With Gartner[1] projecting that, by 2024, 70% of all new FP&A projects will have an extended scope beyond the Finance department, FP&A teams are buzzing with excitement. Why? Well, along with the bold statement on the future of FP&A, Gartner has also reinforced what many of FP&A leaders already know to be true. Finance’s role in driving granular, driver-based operational plans is increasingly critical to driving performance.

We’re now entering the era of what’s being called eXtended planning & analysis (XP&A).

Gartner defines XP&A as the extension of FP&A principles beyond the Finance department. This extension could be into any area of the organization that produces business plans, including Sales, Marketing and HR. What does that ultimately mean? Here’s my take:

- The “lines” between operational and financial planning no longer exist.

- Going forward, Finance teams will now be expected to serve as strategic business partners and help (see Figure 1) drive plans for Merchandising, Sales and Marketing, and Operations.

- Finance must intelligently align these granular plans with the broader consolidated financial plans – and do it seamlessly and at scale.

With the concept of XP&A taking flight, many FP&A teams are of course thrilled with Gartner’s third-party validation of the importance of operational planning. But still, many Finance folks are also wondering how XP&A is different from integrated business planning.

To answer this question and more, we’re dedicating this post in our “Inspiring Digital Transformation with Intelligent Finance” blog series to the rise of XP&A.

Integrated Business Planning (IBP) Defined

As Finance leaders expand their roles, many leverage IBP as a management framework to set organizational strategy and optimize operational plans. IBP allows for aligning external factors like competition and economic changes with financial goals and detailed operational plans between Sales, Operations, Marketing and HR.

Through such alignment, IBP creates a continuous cycle to review and analyze financial results and compare actual results with detailed operating plans across the entire organization. That process, in turn, enables the organization to understand risks/opportunities and develop action plans.

