The value of scalability within the Finance organization cannot be understated. Financial consolidation and planning applications should not only meet current requirements, but also anticipate the future needs of an expanding enterprise. Scalable platforms that efficiently align financial and operational data enable key stakeholders to focus on driving that growth. That’s why, it is critical for Finance teams to have the proper tools in place to help advance the business, not limit it.

With Anaplan as their planning and reporting solution, Diligent Corporation battled with data restrictions, hitting their workspace server limit with every new acquisition. They constantly reprioritized functionality by chipping away at their Anaplan models. These challenges ultimately drove Diligent to seek a true unified CPM platform, focused on providing strong reporting and analysis capabilities. Read on to learn more about their story.

The Modern Governance Company

Diligent is the leading governance, risk and compliance (GRC) SaaS provider, empowering leaders to drive accountability and transparency. Relied on by more than 25,000 organizations and nearly 1M+ leaders, Diligent’s applications support efficient collaboration and secure information sharing. Headquartered in Washington, DC, Diligent Corporation employs over 1,500 people across 70 legal entities and generates $550M in revenue. More information is available at diligent.com.

Limited Scalability with Anaplan

Diligent has become the world’s largest GRC SaaS company due to organic growth and frequent acquisition activity. Yet the organization experienced challenges with Anaplan’s finance application as they worked through 20 new acquisitions over a five-year span. The platform lacked scalability and sufficient workspace, leading Diligent to make sacrifices within their models to allow for the minimum level of business unit reporting required. System generated management reports were burdened by FX related variances and Diligent’s Finance organization lacked confidence in the numbers produced. This caused certain processes to be pushed back into Excel®, decreasing forecast accuracy.

Given these challenges, Diligent began their journey of replacing Anaplan with a unified platform that would get all of their information into the same system. They discovered that OneStream offered a single source for reporting planning, and ensured information supporting forecasts was accurate and consistent. Simply put: OneStream offered the flexibility and added structure that Anaplan did not have. Diligent decided to implement OneStream in the cloud for financial consolidation and reporting, budgeting, planning, and forecasting.

Putting the Right Controls in Place

With multiple acquisitions being integrated at the same time, Diligent is constantly adding new entities and FX rates. But the availability and accuracy of information in OneStream has empowered Diligent to automate financial processes and streamline complicated intercompany eliminations. Since implementing OneStream, Diligent has reduced the monthly close cycle from 45 to 15 days. And now with statutory reporting in OneStream, fundamental calculations are automated, and the Finance team has clear visibility into the underlying data. OneStream has expedited the monthly close process and enabled more investments back into the business, given the increased accuracy of forecasts.

Significant Budget Cycle Improvements

In Anaplan, Diligent could only maintain three scenarios at a time. And now with OneStream, the confidence and level of detail supporting the forecast is noncomparable. The structure and standardization that OneStream provides enables Diligent to plan sales/revenue forecast at product and business unit levels by country and local currency. All forecasts leverage the same methodology, and drivers and assumptions are easily updated as information becomes available. Time spent on forecasting was cut in half, with monthly rolling forecasting, quarterly forecasting, and budget always being maintained at the same time.

Diligent has also replaced their manual headcount forecasting process in Excel® by leveraging People Planning from the OneStream MarketPlace™. A driver-based model provides the ability to customize calculations and assumptions based on the dimensionality defined. Diligent is performing more granular zero-based budgeting at the department, business, unit, country, vendor, and project level. The Finance organization is gaining better insight into the business and providing more value to stakeholders.

Learn More

To learn more about Diligent’s success with OneStream, check out their Anaplan’s finance application and contact OneStream to learn more about the benefits of replacing spreadsheets, legacy applications, and cloud-based point solutions such as Anaplan with an Intelligent Finance platform.

It’s hard to beat the exhilaration of a bluebird day skiing down a freshly powdered mountain with the freedom to unleash full speed ahead down the slopes. Just as skiers look to the mountains as a breath of fresh air and an escape from everyday life, organizations struggling with outdated, complex, and disjointed legacy performance management systems also seek that same feeling of freedom from the stress brought on by outdated finance applications.

Alterra Mountain Company, a family of 15 iconic year-round destinations including the world’s largest heli-ski operation, was buried in the wake of journal entries and fragmented information from their decade-old Oracle HFM system. Read on to learn how Alterra Mountain Company digitally transformed to streamline its finance processes by replacing Oracle HFM with OneStream.

Uphill Battle with Outdated Legacy System

Headquartered in Denver, Colorado, Alterra Mountain Company was formed in the summer of 2017 through the merger of several companies. The company owns and operates a range of recreation, hospitality, real estate development, food and beverage, retail, and service businesses with destinations spanning six U.S. states and three Canadian provinces.

The core company that became the foundation of Alterra was using an outdated, decade-old version of Oracle Hyperion Financial Management (HFM) for a consolidation system. The people who had installed and managed the application were no longer with the company, and the individuals left to take over the system were challenged in maintaining the application.

According to Andrew Renken, Vice President of Enterprise Applications and Program Management Office at Alterra Mountain Company, “There were upwards of 1,000 top side journal entries accumulated over that decade. Unfortunately, very few individuals understood the history that come forward with that installation, and ownership had very few means to find the business outcomes they were trying to see in HFM.”

Unifying Financial Processes for a Streamlined Approach

Alterra had a mission to upgrade the company’s back-office applications, including switching ERP systems from a multi-platform landscape to standardizing on Microsoft Dynamics 365. Once the core financial information was established in the ERP, the Finance team started to evaluate their needs for financial consolidation and reporting. “A pending acquisition created the need to align fiscal years across the business, so with that, we had to make a decision,” said Renken. “We were on an old version of HFM and we started a conversation with leadership about how we wanted to move forward.”

Renken continued, “We knew that the costs to upgrade Oracle HFM and ongoing costs to maintain it would be substantial. We considered upgrading to Oracle EPM Cloud, but the valuation was quite short and frankly non-existent. We knew if we were going to make the investment, we wanted a platform we could grow with and leverage across many business processes — so we immediately looked at OneStream.”

OneStream was ultimately selected for its dedication to customer success along with the platform’s efficient and sleek user interface. OneStream’s attentive attitude also stood out to Renken and his team as a key differentiator. Renken noted, “The partnership is just as important as many aspects of the solution itself, especially for a very prominent platform that will be in our organization for years to come.”

Alterra operates in both CAD and USD with a lot of intercompany activity between 145 accounting entities. OneStream’s multiple ownership and consolidation methods were able to manage this complexity – serving as another key reason Alterra chose the platform to replace HFM.

Leading at Speed

Upon selecting OneStream, Alterra was quick to start the project with The Hackett Group, focusing on the implementation of financial consolidations in OneStream. Alterra’s users started to see the value of OneStream before the company was live. According to Renken, “Although it wasn’t part of the original scope, there was an additional business need to solve for account reconciliations, so we did a parallel effort to transition to the Account Reconciliations solution on OneStream.” Through this transition, Alterra was able to replace Trintech and Excel® for account reconciliations by creating a unified process in OneStream.

OneStream also supports private GAAP reporting, financial consolidation, and account reconciliations for Alterra – addressing one of the company’s biggest challenges with Oracle HFM. “With OneStream, Alterra has seen a dramatic savings of time to close the books, going from a five-week to 3.5 weeks close for the fiscal quarter close,” said Renken. “The team is really hitting their stride now with the close process. We are saving 30 to 40% of the time it took to close the month-end and quarter-end previously with HFM.”

Looking ahead, Alterra plans to continue unifying its financial processes on OneStream’s platform with a long list of capabilities to take on next including implementing budgeting and planning, along with a few additional solutions from the OneStream Solution Exchange. Added Renken, “We chose a best-in-class solution that we could grow with our organization and adopt more capabilities over the long term.”

Learn More

To learn more about Alterra Mountain Company’s OneStream journey, check out their case study here. If your organization is ready for a finance transformation, contact OneStream today.

At OneStream, our mission statement – every customer must be a reference and a success – drives everything we do. And customers are our focus in this final post of our 4-part series titled Sensible Machine Learning for EPM – Future Finance at your Fingertips. Specifically, we’ll delve into inspiring customer stories that highlight the real-world applications and benefits of Sensible Machine Learning (ML) in the Enterprise Performance Management (EPM) landscape. Previous posts in this series discussed the path toward ML-powered intelligent planning. In this post, we’ll show you how Sensible ML has revolutionized EPM, paving the way for better decision-making and improved financial performance.

