In today’s dynamic environment, government agencies are facing increased demands to effectively communicate strategic visions, initiatives and community impact. Volatile economic and financial factors, regulatory issues and technology enhancements especially all make it harder to meet those demands. No wonder looking ahead with a strategic planning process can feel daunting. Yet the right tools, processes and data analytics help agencies gain efficiencies, enable better insights and feel more confident in the future when building strategic plans.

But before we dive into 5 strategic planning tips for government agencies, let’s quickly review what strategic planning entails.

What Is Strategic Planning?

Per the Government Finance Officers Association (GFOA), strategic planning for government agencies involves articulating where or what an organization wants to be in the future. That process includes designing a vision and identifying goals and objectives. While related to developing financial policies, capital improvement planning and budgeting, the strategic plan is inherently different.

Typically, strategic planning is used to do the following:

- Articulate an organizational vision

- Foster organizational alignment

- Undertake comprehensive environmental and economic assessments

- Prioritize services, initiatives and programs

- Establish goals

Why Does Strategic Planning Matter?

Strategic planning helps Finance leaders model the organization as it exists today and then layer on possible strategies over the top. What types of strategies? Changes in tax policies, capital projects, new programs and so forth are some examples. Through this proactive approach, stakeholders can visualize plausible future scenarios and their corresponding impacts. Strategic planning can be a useful storytelling tool to help stakeholders understand the future impact agencies can have on their community within resource constraints.

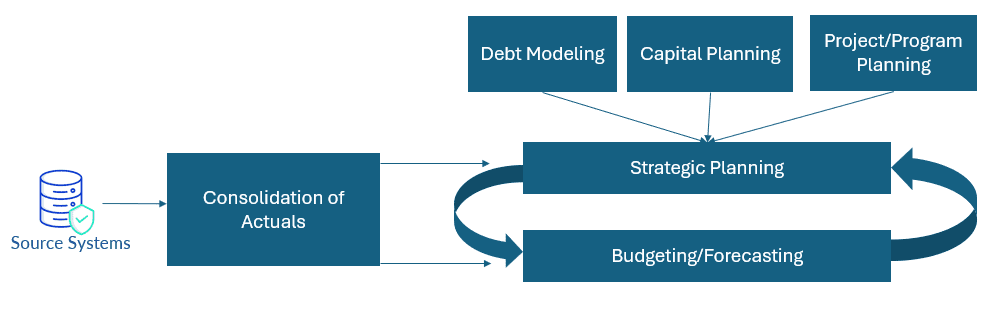

Plus, internally, strategic planning is a powerful way to set the direction and prioritization of an agency. Why? The planning completes a cohesive feedback loop. First, the strategic plan drives the budget and resource allocation. Then actuals drive revisions to the forecast. And finally, forecast changes influence the strategic plan in future years (see Figure 1). This feedback loop ensures agencies are aligned on maximizing community impact.

Strategic Planning Tips for Government Agencies

Getting a handle on what’s going to happen tomorrow or next week is tough on its own. So understanding what might happen in 1-2 years – or in 5 years – seems nearly impossible.

And if the planning process is happening in offline spreadsheets? Well, that’s an even bigger headache. Putting together a plan that truly represents a vision of the future requires aligning actual data with inputs from across the agency. Thus, having to combine various spreadsheets that lack data quality and consistency controls can make any planning process a tedious, time-consuming task.

But it doesn’t have to be that way! Below are 5 strategic planning tips for government agencies to save time, get better insights and gain confidence when building strategic plans.

1. Centralize data and ensure quality control.

The foundation of a reliable strategic plan lies in having accurate and timely data to support confident funding and spending decisions. In addition, the data used for the strategic plan must be consistent and aligned with the data used for other financial planning processes, including the budget.

How can alignment be created? By working with IT and operational stakeholders to leverage available data from across the organization, Finance teams generate informed insights and make data-driven decisions. Implementing tools that centralize data from multiple sources, ensure data quality control and provide transparency with drill-back capabilities ultimately fosters alignment and trust within the organization.

