Integrated Business Planning, or IBP for short, is a strategic management process that connects various organizational departments to align business operations with financial goals. How? By integrating business functions – such as Sales, Marketing, Finance, Supply Chain and Operations – to create a holistic view of the company’s performance and future direction. This blog post offers a comprehensive guide to discuss what precisely IBP entails and how Finance can drive business results and collaboration within the organization via a robust and comprehensive IBP process.

What Is IBP?

While the business world and Finance have always had shared language and acronyms, some new (and reimagined) acronyms may now be flooding your feed. One such topic you may be hearing a lot about lately is Integrated Business Planning (IBP). Yet the concept of IBP isn’t new. In fact, it’s related to Sales & Operations Planning (S&OP), a concept that’s been around awhile.

Still, IBP may seem overwhelming in the context of all the different acronyms related to financial and operational planning floating around lately. For example, IBP, S&OP, eXtended Planning and Analysis (xP&A) and others are just a few acronyms muddying the waters. But this comprehensive guide to all things IBP aims to help demystify the process.

So what, exactly, is IBP?

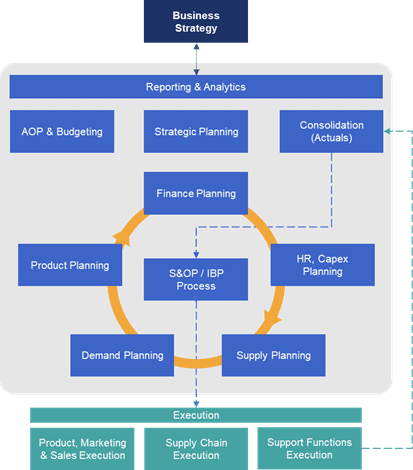

IBP ultimately aims to unify business strategy with planning, budgeting and forecasting activity for all business lines and functions – providing one version of the numbers. In turn, a trusted, common view of the numbers provides a robust baseline for agile decision-making. That common view also keeps all teams collectively trying to achieve the same corporate objectives while staying focused on specific KPIs. In other words, the different teams maintain their independence while working in unison to achieve corporate success by leveraging the same trusted and governed data.

The bottom line? IBP is about aligning strategy intent, unifying planning processes and bringing the organization together.

How IBP Works

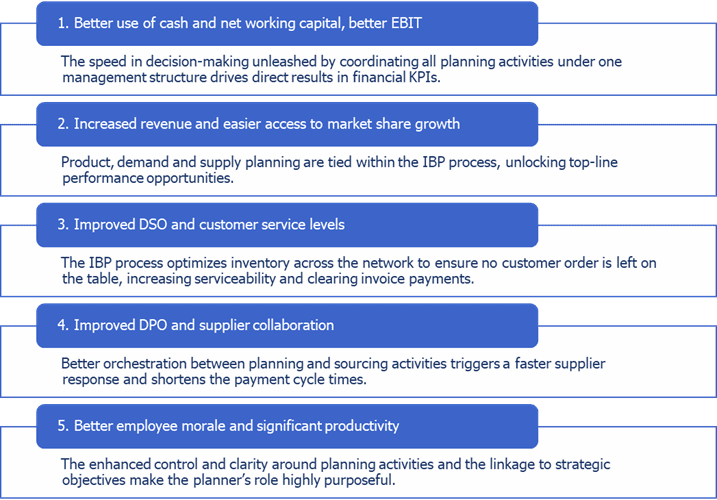

The IBP process is a framework to address the C-suite needs and help implement the business strategy and manage uncertainty to improve decision-making. So what’s the secret sauce of IBP to make all of that happen? A collaboration between the different teams under a single view of the numbers that must unequivocally be tied to financial performance. That’s how the C-suite gets value from IBP. Consequently, Finance plays a central role in the IBP process.

IBP typically focuses on horizons of 24-60 months, as opposed to the short term. That focus equates to Integrated Tactical Planning or Sales and Operations Planning and Execution. Since the process must be fully integrated, it removes the departmental silos. Plus, the IBP process must adapt to the organizational construct of every business (IBP isn’t a one-size-fits-all type of process).

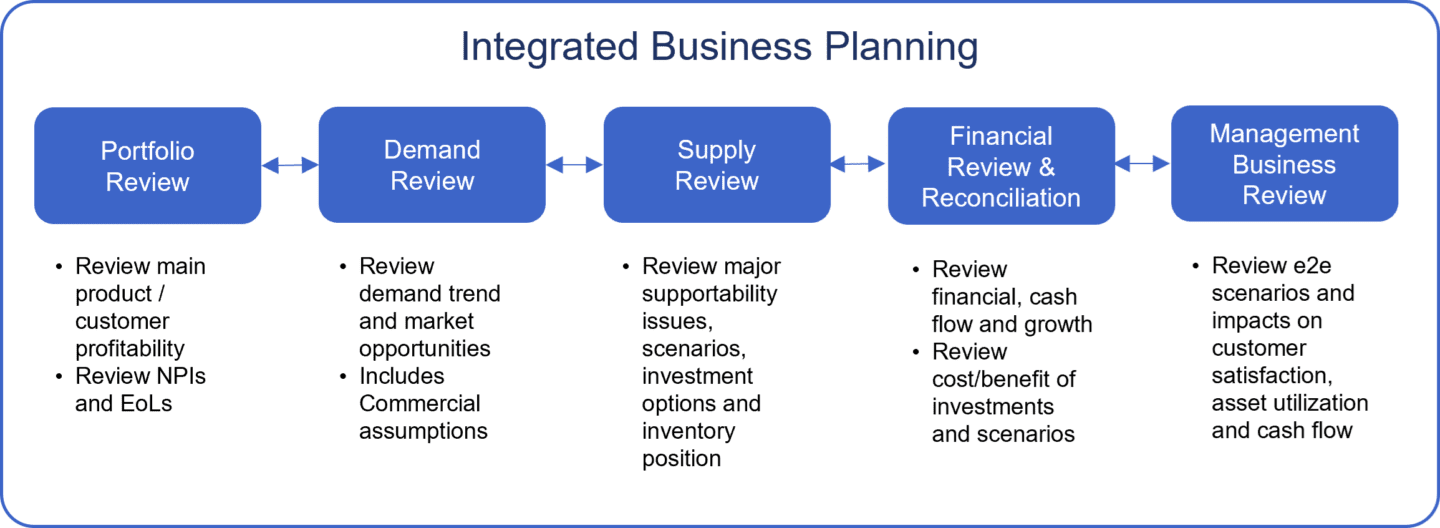

A typical IBP process involves several stages:

- Data Collection and Analysis: Gathering relevant data (e.g., sales forecasts, production capacities, inventory levels and financial projections) from different departments.

- Demand Planning: Predicting future demand based on historical data, market trends, customer feedback and sales forecasts.

- Supply Planning: Determining the resources and capabilities (e.g., materials, production capacity and distribution channels) needed to meet the forecasted demand.

- Financial Planning: Developing financial plans and budgets aligned with the demand and supply forecasts, considering factors such as revenue targets, cost structures and investment requirements.

- Scenario Planning: Creating alternative scenarios to assess how different strategies, market conditions or external factors impact business outcomes.

- Management Business Review: Collaborating across departments to make informed decisions on resource allocation, investments, pricing strategies and operational adjustments.

- Execution and Monitoring: Implementing the plans, tracking performance against targets, and continuously monitoring key metrics to identify deviations and take corrective actions.

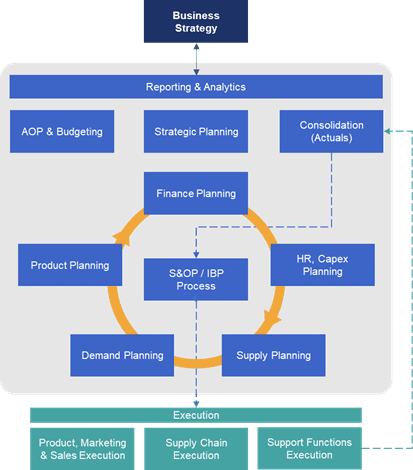

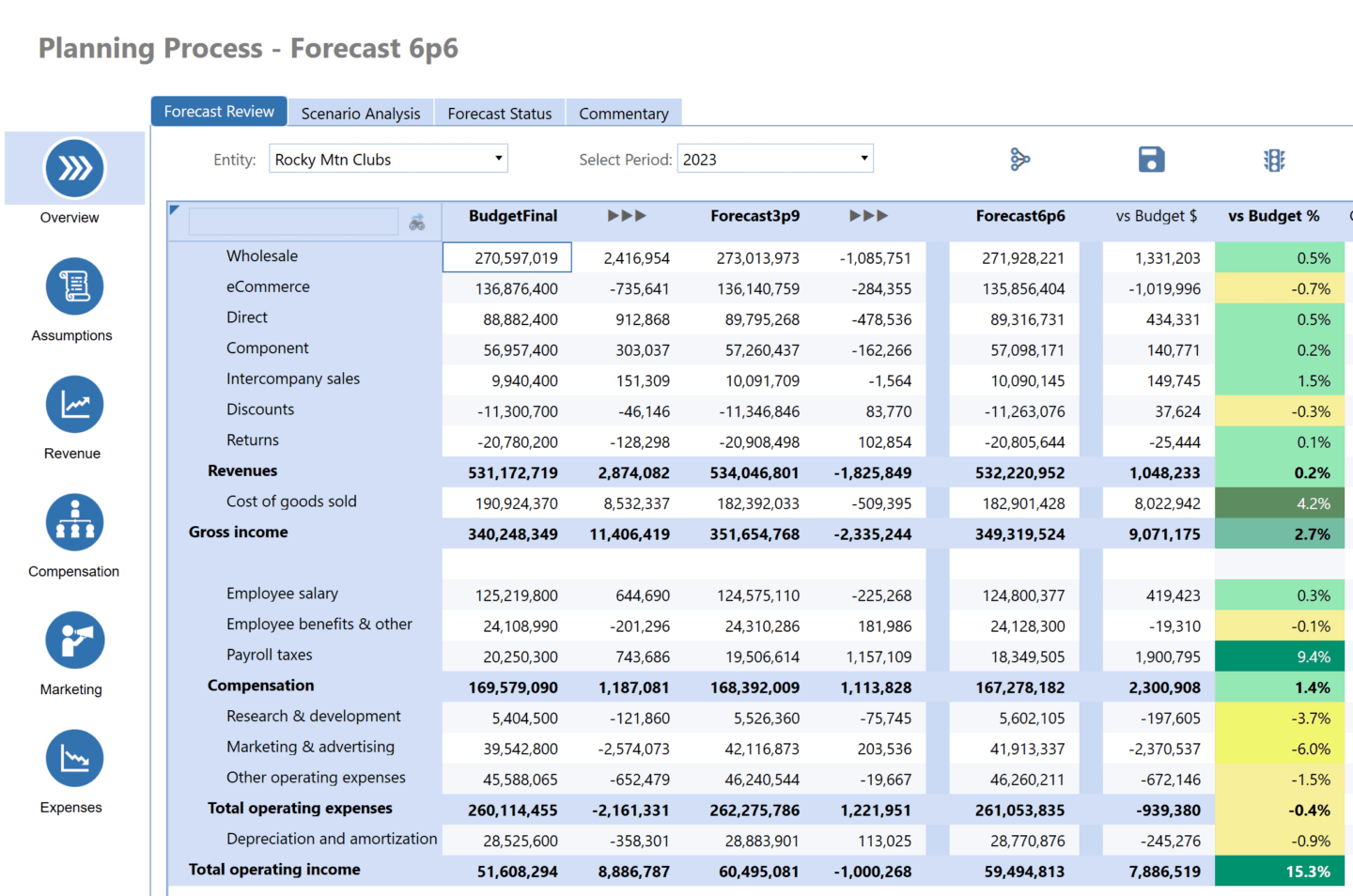

The most efficient way to foster this collaboration is through a unified solution and data model that caters to the needs of the various agents involved on each review. In fact, Figure 1 shows how one solution gathering all the capabilities in the greyed area under a unified data model is the most efficient approach to IBP.

