Back in 1897, American humorist Samuel Clemens (a.k.a. Mark Twain) was in London on a speaking tour. While he was there, someone started a rumor that he was gravely ill, followed by a rumor that he had died. In fact, one American newspaper actually printed his obituary based on the rumor. When Twain was told about this by a reporter, he quipped: “The reports of my death are greatly exaggerated.”

Like the case of Mark Twain, there are now similar rumors circulating in the financial software industry that the concept known as corporate performance management (CPM) is dead. This has been mainly triggered by a research report issued by Gartner in October of 2017 titled “Back to Basics: The Refocusing of Corporate Performance Management.”

Gartner’s Viewpoint On CPM

In the report, and having coined the term CPM back in 2001, the Gartner analysts cite several factors that have led them to retire the CPM moniker. These include:

- A shift away from CPM methodologies and processes such as strategy management and more focus on planning (mostly true – very few companies embraced strategy management)

- The rise of digital business drives the need for more agile planning, linking financial and operational plans (can’t disagree with this)

- A decline in the deployment of broad CPM solution suites and increased adoption of specific solutions for financial close and reporting, or strategic planning and modeling. This led to the splitting of the CPM Magic Quadrant into Financial CPM and Strategic CPM back in 2015. (somewhat true – but was more due to the complexity of these suites than the concept)

- Changes in the technology underpinning CPM – shifting from centralized data warehouses to multiple structured and unstructured data sources for analytics (true)

- Shifts in financial application technology such as cloud and in-memory computing that enable underlying CPM capabilities such as financial planning and consolidation to be more tightly integrated with the underlying applications (somewhat true – but few ERP vendors have pulled it off effectively)

Given all these factors, Gartner feels that companies are being more pragmatic and pursuing point solutions for specific CPM software processes such as planning and financial reporting. So now Gartner is retiring the concept of CPM and will use the following market classifications in the 2018 Magic Quadrant reports:

- Financial Planning and Analysis – replacing Strategic CPM

- Financial Close – replacing Financial CPM

Then to top it off, Gartner predicts that by 2020 at least 70% of large and global organizations will purchase separate FP&A and Financial Close software solutions. That’s a bold prediction, that’s not completely consistent with what we see happening in the market.

Another Viewpoint on CPM

Before we go off and kill the concept of CPM, let’s talk about what CPM is really about. With all due respect to Gartner, the concept of business performance management (BPM) existed well before 2001. The notion of setting goals, collecting data, analyzing the results, and responding to the resulting information goes back to the early days of the industrial revolution, and even early military strategies such as in Sun Tzu’s “The Art of War.”

Prior to the start of the “information age” businesses collected data manually and made decisions based on the data available, and lots of management intuition. Then as information technology started to capture transactional and operational data – data-driven decision making became more viable through Business Intelligence (BI) tools, Decision Support Systems (DSS), Executive Information Systems (EIS), and eventually CPM/BPM software solutions.

decisions based on the data available, and lots of management intuition. Then as information technology started to capture transactional and operational data – data-driven decision making became more viable through Business Intelligence (BI) tools, Decision Support Systems (DSS), Executive Information Systems (EIS), and eventually CPM/BPM software solutions.

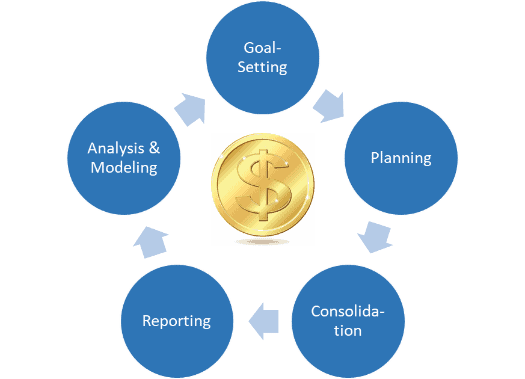

So BPM/CPM is really about helping an organization achieve its financial goals by linking its strategies and goals to plans and execution, in a continuous management cycle. Organizations can use a variety of tools to support this process:

- Spreadsheets & manual processes

- Point solutions such as budgeting applications

- Multi-product BPM/EPM/CPM application suites (on-premise or cloud)

- Unified CPM solutions

Aligning Actuals with Plans is Critical

Whichever technology approach an organization takes to support CPM, there’s still a need to align plans, budgets and forecasts to actual financial and operating results. There’s still a need to analyze performance against your goals and plans, and then to make adjustments to plans and resource allocations to stay on track.