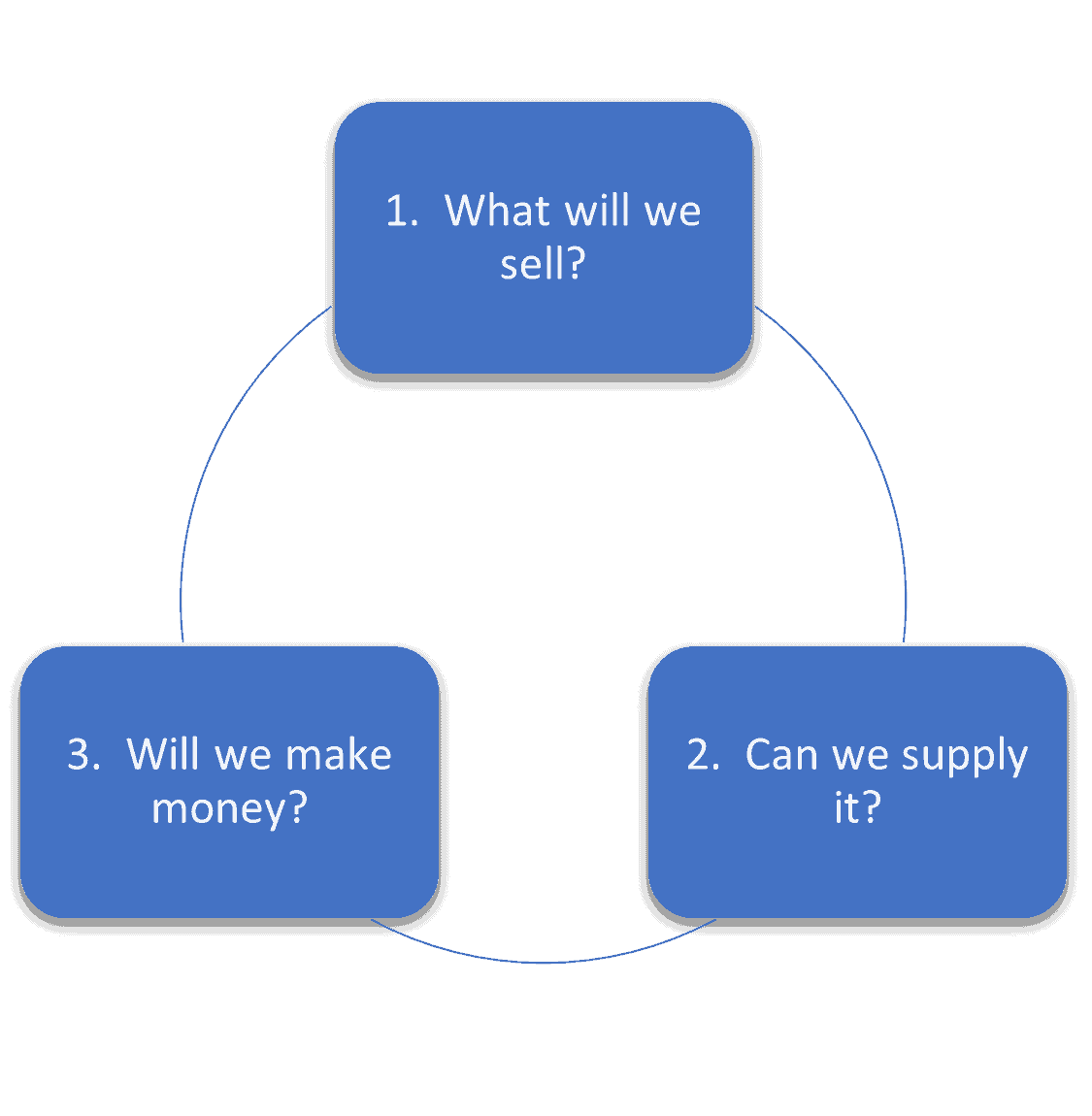

IBP addresses 3 critical management questions. Those questions are designed to align 1) how the company goes to market, 2) what plans are required to support the business and 3) how those plans translate to earnings and cash generation.

More specifically, these questions are designed to address the following (as illustrated in Figure 2):

- What will we sell? What products or services, and to what customers? In what region? When, and how many? Is marketing required to assist?

- Can we supply it? What are the current capacity, staffing and logistical concerns, if any? What changes are required to meet demand and Sales plans?

- Will we make money? What is the impact on the price and profit margin vs. the budget and prior year? What is the impact on cash flow?

Today’s Business Planning Challenges

To thrive in today’s economy, sophisticated enterprises must conquer complexity to execute across diverse lines of business – each of which requires unique go-to-market and operational plans across the globe. Without IBP, organizations face numerous challenges when creating alignment between consolidated company or business-unit financial goals and detailed operational plans.

Here are some of those challenges:

- Difficulty aligning key executives and stakeholders

- Lack of business agility

- Siloed decision-making

- Negative impact to business performance

The Rise of eXtended Planning & Analysis

IBP focuses on providing a management framework for Intelligent Finance organizations to drive performance. In contrast, consider XP&A as the technical enabler to actually execute IBP at scale and with control.

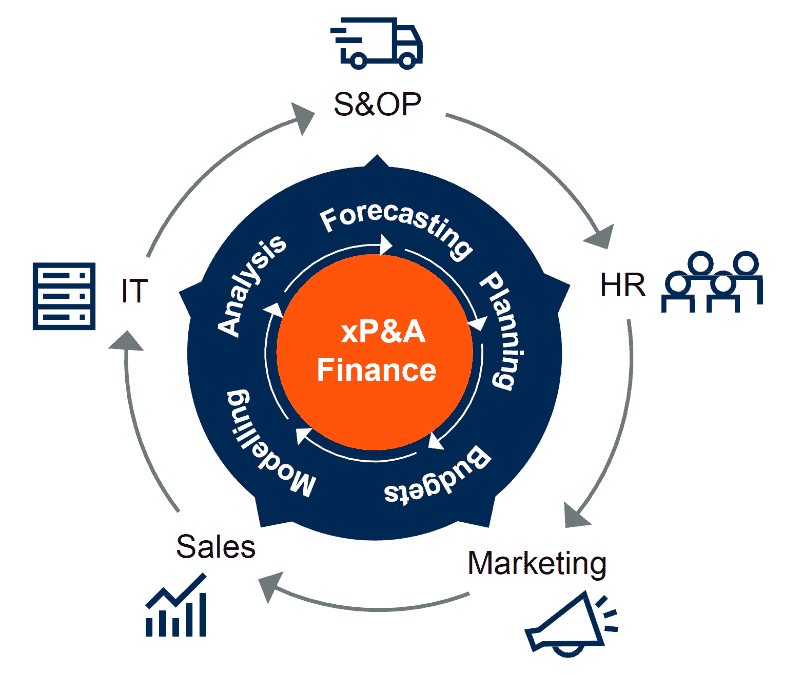

According to Gartner,[2] XP&A is a platform-centric enterprise planning strategy that extends FP&A use cases beyond Finance. How? By adding resident operational applications that use the same composable vendor platform, architecture and data model, all of which improves alignment. And like IBP, XP&A aligns planning disciplines – beginning with Finance – with adjacent functions, such as Supply Chain, Sales, Marketing, Workforce, and IT planning.

And XP&A, according to Gartner, also starts with Finance (see Figure 3).