2. Integrate financial statements.

Organizations often focus primarily on the Statement of Activities. But modeling the Balance Sheet and Cash Flow Statement in the strategic plan also has significant value. Why? In an ideal world, agencies could have endless cash. But today Finance leaders typically have financial constraints and must prioritize and balance funding to ensure long-term financial sustainability.

By integrating all three financial statements, stakeholders can better understand the long-term financial impact of different strategies and external factors. Stakeholders can also make informed decisions that include the following:

- Utilizing recurring vs. non-recurring funds

- Using reserve allocations

- Covering core services

- Funding new initiatives in an optimized way (i.e., debt vs. cash)

3. Conduct scenario analysis.

Scenario planning helps organizations be more resilient and adaptable. The process requires identifying a range of possible future conditions and then developing plans to respond to each condition.

For example, a local agency may want to understand potential scenarios with changes in tax policies. Government agencies, after all, must carefully consider the potential impacts of tax policy changes to balance revenue needs with the economic health of the community.

Scenario planning not only improves the accuracy and effectiveness of the planning efforts, but also helps Finance become a strategic partner to the organization. By understanding possible outcomes and having a plan in place to react, agencies can be better positioned for success in a rapidly changing world.

4. Automate calculations and logic.

Excel can be highly error prone – whether due to mis-keyed or corrupted data cells or incorrect or broken formulas. Plus, Excel can especially be burdensome when data is pulled from multiple sources and each part of a spreadsheet relates to and affects other parts. Tiny errors can easily –and quickly – turn into bigger headaches.

Implementing a software solution that automatically brings data together, leverages standard calculations and easily performs wide-ranging scenarios is a game-changer for Finance teams. Gone are the days of pouring over buggy spreadsheets and digging through rows of data to fix mis-keys or errors. Instead, the right solution can restore work-life balance. How? By allowing the team to focus on research and analysis instead of spending long hours and late nights in the office dealing with data issues.