Small enterprises may start off doing this with spreadsheets and manual processes, but these are often outgrown as the organization expands and grows in complexity. The next step might be a budgeting solution, with some basic management reporting capabilities.

Many mid-sized to large organizations use multiple CPM apps from the same vendor, such as Oracle/Hyperion, SAP or IBM/Cognos. These legacy suites include separate applications or modules for financial consolidation and reporting, budgeting and planning, profitability management, account reconciliations, and others.

While these systems offer a lot of functionality, customers often struggle with integrating data across these applications, and with their GL/ERP systems. They also suffer from the time, effort and costs of maintaining and upgrading these systems as new releases come out. And while the cloud-based versions of these CPM applications alleviate the headache of setting up and maintaining IT infrastructure, the fragmented architecture of these suites hasn’t really changed.

A Better Way Forward

In our experience working with hundreds of mid-sized and large, global enterprises – there’s a clear preference for CPM software solutions that can align planning and forecasting with the consolidation and reporting of actual financial and operational results. Even in large enterprises with separate FP&A vs. Accounting departments, and different levels of information granularity, there’s demand for systems that support both sets of needs. Most of these enterprises have multiple GL/ERP systems across their various divisions and subsidiaries – so they need a CPM platform that can integrate and unify data from multiple systems, for planning, reporting and analysis – at corporate and line of business levels.

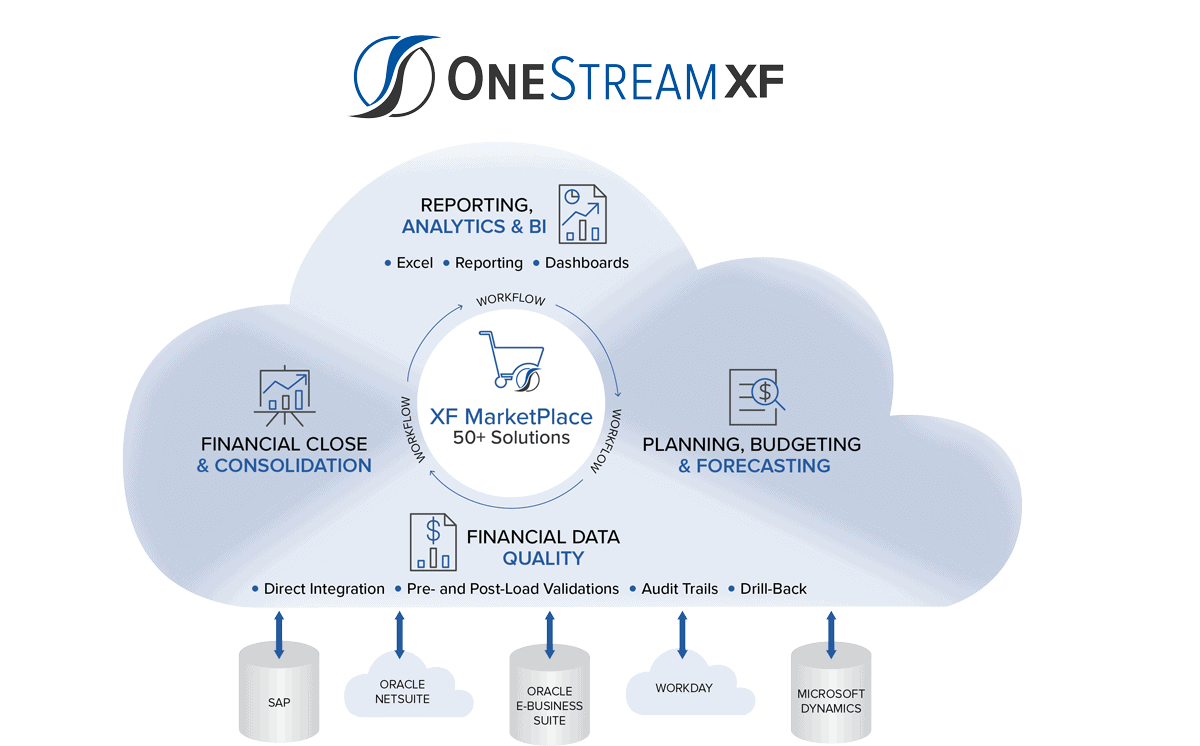

And there’s a clear preference in the market for true platforms that can be extended to address additional requirements through a marketplace of domain-specific solutions. We’ve seen this in the mobile phone market with Apple’s iPhone and the App Store, as well as in the CRM market with Salesforce.com and their AppExchange. And we’re seeing it in the CPM market now, as a growing number of organizations are selecting the OneStream platform, and extending their investment through the XF MarketPlace with solutions such as People Planning, Capex Planning, Account Reconciliations, and others.