Inspiring Intelligent Finance with XP&A

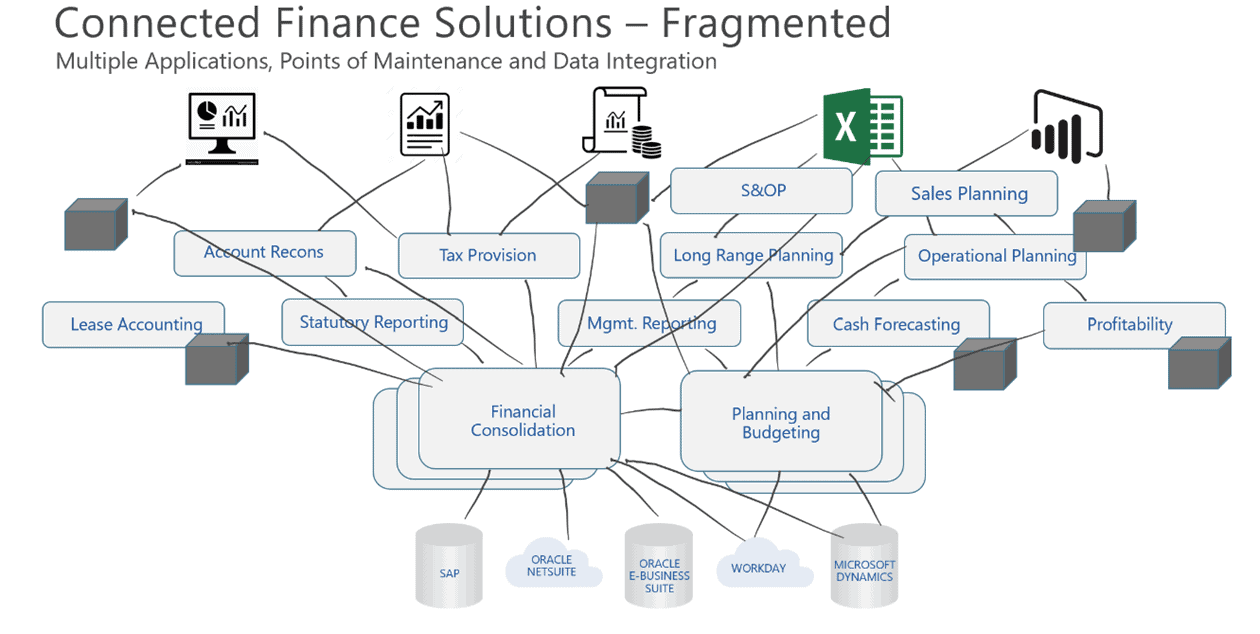

For CFOs and Finance teams seeking a seat at the strategy table, XP&A’s “Finance out” approach validates the importance of Intelligent Finance. Why? Because XP&A calls for Finance teams to make technology decisions with the scale to address a range of capabilities – including people planning, Sales planning and reporting – without adding the technical debt of fragmented tools (see Figure 4).

In many ways, XP&A is designed specifically to address the technical complexity and administrative burden inherent in connected Finance tools, including the key challenges below:

- Moving and reconciling data across diverse planning processes and tools.

- Managing a constant stream of metadata.

- Monitoring data latency and managing security between fragmented products or models.

- Lacking the financial intelligence to understand how diverse operational plans (e.g., S&OP) align to financial plans and goals.

Intelligent Finance teams are not just “connected” – they’re completely unified to allow Finance to conquer the key challenges of integrated business planning.

Intelligent XP&A: Unifying Finance & Operations with Control

For organizations beginning their XP&A journey, now is the perfect time for Finance teams to conquer the complexities of their “connected finance” processes. To move away from siloed decision-making. And to respond rapidly and effectively to the pace of change around them.

An effective XP&A platform also requires a unique set of features to technically enable real-time collaboration between Finance and Operations leaders in order to optimize performance. Here are some of the key features to consider as part of the due-diligence process:

- Extensibility: An extensible platform enables Sales, Product Management, Marketing and Operations to plan at a granular level, such as a business driver, while still adhering to a corporate standard for consolidated reporting.

- Data Blending: Data blending aligns both cube and relational database technology to XP&A processes by enabling users to develop operational plans that dynamically impact financial statements in real-time.

- Financial Data Quality: Financial data quality adds depth to variance analysis and business insights by providing transparency and drill-through back to source systems and guided workflows to ensure accuracy when moving data between source systems.

- Purpose-Built Solutions for Sales, Operations and HR: These solutions generate value for business partners with specific solutions that capture plans at the opportunity level (Sales planning), by capital project (Operations) and with detailed human capital data (HR).

- Flexible Reporting and Analysis: Once detailed plans are complete, Finance and business leaders can build scenarios, conduct sensitivity analysis and leverage dashboards to align financial and business plans for executive reviews.

Conquering Complexity to Lead at Speed

The rise of XP&A provides Finance teams with an ideal opportunity to conquer the complexities of their internal systems and processes – ensuring they have the time and confidence to focus on driving business strategy and performance. Yet process automation, though critical, is not a new concept.

Still, XP&A puts Finance in the driver’s seat to inspire a digitally ready, data-driven and performance-focused culture across the entire organization to help bring the promise of true integrated business planning to reality. To provide the operational relevance and flexibility required for lines of business groups AND Finance. To enable the organization with controls and with the governance required to scale. To continue the endless journey of unleashing the true value and potential of the Finance team to drive performance and inspire a new standard for corporate performance management.

At OneStream, we call this Intelligent Finance.

Learn More

To learn more about OneStream’s Intelligent Finance Platform, tune in for additional posts from our Inspiring Intelligent Finance blog series. You can also download our interactive whitepaper.

[1] Gartner, 2020 Strategic Roadmap for Cloud Financial Planning and Analysis Solutions, Robert Anderson, John Van Decker, 21 February 2020

[2] Gartner, “Innovation Insight for Extended Planning and Analysis (xP&A),” October 2020

Get Started With a Personal Demo