Figure 1: A Unified Data Model for IBP

Core Elements and Stages of the IBP Process

The IBP process includes the following core elements:

- Governance Structure: Establishing a cross-functional team with representatives from key departments to oversee the IBP process, define roles and responsibilities, and ensure alignment with organizational goals.

- Data Integration: Integrating data from different systems and sources to create a single source of truth for decision-making, using technologies such as enterprise resource planning (ERP) systems, Corporate Performance Management (CPM) tools, business intelligence (BI) tools and data analytics platforms.

- Collaborative Planning: Encouraging collaboration and communication between departments to share insights, align objectives and develop consensus-based plans that support overall business objectives.

- Continuous Improvement: Implementing feedback loops, performance reviews and process refinements to enhance the effectiveness and agility of the IBP process over time.

Learn More

Want to learn how you can maximize the benefits of your IBP process and get leadership on board with the plan? Check out our eBook Unifying Integrated Business Planning Across Finance and Supply Chain. You’ll learn how to unify IBP across Finance and Supply Chain teams and read about use cases as proof points. Plus, you’ll gain an understanding of the unique capabilities OneStream’s Intelligent Finance Platform brings to unify Finance and Supply Chain planning activities.

Learn MoreToday, the corporate budget planning process is vital for Finance. Through this structured approach, organizations allocate resources, forecast financial outcomes and plan for future financial performance. Those key uses underscore why the process is so crucial to effective strategic management.

Corporate Budget Planning

In essence, corporate budget planning enables businesses to align their spending and investment with their goals, priorities and market conditions.

The process typically involves 10 key but straightforward steps.

1. Define Objectives and Strategy

Defining objectives and strategy for corporate budget planning involves setting clear, actionable goals that align with the organization’s broader strategic vision. These objectives, in turn, serve as benchmarks for what the company aims to achieve financially within a specific time period. What aims? A few examples include increasing revenue by a certain percentage, reducing operational costs, expanding into new markets or enhancing capital investment returns.

At the same time, effective objectives are both ambitious and realistic. They provide a focused direction for financial planning and decision-making. Accordingly, the objectives should be developed through a collaborative process that involves input from key stakeholders across the organization. Such input ensures alignment with overall business goals and accounts for the company’s operational capabilities, market conditions and competitive landscape.

The strategy for achieving these objectives is the roadmap that outlines how the organization will allocate resources to meet its financial goals. What’s involved in that strategy? Key elements are detailed planning on revenue generation tactics, cost management initiatives, investment in growth opportunities and risk mitigation measures.

This strategic planning requires a deep understanding of the business environment, including customer demand, economic trends and regulatory changes. That understanding allows for making informed decisions on spending, saving and investing. But whatever the strategy, it should be flexible enough to allow for adjustments in response to unforeseen challenges or opportunities.

Ultimately, the combination of well-defined objectives and a robust strategy enables a company to efficiently execute its corporate budget planning. And that matters because it ensures financial stability and supports long-term organizational growth.

2. Review Past Performance

Reviewing past performance is an essential phase in the corporate budget planning process.

That review acts as a mirror to reflect the organization’s financial health and operational efficiency over previous periods. Thus, this retrospective analysis involves a comprehensive examination of financial statements (e.g., income statements, balance sheets and cash flow statements) alongside operational metrics.

The goal? To identify patterns, trends and anomalies that can inform future budgeting decisions. By understanding where the company has had financial success and faced challenges, leadership can make more informed predictions and decisions for the future. (We believe that Finance teams using AI and Sensible ML to identify patterns, trends and anomalies are the ones getting the farthest ahead.)

Yet this review process goes beyond merely looking at numbers. Instead, it requires a deep dive into the reasons behind those numbers. If the company experienced a significant variance in actual revenues compared to budgeted revenues in a recent FP&A report, for example, knowing the why behind that variance is vital. Was it due to changing market conditions, a new competitor entering the market or perhaps internal factors such as production issues?

Similarly, analyzing expenditure trends helps identify areas of inefficiency or overspending. This analysis can involve examining costs line by line to see where the budget was exceeded and why. Through that process, companies can identify opportunities for cost savings or process improvements.

Reviewing past performance, however, is not just about identifying what went wrong. The process also helps organizations recognize what went right. Why does that matter? Well, success in certain areas – such as a particularly effective marketing campaign or a cost-saving initiative – provide valuable lessons. Those lessons can then be replicated and built upon in future periods.

This phase of the budget planning process also encourages a culture of accountability and continuous improvement within the organization. Essentially, by closely examining past performance, departments and teams can:

- Set more realistic goals

- Better align strategies with corporate objectives

- Adjust plans based on what has been proven to work or not work in the past

Ultimately, in the corporate budget planning process, reviewing past performance is a critical step. It lays the groundwork for more accurate and effective budget planning. In fact, this step ensures the budgeting process is grounded in reality – one where strategies and objectives are informed by empirical data and historical context. This grounding helps organizations not only set more achievable financial targets but also devise strategic initiatives more likely to drive the organization toward its long-term goals.

3. Revenue Forecasting

Revenue forecasting allows a company to estimate its future sales and income over a specified period. What so crucial about this projection? It helps with setting financial targets, making informed decisions about expenditures and planning for growth.

Typically, revenue forecasts are based on a combination of historical sales data, market analysis and an assessment of external factors that could influence demand. Those factors can include economic trends, industry developments and competitive dynamics. By analyzing these elements, companies aim to predict their financial inflow with a reasonable degree of accuracy. And they do it while adjusting for seasonality, market shifts and other variables that might impact revenue.

Effective revenue forecasting requires a meticulous approach – one that blends quantitative analysis with qualitative insights. Companies often use models that incorporate past performance trends while adjusting for future market expectations and strategic initiatives, such as product launches or expansions.

Whatever the model, the forecasting process is inherently iterative, with forecasts regularly updated to reflect new information or changes in the business environment. This dynamic approach allows companies to remain agile. How? It empowers companies to make strategic adjustments to operations, marketing and budget allocations in response to evolving forecasts.

Ultimately, accurate revenue forecasting is essential for strategic planning, resource allocation and financial management. Businesses can use the forecasts to set realistic goals and measure progress toward achieving them.

4. Cost and Expense Estimation

Cost and expense estimation is essential for creating a realistic and effective corporate budget plan. Why, exactly? Such estimations help businesses anticipate financial outflows and manage resources efficiently. For any cost estimation, both fixed and variable costs matter. Salaries, rent and utilities are examples of fixed costs – which, by nature, do not change with the level of goods or services produced. Meanwhile, materials, shipping and commissions are example variable costs, which inherently fluctuate with business activity levels.

The accuracy of cost and expense estimation greatly impacts the ability to maintain profitability and cash flow. To estimate costs effectively, companies analyze historical spending trends to forecast future expenses. This analysis is supplemented with information about planned initiatives, expansion efforts or any operational strategy changes that could affect costs. For variable costs, companies also consider projected sales volumes, pricing strategies, supply chain dynamics and other factors that affect the cost of goods sold and operational expenses.

In addition, effective cost and expense estimation requires a forward-looking approach that considers external factors. Market trends, economic conditions and regulatory changes are just a few of such factors. For instance, anticipated increases in raw material costs, changes in labor laws or fluctuations in currency exchange rates can all impact future expenses. Such considerations enable businesses to develop more accurate and resilient budgets.

But companies must also maintain a degree of flexibility in those budgets to accommodate unexpected costs. This accommodation, in turn, ensures companies can respond to unforeseen challenges – without compromising financial stability.

Overall, cost and expense estimations are not just about predicting numbers. This step is also about understanding the financial implications of a company’s operational and strategic decisions. By carefully analyzing both internal and external factors that influence costs, businesses can create budgets that support their goals while effectively managing risk. This process requires the following:

- Collaboration across departments

- Clear communication of financial goals and constraints

- Regular review and adjustment of estimates to reflect new information or changing conditions

Ultimately, through diligent cost and expense estimation, companies lay the groundwork for financial health, strategic growth, and long-term success in corporate budget planning.

5. Capital Budgeting

Capital budgeting in corporate budget planning is a strategic process that helps companies evaluate and prioritize investments in long-term assets and projects. How? Assessments look at potential expenditures on assets (e.g., new machinery, property, technology upgrades or expansion projects), which require substantial upfront investment but generate returns over several years. Accordingly, the capital budgeting process helps determine which projects align with strategic objectives and offer the best potential for financial return.

Capital budgeting employs various analytical techniques, such as net present value (NPV), internal rate of return (IRR) and payback period calculations. Using these techniques, companies evaluate the profitability and risk of investment proposals. This meticulous evaluation, in turn, helps ensure a company allocates its limited resources to the projects most likely to enhance its competitive position and shareholder value over the long term.

Yet capital budgeting is not merely about identifying and investing in profitable ventures. It also involves strategic planning and risk management. Thus, capital budgeting requires a forward-looking perspective that considers how investments might impact the company’s financial health and ability to respond to future market changes. By carefully selecting projects that contribute to strategic goals (e.g., expanding market reach, improving efficiency or innovating product offerings), companies can sustain growth and adapt to evolving industry landscapes.

Ultimately, this process demands cross-functional collaboration. That collaboration involves input from various departments to ensure projects are feasible, strategically aligned and have a clear implementation plan. Through effective capital budgeting, businesses position themselves to make informed decisions that drive long-term success and resilience.

6. Allocate Resources

Allocating resources in corporate budget planning requires distributing financial assets among various departments, projects and initiatives to achieve strategic goals and operational efficiency. Through this critical step, companies decide how much funding to allocate to different areas of the business. Based on what? The strategic importance, the expected return on investment and the alignment with the company’s overall objectives.