AI’s Increasing Role in Financial Planning and Analysis (FP&A)

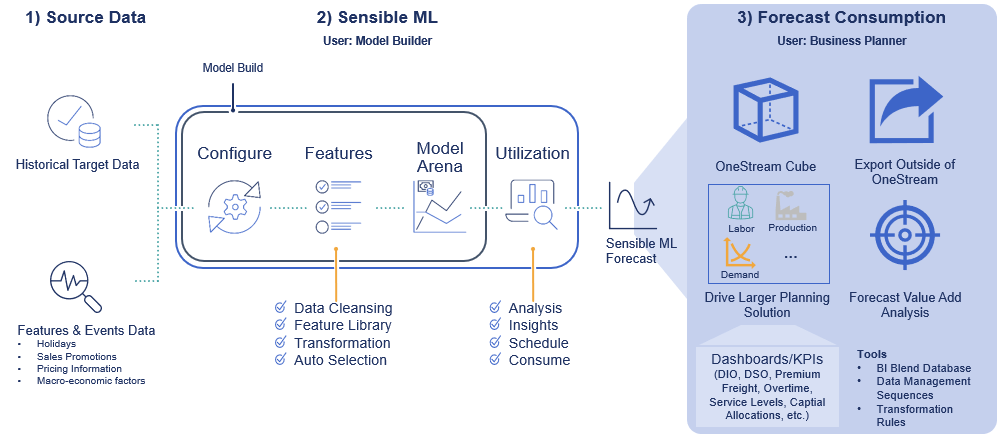

In today’s rapidly evolving business landscape, artificial intelligence (AI) is playing an increasingly crucial role in the realm of FP&A. Organizations are recognizing the immense potential of AI-powered solutions to optimize FP&A processes, drive better decision-making and unlock valuable insights from complex financial data. OneStream’s Sensible ML for EPM is at the forefront of this AI revolution, offering a powerful and practical approach to harnessing the benefits of AI in FP&A through a unified Auto ML and EPM approach, something unique in the market (see Figure 1).

Figure 1: Sensible ML Forecast Workflow

According to Gartner, by 2028, 50% of organizations will have replaced time-consuming bottom-up forecasting approaches with AI. That shift will result in autonomous operational, demand and other types of planning. And our customers who have gotten a head start in automating their FP&A are seeing promising results.

Delivering 100% Customer Success

Below are a few examples of customers we have worked with and the benefits the organizations achieved with OneStream.

Polaris, a global leader in powersports, and Autoliv, a leading car safety manufacturer, both leverage Sensible ML to increase planning efficiency and forecast accuracy. Both also gained insights into the drivers that influence their forecasting and remained agile amid shifting trends during the COVID-19 pandemic. Leading up to the pandemic, both Polaris and Autoliv leveraged demand-based forecasts to run the business. Once COVID-19 hit, however, the businesses shifted from demand to supply-oriented planning.

With Sensible ML’s, Polaris and Autoliv were able to quickly make that shift by easily feeding new supply-chain-oriented features into Sensible ML. This ability to quickly adapt the planning process using Sensible ML enabled both companies to not only survive COVID-19 market impacts but also thrive in amid rapidly changing conditions. In fact, both Polaris and Autoliv’s revenue increased over a 3-year period.

Customer success stories like that extend beyond manufacturing and into other industries as well. Our Sensible ML customers include Financial Services, Professional Services, Retail – CPG and Grocery. Across all customers, Sensible ML has improved accuracy by double digits over each customer’s human-generated forecasts – with significant accuracy improvements in a substantial range.

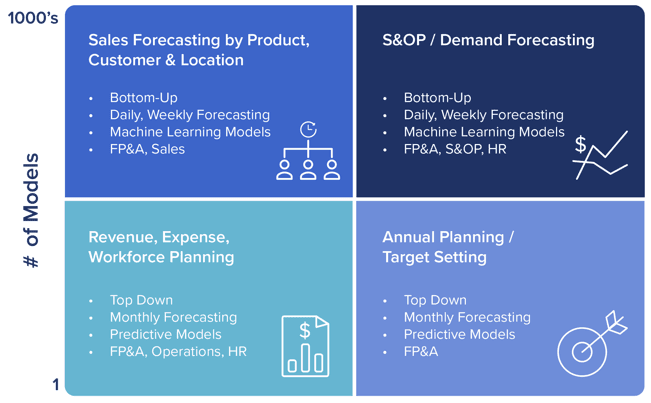

Sensible Use Cases Foster Success

Beyond providing efficient and accurate detailed weekly demand planning, Sensible ML also enables organizations to more quickly and accurately foster success through top-down quarterly strategic planning processes over 3- or 5-year (or longer) periods, monthly Annual Operating Plans, workforce planning and much more. More granular, bottom-up type forecasting by customer, product by location and/or S&OP allows organizations to share hundreds of data points per target. Sensible ML can create weekly or daily forecasts that even account for specific intuition from the business analysis on impacts such as holidays, weather, pricing changes, competitive impacts or any time-based intuition (see Figure 2).

Figure 2: Multiple Use Cases Addressed by Time Series Forecasting

Planning for Downstream Processes

Studies have shown that, when collaborating with machine learning algorithms, humans can leverage their domain knowledge and intuition to refine and improve the outcomes produced by the algorithms. In that sense, the value of having Sensible ML embedded in OneStream’s platform is the ability to easily adjust the ML forecast since no data movement, mapping or reconciliation are required between multiple systems. Sensible ML’s forecast is immediately available in OneStream’s dashboards and reports for business planners to analyze and act upon.

This functionality also creates a seamless flow for downstream processes, such as labor or production planning. For example, a retail customer can take Sensible ML’s forecast for sales of product A in store location XYZ and subsequently plan for the inventory to keep on hand, which in turn minimizes rush orders and maximizes revenue. The retail customer can now also plan for staffing at each location to minimize overtime costs and satisfy customers with sufficient staff available.

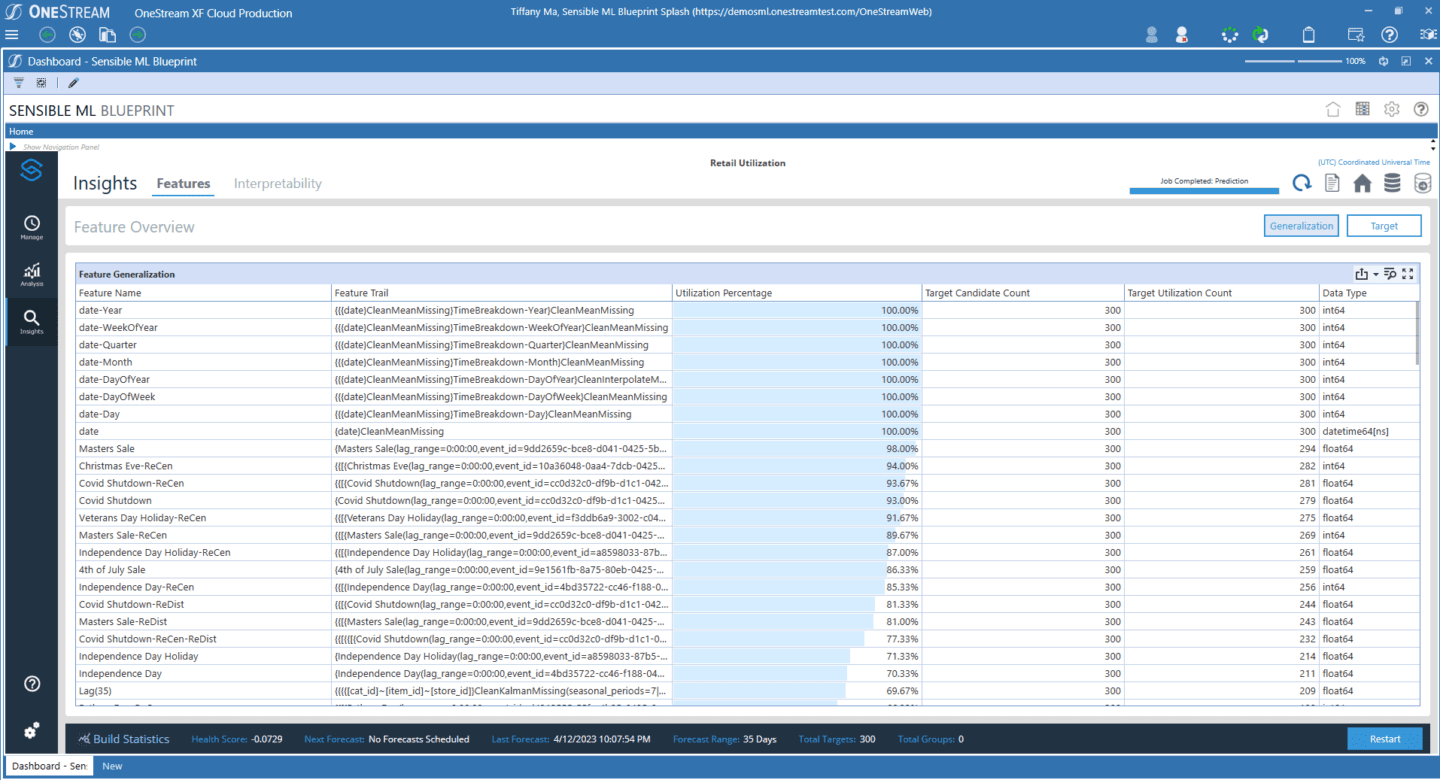

Uncovering Insights

Sensible ML also has Feature Transparency dashboards surfacing insights that previously may not have been known to the business. These dashboards display how impactful each driver (feature) was to the forecast. By measuring the degree of impact for each driver, businesses can proactively plan for drivers or events and be better prepared when events occur (see Figure 3).