5. Utilize dashboards & visuals to tell your story.

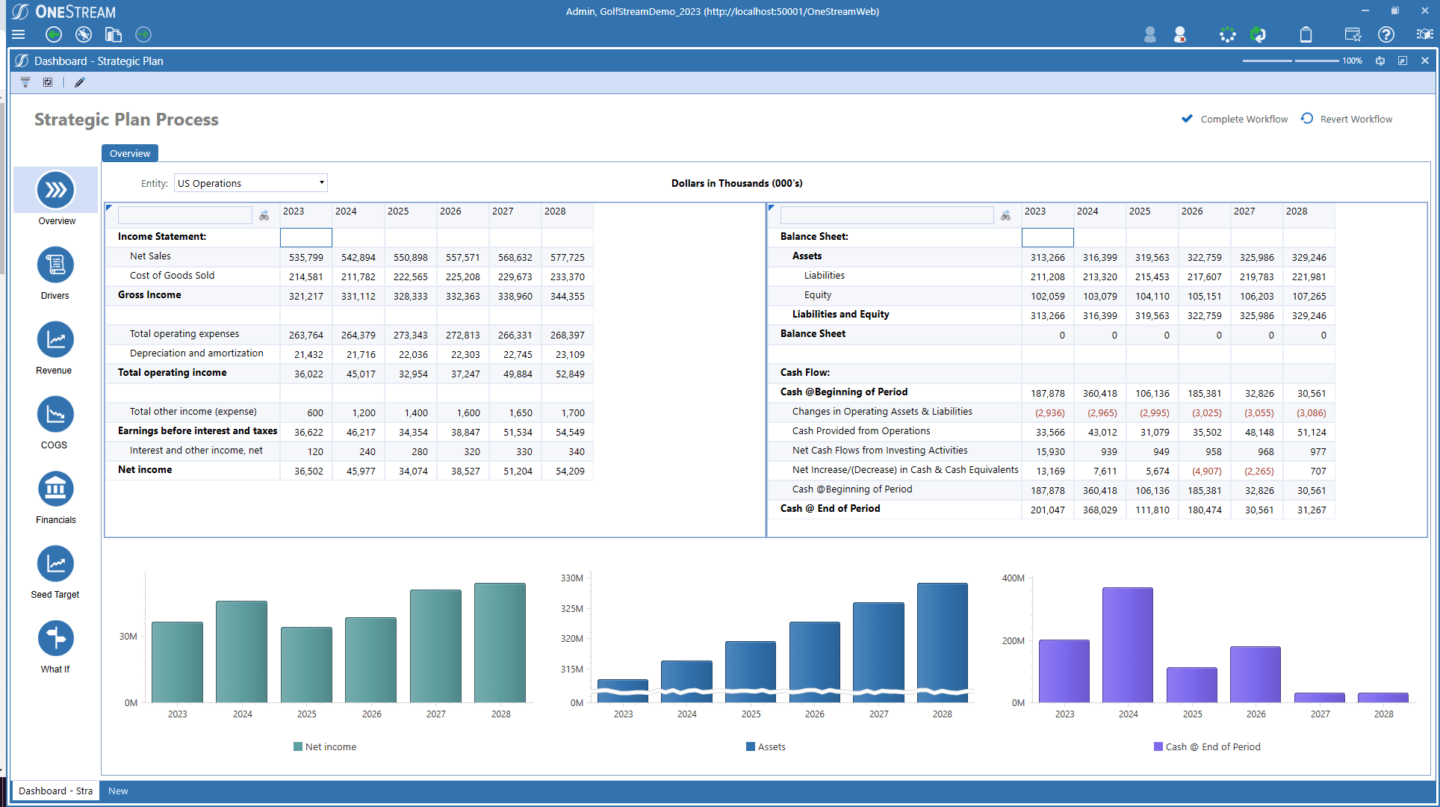

Dashboards and visualizations are powerful storytelling tools for the strategic plan. In fact, effective dashboards help guide decision-making with a varied audience (see Figure 2). The ability to quickly visualize data trends, impacts of initiatives and economic drivers, and core financial KPIs over time becomes possible with dashboards and reports. And those capabilities enable better and faster decision-making.

Conclusion

While predicting the future remains uncertain, strategic planning equips Finance leaders with the foresight and agility to capitalize on opportunities and navigate potential changes effectively. Finance can leverage integrated data solutions, automated calculations, scenario planning frameworks and impactful visualizations. Through those aspects, Finance teams will improve efficiency, insights and confidence in the strategic plan and position the agency for long-term success.

Learn More

OneStream brings Finance processes into a single platform solution to enable seamless integration between the data, people and processes driving the organization. Learn more about how OneStream uniquely empowers government Finance teams to enhance planning, gain new insights and streamline Finance processes.

Learn MoreIntroduction

The market buzz around artificial intelligence (AI), and especially generative AI, has risen to a fever pitch in the first 9 months of 2023 and Finance teams are actively working to learn about the risks and potential benefits these technologies can provide. At the same time, they are challenged with steering their organizations through rapidly changing market conditions and adapting to new accounting and regulatory requirements around the world, including new ESG disclosure mandates.

These topics were key agenda items at the OneStream Splash EMEA user conference and partner summit which was held in Berlin, Germany September 19 – 21st. Read on to learn about the highlights of the event and register for Splash Berlin on-demand to experience the event for yourself.

Making a Splash in Berlin

The attendance at OneStream’s Splash EMEA conferences has been steadily increasing over the past 8 years, having attracted over 600 attendees at the Paris event in 2022 and now over 900 in-person attendees at Splash Berlin. These events provide a great opportunity for OneStream customers, prospective customers, partners, employees, industry analysts and other guests to connect, learn, and get inspired about how they can address the business challenges of today, and future challenges, with OneStream’s Intelligent Finance Platform.

The conference offers a myriad of learning opportunities ranging from hands-on workshops to keynote sessions, 40+ breakout sessions, drop-in demos, a partner summit, meals and other networking sessions.

Empowering Today to Plan for Tomorrow

The keynote session hosted by OneStream EVP of EMEA Matt Rodgers, and featuring CEO Tom Shea and President Craig Colby highlighted how OneStream is supporting the key initiatives of CFOs and Finance teams through our investments in the OneStream platform and Solution Exchange.