Thus, allocating resources requires a delicate balance between supporting existing operations, investing in growth opportunities and maintaining financial health. Effective resource allocation ensures that every dollar spent contributes to the company’s long-term success. Whether through driving revenue growth, enhancing productivity or entering new markets, those contributions all matter to the company’s bottom line.

Effective resource allocation demands thorough analysis and strategic thinking. To get started, companies must clearly understand its priorities and objectives. A detailed evaluation of the potential impact and costs tied to each budget request is also important. Throughout the process, decision-makers must consider projected revenue, cost savings, market trends, competitive dynamics and other factors. Yet the process isn’t static. It requires continuous monitoring and adjustment in response to performance data and changing market conditions.

Ultimately, companies must regularly review how resources are allocated and make data-driven adjustments. By doing so, companies can invest in the right areas to support sustainable growth and adaptability. This approach thus not only maximizes the return on investment but also strengthens the organization’s ability to navigate uncertainty and capitalize on emerging opportunities.

7. Prepare Budget Drafts

Preparing budget drafts in corporate budget planning is a crucial phase. Preliminary financial plans are developed in this step, reflecting the company’s strategic objectives, revenue forecasts, and resource allocation decisions. This process involves compiling detailed estimates of expected income, expenditures and investments for the upcoming period, usually the next fiscal year.

Drafting the budget requires a collaborative effort across various departments, ensuring each contributes its insights and requirements. This collaborative approach ensures the budget aligns with both the strategic goals of the company and the operational needs of individual departments. In essence, the draft budget serves as a working document – one that facilitates discussions and adjustments before being finalized.

The draft incorporates all the key components of financial planning. What are those components? They include sales forecasts, cost estimates, planned capital expenditures and any other financial commitments. By including these elements, the draft budget provides a comprehensive overview of the company’s financial strategy.

The preparation of budget drafts is iterative, allowing for refinement and adjustment as more accurate or updated information becomes available. That iteration, however, requires a balance between ambition and realism to ensure the budget is challenging but achievable.

In this phase, Finance teams therefore play a pivotal role. How? They analyze data to ensure consistency across different parts of the organization and integrate strategic priorities into the financial planning process. This stage often involves scenario planning and sensitivity analysis to assess the impact of various assumptions and potential risks on the company’s financial performance.

Ultimately, by carefully crafting these budget drafts, companies lay the groundwork for financial discipline, strategic alignment and operational efficiency. The draft budget is therefore a critical tool for guiding decision-making, setting expectations, and providing a baseline against which actual performance can be measured and managed throughout the fiscal year.

8. Review and Approve

In this phase, the draft budget developed through collaborative efforts across departments undergoes scrutiny by senior management and, often, the board of directors. This step ensures the proposed budget aligns with the strategic goals of the organization, remains financially sound, and sets realistic revenue and expenditure targets.

The review process involves a thorough examination of three aspects:

- Assumptions made during the drafting phase

- Validation of the financial forecasts

- Assessment of the proposed resource allocations

Through those aspects, the process offers an opportunity for key decision-makers to challenge and refine the budget. Doing so ensures it supports strategic initiatives, addresses operational needs and effectively manages financial risks.

Notably, this phase may involve several rounds of review and adjustment, with feedback provided to department heads and Finance teams. Why? To further refine the budget until it meets the organization’s strategic and financial objectives. After satisfying the scrutiny of the review phase, the budget moves to the approval stage. This formal endorsement, usually by the company’s top executives and the board of directors, signifies the budget is the official financial plan for the upcoming period.

In other words, the approval process solidifies the organization’s commitment to the budget’s targets and allocations, setting the stage for implementation. The approval also serves as a signal to the entire organization about the priorities and financial direction for the forthcoming period. With that signal, the approval emphasizes accountability and the importance of adhering to the budget.

Ultimately, the approved budget becomes the benchmark against which financial performance is measured, guiding decision-making and financial management throughout the fiscal year. This process of review and approval is crucial for ensuring the budget reflects the collective wisdom and strategic intent of the organization’s leadership. Thus, the process effectively balances ambition with realism and aligns resources with opportunities.

9. Implement the Budget

Implementing the budget in corporate budget planning marks the transition from planning to action. In essence, the approved budget serves as a roadmap for the organization’s financial activities over the upcoming period. This phase involves disseminating the budget details across departments, ensuring that managers and team leaders understand their financial targets and resource allocations.

Implementation requires the following:

- Setting up systems for monitoring expenditures and revenues

- Establishing accountability mechanisms

- Integrating the budget into daily operations and decision-making processes

Effectively taking those actions during implementation ensures all parts of the organization work toward the common financial goals set out in the budget. And everyone does it with a clear understanding of their roles in achieving the targets.

Ultimately, implementing the budget is a continuous process that involves not just following the budget but also adapting to changes. Successful adaptation requires ongoing communication and coordination across the organization to maintain alignment with the overall financial strategy.

10. Monitor and Review

Monitoring and reviewing in corporate budget planning are an ongoing process that involves continuously tracking financial performance against the approved budget throughout the fiscal year. Through this critical step, companies can ensure any deviations from the budget – whether in revenues, expenditures or other financial metrics – are quickly identified. Doing so allows for timely adjustments to stay on track. Collectively, the monitor and review process encompass the following:

- Regular reporting on financial performance

- Analysis of variances

- Assessment of the budget’s effectiveness in supporting the organization’s strategic objectives

Ultimately, the review component allows for reflection on what is driving any discrepancies between actual and budgeted figures. Such reflection leads to insights that inform future budgeting cycles or immediate corrective actions. Through the cyclical process of monitoring and review, companies can foster a culture of financial discipline, promotes accountability across departments. That process thus enhances the organization’s ability to adapt to changing circumstances, thereby ensuring financial stability and strategic alignment.

What’s Next for Corporate Budget Planning?

Don’t forget to reflect on what you learn through every corporate budget planning cycle. Insights gained from monitoring, reporting and adjusting the budget can feed into the next round. In doing so, insights will help your company refine its planning approach and improve accuracy and effectiveness over time.

Want a deep dive into budgeting, planning and forecasting? Check out our free ebook!

Download the eBookMaximizing Success through Corporate Performance Management in the Modern Business Landscape

In today’s competitive business world, achieving optimal performance and driving business success requires a structured approach. Enter Corporate Performance Management (CPM). Across the organization, CPM provides the tools and methodologies to define, measure, monitor and improve performance.

The definition of CPM, its methods and its key performance metrics are crucial knowledge for modern enterprises. In this blog post, we’ll unveil all 3 aspects. We’ll also highlight a few modern examples of organizations that have successfully implemented CPM in different functional areas to achieve desired business outcomes.

Let’s get started by defining precisely what CPM entails.

What Is Corporate Performance Management?

In essence, Corporate Performance Management is a comprehensive approach to managing business performance, encompassing the entire organization. What does that entail? Setting strategic goals, developing plans, budgeting, monitoring, analyzing data and making informed decisions aligned with business objectives are all part of CPM. By adopting a comprehensive CPM approach, organizations can assess overall performance, enhance performance and drive business success.

CPM addresses the following pivotal questions (among others!):

- Are strategic goals being realized?

- How effectively are resources being utilized?

- What areas demand operational enhancement?

- Are stakeholders receiving adequate value?

Methods in Corporate Performance Management

Now let’s dive into 5 key CPM methods that help drive organizational success.

1. Strategic Goal Setting and Planning

Strategic goal setting and planning is a fundamental aspect of CPM. Why? Through this method, an organization articulates its mission, vision and values. Organizations can also establish SMART goals and devise strategic initiatives. Accordingly, this method aligns activities with strategic objectives, ensures efficient resource allocation and maximizes business performance.

An example of this CPM method in action is Virgin Atlantic’s strategic goal-setting and planning:

- Long-term goal: To make Virgin an industry leader in customer service.

- Actions: Developing strategic initiatives (e.g., launching in-flight Wi-Fi, revamping seat designs and improving entertainment systems).

- Outcome: Increased customer satisfaction and improved financial performance.

2. Budgeting, Planning and Forecasting

Budgeting, planning and forecasting together form another essential aspect of CPM. Why? This method involves preparing budgets based on historical data, future projections and strategic goals. By conducting regular monitoring and variance analysis, organizations can identify deviations and take corrective actions. Effective budgeting and forecasting thus contribute to optimal resource allocation and planning.

An example of the budgeting and forecasting method in action is Coca-Cola’s CPM approach:

- Actions: Employing continuous forecasting and performance tracking against KPIs.

- Outcome: Well-informed decision-making, reduced costs and improved sales.

3. Performance Measurement and Reporting

Performance measurement and reporting involves assessing the performance of departments, processes and business units against KPIs to set objectives. How? By employing performance reports, dashboards and scorecards to help not only visualize KPIs, but also identify areas of improvement and those that require attention. Effective performance measurement and reporting drives successful decision-making and performance improvement.

One example of this CPM method in action is Netflix’s performance measurement and reporting:

- Actions: Using performance reports and dashboards to measure organizational performance against subscriber retention, watch time and content quality – all metrics aligned with Netflix’s long-term objectives.

- Outcome: Data-driven decision-making, improved subscriber satisfaction and comprehensive evaluation of organizational performance.

4. Risk Management

Risk management in CPM involves identifying, assessing and mitigating risks that can impact an organization’s performance. How, precisely, is that achieved? The focus is on developing strategies for risk mitigation, conducting risk assessments and monitoring risk indicators. Effective risk management, in turn, contributes to optimal execution and thus reduces the potential negative impacts on performance.

One example of this CPM method in action is Amazon’s risk management strategy:

- Risks to be managed: Supply chain and logistical challenges, as well as concerns about meeting customer satisfaction levels, when launching Amazon Prime.

- Actions: Implementing a proactive risk management strategy.

- Outcome: Identification of potential areas of risk and actions to mitigate those risks.

5. Continuous Improvement

Continuous improvement involves evaluating and refining processes to enhance overall efficiency, effectiveness and business outcomes. What does that entail? In short, this method involves adapting to changing environments and aligning tactics with evolving strategic goals. Continuous improvement then drives innovation and enhances organizational competitiveness.

One example of continuous improvement in action is Toyota’s KAIZEN methodology:

- Actions: Engaging in continuous process improvement, emphasizing corporate culture and prioritizing employee involvement.

- Outcome: Fulfilled production demands and improved production quality, making Toyota one of the leading car manufacturers globally.

Key Performance Metrics in Corporate Performance Management

Choosing the appropriate performance metrics is crucial for effective CPM. Why? Well, appropriate and effective KPIs enable organizations to evaluate performance, identify areas of improvement and monitor progress toward goals. Below are some common metrics used in different functional areas.

Financial Metrics

Financial metrics are vital for assessing the profitability, liquidity and overall financial health of an organization. These common financial metrics, among others, are used in CPM:

- Revenue growth: Measures the rate at which revenue is increasing over a specific period to indicate the effectiveness of sales and marketing efforts.

