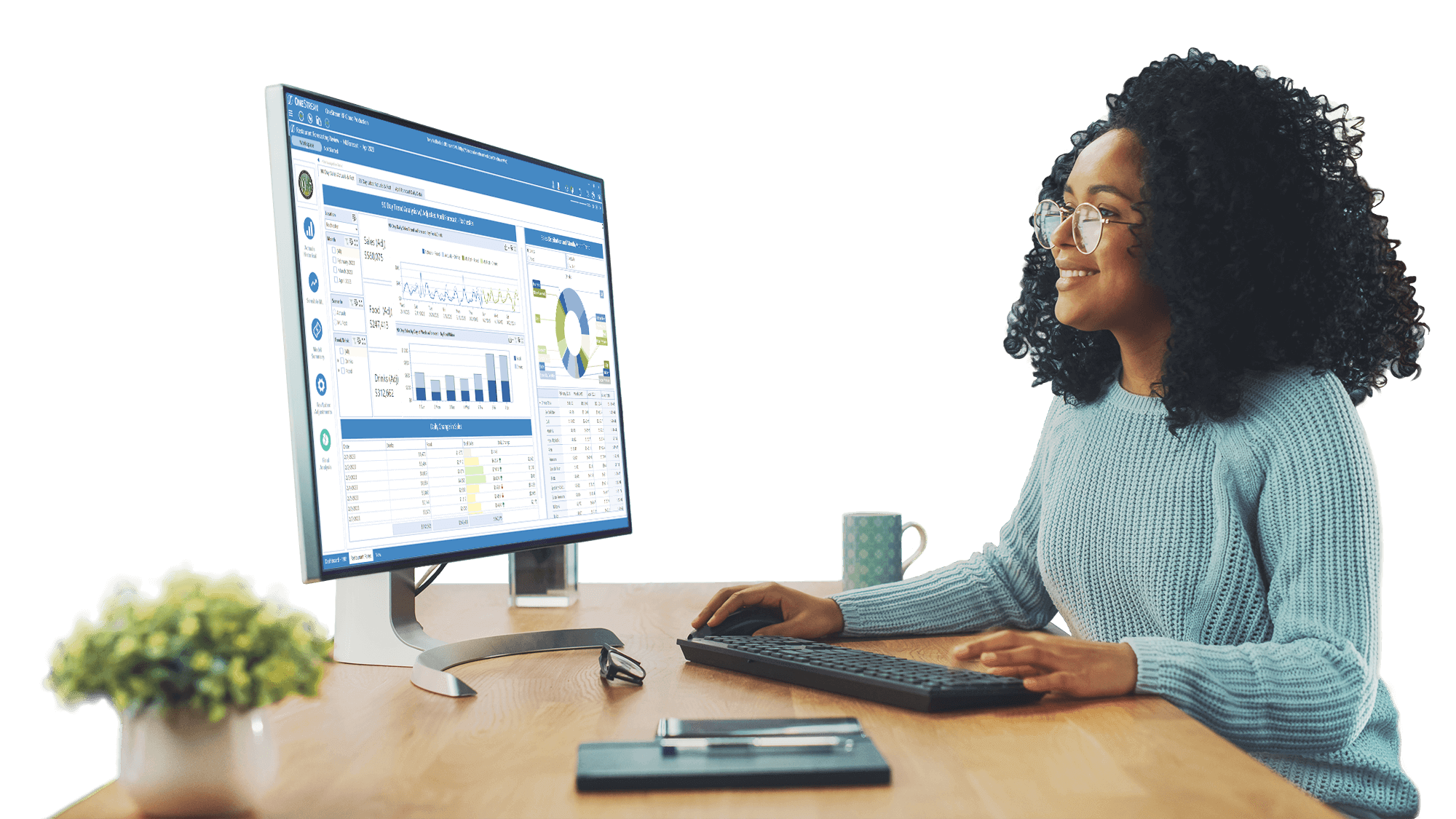

Supercharge Your

Finance Team With AI

AI-powered finance solutions

Empower the Enterprise with Insights

Conquer Complexity

Latest News & Press

Upcoming Events

Featured Resources

FAQs

Corporate performance management (CPM) systems focus on helping organizations improve management processes. CPM software systems help organizations achieve their financial objectives by linking corporate strategy to plans and execution. It includes the process of collecting and integrating data from many systems across the enterprise (e.g., ERP, CRM, HCM) to plan, monitor and manage performance. Examples of the key processes EPM/CPM systems help automate include:

- Strategic Planning

- Financial and Operational Budgeting, Planning and Forecasting

- Financial Close, Consolidation and Reporting

- Financial Reporting and Management Reporting

- Analytics and Scenario Modeling

From a software standpoint, a small enterprise may start out using Microsoft Excel® for budgeting. Then as the enterprise grows it may implement a basic CPM software solution for budgeting, planning, and management reporting. Then as the organization grows and expands in complexity, with multiple subsidiaries transacting with each other, international operations with multiple currencies, joint ventures and partial ownership interests – they may upgrade to an enterprise-class CPM software solution with more robust financial consolidation, reporting, planning, forecasting and analysis capabilities.

ERP systems focus on helping organizations run operational processes. The term first came into use in the 1990’s to extend the capabilities of manufacturing resource planning (MRP/MRP II) and to reflect the evolution of application integration beyond just manufacturing.

Today, ERP is generally referred to as a category of business software — and typically a suite of integrated applications—that an organization uses to collect, store, manage and interpret data from these many business activities. Examples of the business activities ERP systems help automate and track include:

- Manufacturing

- Supply Chain Management

- Project Management

- Order Processing

- Finance and Accounting – e.g., General Ledger, Fixed Assets, Accounts Payable, Accounts Receivable, Cash Management

The objective of ERP systems is to automate and integrate these processes across the enterprise to drive accuracy and efficiency in day-to-day transaction processing and operations.

So in summary – ERP systems help organizations run the business, CPM software solutions help organizations manage the business.

Get Started With a Personal Demo