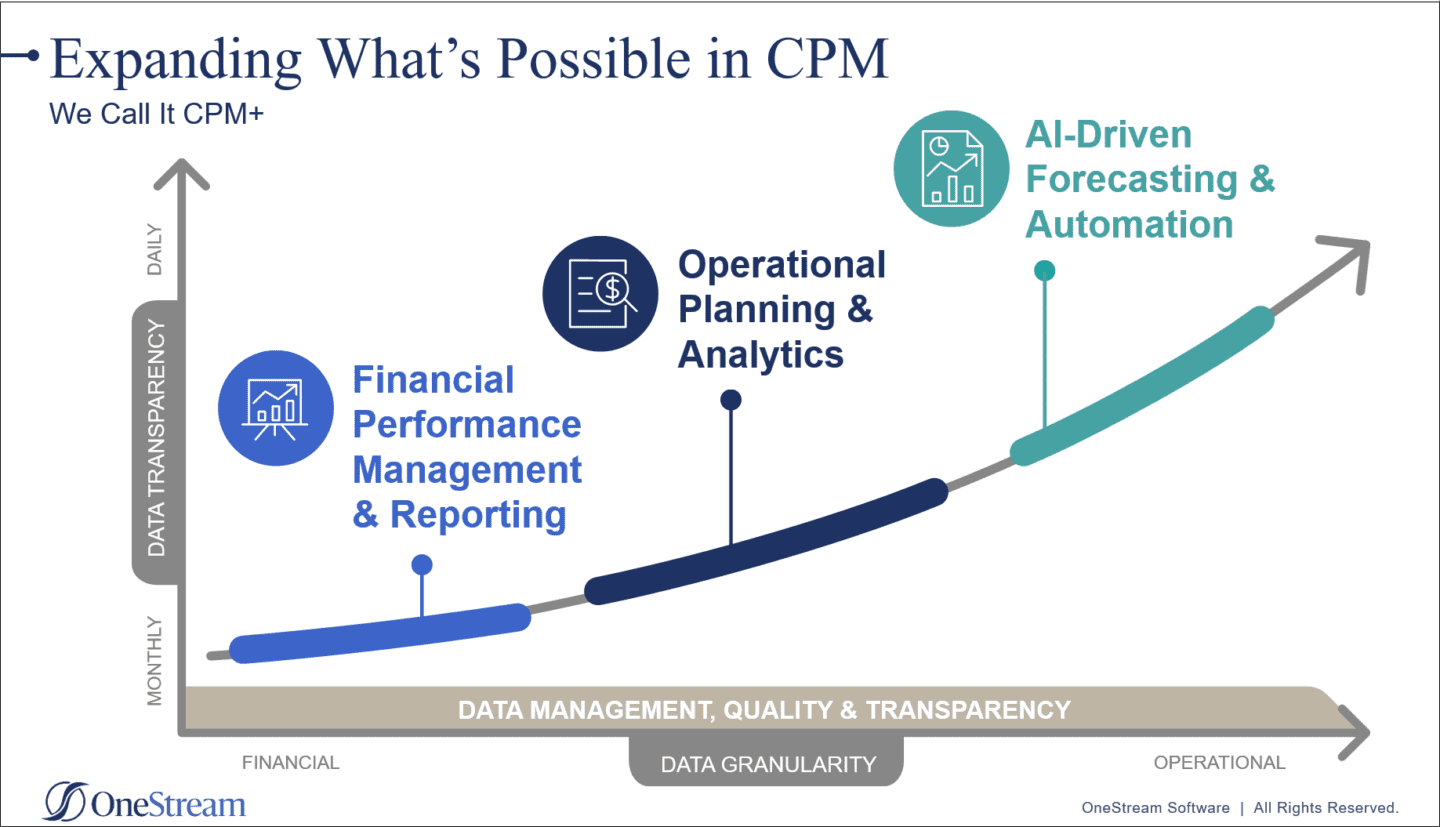

Mr. Shea highlighted OneStream’s vision of expanding what’s possible in CPM through our focus on 3 main initiatives that deliver what we call CPM+:

- Addressing the core Financial Performance Management and Reporting needs of customers.