- Gross profit margin: Calculates the percentage of revenue left after deducting the cost of goods sold, with a higher margin indicating better cost management and pricing strategies.

- Operating margin: Reveals the profitability of core operations by measuring the percentage of revenue left after deducting operating expenses, indicating the efficiency of the cost control efforts.

- Return on investment (ROI): Measures the return on investment generated from a particular asset, project or initiative to help evaluate the effectiveness and profitability of investments.

- Cash flow: Assesses the inflow and outflow of cash, with positive cash flow indicating healthy liquidity and good financial stability.

By monitoring these financial metrics, organizations can assess their financial performance, identify areas for improvement and make informed decisions to enhance both profitability and financial stability.

Operational Metrics

Operational metrics evaluate the efficiency and effectiveness of an organization’s core operational processes. Why? Essentially, these metrics provide insights into productivity, quality and resource utilization. The following operational metrics, among others, are used in CPM:

- Cycle time: Measures the time taken to complete a specific process or cycle, helping to identify bottlenecks and areas for process improvement.

- Quality metrics: Assesses the quality of products or services delivered via metrics such as defect rate, customer satisfaction score and product/service, which all reliably provide valuable insights into quality performance.

- Production yield: Determines the percentage of units that meet quality standards during manufacturing, helping to detect inefficiencies and optimize production processes.

- Inventory turnover: Calculates how quickly inventory is sold and replenished, with high turnover indicating efficient inventory management, to minimize risk of inventory obsolescence.

- Supplier performance: Evaluates the effectiveness and reliability of suppliers in meeting quality, delivery and cost requirements, helping to optimize the supply chain and reduce operational risks associated with suppliers.

By using operational metrics, organizations can identify process inefficiencies, improve productivity, enhance quality and optimize resource allocation.

Customer Metrics

Customer metrics focus on measuring and evaluating the organization’s relationship with customers. Why? These metrics ultimately help assess customer satisfaction, loyalty and overall customer experience. Examples of customer metrics used in CPM include the following, among others:

- Customer acquisition rate: Measures the number of new customers acquired during a specific period, indicating the effectiveness of marketing and sales efforts.

- Customer retention rate: Calculates the percentage of existing customers who continue to do business with the organization over a given period, with high customer retention rates indicating customer loyalty and satisfaction.

- Customer satisfaction score: Evaluates customer satisfaction via surveys or feedback mechanisms, helping to identify areas for improvement and ensure customer-centricity.

- Net Promoter Score (NPS): Determines customer loyalty and advocacy by measuring the likelihood of customers recommending the organization to others, with a higher NPS indicating stronger customer loyalty and a positive brand image.

By monitoring these customer metrics, organizations can understand customer needs, improve customer satisfaction and strengthen customer loyalty, eventually driving business growth.

Employee Metrics

Employee metrics assess the performance, satisfaction and engagement levels of the organization’s workforce. Why? These metrics play a crucial role in managing talent, fostering a positive work environment and promoting productivity. The following common employee metrics, among others, are used in CPM:

- Employee satisfaction: Measures employee satisfaction and engagement through surveys or feedback mechanisms, helping to identify areas for improvement and assess the effectiveness of HR initiatives.

- Employee turnover rate: Calculates the percentage of employees who leave over a specific period, with high turnover rates potentially indicating underlying issues (e.g., low job satisfaction or ineffective talent management).

- Training hours per employee: Quantifies the investment in employee training and development, helping to assess the organization’s commitment to enhancing employee skills and knowledge.

- Employee productivity: Measures the output or performance of employees in relation to their time and effort, helping to identify high-performing individuals and teams, as well as potential performance gaps.

By tracking and analyzing employee metrics, organizations can make strategic decisions regarding talent management, employee development and overall organizational effectiveness.

Innovation Metrics

Innovation metrics evaluate an organization’s ability to innovate and bring new ideas, products or services to the market. Why? These metrics provide insights into an organization’s innovative capacity and can drive a competitive advantage. Some key innovation metrics used in CPM, among others, include the following:

- Number of new product launches: Measures the number of new products introduced to the market within a specified period, reflecting the organization’s commitment to continuous innovation and ability to generate new revenue streams.

- Research and development investment: Includes the amount of funds allocated to research and development activities, which is essential information for organizations heavily reliant on innovation (e.g., technology companies or pharmaceutical firms).

- Patent filings: Quantifies the number of patents filed by the organization, indicating its ability to protect intellectual property and a commitment to innovation.

By monitoring innovation metrics, organizations can assess their innovation capabilities, identify areas for improvement and foster a culture of continuous innovation.

Conclusion

Ultimately, Corporate Performance Management (CPM) enables organizations to manage performance, align activities with strategic objectives and make informed decisions. With that in mind, here are the key takeaways from this blog post:

- Effective CPM methods (e.g., strategic goal-setting, budgeting and forecasting, performance measurement and reporting, risk management, and continuous improvement) drive organizational success.

- Appropriate KPIs (e.g., financial, operational, customer, employee, and innovation metrics) help manage CPM effectively.

- Success in applying CPM in different functional areas – as shown by Virgin Atlantic, Coca-Cola, Netflix, Amazon and Toyota – helps drive business outcomes and achieve success.

Learn More

For a more in-depth look at CPM in action, check out our Platform webpage – it’s all online, no forms required.

Are you at an enterprise organization looking to upgrade your CPM processes? Get started with a OneStream demo today!

Government Finance leaders today are under pressure to improve decision support, increase transparency and create efficiencies. In addition, agencies are up against the constraints of legacy systems, tedious manual processes and inefficient analytics tools. Agencies thus turn to the best government budgeting software solutions to automate processes and mitigate those challenges. Here, we’ve curated the 5 best budget government software solutions based on their features, customer reviews and industry recognition.

To compile this list, we’ve considered software that meets the following qualifications:

- Earns industry recognition on reputable review platforms such as Gartner Peer Insights

- Offers comprehensive budgeting features for government agencies

- Provides reliable customer support

What Is Government Budgeting Software?

For government agencies, budgeting software plays a pivotal role in the ability to streamline planning processes, increase transparency and gain new insights. Solutions should be tailored to the specific needs of government agencies. How? By encompassing the entire budgeting process from strategic planning, budget formulation, budget execution and performance management to reporting and analytics.

Below are some common features found in budgeting software for government agencies:

- Automation of budget preparation tools

- Robust integration and enterprise data management

- Standard and ad-hoc reporting and dashboard capabilities

- Strong security measures

- Intuitive workflow management

By leveraging these features, agencies can streamline planning processes, minimize errors and make well-informed financial decisions.

Not sure what budget software solution best suits your agency? You’re in the right place!

In the comparative analysis that follows, we’ll explore the features and functionalities of 5 leading government budgeting solutions: OneStream, Oracle EPM Cloud, SAP, Workday/Adaptive and Anaplan.

The Best Budgeting Software Solutions for Government Agencies

1. OneStream

OneStream is a leading enterprise Finance solution trusted by government agencies. It offers a comprehensive platform uniquely unifies financial consolidation, planning, reporting and analysis. With robust budgeting features, OneStream offers the following benefits to government agencies (see Figure 1):

- Unifies all financial and operational data

- Allows agencies to accelerate and simplify planning processes across the Budget and Finance offices

- Embeds AI for better decisions and productivity

OneStream’s unified platform enables Finance and Operations teams to better collaborate and deliver a single source of truth. Having that single source eliminates the complexity of multiple solutions, interfaces and integrations. Not to mention, agencies can also avoid the heavy cost and duplication of data and metadata while avoiding time-consuming processes and upgrades.

OneStream’s unified platform enables Finance and Operations teams to better collaborate and deliver a single source of truth. Having that single source eliminates the complexity of multiple solutions, interfaces and integrations. Not to mention, agencies can also avoid the heavy cost and duplication of data and metadata while avoiding time-consuming processes and upgrades.

Pros:

- Highest customer success rate in the industry.

- Only complete, end-to-end FedRAMP Moderate certified and DoD Impact level 4 (IL-4) provisional authorized cloud CPM provider.

- Intuitive platform with a logical, efficient and modern user experience.

- Comprehensive platform that supports end-to-end PPBE processes for government agencies.

- Ability to support growth and evolution of agencies over time without reimplementing or adding more technical debt.

- Built-in self-service reporting, dashboarding, ad-hoc analysis and deep integration with Microsoft Office in one platform – from balance to transactional details with seamless drill down and drill back to supporting details for transparency, auditability and actionable details behind every number.

Cons:

- Implementation may require additional time and resources.

- Users may face a learning curve during initial implementation.

2. Oracle Enterprise Performance Management Cloud

Oracle Enterprise Performance Management Cloud (Oracle EPM Cloud) provides a solution for federal agencies to automate budget formulation and execution. It offers features for planning, forecasting, reporting, security and workflow capabilities.

Pros:

- Access to a pool of skilled professionals, services, partners and domain expertise thanks to a large customer base and global network.

- Integration with Oracle solutions (ERP, HCM, CRM, etc.) and databases, and a good solution for master data management, data integration and data quality.

- FedRAMP low authorized provider.

Cons:

- Limited live references, footprint and peer reviews/insights for the cloud EPM solutions.

- Multiple fragmented solutions that require multiple complex integrations across solutions to reconcile actuals with plans and bring in financial and operational data to support end-to-end consolidation, close, financial & operational planning, and reporting processes.

- Implementation may require significant time and resources.