Figure 3: Feature Transparency Dashboard

Feature Transparency dashboards showing driver impact could then be used in scenario modeling to see whether offering a promotion would affect sales vs. not offering the promotion. Or planners can create various models offering the promotion at various times of the year.

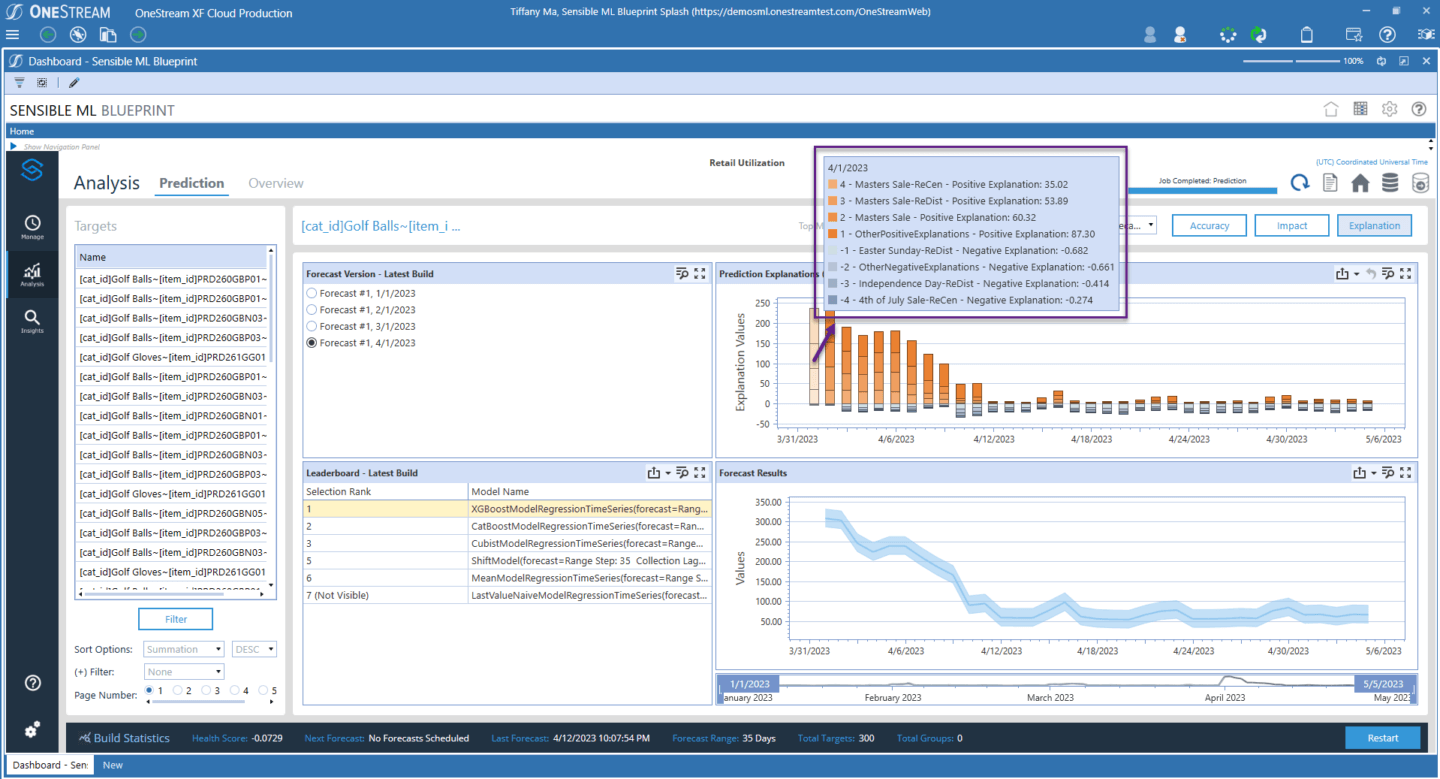

A Tug of War dashboard also shows how all the various drivers, events and macroeconomic data are affecting a forecast on an individual basis. Customers can see both the positive and negative impact to the dollar amount for the forecasted item on each day. Accordingly, this dashboard gives users actual evidence to substantiate the Sensible ML forecasts. If more labor and inventory are required at store XYZ for a particular day, for example, the Tug of War dashboard gives the reasoning with an exact dollar amount to justify the spike in required resources (see Figure 4).

Figure 4: Tug of War Dashboard

Conclusion

OneStream’s Sensible ML for EPM has emerged as a groundbreaking solution, revolutionizing the way organizations approach planning, budgeting and forecasting. Through the power of ML algorithms and real-world customer stories, Sensible ML has proven its ability to drive better decision-making, enhance accuracy, adapt quickly to changing business dynamics and unlock valuable insights for businesses of all sizes and industries. From streamlining budgeting processes to improving forecasting accuracy, organizations that have embraced Sensible ML have gained a competitive edge in the market. And organizations using Sensible ML can harness the power of ML in EPM without the complexity and technical expertise typically associated with ML implementations.

Learn More

To learn more about how FP&A teams are moving beyond the AI hype, download our white paper here.

Conquering Supply Chain Disruptions

Prior to the supply chain disruptions of recent years, Polaris Inc., a leading provider of powersports equipment, forecasted production and shipments based on innovation and market demand. However, since these disruptions occurred, the business environment became constrained by supply. Recognizing a need for more speed and agility across planning processes, the Polaris Finance team turned to the power of OneStream’s Sensible Machine Learning (Sensible ML) solution to assist with demand forecasting.

In previous years, Polaris’ business units had relied on a highly manual financial planning model with inputs such as SIOP-generated shipped unit forecasts by product, product costs and MSRPs, freight cost, and dealer discounts to arrive at a gross margin view. This model was referred to as the “Driver-Based Revenue Model,” and it provided the perfect opportunity to incorporate machine learning-driven forecasting and transition to a unified planning process within OneStream.

Putting Sensible ML to the Test

Polaris decided to focus their Sensible ML project on their North American Off-Road Products GBU, looking at a 12-month forecasting time horizon with a focus on variables impacting their Shipped Units forecast. These variables included Commodity Prices, Presold Orders, “Clean Build” Percentage and Build-to-Ship Durations. Historic data representing these variables would be combined with historic shipped units to generate the ML models and their forward-looking forecasts.

The historic data model covered 181 products, with weekly units sold from 2016 through 2022. Sensible ML crunched through this data, combined with commodity prices for steel and aluminum, factored in events such as holidays, and generated over 2,800 models for comparison. The OneStream ML models proved to be the most accurate, based on the historic data. The ML forecasts were run monthly and were incorporated into a driver-based forecast.

Faster, More Accurate Forecasts and More

The results were impressive. Not only were the forecasts more accurate than with prior approaches, but with Sensible ML, Polaris added speed and efficiency to their forecasting processes, reducing forecasting cycles from days to hours. Polaris also now has more transparency into what’s behind the ML models, including insights into the key forecast drivers for more informed decision-making.

It provides a finance-run ML forecasting process that integrates seamlessly across planning and forecasting processes in the same user experience used for financial close and consolidations, account reconciliations and reporting.