- Delivering more value across the enterprise through Operational Planning & Analytics.

- Leveraging the power of AI-Driven Forecasting and Automation.

Mr. Shea then reviewed the recent innovations OneStream has delivered to enable customers to achieve this vision. This included the following:

Next Generation Platform Developments: Released in August, OneStream V 8.0 helps Finance teams work faster, smarter and stronger with significant performance gains, enhanced end-user reporting and analysis, and user-driven data connections and security. New updates include:

- Technology Modernization with Microsoft .Net 6 to provide faster performance, greater throughput and a path to real-time scaling that responds to demand, decreased maintenance intervals and faster upgrades.

- No-code SAP integration through a previewed SAP connector to provide direct integration with SAP ERPs to create, test and validate connections.

AI-Driven Forecasting and Automation: Building on the customer success and value delivered by its Sensible Machine Learning solution, at Splash Berlin OneStream previewed a Sensible LLM solution designed to unify generative AI with CPM, including providing tech support assistance, platform & design assistance and enhancements to Sensible ML for scenario planning use cases.

Expanded Solution Exchange Offerings Including ESG Planning & Reporting: Initially launched in April, the OneStream Solution Exchange is designed to enhance the development experience and accelerate the delivery of new businesses and productivity solutions from OneStream and OneStream partners. The Solution Exchange provides over 75 downloadable solutions built and optimized for the OneStream platform. One of the latest developments of the OneStream Solution Exchange includes:

- ESG Blueprint: The ESG Blueprint leverages platform capabilities to accelerate the delivery of ESG reporting and planning with pre-built carbon calculations and ESG metric conversions. This enables the Finance team to easily track and report on key sustainability metrics on a monthly and quarterly basis, as well as easily compare and analyze performance across difference business units and locations.

Challenging the Status Quo

Another highlight of Splash Berlin was the insightful keynote session on Women in Finance: Challenging the Status Quo. Moderated by OneStream’s SVP and Controller Pam McIntyre, this session featured three industry experts sharing their experiences and insights on how women can break through the barriers in the finance industry, including challenges related to innovation and technology. The panelists included Kayla Flanders, Director of Corporate Accounting, Pella Corporation, Marina Neto, Project Finance Director, Alliance Automotive Group, and Marianne Abib-Pech, CFO, Writer & Founder.

OneStream brand ambassador Nic Hamilton in an interview with Tom Shea. For those unfamiliar with Nic’s story, he was told as a child that he would never walk due to his cerebral palsy. Not one to be told he cannot do things, with determination and grueling training he not only walked unaided, but also started to realize his dream: to be a racing driver. Now a regular in the British Touring Car Championship, his story and ‘anything is possible’ attitude inspires everyone who hears it.

And The Winner Is……

No OneStream Splash conference would be complete without the recognition we provide to partners and customers via our awards program. This year’s winners included:

- Top Customer Advocate Award: Gijs van der Veen from Mileway

- Power of the Platform Partner Award: AIQOS / Bradley Cooper

- Partner Innovation Award: AMCO / Chiara Alessandri & Pascal Walk

- Power of the Platform Award: PwC / David Jones

Congratulations to the winners and thanks for your support of OneStream!

Learn More

Besides the keynote sessions highlighted above, Splash Berlin included over 40 breakout sessions covering a wide range of topics from budgeting and planning to financial close & consolidation, ESG reporting, Sensible Machine Learning, data integration, workflow and many customer and partner success stories. If you missed the event, you can register for OneStream Splash Berlin On-Demand, which will be available October 2 – December 2nd.

Otherwise, Auf Wiedersehen for now and we look forward to seeing everyone at the next Splash event in Las Vegas, May 20 – 23, 2024!