3. SAP

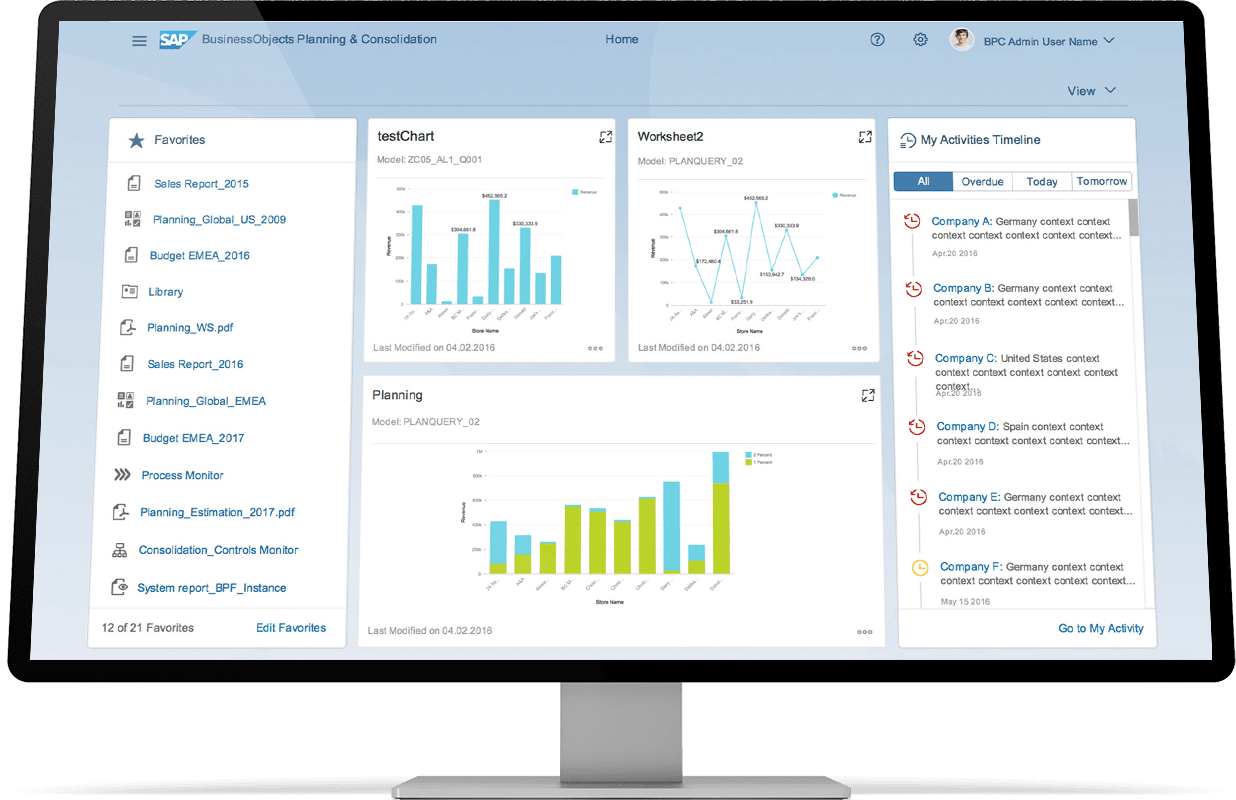

SAP’s solution for EPM are a combination of SAP Group Reporting embedded in S/4HANA for consolidations and SAP Analytics Cloud (SAC) for financial and operational planning.

SAP S/4HANA Group Reporting is an enterprise solution for consolidations. As part of S/4HANA, the Group Reporting solution leverages a combination of features tied to Group Reporting for consolidations and S/4HANA for core close capabilities. SAP Analytics Cloud is a cloud-based platform for planning, business intelligence (BI) and predictive analytics that enables organizations to visualize, plan and make data-driven decisions.

Pros:

- Reliance of both solutions on the same S/4HANA technology to streamline integration with SAP ERP systems.

- Global footprint that ensures access to a vast pool of skilled professionals and SAP domain knowledge.

- FedRAMP authorized provider.

Cons:

- Group Reporting and SAC use the same underlying technology, but remain separate solutions with separate implementations and resources.

- Multiple products must be connected and result in disparate data silos. Each product implemented means an additional integration point. Each integration is a point of failure risk due to needing data quality testing and problem resolution, plus on-going maintenance and modifications as requirements change.

- Lack of features, capabilities and flexibility means solutions cannot meet comprehensive and changing requirements of organizations.

4. Workday Adaptive Planning

Workday Adaptive Planning covers planning, consolidation, analytics and reporting functions. Built on a proprietary in-memory database, the solution enables collaboration and real-time updates in a spreadsheet-like browser user interface.

Pros:

- Supports financial planning process support that covers budgeting, forecasting and strategic planning.

- Intuitive interface for users across different departments.

- Easy integration with Workday Finance and HR.

Cons:

- Limited live references, footprint and peer reviews/insights for the cloud EPM solutions.

- Not a FedRAMP authorized provider.

- Fragmented, multiple solutions and technologies that require multiple complex integrations across solutions to reconcile actuals with plans.

- Limited data model for all CPM/EPM processes and limited data integration capabilities for managing the multiple ERP and other source system data integrations.

- Potential learning curve for new users.

5. Anaplan

Anaplan is a cloud modeling technology that enables planning, budgeting and forecasting on a single platform. The solution serves clients in an array of verticals and functions, including Finance, Sales and Marketing, Supply Chain, and HR and Workforce.

Pros:

- User-friendly browser interface.

- Flexible modeling that supports a broad set of planning use cases.

- Professional services team that works alongside its partner network to ensure implementation support.

Cons:

- Limited live references, footprint and peer reviews/insights for the cloud EPM solutions.

- Not a FedRAMP authorized provider.

- Extra time and resources potentially needed to scale and evolve with agency to update and/or connect modules in response to changes.

- Limited financial intelligence in platform, requiring everything to be developed each time.

- Potential learning curve for new users.

Conclusion

Choosing the right budgeting solution is essential for agencies looking to move beyond legacy/manual processes and evolve to a modern EPM solution. In this blog post, each of the 5 best budgeting software solutions highlighted offers unique features and benefits, catering to the diverse needs of government agencies.

However, one financial budgeting software solution stands above the rest if you’re looking to streamline back-office Finance processes and significantly increase confidence in reporting and planning. OneStream ultimately offers the best software to handle your agencies evolving needs, no matter how complex.

Learn More

To learn more about how government agencies are conquering complexity and modernizing back-office processes, click here to check out our customer success with government agencies.

Learn MoreIn recent years, Financial Planning and Analysis (FP&A) providers have seen a relative explosion in the number of AI software solutions. AI software for FP&A is gaining importance because it significantly enhances the efficiency and accuracy of financial analysis. In fact, the best AI software solutions for FP&A enable organizations to quickly analyze vast amounts of financial data, identify patterns and generate insights.

AI helps automate routine tasks, freeing up Finance professionals to focus on the more strategic aspects of financial planning. Overall, the integration of AI in FP&A contributes to resource optimization, efficiency, agility and better-informed decision-making.

In this blog post, we examine the Top 5 AI software solutions for FP&A in 2024 using our own interpretation of their relative offerings. We only include software that meets the following non-negotiable qualifications:

- Earned at least 4.5/5 stars on Gartner Peer Reviews – Financial Planning Software

- Listed in the Budgeting Section on Capterra

- Offers a wider EPM offering

What Is AI Software for FP&A?

AI software for FP&A enables Finance teams to move beyond historical reporting and embrace machine learning (ML)-backed predictive analytics. By analyzing historical data patterns, AI algorithms can more accurately forecast future trends. Those trends then help organizations make more informed financial decisions. For example, AI can analyze customer behavior, purchase history and market trends to predict the ideal price point for each product or service. This personalized approach maximizes both revenue and customer satisfaction, paving the way for sustainable growth.

As FP&A teams continue to embrace AI, adopting a sensible approach to ML – one that balances automation with transparency and human insight – has become increasingly important. After all, effective planning is critical for businesses to remain competitive and adapt to changing market conditions.

Common features across AI software solutions for FP&A include the following capabilities:

- Easy-to-access interactive dashboards that FP&A teams can use to discern financial trends.

- Enhanced forecast accuracy by generating more precise analysis using business intuition or external factors within forecasts.

- Easily visualized impact of planning decisions on profitability and margins with “What-if” driver-based planning.

- Reduced forecast bias within scenarios, compare against human forecasting to drive better dialogue and collaboration.

By leveraging these features and others, organizations can transform the FP&A function, plan with confidence, gain insights and forecast more accurately.

This comparative analysis explores the features and functionalities of 5 leading AI software solutions for FP&A: OneStream, Planful, Board, Workday Adaptive and Wolters Kluwer CCH Tagetik.

The Best AI Software for FP&A

1. OneStream

OneStream is how finance teams can stop wrangling data and start making more of an impact on the business. It’s the only enterprise finance platform that unifies all your financial and operational data, embeds AI for better decisions and productivity, and lets you keep adding capabilities without adding technical debt.

Pros

- Enables users to create thousands of highly accurate daily and/or weekly ML forecasts across products and locations via the unique “Model Arena” concept where models compete to win the most accurate forecast for each individual team.

- Allows the capture of business intuition such as promotions, events and other external factors within ML forecasts.

- Fully unifies and aligns demand forecasts with driver-based sales, material costs, inventory and labor plans across financial statements including the P&L, Balance Sheet and Cash Flow.

Cons

- Tailored implementation process potentially requiring additional configuration time to meet customers’ unique business requirements.

- Potentially prohibitive pricing, especially for smaller businesses.

- Smaller but growing market presence compared to other alternatives – despite growing popularity and having 1,300+ customers across the globe.

2. Planful

Founded in 2001, Planful is a private company supported by private equity firm Vector Capital. The Planful platform aims to streamline diverse business processes, such as planning, budgeting, consolidations, reporting and analytics. Used globally, this platform acts as a tool for Finance, Accounting, and Business users to improve their planning, reporting and closing processes. Planful’s ultimate stated aim with its AI software for FP&A tool is to accelerate process cycles, boost productivity and enhance overall accuracy.

Pros

- Offers very user-friendly, adaptable interface (i.e., functions in both web and Excel interfaces) that requires little IT help and has syntax similar to Excel.

- Allows customers to only buy what they need since Planful is sold as modules.

- Receives very highly rated customer service within public reviews.

Cons

- Difficult-to-detect seasonality due to the lowest granularity being monthly.

- Inability to allow capture of business intuition such as promotions, events and other external factors within predictive forecasts.

- Limited scale as users are constrained to running only 10 models at one time.

- Data integration delivered using a third-party solution – not developed by Planful.

3. Board

Board was founded in 1994 in Chiasso, Switzerland, and has headquarters in both Boston and London. While the overall product is marketed as integrated business intelligence reporting and analytics with enterprise scalability, Board markets its planning solution as Intelligent Planning for FP&A teams. Board is a private company with customers worldwide, the highest percentage in Europe.

Pros

- Employs a model competition concept where models compete to win the most accurate forecast for each individual line item – enabling users to create thousands of highly accurate daily and/or weekly ML forecasts across products and locations.

- Provides prebuilt integrators with ERPs and over 270 APIs to multiple source systems that import GL and transactional information.

- Offers visually appealing UI with tight connection between the presentation layer and back-end.

Cons

- Ongoing maintenance required as everything must be built, meaning little pre-built functionality exists.

- No ability to allow capture of business intuition such as promotions, events and other external factors within predictive forecasts.

- Limited accuracy improvements due to only statistical models vs. machine learning models being available.

- No health monitoring of models and auto-rebuilds to maintain accuracy of models.

4. Workday Adaptive

Workday is a leading provider of enterprise cloud applications for Finance and Human Resources. Founded in 2005, Workday delivers financial management, human capital management and analytics applications. Workday Adaptive Planning originates from the acquisition of Adaptive Insights in 2018. Marketed as enterprise planning software, the Workday solution helps Finance create budgets and forecasts with more speed, flexibility, collaboration and accuracy.

Pros

- Provides Finance-focused planning solution with strong market awareness, especially in the US.

- Uses automation and connectivity to Excel through Office connect, ensuring ease of use.

- Offers outlier reporting and anomaly detection, allowing for quick analysis and plan comparison.