“The ability to quickly generate driver-based forecasts is essential to adapting to our changing business conditions,” said Melanie Hermann, Director, Finance Process & Systems at Polaris Industries. “Incorporating AI into our planning and forecasting through the OneStream Sensible ML solution accelerates the forecasting process and further elevates it with powerful ML data-driven forecasts. Sensible ML forecasts have shown to be more accurate, and the Value-Add Dashboard provides the business users with insights into the key features driving the forecast to easily manage, improve and enhance the model.”

The Polaris Data Science team was impressed with the process and results. “Sensible ML commoditizes the part of my job that can be commoditized and allows me to focus on where I can add value… with the output that Sensible ML provides,” said Luke Bunge, Manager Data Science Product. “It’s an incredible timesaver and gets you to the best answer possible. The team did a great job immersing us in the tool…as opposed to turning it into a black box.”

Learn More

For companies across fast-changing industries such as CPG manufacturing, retail and hospitality, Sensible ML reduces the traditional barriers to ML forecasting and improves both the speed and accuracy of demand planning. This enables organizations to fine-tune production plans, optimize inventories as well as reduce volatility and fluctuations in labor planning.

To lean more, download the Polaris Inc. case study and contact OneStream if you are ready to learn how your organization can take advantage of the power of machine learning.

Why are visibility and agility so important in today’s business environment? Because these are critical factors for success – they enable quick decision-making, drive resilience and are essential for enterprises in navigating a complex, fast-paced world. Driving visibility and agility to scale across the enterprise is essential for businesses looking to digitally transform. Creating an agile, digital business environment affects the entire enterprise, allowing employees to cohesively work together and freeing up time from manual tasks to allow for more analysis and innovation.

Read on to learn how Ingram Micro embarked on their own finance transformation journey with OneStream’s unified corporate performance management (CPM) platform. After facing the challenges of integrating multiple ERP systems into several different Oracle Hyperion applications Ingram Micro implemented OneStream to streamline its complex financial processes and improve visibility into profitability across products and customers. The result? Hours-long processes shortened to just minutes, better visibility into what drives the business and increased business agility. Let’s dive in!

Driving Finance Transformation

Ingram Micro is one of the world’s largest technology distributors, helping businesses realize the promise of technology. Based in Irvine, CA, Ingram Micro employs over 29K people and has an annual revenue of approximately $54B. Ingram Micro had multiple ERP systems and an extensive Oracle Hyperion footprint for financial consolidation, budgeting and management reporting, including Hyperion Financial Management (HFM), Hyperion Planning, Essbase, and Hyperion Profitability and Cost Management (HPCM). Additionally, Ingram Micro was using Trintech for account reconciliations and Qlik for reporting.

Ingram Micro was challenged by this complex environment of fragmented solutions. The company set out on a mission to replace the Hyperion suite, with the speed of profitability allocations as a main driver. Other key measurements of success for Ingram Micro included managing margins, profitability analysis and impact on working capital. However, Ingram Micro has many ERP systems with different instances around the world, making it difficult to get data from those systems into the profitabiltiy solution.

Financial reporting was also an issue as countries had to wait between two and four hours after posting a journal in the general ledger to see the data in Hyperion. “We have an annual CFO conference where financial directors from all countries came together in Irvine,” said Jan de Leeuw, Director of Financial Systems at Ingram Micro. “Normally I present there, and I was always apologizing about challenges with our data in Hyperion. It felt like nobody was happy with me during the first three years that I was working in this role. We needed a better way to understand profitability for a customer to evaluate new opportunities.”

Selecting a Modern CPM System

Ingram Micro was concerned about their profitability solution and was careful in their decision to explore the market as the company operates globally in 62 countries, with approximately 200 entities. Ingram Micro initially tried the Oracle EPM Cloud solution, but upon testing saw it resulted in a very slow allocation process and the numbers didn’t reconcile.

“Oracle simply couldn’t handle our performance needs — it was not the right solution for Ingram,” said de Leeuw. “From there we had many conversations with OneStream about the solution’s ability to handle large volumes of data. We looked at our current processes and future goals and felt confident that OneStream could handle it. We put a lot of trust in OneStream and took a step in the dark, which in the end was very successful. We have a high boosted environment right now with over 1,000 users currently, which is expected to grow to 1,100 by the end of the year.”

Ingram Micro went live with OneStream in the Microsoft Azure cloud for financial consolidation and budgeting in 2021. The company further extended their investment in the platform, adding People Planning, Capital Planning and Account Reconciliation solutions from the OneStream™ MarketPlace.

Streamlined Financial Operations & Profitability Models

Because of Ingram Micro’s complex ERP landscape and with multiple Hyperion applications, everything was batch driven. Users were pushing the data every two hours into Hyperion, creating delays with consolidation and management reporting. Now with OneStream’s unified CPM software, it is an on-demand process where users can push the data in whenever the country is ready. The timeline between the journal posting in the ERP to it landing in the consolidation system shortened from two hours to five minutes.

“The OneStream dashboarding is strong, with the ability to give every country one standard way of starting their analysis, plus the ability to play with the data for their own needs,” said de Leeuw. “On the budgeting side, we are leveraging OneStream for the annual budget, quarterly forecasting, and some monthly forecasting. We look forward to implementing weekly forecast soon.”

Ingram Micro also built dashboards to provide the company’s users with improved visibility into profitability across 170K customers and 1,500 vendor partners. De Leeuw added, “We now have much more insight into performance and profitability by customer, item and country. It’s one of our most important instruments.”

Benefits of OneStream

Since implementing OneStream, the speed of allocations has significantly improved, shortening the cycle from eight hours down to 10-20 minutes. Users can check the data, adjust and complete allocations within minutes, instead of waiting overnight. According to de Leeuw, “Rapid refresh was not possible in Hyperion, and it took 56 hours from beginning to end to run the process. We were able to reduce that process to eight hours and now users can run it whenever they want, and it takes only 20 minutes to refresh. That’s a huge game changer for everyone that’s working with the data.”

Scalability has also significantly improved with OneStream. In HPCM, onboarding new countries would take three to four months to build a new application. With OneStream, the information is already there so users can simply add the vendors and customers of that specific country and they are on board.

“There are so many things I like about OneStream,” said de Leeuw. “Speed, speed, speed, everything is faster. The users are happy and it’s easier to present. Support is fantastic, escalations are reduced to the minimum, and the technical reliability is amazing — which is something I never experienced with Hyperion. I like having the flexibility to build solutions out in the in the platform— the technology is very powerful. And the OneStream team listens and is always willing to help by continuing to develop things that are beneficial for companies like Ingram Micro. It’s been tremendous.”

Looking Ahead

Ingram Micro is exploring additional opportunities to automate their budget process and implement new MarketPlace solutions. The company hopes to do a 6-12 months trend analysis in the platform. But high on their list of plans is exploring OneStream’s Sensible Machine Learning solution.

Learn More

To learn more about Ingram Micro’s journey from Oracle Hyperion to OneStream, check out the case study for more information. If your organization is ready for a finance transformation, contact OneStream today.

There’s been a debate brewing for years in the enterprise performance management (EPM) software market about what’s the best way to deliver the functionality required to support the various EPM processes. The debate centers around whether customers are better served by a unified EPM platform or by best of breed applications designed to support specific processes such as financial consolidation, reporting, planning and forecasting. At the heart of this debate is also the question about what’s more important in EPM software – control or flexibility? What if you could have both in a single product? Read on to learn more.

Taste Great vs. Less Filling

Remember the Miller Light beer commercials from the 1970’s when the product was first introduced? The premise behind them was that most beer-drinkers believed that a low-calorie beer sacrificed taste, then Miller came along and dispelled the myth with their product which “tasted great” and was also “less filling.” There’s a similar debate “brewing” in the EPM/CPM software industry regarding best of breed applications vs. unified platforms.

The main focus of the EPM debate has been financial consolidation and reporting vs. planning, budgeting and forecasting. The financial consolidation and reporting process requires control and accuracy, while planning, budgeting and forecasting requires the flexibility to budget, plan and forecast at different levels of detail than the actual financial results. And furthermore, this level of detail can vary based on the planning process (strategic vs. financial vs. operational) and line of business. The camp that favors the best of breed approach believes that the control required to deliver fast and accurate consolidated financial results hinders the planning and forecasting process, and vice versa. But is this really true? The answer is that it depends on the architecture of the software.

