advanced features, real-time insights, streamlined data integration, regulatory compliance support, scalability, user-friendly interface, collaboration tools and cost-effectiveness. As organisations continue to navigate the complexities of the global business landscape, OneStream stands as a reliable partner in achieving efficient and accurate financial consolidations.

Learn More

To learn more about how organisations are conquering the complexity in the financial close, click here to read our whitepaper. And if you’re ready to take the leap from spreadsheets or legacy EPM solutions and start your Finance Transformation with OneStream, let’s chat!

Download the White PaperIn the previous post in our “What’s Next for Cartesis/SAP BFC Customers” blog series, we covered how many organisations are now facing the end of support for their Cartesis/SAP BFC application, currently announced for 2027. Of course, this end date could be further extended if significant pressure is placed on SAP. We also looked at some of the concerns/risks. Plus, we detailed 5 key considerations for Cartesis/SAP BFC customers who are moving towards an evaluation process.

Given the above challenges, current Cartesis/SAP BFC customers have 3 options to consider, as outlined in the first post in this series:

- Choice 1: Continue with legacy Cartesis/SAP BFC until support ends.

- Choice 2: Invest in SAP’s unproven next-generation products, such as Group Reporting, Analytics Cloud, Central Finance or some variant hybrid strategy.

- Requires at least one S/4 HANA Finance instance for Group Reporting.

- Requires implementation of multiple fragmented solutions.

- Choice 3: Take control of the Finance Transformation by evaluating alternate EPM strategies such as OneStream.

In this blog post, the focus will be on Choice 2.

Choice 2 – Invest in SAP’s Unproven Next-Generation Products

SAP has chosen a vastly different path than OneStream for the future of SAP EPM solutions. Much like Oracle, SAP chose to continue with the legacy of the past by creating new, separate cloud solutions for each key EPM process area. This suite of applications is still fragmented – rather than innovated towards the future of EPM where all processes can and should exist in one unified platform.

The previous generation of EPM applications was dependent on the technology available at the time. Accordingly, the financial consolidation process was typically built in technology suited to processing data, running calculations and handling non-financial data/commentary. The planning process was typically built using cube technology to handle volumes of data and fast analysis. With the advancements now available, however, separating these processes is no longer necessary. The latest technology can handle the differences in data granularity, differing levels of dimensionality and distinct process steps – all in a single, unified solution.

The different path SAP has chosen results in this current fragmented suite of EPM products:

- SAP Analytics Cloud (SAC)

- SAP Group Reporting

- SAP Group Reporting Data Integrator – tool that gathers financial data from business units

- SAP Datasphere – latest generation of SAP Data Warehouse Cloud

- SAP Fiori – a design system to create specific business applications

- SAP Profitability & Performance Management – separate product for automating all allocation-based business processes

- Account Reconciliations provided by Blackline

- Tax Reporting solution provided by a partner, promoted in SAP Store

- Lease Accounting provided by partner Nakisa

Customer/Peer Reviews

SAP does not have an entry in Gartner Peer reviews for Cloud Financial Close Solutions. Does SAP not consider Group Reporting to be in this category? SAP BFC does appear for financial consolidation, but no reviews have been posted since 2019. The former Outlooksoft product – now SAP BPC also appears but with little focus on close and consolidation, and only 52 reviews have been given in the life of the product.

SAP SAC appears on Gartner Peer Reviews as well – in Cloud Extended Planning & Analysis Solutions with 95 reviews and in Financial Planning Software with 112 reviews. I would expect to see higher numbers given the number of customers SAP claims to serve.

Some of the Gartner reviews include dislikes, as shown in the excerpts from actual reviews:

- “Some of the features in planning that exist in EPM are not yet available in SAC, and user adoption is challenging as users are attached to EPM/BPC”.

- “Insufficient data modelling capabilities, product immaturity, oversold capabilities”.

- “Involves steep learning curve. UI should be more polished and modernised”.

- “Sometimes we want to modify things, and the way to do it is very complicated. It is not user friendly. Simple things like conditional formatting or smart text are very difficult to add”.

- “Reporting/story building and editing is NOT intuitive or user-friendly at all”.

- “Getting started time needs quite some onboarding. User community is not very active, but I guess this is due to the short time of tool availability”.

In contrast, OneStream has 269 reviews in Financial Planning Solutions (4.6 average rating) and 258 reviews in Cloud Financial Close Solutions (4.7 average rating).

Key Considerations

The following key considerations/questions will significantly help facilitate the evaluation process and value assessment when you’re considering what’s next for your EPM solution:

- SAP’s go forward strategy is HANA. The SAP Group Reporting solution relies on underlying HANA technology. Are you being forced to take on the additional cost of implementation and support for HANA?

- For some years to come, the SAP EPM solutions are likely to have limited capability compared to what you’re familiar with in Cartesis/SAP BFC.

- Can your organisation cope with less capability for a period of time?

- Can you count on more capability being delivered in the future?

- The SAP journey is likely to involve significant cost over the life of the application and deliver less. Will you get VALUE quickly from SAP EPM?