Cons

- Limited accuracy improvements due to a single model applied across all line items or product-location combinations vs. a specific model application for each line item, which can be achieved through a Model Arena.

- No ability to allow capture of business intuition such as promotions, events and other external factors within predictive forecasts.

- No health monitoring of models and auto-rebuilds to maintain accuracy of models.

5. Wolters Kluwer CCH Tagetik

Wolters Kluwer is a global entity specializing in professional data, application solutions and services. The company targets sectors such as healthcare; taxation and accounting; corporate and financial compliance; legal and regulation; and corporate performance and ESG. Originally developed in 2005 to deliver trusted, comprehensive and scalable CPM solutions globally, CCH Tagetik was acquired by Wolters Kluwer in 2017.

Pros

- Surfaces drivers impacting the business.

- Shows accuracy uplift with forecast comparison of statistical predictive vs. baseline forecasts.

- Offers unified platform approach that differs from multi-solution approaches (e.g., SAP and Oracle).

Cons

- Separate ML product requiring integration, administration and, therefore, unification and transparency.

- Limited accuracy improvements due to a single model applied across all line items or product-location combinations vs. a specific model application for each line item.

- Limited accuracy improvements due to only statistical models vs. machine learning models being available.

Conclusion

Choosing the right AI software for FP&A is essential for organizations seeking to move away from unreliable, inadequate EPM applications and/or spreadsheets and instead evolve to a modern AI-driven EPM solution.

Each of the Top 5 solutions featured in this blog post offers unique features and benefits, catering to the diverse needs of organizations across industries. Ultimately, however, if you’re looking to streamline your key Finance processes and significantly increase confidence in your reporting, OneStream is the best AI software for FP&A to handle all your needs, no matter how complex.

Learn More

To learn more about how organizations are managing the complexity in their financial planning and analysis by using AI, check out our whitepaper titled “Revolutionize Your Planning with Sensible ML.” And if you’re ready to take the leap from spreadsheets or legacy EPM solutions and start your Finance Transformation with OneStream, let’s chat!

Download the White PaperTo chart an organization’s fiscal future, Financial Planning and Analysis (FP&A) managers examine, analyze and evaluate the organization’s financial undertakings. FP&A managers also simplify complex financial information for executives (often with little time), narrate financial performance and advise on adhering to the strategic plan. How? With FP&A reports.

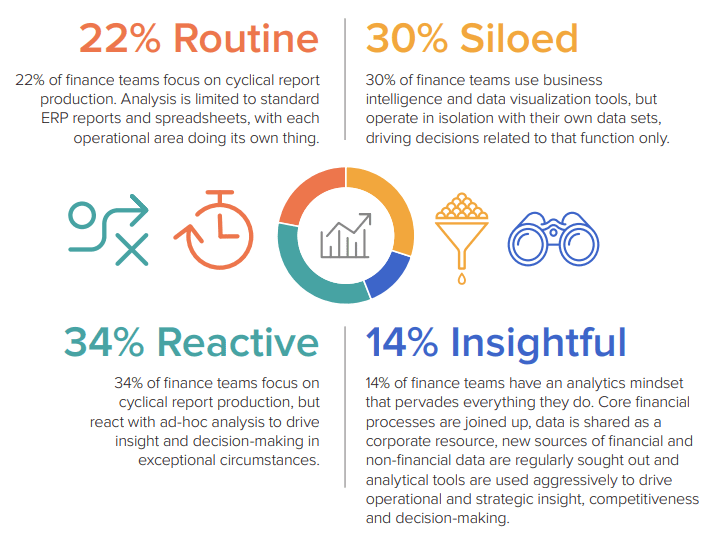

Yet despite the explosion of data across sophisticated organizations, many organizations still struggle to meet the information requirements of executives and managers because the organizations just don’t have the right tools for the job. In fact, only 14% of Finance leaders classify their reporting and analytics as insightful, as illustrated in Figure 1.

Figure 1. Source: Reporting and Analytics for Intelligent FP&A

With the right FP&A software, reporting should be easy – if you know which reports will drive the organization furthest. And we’ve got you covered in that regard. Below, we’ve aggregated the most important FP&A reports for enterprise Finance teams.

The Best FP&A Reports

Regardless of the platform you’re using (even if OneStream is the most straightforward), FP&A reports offer important insights and information. The following reports will help keep the financial division at your organization well-coordinated month to month, quarter to quarter and year to year.

1. Income Statement (Profit and Loss Statement)

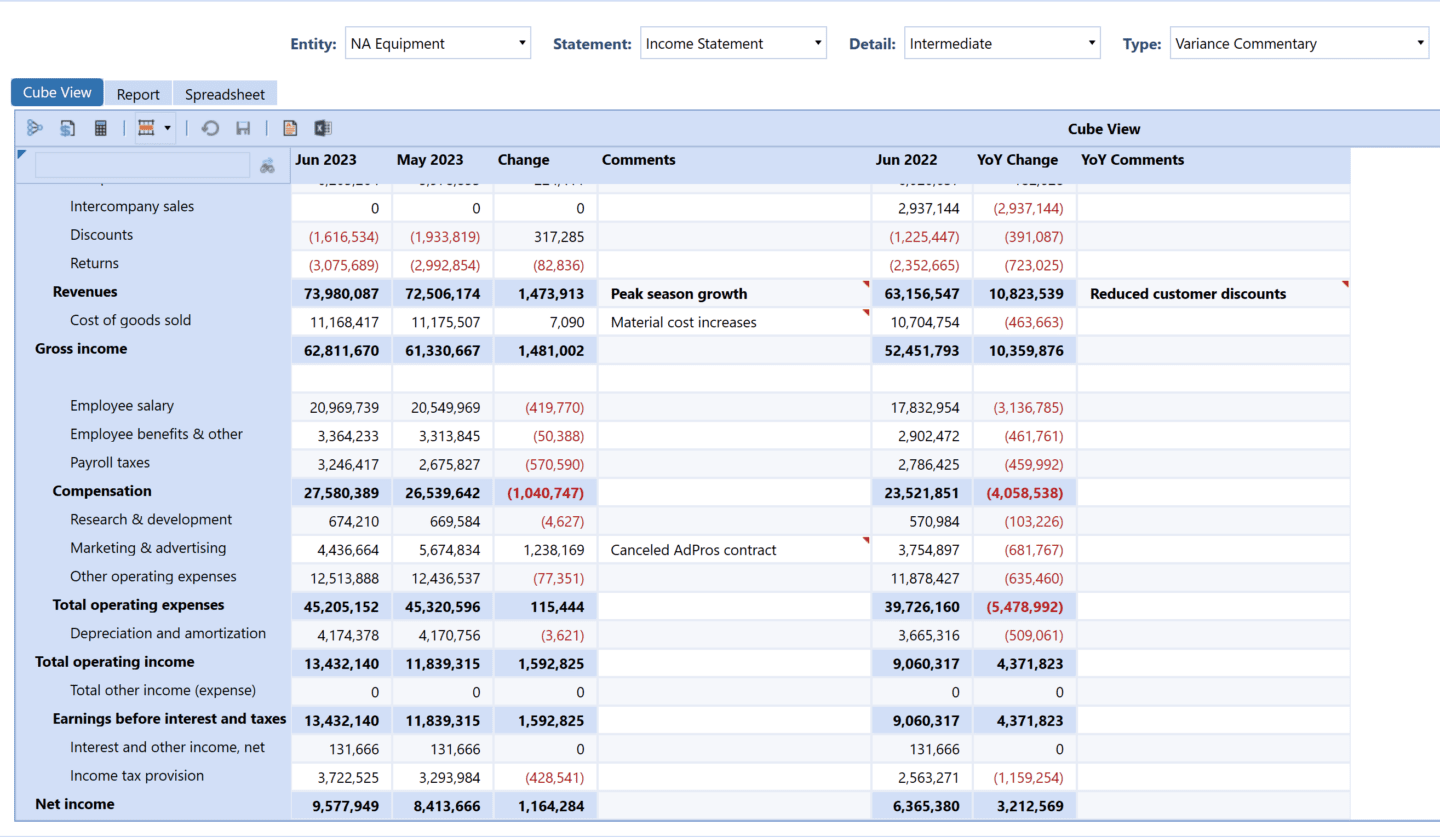

Figure 2. Screenshot of an income statement from OneStream

Sometimes called a “profit and loss” or “P&L” statement, an income statement is a critical financial report. It summarizes the revenues, costs and expenses incurred during a specific period, usually a fiscal quarter or year. Through such details, this FP&A report provides a clear view of the company’s operational efficiency and profitability over time.

Here’s how FP&A views and uses an income statement:

Operational Insight

- Revenue Analysis: FP&A teams dissect revenue streams to understand the business’s income sources and identify trends, seasonal variations and growth opportunities. In turn, this analysis helps with forecasting future revenues and setting realistic sales targets.

- Cost and Expense Management: By examining the costs of goods sold (COGS) and operating expenses, FP&A can pinpoint areas of inefficiency or overspending. This insight is used to recommend cost-saving measures and operational improvements.

Financial Health and Profitability

- Gross Profit Margin: Analyzing the gross profit margin helps FP&A assess the direct profitability of the company’s core activities, excluding overhead costs. When FP&A is evaluating the effectiveness of production and pricing strategies, this analysis is crucial.

- Net Profit Margin: The net profit margin reveals the overall profitability after all expenses, providing a comprehensive view of financial health. With this information, FP&A can advise on budget adjustments, investment decisions and strategies to improve profitability.

Forecasting and Strategic Planning

- Trend Analysis: By comparing income statements over multiple periods, FP&A teams can identify trends in revenue, costs and profit margins. This historical analysis is foundational for accurate financial forecasting.

- Scenario Planning: FP&A often uses the income statement for scenario planning. Using this report, FP&A can assess how different strategic decisions (e.g., market expansion, product launches) might impact the company’s financial performance.

Performance Measurement

- Budget vs. Actual: By comparing actual results with budgeted figures on the income statement, FP&A can measure organizational performance, identify variances and understand why they occur. This evaluation is crucial for refining future budgets and improving forecasting accuracy.

Communication and Reporting

- Executive and Stakeholder Communication: By translating the complex details of the income statement into actionable insights, FP&A can give strategic advice to executives and stakeholders. This communication involves highlighting key financial metrics, risks and opportunities in a comprehensible manner.

In essence, from an FP&A standpoint, the income statement is not just a retrospective financial report. The statement is also used for ongoing analysis, strategic planning and decision support – providing a foundation for guiding the organization toward financial stability and growth.