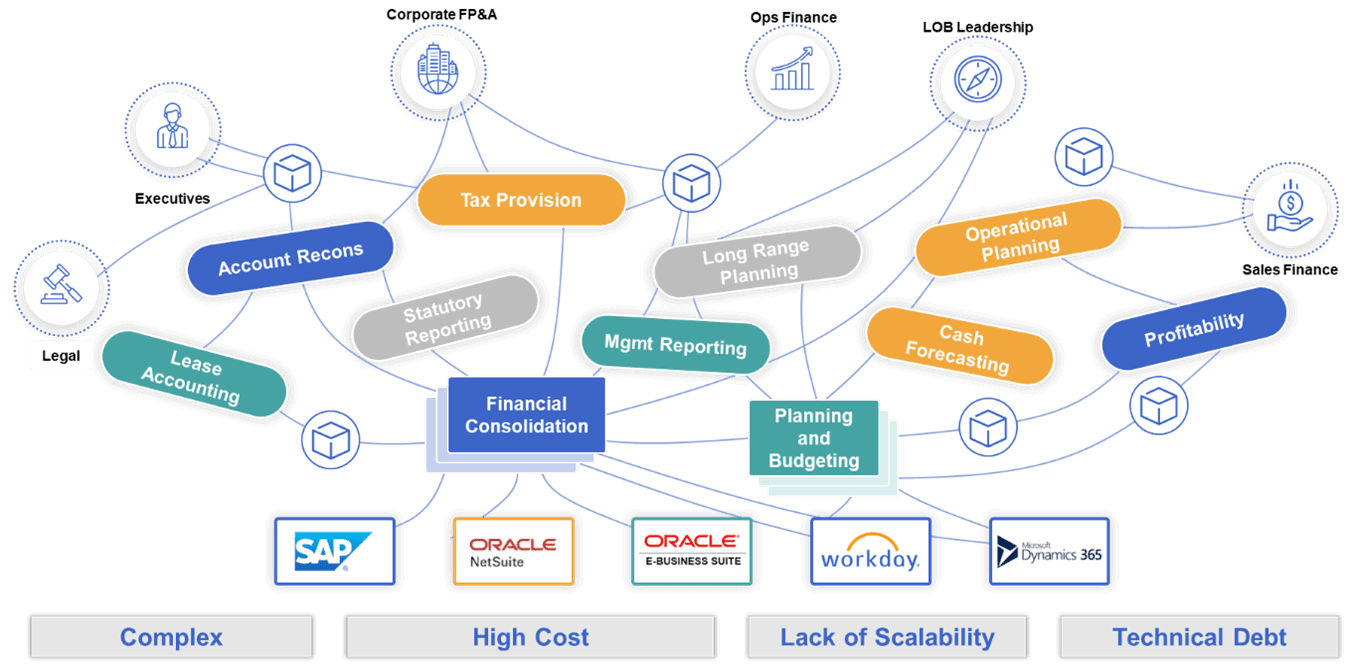

Best of Breed Applications and Fragmentation

Several EPM vendors have chosen to deliver a fragmented set of best of breed applications (see figure 1) to support processes such as financial close and consolidation, reporting and various types of planning. These vendors claim that each of these processes requires a dedicated application that’s optimized to provide either the control or flexibility required by the application. The problem with this approach is that every organization has the need to compare their actual, book of record financial or operating results against their budgets or forecasts in order to identify and analyze variances.

With a fragmented suite of applications, this requires users to move data from the financial consolidation application to the planning application, or vice versa, or to yet another application where the data can be aligned for reporting and analysis. And in addition to spending a lot of time moving data around, the users must maintain and update metadata in multiple applications as new accounts, departments, locations, or products are added to the business.

For example, what happens when your business changes via re-orgs, acquisitions, or divestures? The answer is you need an army of consultants or admins to realign systems, metadata, data and reports to ensure all users are seeing the same definition of net income for example. Having multiple systems means that there is a data reconciliation effort just to try to ensure common definitions. This tax on your systems and resources means they can’t attack other business problems.

Some of the cloud-based vendors in the market offer point solutions that support only specific EPM processes, such as enterprise planning or account reconciliations. The cloud-based planning software vendors claim their software is optimized for this process and that consolidation and reporting should be handled in a separate application. Again, the problem here is that customers need to be able to compare actual book of record financial and operational results against the budgets or forecasts to identify and analyze variances. So the users end up having to extract the actuals, budgets and forecasts out of their respective applications and into Excel spreadsheets or some other system for comparative reporting.

Another problem is that some cloud-based planning software vendors provide planning platforms that include no pre-built financial intelligence – it must all be built from scratch. While this approach might work for supporting only operational planning processes, it doesn’t work for linking operational plans to financial plans and forecasts. This linkage of financial and operational plans is a key market requirement and the essence of what’s now being referred to as eXtended Planning & Analysis (XP&A).

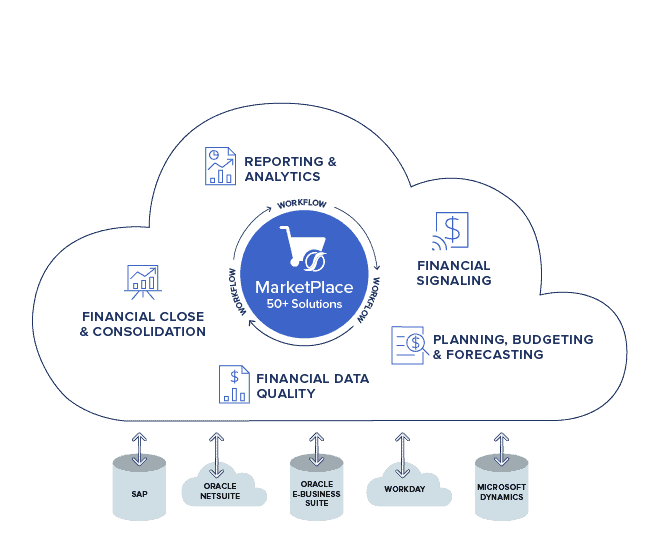

OneStream Provides Control and Flexibility in a Single Application

Now that we have identified the complexities that are created for users by fragmented EPM suites or best of breed planning solutions the question is – can a single unified EPM/CPM application provide both control and flexibility? Is it possible to have a single application that provides the control and accuracy needed to support the complex financial consolidation needs of global enterprises, as well as the flexibility to support financial and operational planning, budgeting and forecasting. The answer is yes – and that’s the essence of OneStream.

OneStream provides a unified, Intelligent Finance Platform (see figure 2) with a modern architecture designed to provide accuracy and control as well as flexibility in a single application. One of the secret sauces behind this is something called Extensible Dimensionality®. This is essentially the ability of the system to support corporate standards, such as the corporate chart of accounts (COA), while providing relevance for operating units. This means the corporate COA can be extended to support the more detailed reporting and planning requirements of various business units without impacting the corporate standard.

The other secret sauce is the multiple calculation engines within OneStream’s Intelligent Finance platform. This includes a world-class financial consolidation engine, as well as an aggregation engine designed to rapidly roll up budgets, plans and forecasts that don’t require the same precision and audit trails as book of record financial results. The beauty of this approach is that the data for all these processes resides in a single data store, providing a single version of the truth for actuals, plans, forecasts and other corporate data.

In addition, a unified application means all processes are aligned with a single point of change, so solutions are always in alignment without manual reconciliation efforts. This single point of changes gives OneStream customers the agility needed to conquer the complexity of business changes. This unique capability is what allows OneStream to replace multiple legacy applications with a single, unified platform. That platform provides the control to support fast and accurate financial close, consolidation and reporting – while also providing the flexibility to support agile budgeting, planning and forecasting across the enterprise. And this unified approach makes it very easy for users to compare actual financial and operating results with budgets and forecasts – at whatever level of detail is required, without moving data between applications. It provides a single version of the truth for actuals as well as strategic, financial and operational plans, budgets and forecasts.

Proof is in the Pudding

Does this approach really work? You bet it does. How do we know that? Because over 80% of OneStream customers use the platform to support their financial consolidation, reporting and planning processes, as well as other tasks such as account reconciliations, transaction matching, tax provisioning, profitability analysis, ESG reporting and other tasks. Here’s one example below.

SPX Corporation had been using their prior EPM application suite for 18 years. SPX was using separate solutions for data loads, consolidations, planning and forecasting and account reconciliations. They had also built their federal tax provision process into their consolidation solution and had built flash forecasts, bridge reporting and state tax provisioning in their planning applications.

This multi-product approach to their critical financial applications created challenges for the Finance and IT teams. According to Keith Chapman, Director of IT for Corporate Applications, “Just keeping all the data and metadata in sync was challenging — given all of the changes in our organization structure with acquisitions and divestitures. The end-users were constantly moving and reconciling data. There was no single version of the truth, and reporting was siloed and fragmented. From an IT standpoint, it was a lot of work maintaining and upgrading the applications, and we also used managed services to keep the products running.”