- SAP’s core focus is not EPM as the company has many other larger revenue streams. Can you get the service and support you need when the vendor is not specialised in business-critical EPM solutions?

SAP EPM Strategy

I have the greatest respect for SAP’s ERP strategy, and the company has an excellent product – one well-respected by many. Comparatively, the SAP EPM strategy is a very different story. The EPM strategy is not taking advantage of technological advancements which can change the game for EPM solutions by unifying all processes. Regarding EPM & ERP, my best advice when I speak to organisations has always been consistent: the EPM management layer is best kept separate from any ERP. This separation delivers a degree of future proofing for the organisation, and being ERP agnostic leaves room for a lot of flexibility as the organisation evolves and changes over time.

Reasons to Change

Given those considerations, consider joining the more than 300 SAP ERP customers who use OneStream. Below are just some of the reasons these organisations moved to OneStream:

- Ability to replace multiple legacy systems or cloud point solutions with a unified application

- Reduced time, effort and cost to maintain legacy applications

- Fewer manual steps and accelerated reporting and planning

- Support for both corporate and LOB needs in a unified solution

- More flexibility and agility in IT to support the application and extend the solution beyond CPM to CPM+ scenarios like Sales & Operations Planning (S&OP), vendor management, demand planning.

- Shift in Finance staff’s time requirements from admin and manual tasks to value-added analysis

Those reasons highlight why the most natural and capable successor to Cartesis/SAP BFC is OneStream.

Move Forward with the Next Generation of CPM

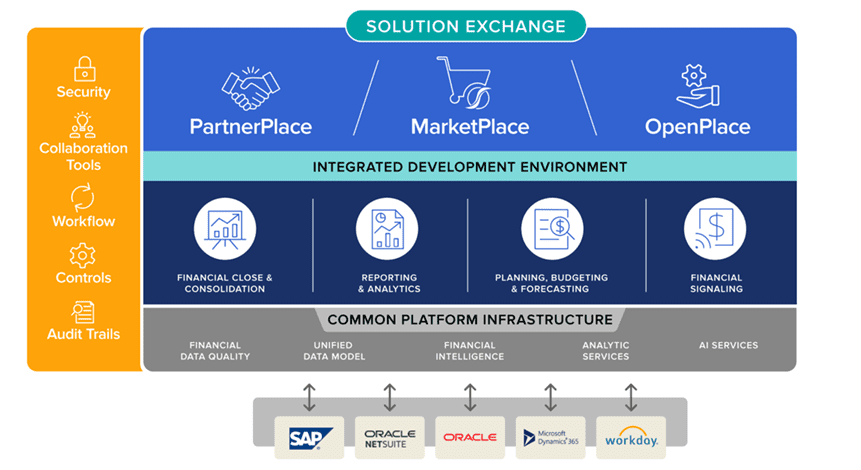

OneStream’s Intelligent Finance platform (See Figure 1) is completely agnostic to ERP strategy. Rather than relying on a central ERP strategy, Intelligent Finance platforms integrate data from multiple sources – such as ERP, CRM, HCM and data warehouses – to create a single and governed version of the truth across finance and operational processes.

Figure 1 – OneStream Intelligent Finance Platform

This interoperability is important. Why? It keeps the management layer technology independent from the transactional layers. Any IT department that forces a move to a single tech solution is setting the organisation up for unnecessary costs and delays when future changes occur. After all, you can never say never to changes in your business model or structure.

To learn more about Choice 3 – evaluating alternate EPM strategies such as OneStream – and to understand why OneStream is the most logical move from Cartesis/SAP BFC, tune in for our next and final blog post in the ‘What’s next for Cartesis/SAP BFC Customers’ series.

Learn more!

Ready to join the organisations that have taken the step from Cartesis/SAP BFC to OneStream? Check out our video here, and be sure to visit our website.

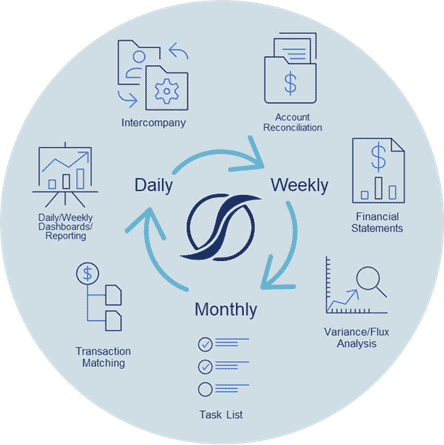

At OneStream, we realize that delivering timely and accurate consolidated financial statements is just a part of the period-end financial close process. We see the Financial Close as a comprehensive and continuous cycle that involves managing the close process and all related tasks. It includes collecting and consolidating data from multiple sources, matching transactional detail to eliminate misstatements, reconciling intercompany balances, and utilizing matched data and reconciled intercompany balances to reconcile account balances required to publish consolidated financial statements.

OneStream is the only corporate performance management (CPM) platform on the market that supports the entire financial close process within one, unified application (see Figure 1). It’s this capability to unify all of these processes in parallel and without complexity that gives OneStream the ability to replace multiple legacy or connected finance applications as well as spreadsheets. This approach not only drives speed and accuracy in the close process, but it’s a huge opportunity for organizations to drive total cost of ownership savings and generate a high return from their OneStream investment.