Buying EPM software is a complex and time-consuming process – one that sometimes becomes a buyer’s nightmare. After all, the process involves managing stakeholder relationships and communicating with multiple software vendors and system integrators. The demands for thinking critically, meeting aggressive deadlines, navigating office politics and making compromised decisions further complicate the process. But overall, software vendors must satisfy the requirements based on very demanding standards to win the buyer’s heart. All those dynamics mean that demonstrating the application is perhaps the single-most important step in the buying process. What, then, does it take for you to get the perfect EPM demo?

Demoing Is Hard for the Buyer and the Seller

Every software demo team wants to hit the mark when it comes to your expectations. But have you ever gazed through the room after a demo and found your colleagues’ facial expressions looking unimpressed or bewildered – basically anything but impressed?

Unfortunately, these situations happen often, for several reasons. To name a few, lack of preparation, misalignment between requirements and capabilities shown, discordant emotional states and more are all possible reasons. Preparing for a demo with the software demo team is therefore key for a successful outcome.

Delivering an EPM demo is pretty much like conducting an orchestra. There is planning, selecting musicians with the right skills, assembling the orchestra, tuning the instruments, rehearsing and more. Then, during the concert the conductor ensures all musicians – the string section, the brass section, etc. – are following the music sheet. Otherwise, all the right notes will likely be played in the wrong order! In a similar way, the demo team needs to plan, understand the requirements, assemble a skilled demo team with influential representatives, rehearse and … rehearse, all to ensure a smooth and enjoyable demo experience for you!

So why, then, can a demo go wrong? Or more importantly, what needs to happen to ensure every EPM demo is tuned to exceed expectations? This post walks you through 3 considerations for a successful EPM demo.

