In today’s world of rapidly changing business conditions and market volatility, it’s important that Finance teams have the agility they need to lead at speed. What type of agility? I’m mainly referring to the need to update corporate reporting and planning systems to support mergers, acquisitions and divestitures, organizational changes, new product launches, and other business initiatives.

If the organization’s corporate performance management (CPM) software solution is controlled and managed by the Information Technology (IT) department, this can hinder the Finance team from making the changes needed to respond quickly to new requests or to support changing business requirements.

Leading at Speed

Modern organizations are not static. They are increasingly dynamic, with constant change being driven by both external and internal factors. In order to survive and thrive through these changes, Finance teams need to “control their own destiny” when it comes to managing and maintaining the applications they use to manage the business. I’m referring here to CPM software applications used for financial close, consolidation and reporting, planning, forecasting, and analysis. These systems integrate data from multiple GLs, ERPs, HCM, CRM, and other systems to provide an enterprise-wide view into financial and operating results and plans.

If the Finance team has to submit a support ticket to IT, then wait in the queue for changes to be made to their CPM applications, which hinders their agility and responsiveness to change. This includes the ability to quickly integrate new companies and systems into corporate reporting, planning, and other processes. It includes having the ability to add new accounts, departments, or cost centers, and support other organizational changes. And it includes having the ability to quickly create new reports or analytic views of the business to support ad hoc requests from management.

Does having Finance control over CPM applications mean they should evaluate and procure these systems completely on their own without involving IT? Absolutely not. There should be a collaboration between Finance and IT in evaluating, selecting, and implementing new CPM software. One of the benefits of cloud-based CPM software is that there’s little burden on IT from an infrastructure and staffing perspective to support new solutions. But IT should be involved in the evaluation and implementation process to ensure any new CPM or analytic software being considered integrates with operational systems, meets the organization’s security requirements and protocols, and fits with the overall IT strategy. But the Finance team should be able to own and operate the new CPM solution with minimal IT support.

OneStream was Built for Finance Teams

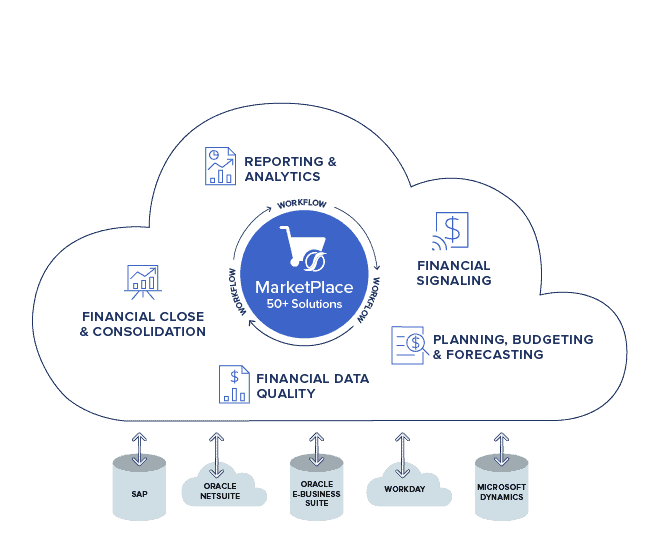

Not all CPM software solutions are designed to be Finance-owned and operated. Some solutions are very IT-centric, especially those that are closely tied to a particular ERP system. OneStream’s Intelligent Finance platform was designed to be owned and operated by Finance teams and deployed to Finance and operating staff across the enterprise. And while it’s not tied to any particular ERP system, OneStream integrates with over 250 data sources.

OneStream includes several key capabilities that enable organizations to deploy OneStream with minimal IT support and maximum control by Finance teams. These include the following:

- Cloud deployment – no internal IT infrastructure or resources are required for installation. OneStream’s support team provisions the system and manages the infrastructure.

- Finance-managed data integrations – data can be integrated from GLs, ERPs, HCM, and CRM systems via file transfers or direct connection to over 250 data sources.

- Drill-back to source systems – based on the direct connect integration capability mentioned above, OneStream also enables users to drill back from the summary information to the transaction details in source systems. This feature enables Finance staff to get rapid answers to their questions and eliminates the need to request data extract files for review.

- Finance-managed metadata changes – OneStream system administrators (in Finance) can update the chart of accounts, organizational hierarchies, business rules, and other metadata as needed to support changing business requirements.

- Finance-driven configuration – through the OneStream MarketPlace TM of over 50 pre-built business and productivity solutions, Finance teams can “extend” the capabilities of the application simply by downloading, configuring, and deploying them.

- Finance-driven reporting – Finance and line of business analysts with proper access rights can create or modify reports, dashboards, and analytic views of OneStream data on their own with just a few hours of training.

- Rapid upgrades – OneStream upgrades are painless, typically being completed in a few hours by our Cloud Services team, based on the customers’ schedule, we don’t force upgrades on our schedule.

OneStream Customers Take Control

When OneStream customers talk about their implementations at events and in testimonials, they often mention their delight at being able to manage everything themselves and how very few dedicated admins are needed. Here are some examples of OneStream customers who have taken control of their own destiny and gained agility through our unified, intelligent finance platform.

With multiple instances of SAP ERPs already in use, global chemical supplier Solenis was using an SAP GL and Excel® spreadsheets for financial consolidation and reporting. Using a series of fragmented systems, Solenis had limited transparency between underlying SAP financial data and corresponding operational data. Solenis needed a solution that would allow them to streamline finance processes with limited IT support.

OneStream has provided Solenis with more timely and accurate financial reporting to external stakeholders – even reducing the close process from 15 days to five! They have also moved their annual budgeting process into OneStream, along with a rolling forecast – providing additional business agility.

Global CPG company Post Holdings was leveraging Tagetik and Excel® to compile and aggregate financial and non-financial data across the portfolio. As Post was relying on Tagetik for most of the IT support, any delays, errors, and connection issues required a Tagetik IT intervention, which introduced additional time into the monthly closing process.

Post Holdings was in search of a corporate performance management (CPM) solution that could efficiently handle acquisitions, with flexibility for the Finance team to make changes to the system themselves. The challenges with its current system led Post Holdings to seek a new solution that could accommodate its needs and they ultimately landed on OneStream.™

Learn More

In order for Finance teams to lead at speed, they need to have agile processes and systems that enable them to quickly respond to changes in the external environment as well as internal changes. This can include M&A activity, reorganizations, or launching new products and services. If Finance teams are reliant on IT to enact changes to their CPM software applications, that can hinder their responsiveness and agility. OneStream’s customers are gaining this agility by having a CPM platform that can be owned and operated by the Finance team, with limited support from IT.

To learn more, download our white paper titled “Taking Performance Management to the Next Level with Intelligent Finance” and contact OneStream if your organization is ready to lead at speed!

Get Started With a Personal Demo