Since moving to OneStream, the SPX team has experienced many benefits from having one unified platform for actuals, plans, forecasts, tax and account recons. This makes life much easier for users in terms of loading data, reviewing and drilling into the data staging area for the details.

According to Chapman, “OneStream has provided a huge benefit in keeping everything aligned with automated control procedures in place, so when business changes happen, we can keep up. Tax and FP&A are no longer separated; actuals can be seeded into budgets; and we are no longer waiting for overnight processes. The tax team can leverage the roll-forward data from consolidation right into the tax solution. Users enter the data once, and it is leveraged across multiple processes.”

Said Chapman, “We also leverage OneStream’s Extensible Dimensionality®. This allows us to do corporate cost forecasting in the same application, at lower level of detail than our normal forecast — very easily. It’s all about offering solutions to the business and delivering rapid value. Instead of being viewed as a corporate application, OneStream is a platform; it adds value and continues to add value by providing timely insights.”

Learn More

Having the control required to produce an accurate and auditable book of record financial results as well as the flexibility to plan and forecast at the right level of detail is essential for success in EPM or CPM software. And although some vendors are promoting the myth that both control and flexibility can only be provided through separate applications – OneStream has proven this myth is false, just like Miller beer, with a platform that “tastes great and is also less filling.” We have successfully delivered a unified platform that supports financial consolidation, reporting, planning and forecasting for more than 1100 organizations globally. To learn more, check out our Intelligent Finance white paper and contact OneStream if your organization is ready to take the leap to a modern, unified platform that can support all your EPM/CPM processes.

Managing account reconciliations in a mid-sized to large enterprise can be a challenging and complex process with hundreds to thousands of accounts to reconcile, and tens or hundreds of thousands of transactions to match as part of the process. Read on to learn how West Bend Mutual Insurance replaced Microsoft Excel® with OneStream to conquer the complexities of account reconciliations and transaction matching, while increasing confidence in the accuracy of their financial results.

Breaking Reliance on Excel

West Bend Mutual Insurance Company has been insuring homes, autos, and businesses for more than 125 years. Headquartered in West Bend, Wisconsin, the company employs more than 1,400 associates and partners with 1,500 independent insurance agencies in 15 states to bring these products and services to their valued customers.

At the OneStream Splash user conference in San Antonio, I had a chance to interview Jessica Greisch, Manager of Financial Planning and Analysis at West Bend about their journey with OneStream. Prior to implementing OneStream, West Bend had been using mostly Excel for budgeting, planning and reporting. Their annual budgeting process was very manual with Excel spreadsheets going back and forth between Finance and various departments over a four- month process. According to Ms. Greisch, “It would be very inefficient, time consuming and it was very error prone. So we started looking at software solutions.”

In addition to streamlining budgeting and planning, West Bend also had challenges with their account reconciliations process as part of the financial close, so that was also in scope as they began evaluating various CPM software vendors. The Finance team considered Adaptive Insights, Anaplan, Blackline and other solutions. Then based on a recommendation from an industry analyst they evaluated OneStream and selected it as the best solution to address their broad range of requirements.

Implementing OneStream

West Bend implemented OneStream in fairly rapid phases starting with financial consolidation, which was started in September 2018 and went live in January of 2019. Next, they implemented and went live with OneStream for the annual budget process in September of 2019 and then went live for forecasting in September of 2020.

Also on the agenda was account reconciliations and transaction matching. In 2020 West Bend needed to implement a new account reconciliation process for their claims checking account. According to Ms. Greisch, “With our claims checking account we would have to start looking at it every single day and matching the transactions. We didn’t want to do that in Excel.”

So West Bend became an early adopter of the new Transaction Matching solution from the OneStream™ MarketPlace and went live with the solution in March of 2020. Said Ms. Greisch, “It’s been very good to us, and I don’t know what we would have done if we would have had to do this daily reconciliation every day in Excel. For something that would have taken, I want to say, probably three or 4 hours in Excel, but we have it done in ten or 15 minutes a day.”

Reaping the Benefits

The Finance team at West Bend has experienced many benefits from implementing OneStream to conquer the complexities of their financial operations. This includes increased efficiency in the financial close process and increased confidence in the accuracy of their financial reporting.

While they are still running a nine-day close process, what the team is doing during the process has changed. The Finance team has shifted more of their time from collecting and consolidating data to spending more time on analysis before they share the financial results internally. Said Ms. Greisch, “Now, with OneStream, we can do the analysis at the same time that we’re closing because the process just became more efficient. We can get into the analysis faster and we can actually do our cash flow before our nine-day close is up.”

The team has also seen efficiency benefits in their budgeting and planning process. With their prior process reliant on Excel, they weren’t able to perform allocations and compare actuals and budgets at the same level of detail. According to Ms. Griesch, “Now that we’re budgeting in OneStream, and we can use the same allocation method as we do in actuals, we can produce the exact same reports for our executives that they’re used to seeing for the actuals. So then they can pull up their actual report, they can pull up their budget report, and they can compare.”

Learn More

To learn more, watch the West Bend Mutual customer testimonial video and contact OneStream if your organization is ready to reduce reliance on Excel and conquer the complexities of your financial close, reporting and planning processes.

Many organizations rely on Microsoft Excel® to support critical financial processes such as financial planning, consolidations and reporting. This approach can work for smaller enterprises with a few users and simple business requirements. But as organizations grow in size and complexity, they often outgrow the capabilities of Excel, which then bogs down the processes and leads to errors and omissions. Read on to learn how Orchid Orthopedic Solutions replaced Excel and Infor EPM with OneStream to unify and accelerate financial planning, consolidations and reporting.

Reconstructing Financial Planning and Consolidations

Orchid Orthopedic Solutions is a world leader in orthopedic medical device solutions, providing manufacturing services globally. Orchid specializes in implants, single use instruments and innovative technologies within joint reconstruction, hips, knees, spine, trauma, extremities and dental.

The Finance team at Orchid had been using Excel and manual processes to support their annual financial planning process and was using Infor EPM for financial consolidation and reporting. I recently interviewed Josh Thompson, VP of FP&A at Orchid to learn about their journey from Excel and legacy software to OneStream’s unified CPM software platform.

According to Mr. Thompson, “I realized we needed a better solution for our planning process at Orchid when we kept having just really blatant errors in the financial projections. They were missing really easy things like bonus percentages and FICA taxes and things like that. And there was really no common way that any of our facilities were planning.”

Like many organizations relying on Excel for planning, everyone had their own disparate Excel models, with different kinds of functionality. The Finance team collected these Excel worksheets and rolled them up into a common Excel model, and then loaded the results of that into their legacy CPM platform, which was Infor EPM.

Mr. Thompson and his team evaluated several alternative solutions, including Host Analytics (now Planful), Adaptive Insights, OneStream and several others. Based on the capabilities of the platform, the support of the sales team, and feedback from other customers – the Orchid team selected OneStream to unify their CPM processes. Said Mr. Thompson, “I went on visits with existing OneStream customers, and it was just fabulous. They were so open, and they had us in for lunch and walked us through how they were using OneStream and it was all just Finance people. So we felt really comfortable that we wouldn’t need IT to run this thing.”

Implementing OneStream at Orchid

According to Mr. Thompson, “The implementation of OneStream was absolutely fantastic. We kicked it off in March and by October of that year, six months later, we were live on OneStream with both the consolidation as well as the planning that we built from scratch.” The Orchid team worked in parallel on both the planning and financial consolidation implementations of OneStream so they could go live with both at the same time.

Several months after going live, they added People Planning from the OneStream MarketPlace. Said Mr. Thompson, “We really want to have this as part of the planning process. And that’s worked out really well too. We’ve actually connected that to Workday, so we have a live feed from Workday that just feeds in the census information into People Planning and it makes it really easy to tell what’s in your plan and to adjust it on the fly.”

Future areas of interest for extending their investment in OneStream include profitability by product SKU and customer as well as long-range planning. Said Mr. Thompson, “We’re constantly re-rolling a 3-to-5-year plan in Excel, but I’d love to start building out a model for that in OneStream in the near future.”

Eliminating the Pain – Seeing the Gains

Like a patient whose years of pain are alleviated through a knee or hip replacement, the Finance team at Orchid Orthopedics is now seeing the benefits of a unified CPM software platform. Life is much easier for the users and admins with one system to learn and maintain and they now have one source of the truth for actuals, plans and forecasts. Said Mr. Thompson, “You never doubt what’s feeding your plan in terms of actuals. We have a lot of drivers that are based off of the last three months, or six months of actuals. So you just know that those actuals that are featured in the plan are the actuals because they’re in the same system.”