3 Considerations for the Perfect EPM Demo

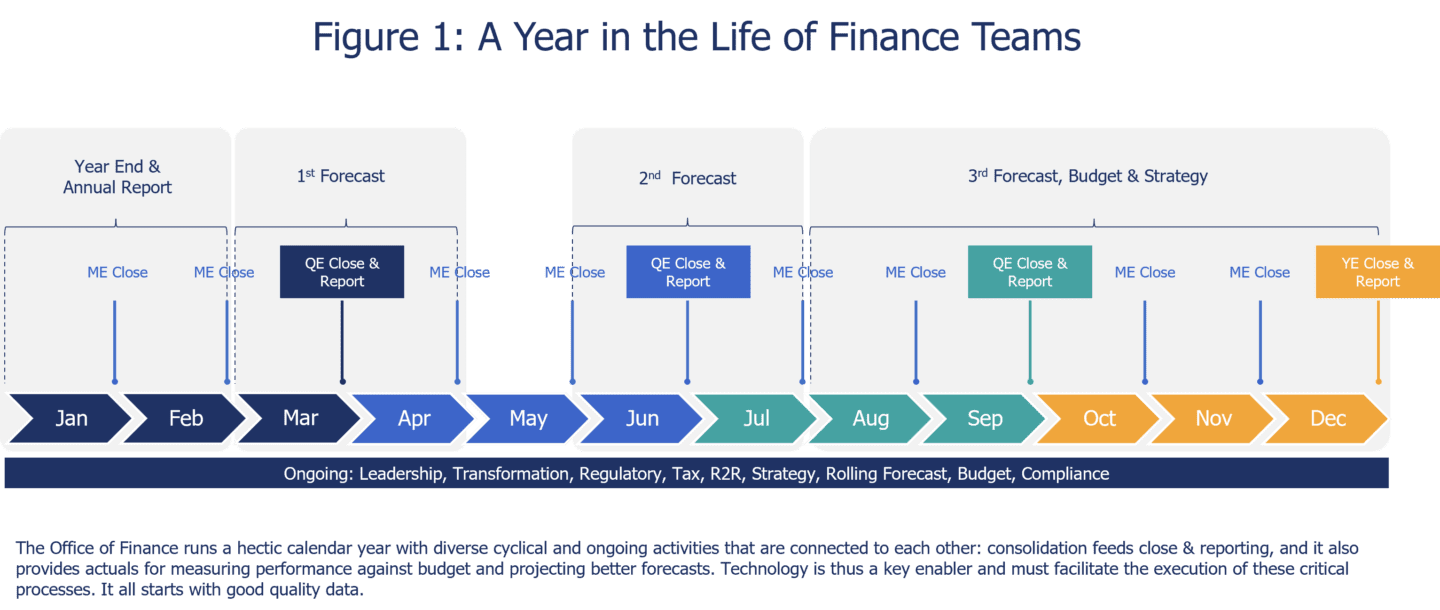

The role of the Office of Finance is evolving to become a trusted business partner that enables and deploys the corporate strategy across the organization. Thus, an EPM solution must support the diverse cyclical processes that Finance teams execute (see Figure 1). The application must also be designed to scale and to accommodate the ever-changing needs from Finance. So when you’re shopping for an EPM solution, it must scale to support the future.

The 3 key considerations below will help you make the most of an EPM demo:

1. Actively engage discovery sessions

A good discovery is key for a successful demo afterward. Demos can go wrong when insufficient time is apportioned to explain your needs in depth. To help ensure things go right, be open to feedback from the vendor’s team and engage in a discussion to level expectations. Discovery is also a great moment to identify risks and start digging up hidden costs:

- Validating the solution scope to avoid risk. The best practice to identify risks is to validate the solution scope together with the vendor. Describe pain points and needs holistically and within the context of the greater Finance processes under which those pains and needs fall (See Figure 1). Consider the flexibility the solution provides to cover all critical financial processes. Especially, revisit the scope if certain future needs can be tackled on the current buying process. Doing so will avoid risk in the long term.

- Surfacing hidden costs. Focus on total cost of ownership and ask questions about not only the infrastructure and third-party applications required to solve for your needs, but also how well the solution can support future requirements.

At the end of discovery, you should be able to answer the following questions:

- Are we aiming for the right scope?

- Are we targeting the right software solution for the problem at hand? Does the software solve for future needs?

- Do we need to adjust the budget due to scope changes?

- Have we agreed to the EPM demo content?

2. Use the demo to further qualify the vendor

Interactions prior to and throughout the demo are a fantastic opportunity for you to further qualify the vendor: is the vendor being professional? Does the vendor understand your industry and business? Does the vendor have the right values and culture? Those questions matter because past behavior is a good indicator of future behavior. Thus, how the demo team works and delivers a demo may reflect the cultural traits on how the company may support you after the solution implementation.

Also, experience has shown that an EPM solution is rarely understood with just one demo, so don’t be afraid of asking for follow-up sessions. In addition, don’t let your current software vendor tarnish the relationship with other vendors or cut down the time needed for assessing other products!

3. Defining the right demo content

Many EPM demos start with a nice-looking dashboard populated with clean data. All very appealing, but how does the data get in there? How easy is to build that dashboard? It is important that key technical aspects are demonstrated. That knowledge will save you many headaches in the future! Accordingly, always request the following points in the demo content:

- Data quality. Knowing how the solution handles and validates the data is quintessential to building one version of the truth between the EPM solution and the source systems where the data resides. Does the solution require loading the same data more than once to support different processes? How easily can you add a new entity structure or a new product SKU? These aspects can hinder the speed at which you can make decisions or add rigidity to business changes, such as M&A activity or expansion into a new market. Learn more about why financial data quality matters.

- Process flexibility. The EPM solution should adapt to your process instead of forcing it to fit rigid workflows. You may be looking for process harmonization opportunities when you replace software, however flexibility will always be required to adopt new business requirements.

- Features and functions. The features and functions are critical since those aspects are why you want to use the technology in the first place. During discovery, you should have clarified your requirements well enough, so now the demo team must show how the solution matches your current needs and future vision.

- User experience. The experience does indeed drive user adoption. But that experience involves much more than just the look and feel. Importantly, you are investing in user adoption when your teams can use one EPM solution for the full range of Finance processes and cover future needs.

- Core Technology. The type of technology can help you decide on the best deployment model (SaaS, PaaS, on-prem), but also informs total cost of ownership by surfacing the hidden costs. Does the infrastructure need ETL middleware or data warehouses? Does it scale to cover your business needs? Is the infrastructure capable of managing FX conversions, multi-GAAP standards, etc. without add-ons?