Investing in an extensible platform that can address financial close and FP&A needs, and can be extended to address other CPM requirements within Finance and beyond makes life easier for users, and delivers a higher ROI than investing in and deploying multiple point solutions.

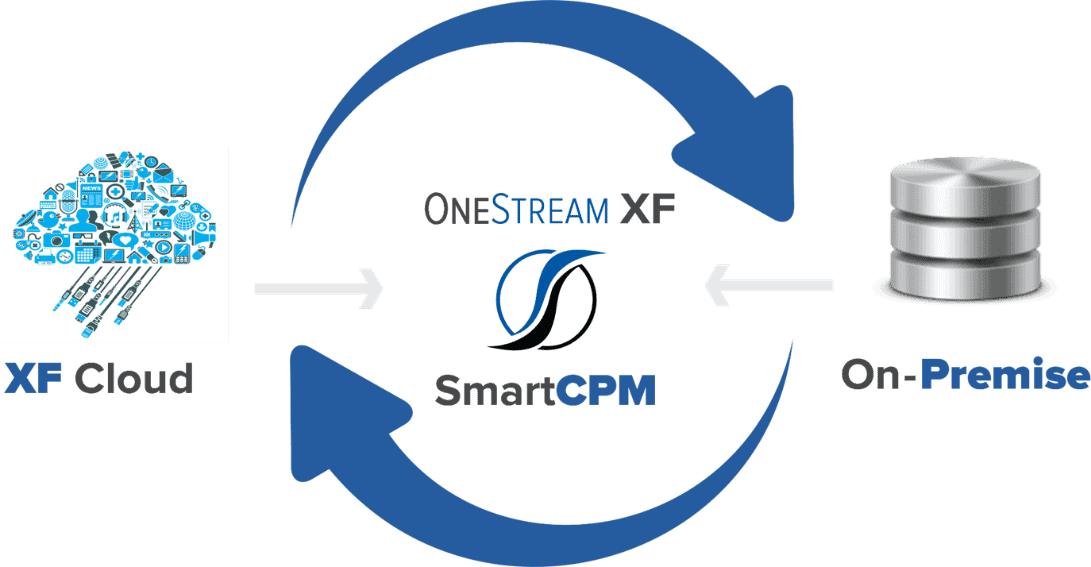

And while the cloud is becoming the preferred deployment approach for most new applications, many organizations aren’t ready to embrace the cloud, and value modern solutions that can be deployed on-premise or via the cloud.

Over 70% of OneStream’s customers have replaced legacy CPM applications with our unified, SmartCPM platform, and over 90% of them use OneStream for both financial consolidation & reporting, as well as planning/forecasting, and other requirements such as account reconciliations or profitability analysis. While most customers previously deployed the solution on-premise, the vast majority of new customers are embracing the cloud. And they are seeing the benefits of a unified solution, with the ability to deploy it based on their IT preferences:

- Reduced costs of ownership

- Rapid deployment and faster upgrades

- Streamlined reporting and planning processes

- Improved accuracy of financial results, plans and forecasts

So while Gartner may be moving away from CPM as a term to describe this market, OneStream will continue to promote the value of a unified SmartCPM platform, and will have our solution evaluated in both of Gartner’s Magic Quadrants for Cloud Financial Close and Cloud FP&A solutions.

In conclusion, like in the case of Mark Twain, the rumors of CPM’s death are greatly exaggerated. CPM is alive and well and it’s easier to support with a unified SmartCPM solution that can be seamlessly integrated with single or multiple ERP/GLs. And organizations should be able to run their CPM solutions on-premise, or in the cloud – it’s your choice.

To learn more, watch the replay of our recent webinar featuring Carlyle Group to learn how they replaced several legacy CPM products with OneStream’s unified SmartCPM platform.

John O’Rourke is Vice President of Product Marketing at OneStream Software. With a background in accounting and finance, John has over 30 years of experience in the software industry, including 20 years of experience in product marketing at Hyperion Solutions, Oracle and Host Analytics. He has worked with many customers and partners on financial reporting and planning initiatives and has spoken and written on many topics in corporate performance management. John has also held positions in strategic marketing and product marketing at Dun & Bradstreet Software, Kenan Systems and Decisyon.

Get Started With a Personal Demo