2. Balance Sheet

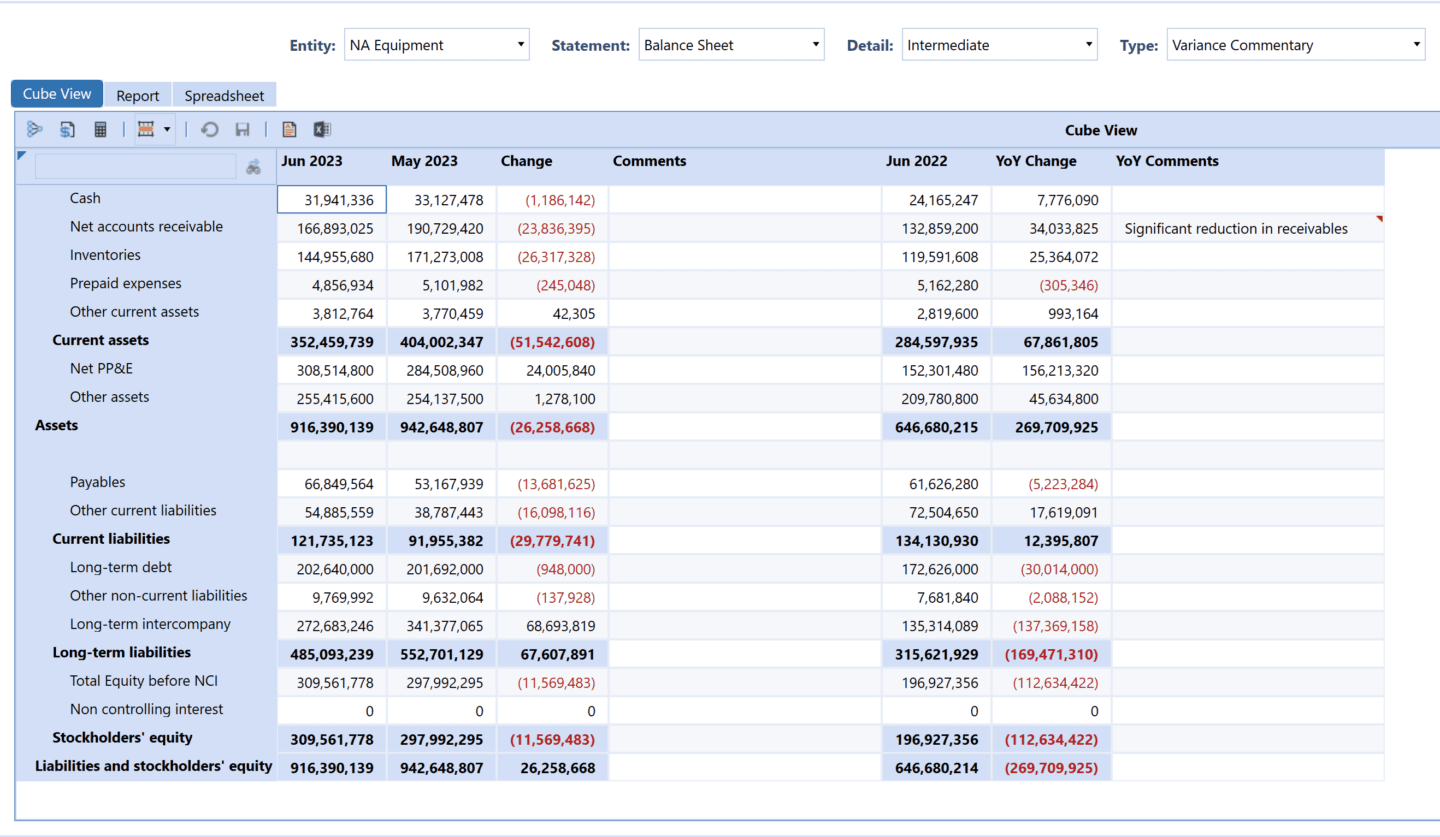

Figure 3. Screenshot of an balance sheet from OneStream

As a fundamental financial statement, a balance sheet gives a snapshot of a company’s financial condition at a specific point in time. The statement details the organization’s assets, liabilities and shareholders’ equity to provide a comprehensive overview of financial health and stability.

Here’s how FP&A views and uses a balance sheet:

Asset Management

- Current Assets Analysis: With this analysis, FP&A teams evaluate current assets (e.g., cash, marketable securities and receivables) to assess the company’s liquidity and ability to meet short-term obligations. The analysis then helps organizations effectively manage working capital.

- Fixed Assets Management: In fixed assets management, long-term assets – such as property, plant and equipment (PP&E) – are assessed. FP&A specifically looks at the role fixed assets play in the company’s operational capabilities and long-term strategy (e.g., investment, depreciation and disposal decisions).

Liability Oversight

- Short-Term Liabilities: Analyzing short-term liabilities (e.g., accounts payable and short-term debt) helps FP&A understand the company’s immediate financial commitments and liquidity pressures.

- Long-Term Liabilities: Evaluating long-term obligations (e.g., bonds payable and long-term leases) provides FP&A with insight into the company’s long-term financial planning and sustainability.

Equity Evaluation

- Shareholders’ Equity: This evaluation includes analyzing retained earnings, paid-in capital and other equity items. Through this analysis, FP&A can understand the company’s funding structure and the impact of operational performance on equity. The information and insights gained are especially crucial for decisions related to dividends, stock repurchases and equity financing.

Financial Ratios and Health

- Liquidity Ratios: When assessing financial health, FP&A uses ratios such as the current ratio and quick ratio to evaluate the company’s ability to pay off short-term liabilities with short-term assets. Such analysis is crucial for liquidity management.

- Leverage Ratios: Debt-to-equity and debt-to-asset ratios are analyzed to understand the level of indebtedness and the financial leverage of the company. In turn, the organization can use the information and insights gained when making impact risk assessments and capital structure decisions.

Strategic Planning

- Capital Structure Analysis: Through capital structure analysis, FP&A assesses the balance between debt and equity financing. The information and insights gained are then used to recommend strategies for optimizing the company’s capital structure. For any strategy, key considerations include cost of capital, risk and financial flexibility.

- Investment and Growth Opportunities: By analyzing the balance sheet, FP&A can identify surplus cash or underutilized assets. Any surpluses or assets can then be redirected toward growth opportunities, mergers, acquisitions, or other strategic investments.

Risk Management

- Contingent Liabilities: Potential future liabilities (e.g., lawsuits or warranties) are considered given their potential impacts on financial planning and risk management strategies.

Stakeholder Communication

- Communicating Financial Stability: FP&A translates balance sheet data into insights about the company’s financial stability, growth potential, and risk profile for investors, lenders and internal stakeholders. In turn, the information and insights gained help support informed decision-making.

The balance sheet is not just a static reflection of assets, liabilities and equity. Instead, this financial statement is a dynamic tool. It’s used for managing liquidity, assessing financial stability, guiding strategic investments and ensuring the company is positioned for sustainable growth.

3. Cash Flow Statement

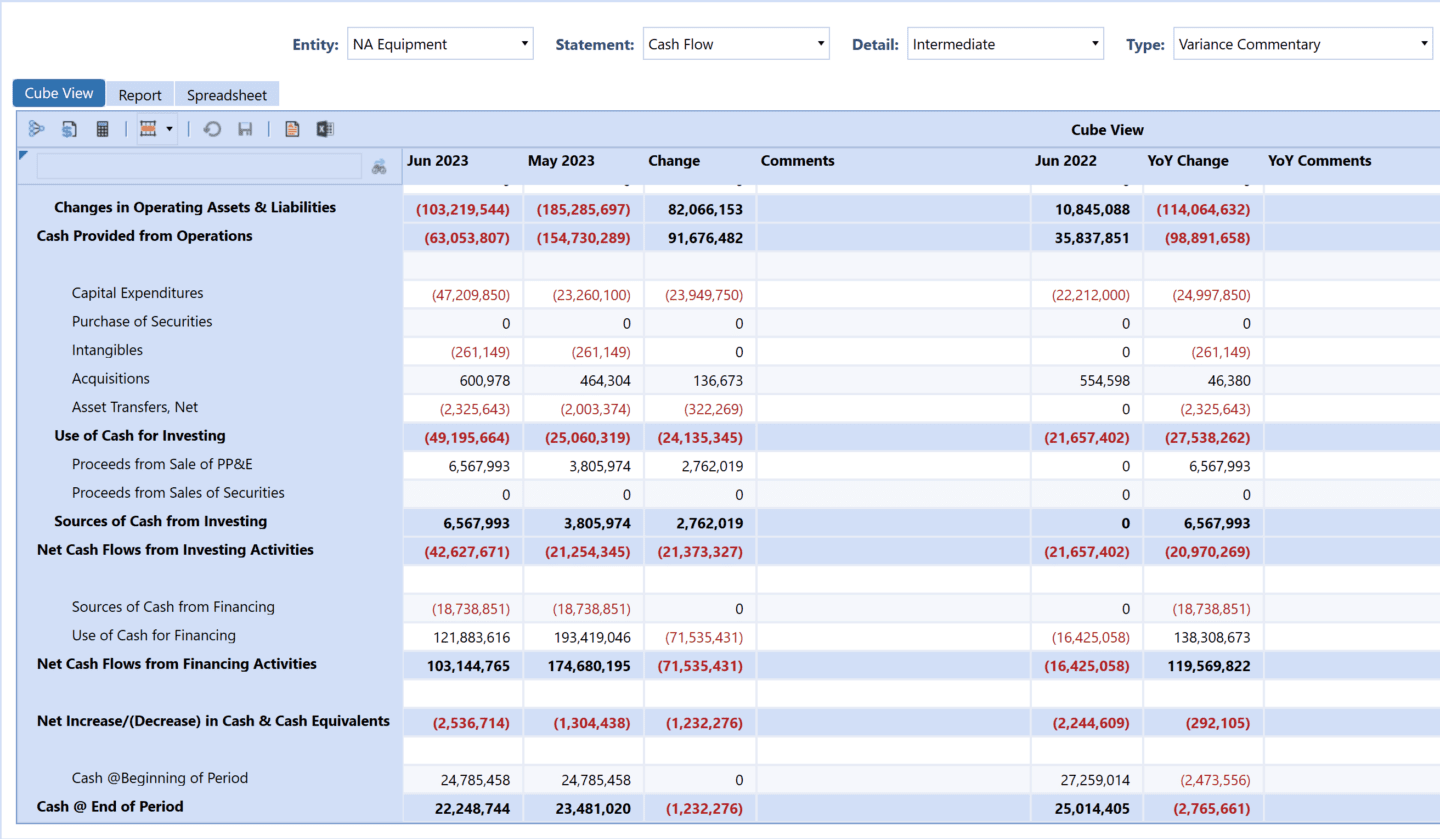

Figure 4. Screenshot of a cash flow statement from OneStream

A cash flow statement is an indispensable financial document. Why? It tracks a company’s incoming and outgoing flow of cash over a specific period. Through that information, a cash flow statement provides a detailed breakdown of cash movements related to operating, investing and financing activities. This statement thus offers a clear view of a company’s liquidity, solvency and overall financial health – beyond what income statements and balance sheets can reveal.