The Orchid Finance team has also seen efficiency gains in their planning and reporting processes with OneStream. Said Mr. Thompson, “I would say the first thing that’s really measurable is just the time for close process. I have a counterpart that’s in charge of financial reporting, all the accounting for the organization. And he would have to wrap up the close on the weekend after close. He was always working Saturday to get the close done. And now we’re done, close of business on Thursday.”

Mr. Thompson continued,” I think the intangible part of the benefit is it just allows everyone to work on a lot more interesting things, because the basics are covered, and they’re covered fast. It’s allowed us to retain our staff. They’re able to go on to bigger and better things.”

Learn More

To learn more, watch the Orchid Orthopedics video testimonial and contact OneStream if your organization is ready to make the leap from Excel and legacy applications that may be holding you back from unleashing the true value of your organization.

Airlines were one of the hardest-hit industries during the global pandemic that broke out in early 2020 and brought global travel to a screeching halt. While the travel industry has since rebounded, it’s still a challenging industry to navigate with rising fuel prices, labor shortages and increasing demand. Learn how KLM Airlines is using OneStream to help their Finance team lead at speed and navigate through the complexities of today’s airline industry.

Leading at Speed at KLM Airlines

One of the most valuable benefits we get from hosting our annual Splash user conferences is the opportunity to meet with and learn about how customers are leveraging the OneStream platform to navigate today’s challenging business environment. At our Splash Paris user conference in September 2022, I had a chance to interview Stefan van Heukelum, Manager of Finance Decision Support at KLM Airlines to learn how they are using OneStream.

For 99 years, KLM Airlines has been a pioneer in the airline industry and is the oldest airline to still be operating under its original name. KLM aims to be the most customer-focused, innovative and efficient airline in Europe, offering reliable service and top-quality products.

Prior to implementing OneStream’s corporate performance management (CPM) platform, KLM’s Finance team had been relying mostly on Oracle Essbase and Excel and a variety of other tools across various businesses in support of financial planning, reporting and analysis.

After evaluating several alternatives, KLM selected OneStream’s unified CPM software platform to streamline and unify their complex financial processes. According to Mr. van Heukelum, “In the end, we really wanted to focus on getting a solution in which we could operate from one platform. So really creating a one stop shop for our Finance staff where they could do all their processes.”

Creating a Solid Foundation for Expansion

The KLM Finance team implemented OneStream in a phased approach, onboarding various businesses sequentially. Their initial deployment to the Inflight Services department set the foundation for further expansion with their chart of accounts, organization structures, certain standard calculations, variance analysis, impact of exchange rates, and other capabilities.

After the rollout to Inflight Services, they extended the application to other departments such as Flight Operations, the Fuel Department and Ground Services.

The initial focus was mainly on financial planning, budgeting and the related reporting and analysis, people planning as well as capital expense planning. As part of the foundation implementation of OneStream, KLM also implemented the core design of their route profitability analysis.

Gaining Visibility into Airline Route Profitability

The focus of the profitability analysis solution KLM implemented was airline route profitability. This requires the ability, at the lowest level of detail, to allocate all the costs of the business, via drivers, to all of the flights KLM operates so they can gain a view into profitability at a very granular level to assess performance across the network. According to Mr. van Heukelum, “For us as an airline, specifically in these dynamic times, it’s absolutely key that we have the ability at a low level of detail, to be able to steer and optimize our network. And the route profitability model with within OneStream really helps us to do exactly that.”

Empowering the Enterprise with Insights

As a result of the OneStream implementation, KLM is now benefiting from a unified platform that provides a single source of the truth for financial and operational information that’s critical to their business. According to Mr. van Heukelum, “Instead of people collecting all the data themselves and always ending up with differences in numbers, we now have one place where all the data centrally load loaded, all the pricing information, salary information, all that kind of information is just monitored and operated centrally. So there’s a huge increase in the quality of information and decreased risk of reporting different numbers in different places.”

He continued, “The impact this project has had on the users is that they get a lot more information, which they didn’t have before. And a lot more costs are allocated more precisely to the routes than was done before. So that’s helped the users to get more insights into the whole build-up of the profitability model and getting more qualitative information as well.”

Learn More

To learn more, watch the KLM Customer Testimonial video and contact OneStream if your organization is ready to conquer the complexities of managing in today’s volatile economic landscape and lead at speed!

In today’s fast-changing business and economic environment, managers can no longer wait until month-end or quarter-end to receive critical financial and operational metrics they need for decision-making. We are hearing more and more demand from finance executives and line managers for daily and weekly metrics they can use to identify key financial signals and trends in their businesses that enable agile decision-making.

As a case in point, I recently had a chance to interview Lynn Calhoun, Chief Financial Officer at BDO, a global accounting, tax and advisory firm. Read on to hear how BDO is delivering daily operational insights and financial signals to over 5,000 managers across the organization, as well as supporting their traditional financial close, consolidation, reporting and planning processes – all through OneStream’s unified, Intelligent Finance Platform.

Keeping Up with Growth and Increasing Complexity

BDO USA is part of an international consortium of accounting, tax and advisory firms that operates in 167 countries worldwide. BDO USA is the US arm of that global network and has been experiencing very significant growth over the course of the past ten years. This occurred both through organic growth as well as M&A activity.

BDO had been using Oracle Hyperion for several years for financial reporting and planning and according to Mr. Calhoun, “It just wasn’t keeping up with our growth and the complexity of our business as it was continuing to evolve. And primarily in the operational area where we were trying to provide a lot of customer analytics to our user community.”

To address their needs, BDO had created 13 different Essbase cubes, which weren’t very integrated and required the users to go to different places to get the information they needed. So they began talking to OneStream, and several of our customers, and became convinced that OneStream could handle the growing volume at the time, and what they expected in the future.

Moving to Right Time Finance

For their OneStream implementation, BDO used the “big bang” approach, implementing the platform for planning, reporting and analytics all at the same time. In fact, the global pandemic of 2020 forced them to launch their new planning application a little earlier than planned. But what’s really powerful is how BDO went beyond the traditional monthly reporting and planning process with their OneStream solution.

BDO was one of the first customers to leverage OneStream’s Analytic Blend capabilities to integrate detailed transactional data with their summarized financial data to empower managers with critical insights on a daily and weekly basis. This includes critical data about their clients, projects, resources, billings, DSO and other metrics that help them guide the business.

According to Mr. Calhoun, “On the operational side, we’re pulling a lot of data into OneStream. On a nightly basis will pull in our entire data set again and refresh that on a nightly basis. So anybody at any point in time can pull up data related to the projects that are running, the customers they’re responsible for, and see up-to-date information through yesterday and the performance of those projects and know that that’s something that has been a game changer for us.“

Having this daily information in front of the teams that are responsible for managing client contracts and engagements makes a huge difference in being able to spot problems quicker and to identify and address any issues faster.

Mr. Calhoun continued, “We’ve got 5000 users on the system on any given day. On an average day, we have a little over 400 to 450 people accessing the system. So not all in there every day, but they’re in there. When they are in there, the information they are looking at is current. And so it’s not like we’re waiting for a month end or mid-month to put the information in and have everybody go in at one time. It’s really designed to be more that the information is there when your schedule permits you to take a look at it, or when you want to take a look at it. And we’re not going to try to dictate when it’s available for you to look at.”

Learn More

To learn more, watch the 5-minute video interview with Lynn Calhoun and contact OneStream if your organization is ready to make the leap from multiple legacy applications to OneStream’s unified Intelligent Finance Platform for reporting, planning, analysis and beyond.

In today’s global economy, logistical and supply chain disruptions are part of the new normal. Economic slowdowns are challenging organisations to anticipate supply strains, constantly changing consumer demand, labor shortages, and logistical support. To overcome these challenges, organisations need to be armed with agile insights, streamlined processes, and real-time data to remain resilient.

With a unified corporate performance management (CPM) platform, organisations have access to critical financial and operational data to quickly address challenges through data-backed insights and scenario planning. In this blog post, learn how Toll Group, a global transportation and logistic company, turned to OneStream to streamline its outdated and disjointed financial processes and the efficiencies they gained through this digital transformation.

Problem Solving for Global Logistics and Distribution

Toll Group is a global logistics, distribution and freight forwarding business. As part of Japan Post, Toll Group has dual headquarters in Melbourne and Singapore with approximately 20,000 team members to help solve any logistics, transport, or global supply chain challenges. Toll Group supports more than 20,000 customers worldwide and operates across 500 sites in 25 countries, with an Asia Pacific focus and a forward network spanning 150 countries.