What’s New?

OneStream continually looks for ways to help customers get the most from the platform and has just announced the release of the OneStream Financial Close MarketPlace solution which streamlines and simplifies existing customers’ access to our Account Reconciliations and Transaction Matching solutions.

The OneStream Financial Close (OFC) solution fully unifies the ability to use Transaction Matching detail to support Account Reconciliation balances. Integration between these solutions is optional allowing each solution to also be used independently. The solutions included within OFC require the same minimum OneStream platform version which always ensures alignment between these critical processes.

Here are a few of the benefits of OneStream’s Financial Close (see Figure 2) solution:

- Single downloadable solution with single install and uninstall, with one source of the truth and one point of maintenance.

- Effortlessly unify and maintain Account Reconciliations and Transaction Matching Integration by leveraging existing dimensionality to identify which transactions relate to corresponding reconciliations.

- Transactional level support may be created from Transaction Matching and pushed to multiple reconciliations, OR detail specific to a reconciliation may be pulled from Transaction Matching to a reconciliation.

- Aggregated transactional level detail such as transaction date to provide aging information with the ability to drill back directly to detail information.

- Create and unify tables for Account Reconciliations and Transaction Matching in parallel.

Learn More

Hundreds of OneStream customers have implemented our platform to streamline their financial close, consolidation, and reporting process – replacing spreadsheets and multiple legacy applications. And many have extended their investment with the OneStream Account Reconciliations and Transaction Matching MarketPlace solutions. This has enabled them to reduce data latency and further streamline the close process while eliminating risky spreadsheets and standalone point solutions. To learn more about OneStream’s Financial Close Suite please visit our website or contact your OneStream account representative. If you are a current OneStream customer, you can download the OneStream Financial Close solution directly from the OneStream Solution Exchange.

The value of scalability within the Finance organization cannot be understated. Financial consolidation and planning applications should not only meet current requirements, but also anticipate the future needs of an expanding enterprise. Scalable platforms that efficiently align financial and operational data enable key stakeholders to focus on driving that growth. That’s why, it is critical for Finance teams to have the proper tools in place to help advance the business, not limit it.

With Anaplan as their planning and reporting solution, Diligent Corporation battled with data restrictions, hitting their workspace server limit with every new acquisition. They constantly reprioritized functionality by chipping away at their Anaplan models. These challenges ultimately drove Diligent to seek a true unified CPM platform, focused on providing strong reporting and analysis capabilities. Read on to learn more about their story.

The Modern Governance Company

Diligent is the leading governance, risk and compliance (GRC) SaaS provider, empowering leaders to drive accountability and transparency. Relied on by more than 25,000 organizations and nearly 1M+ leaders, Diligent’s applications support efficient collaboration and secure information sharing. Headquartered in Washington, DC, Diligent Corporation employs over 1,500 people across 70 legal entities and generates $550M in revenue. More information is available at diligent.com.

Limited Scalability with Anaplan

Diligent has become the world’s largest GRC SaaS company due to organic growth and frequent acquisition activity. Yet the organization experienced challenges with Anaplan’s finance application as they worked through 20 new acquisitions over a five-year span. The platform lacked scalability and sufficient workspace, leading Diligent to make sacrifices within their models to allow for the minimum level of business unit reporting required. System generated management reports were burdened by FX related variances and Diligent’s Finance organization lacked confidence in the numbers produced. This caused certain processes to be pushed back into Excel®, decreasing forecast accuracy.

Given these challenges, Diligent began their journey of replacing Anaplan with a unified platform that would get all of their information into the same system. They discovered that OneStream offered a single source for reporting planning, and ensured information supporting forecasts was accurate and consistent. Simply put: OneStream offered the flexibility and added structure that Anaplan did not have. Diligent decided to implement OneStream in the cloud for financial consolidation and reporting, budgeting, planning, and forecasting.

Putting the Right Controls in Place

With multiple acquisitions being integrated at the same time, Diligent is constantly adding new entities and FX rates. But the availability and accuracy of information in OneStream has empowered Diligent to automate financial processes and streamline complicated intercompany eliminations. Since implementing OneStream, Diligent has reduced the monthly close cycle from 45 to 15 days. And now with statutory reporting in OneStream, fundamental calculations are automated, and the Finance team has clear visibility into the underlying data. OneStream has expedited the monthly close process and enabled more investments back into the business, given the increased accuracy of forecasts.

Significant Budget Cycle Improvements

In Anaplan, Diligent could only maintain three scenarios at a time. And now with OneStream, the confidence and level of detail supporting the forecast is noncomparable. The structure and standardization that OneStream provides enables Diligent to plan sales/revenue forecast at product and business unit levels by country and local currency. All forecasts leverage the same methodology, and drivers and assumptions are easily updated as information becomes available. Time spent on forecasting was cut in half, with monthly rolling forecasting, quarterly forecasting, and budget always being maintained at the same time.