Here’s how FP&A views and uses a cash flow statement:

Cash Management

- Operating Activities: By analyzing cash flows from operating activities, FP&A can better understand the cash generated from the company’s core business operations. This analysis is vital for assessing the quality of earnings and the company’s ability to sustain operations without relying on external financing.

- Investing Activities: Cash flows, particularly a 13-week rolling cash flow, related to investing activities are scrutinized to evaluate the company’s investment strategy and the impact on long-term growth. Through this analysis, FP&A looks at activities such as the purchase or sale of assets, investments and capital expenditures.

- Financing Activities: Examination of financing activities provides insights into the company’s financing strategy and approach to managing capital structure and shareholder returns. Through this analysis, FP&A looks at activities such as issuing debt, repaying loans or distributing dividends.

Liquidity Analysis

- Short-Term Liquidity: To assess the company’s ability to meet short-term obligations and efficiently manage working capital, FP&A uses the cash flow statement. This process includes planning for potential cash shortfalls or allocating excess cash.

- Long-Term Solvency: Analysis of long-term cash flow trends is essential for evaluating the company’s solvency. Specifically, the analysis looks at the capacity to fund operations, repay debt and pursue expansion opportunities over the long term.

Forecasting and Planning

- Cash Flow Forecasting: By analyzing historical cash flow patterns, FP&A teams forecast future cash flows, which helps with budgeting and financial planning. This forecasting is crucial for ensuring the company maintains sufficient liquidity to meet any operational and strategic needs.

- Scenario Analysis: Using the cash flow statement, FP&A performs scenario analysis to understand how various strategic decisions and external factors could impact the company’s cash position. This analysis helps in risk management and strategic decision-making.

Performance Measurement

- Free Cash Flow Analysis: Free cash flow (FCF) is a key metric derived from the cash flow statement. Through this metric, FP&A can better understand the cash a company generates after accounting for cash outflows to support operations and maintain capital assets. FP&A uses FCF to evaluate the company’s financial performance, dividend-paying ability and potential for growth investments.

Communication

- Stakeholder Reporting: FP&A communicates the insights gained from the cash flow statement to internal and external stakeholders. With those insights, FP&A can present a clear picture of the company’s financial health, operational efficiency and future outlook.

- Strategic Recommendations: Based on the analysis of the cash flow statement, FP&A advises senior management on cash management strategies, investment opportunities and financial risk mitigation.

In essence, a cash flow statement is a strategic tool for managing financial health, supporting operational needs, guiding investment decisions and planning for sustainable growth.

4. Budget vs. Actuals Analysis

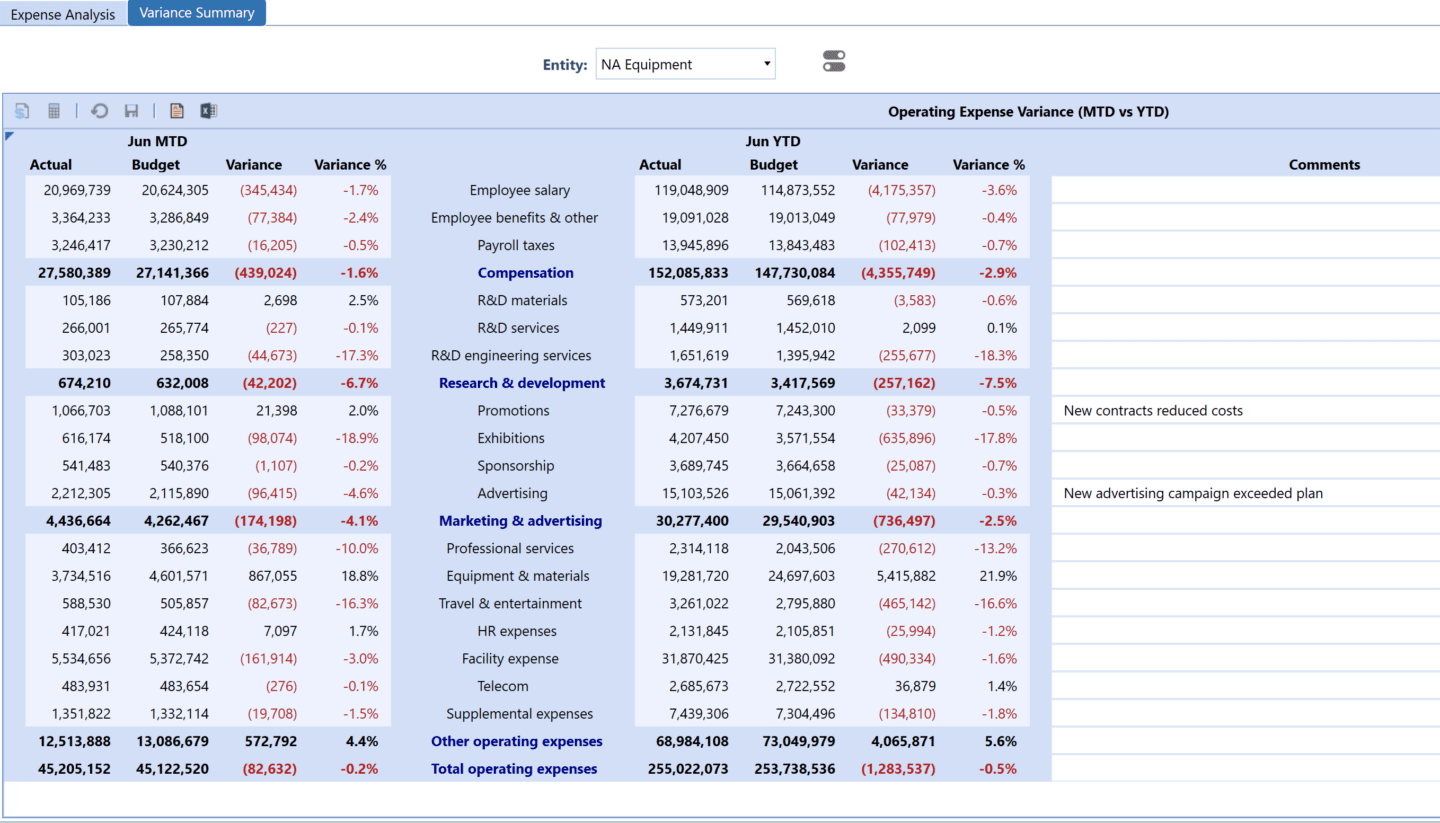

Figure 5. Screenshot of a budget vs actuals analysis from OneStream

The analysis of budget vs. actuals compares planned financial outcomes (budget) with actual results. Using this report, FP&A teams can identify variances, understand the reasons behind these differences and take corrective actions if necessary. The report also helps with refining future budgets and improving forecasting accuracy.

Here’s how FP&A views and uses a budget vs. actuals analysis:

Performance Measurement

- Identifying Variances: One of the primary functions of the budget vs. actuals report is to identify variances between what was expected and what has been achieved. By analyzing these variances, FP&A seeks to understand their causes, whether they stem from changes in the market environment, operational challenges or deviations in strategic execution.

- Operational Insights: By analyzing the differences between budgeted and actual figures, FP&A can pinpoint underperforming or overachieving operational areas. This insight is crucial for making informed decisions about operational adjustments and resource allocation.

Financial Control and Management

- Cost Control: By monitoring actual expenses against budgeted expenses, FP&A can identify areas of overspending. Such information then prompts immediate corrective action to control costs and improve efficiency.

- Revenue Management: Analyzing actual revenues against forecasts enables FP&A to gauge the effectiveness of sales strategies and market conditions, potentially leading to strategy adjustments.

Forecasting and Strategic Planning

- Refining Forecasts: The insights gained from budget vs. actuals analysis are instrumental in refining future forecasts. By understanding the reasons behind variances, FP&A can make more accurate predictions, improving the reliability of financial planning.

- Strategic Adjustments: Regular analysis of budgetary variances informs strategic decision-making, helping to more closely align future budgets with strategic goals and market realities.

Accountability and Performance Incentives

- Driving Accountability: The budget vs. actuals report serves as a basis for evaluating the performance of departments and managers. Through that evaluation, FP&A can be held accountable for their financial management and operational execution.

- Performance Incentives: The analysis of budget vs. actuals informs the development of performance incentives, linking financial rewards to the achievement of budgeted targets and strategic objectives.

Communication and Stakeholder Engagement

- Internal Communication: The budget vs. actuals analysis report is a vital tool for internal communication. With the insights from this analysis, FP&A can provide management and stakeholders with a clear view of the company’s financial performance and operational efficiency.

- External Stakeholders: While primarily used internally, insights from the budget vs. actuals analysis can be shared with external stakeholders to demonstrate fiscal responsibility and operational transparency.

Risk Management

- Identifying Financial Risks: Regular comparison of budgeted and actual figures helps in identifying financial risks early. Using that information, FP&A teams can recommend risk mitigation strategies and contingency plans.

In other words, the budget vs. actuals analysis report is a comprehensive tool for operational and strategic management. The report ultimately enables informed decision-making, enhances financial discipline and drives organizational growth.

5. Forecast Reports (Financial Forecasts and Projections)

Figure 5. Screenshot of a forecast analysis from OneStream

Encompassing both financial forecasts and projections, forecast reports are forward-looking documents that estimate a company’s future financial outcomes. Those estimates are based on historical data, current market trends and assumptions about future conditions. For FP&A teams, these reports are pivotal for strategic planning, resource allocation, risk management and decision-making processes.

Here’s how FP&A views and uses forecast reports:

Strategic Planning and Decision-Making

- Guiding Strategic Decisions: Financial forecasts provide a foundation for strategic decisions. With the information and insights gained, companies can plan expansions, investments, new products, or market entries by projecting future revenue, expenses and cash flows.

- Resource Allocation: Forecasts enable the efficient allocation of resources by identifying future financial needs, potential funding gaps and areas where investments can yield the highest returns.

Budgeting Process

- Budget Preparation: Forecasts often serve as a starting point for the budgeting process to offer an initial estimate of financial performance. Then, that estimate gets refined into a detailed budget.

- Dynamic Budgeting: In a dynamic and uncertain environment, financial forecasts allow FP&A to adjust budgets in real time. Those adjustments help FP&A respond effectively to changes in market conditions or operational performance.

Performance Measurement

- Setting Performance Targets: Financial projections are used to set performance targets for departments and teams. With such targets, FP&A can align operational efforts with the company’s financial goals.

- Benchmarking: Forecasts serve as benchmarks for evaluating actual financial performance, enabling companies to measure progress towards their strategic objectives.

Risk Management

- Identifying Risks and Opportunities: By examining various scenarios, forecasts help identify potential financial risks and opportunities. Companies can use the information and insights gained to devise strategies to mitigate risks and capitalize on opportunities.

- Contingency Planning: Financial forecasts are essential for contingency planning. Through such planning, companies can prepare for various future scenarios by understanding the financial impact of different risks and uncertainties.

Cash Management