Streamlining a Complex EPM Landscape

Toll Group was challenged operating with an outdated and fragmented ERP landscape and using Oracle Hyperion and EPM Cloud applications for financial close, consolidation, reporting, budgeting and forecasting. This system was complex, disjointed and costly to maintain and support. As Oracle’s support for their existing version of Hyperion was ending, Toll Group decided to re-evaluate their options in search of a more strategic, streamlined and better-integrated CPM platform.

Toll’s goal was to have the statutory consolidation and reporting processes for all legal entities handled by a single group team in a single system. Unifying this process would allow Group governance and oversight on compliance activities and results analysis, while enabling divisional team resources to focus on internal budgeting and forecasting performance reporting and local ledger reporting development.

Selecting OneStream as the Future of Finance

Toll Group embarked on a market scan to investigate alternative solutions, with a key business requirement of having one common consolidation and reporting platform across the organisation to address complexity. They also wanted to move to the cloud with the goal of significantly streamlining the number of integrations and data mapping points that were contributing to their time-consuming and error-prone month-end reporting process.

After seeing a demo of the OneStream platform in action, Toll Group’s Finance team realised that a unified environment for consolidation, statutory reporting, management reporting and analysis could allow them to effectively address key business requirements. The Finance team saw firsthand how OneStream offered a wealth of additional functionality, with the capability to improve Toll’s operational processes and efficiencies now and the flexibility to address future challenges as the company grows.

With OneStream’s unified platform approach, cloud-based model and proven record of customer success, Toll Group decided to invest in OneStream as the future of finance. With the help of OneStream partner James & Monroe, Toll Group implemented OneStream for financial consolidation, statutory and management reporting, and budgeting and forecasting.

Following the initial implementation, Toll Group decided to further leverage the initial build by implementing a tax-effective accounting solution and enhancements to their budgeting and forecasting systems, including the addition of bottom-up models, guided workflows, FX model scenarios and a global logistics customer profitability model.

According to Peter Smith, Group Finance Manager at Toll Group, “OneStream allows us to seamlessly roll up our business units’ financial data to the group level. The unified platform and the budgeting and forecasting enhancements OneStream facilitated mean that each subsidiary can model their budget at the level of detail required for their subsidiary and make the results immediately available to Group Finance.”

Leading at Speed

Replacing their fragmented legacy systems with OneStream’s single, unified platform is already paying dividends for Toll Group through improved data quality, insight and process control. Through OneStream, Toll Group is able manage the reporting of all legal entity results on one system. Toll is also leveraging OneStream’s Extensible Dimensionality® to standardise reporting and business unit budgeting and forecasting processes.

Toll Group has seen transformational effects and significant improvement in the accuracy and timeliness of reporting since implementing OneStream. OneStream’s automated processes have improved data quality, eliminating the need to manually handle massive amounts of data in Excel®. Additionally, Toll Group significantly reduced IT support costs and 3rd-party application support costs by migrating to OneStream’s cloud-based platform.

“Untangling our Oracle systems was challenging but OneStream provided the platform we needed to do it effectively. Moving to OneStream’s single, unified platform was a big change for the organisation to take on but all the business units are on-board with the benefits and are very happy with what has been delivered,” said Smith. “The fact that we can now trust the data in the system and all the organisation’s data is in one place and immediately visible when changes are made is a significant advantage. The delays we experienced with the legacy systems between the collection of data and the issuance of reports and analyses have been largely eliminated.”

Looking Ahead

Toll Group is evaluating additional initiatives to extend their investment in OneStream through both their core application and OneStream MarketPlace solutions. They are currently undertaking a pilot of OneStream’s Account Reconciliations & Transaction Matching MarketPlace solutions and investigating future implementations of capabilities including Cash Planning, Treasury schedules and registries, and tax compliance reporting.

Learn More

To learn more about Toll Group’s journey from Oracle Hyperion to OneStream, check out the case study and discover how OneStream unified the global organisation with powerful business insights. If your organisation is ready for a finance transformation, contact OneStream today.

Private equity investors have become a powerful force in today’s capital markets. With a reported $1.5 trillion in cash as of January 2020, private equity investors have bolstered many private companies and have also purchased public companies and taken them private in order to fund new technology, make acquisitions, or restructure them and solidify their balance sheets.

With broad portfolios of companies to manage, private equity companies have unique needs when it comes to financial reporting, planning, forecasting, and business analysis and many are turning to OneStream’s unified CPM software solution as their platform of choice for these critical Finance processes.

Conquering Complexity in Private Equity

Picture a private equity company with say 100+ portfolio companies to manage and report the financial results on. There’s quite a bit of complexity involved in collecting and consolidating financial results from 100+ companies and reporting results to stakeholders on a monthly and quarterly basis. Then there’s the challenge of tracking and managing new investments and acquisitions as well as spinouts and divestitures.

From a planning and forecasting perspective, there’s the need to collect updated forecasts from portfolio companies on a regular basis, and a diverse workforce that must be considered in budgeting for salaries, benefits, and compensation.

And if getting access to summarized financial results from 100+ portfolio companies isn’t hard enough, consider the need to gain visibility into the more detailed operating results of portfolio companies. It’s a tall task indeed.

That’s why a growing number of private equity companies are turning to OneStream as their strategic corporate performance management (CPM) platform. Private equity companies such as Antares Capital, Benchmark Holdings, The Carlyle Group, Main Street Capital, Melrose PLC, and many others are leveraging OneStream to conquer the complexity of financial close and consolidation, planning and forecasting, reporting and analysis of their financial and operating results.

OneStream in Action

Here are a few examples of how OneStream is delivering value for private equity companies.

Main Street Capital Corporation is a publicly traded company (NYSE: MAIN) who manages investment capital in excess of $4 billion. Main Street provides long-term debt and equity capital to lower middle market companies and debt capital to middle market companies. Their portfolio companies use a variety of accounting systems, including QuickBooks, Sage, Great Plains and others.

Before implementing OneStream, financial results from ~85 portfolio companies were collected in many different formats – such as Excel, PDFs, etc. for consolidation and reporting at the parent company level. Now with direct access to OneStream, portfolio companies enter their month-end trial balances directly into the system for consolidation, which has reduced the process of collecting, consolidating and reporting the results from 5 days to 30 minutes.

In addition to the control and accuracy this provides to the Finance team, they can also load budgets and perform actual vs. budget reporting in OneStream and gain better visibility into the operating results of portfolio companies. After their initial implementation, Main Street Capital extended their OneStream application to support free cash flow, debt waterfall, capital allocation and dividend income forecasting. As a result, they are now able to continuously forecast for ~85 portfolio companies within a centralized framework and accurately plan capital investments, and track results across the entire portfolio.

The Carlyle Group is a global alternative asset manager based in Washington, DC, with offices on six continents. Carlyle invests across four segments – Corporate Private Equity (buyout and growth capital), Real Assets (real estate, infrastructure, and energy), Global Market Strategies (structured credit, mezzanine, distressed, hedge funds, and middle market debt), and Investment Solutions (funds that invest in private equity funds).

The Carlyle Group was looking to simplify their CPM landscape by combining three disparate tools into a single platform. Additionally, they were seeking a modern, extensible platform that was scalable to meet current and future business needs. The Carlyle team evaluated several alternatives and selected OneStream based on its ability to unify and replace their existing financial and HR planning systems, as well as Oracle Hyperion Financial Management (HFM) for financial consolidation and reporting, and other point solutions such as account reconciliations.

The implementation of OneStream has resulted in significant process improvements for Carlyle. For example, consolidating a full year of GAAP actuals was reduced by 50% while including significantly more detail than was previously loaded in Hyperion (e.g., project-level details). They were also able to achieve significant process improvements in budgeting and planning. For instance, submitting revenue and expense budget updates and reviewing the impact was reduced from 1 week to 5-10 minutes. And updating headcount assumptions and reviewing the impact was reduced from 1 week to 20 minutes.

Learn More

Helping customers conquer the complexity of their financial operations so they can lead at speed is a key focus of OneStream software. In 2022 we passed the milestone of having over 1000 organizations across all industries around the globe leveraging our unified platform and MarketPlace solutions to address an ever-growing range of requirements.

To learn more about how OneStream is delivering value for private equity companies, check out our case study on The Carlyle Group and contact OneStream if you are ready to conquer the complexity of your financial operations.