These aspects require different audiences, so splitting the EPM demo content into more than one session is a standard practice.

Conclusion

Investing time in preparation will help you better qualify the vendors and revisit the scope of each EPM solution to ensure you get the best from your investment. To ensure your EPM demo session is fruitful, clearly communicate your needs and expectations. Also consider the feedback you receive from the demo team to really build the best demo content.

Finally, during the EPM demo, you shouldn’t focus only on the user experience. No matter how easy to use the tool is, adopting it is not a good move if it doesn’t provide the data, doesn’t facilitate the process or people don’t want to use the tool. Adequate demo time must be allocated to prove the EPM solution to ensure it fits the holistic financial process and not just isolated use cases.

Rest assured that every demo team strives to thrill the audience with a stunning demo and end with a room filled with excitement:

Ready for the Next Step?

Meet our expert team of solution consultants, and book a demo of OneStream’s Intelligent Finance Platform.

With an ever-increasing requirement from the financial markets to have better transparency into Environmental Social & Governance (ESG)/Sustainability initiatives, enterprises must collect, measure and publish non-financial information on ESG-related risks and opportunities to attract or retain investors. ESG goes beyond a simple collection exercise of new KPIs. In fact, much like the current external financial disclosures produced today, ESG reporting is becoming a key investment criterion. This criterion elevates the conversations from “just” reporting KPIs to instead developing an ESG investment strategy designed to respond to market expectations. For the past few years, OneStream Software has sponsored Hanover Research surveys of Finance executives to gain a better understanding of how they are helping their organizations navigate the complexities of today’s economic landscape. The Q4 2022 Hanover Research survey included over 650 financial decision-makers and aimed to understand their expectations for 2023 regarding inflation, a potential recession, supply chain disruptions, talent management, ESG and DEI initiatives, and technology investments. Keep reading to learn the results of the most recent survey on ESG initiatives.

ESG Initiatives Still in Focus

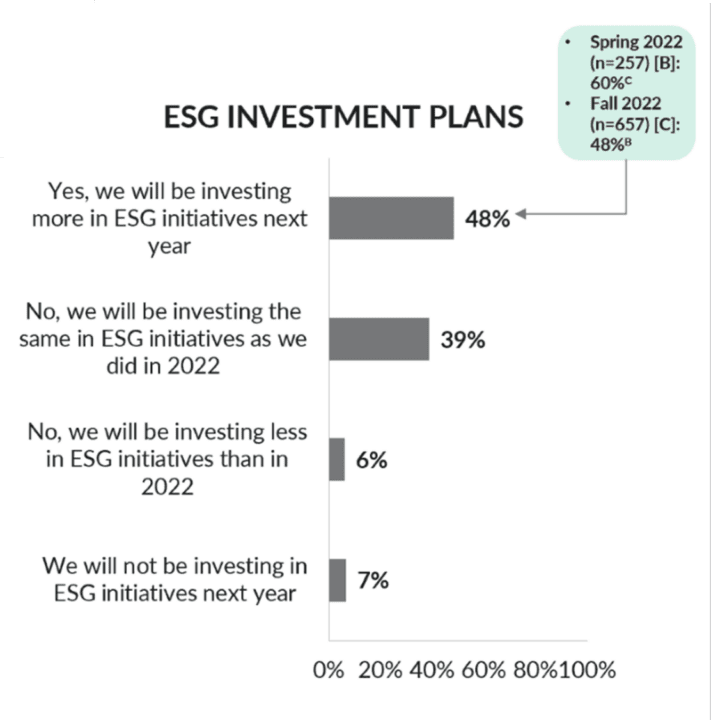

With ESG reporting guidelines converging and new mandatory disclosure requirements being proposed by the US SEC and regulators in other countries, investments in ESG remain a priority. Half of organizations surveyed expect to invest more in ESG goals and initiatives in 2023 than in 2022. The percentage is a slight drop compared to expectations from the Spring 2022 survey (60%). However, over a third of enterprises expect to invest the same amount in ESG in 2023 (39%) (see Figure 1).

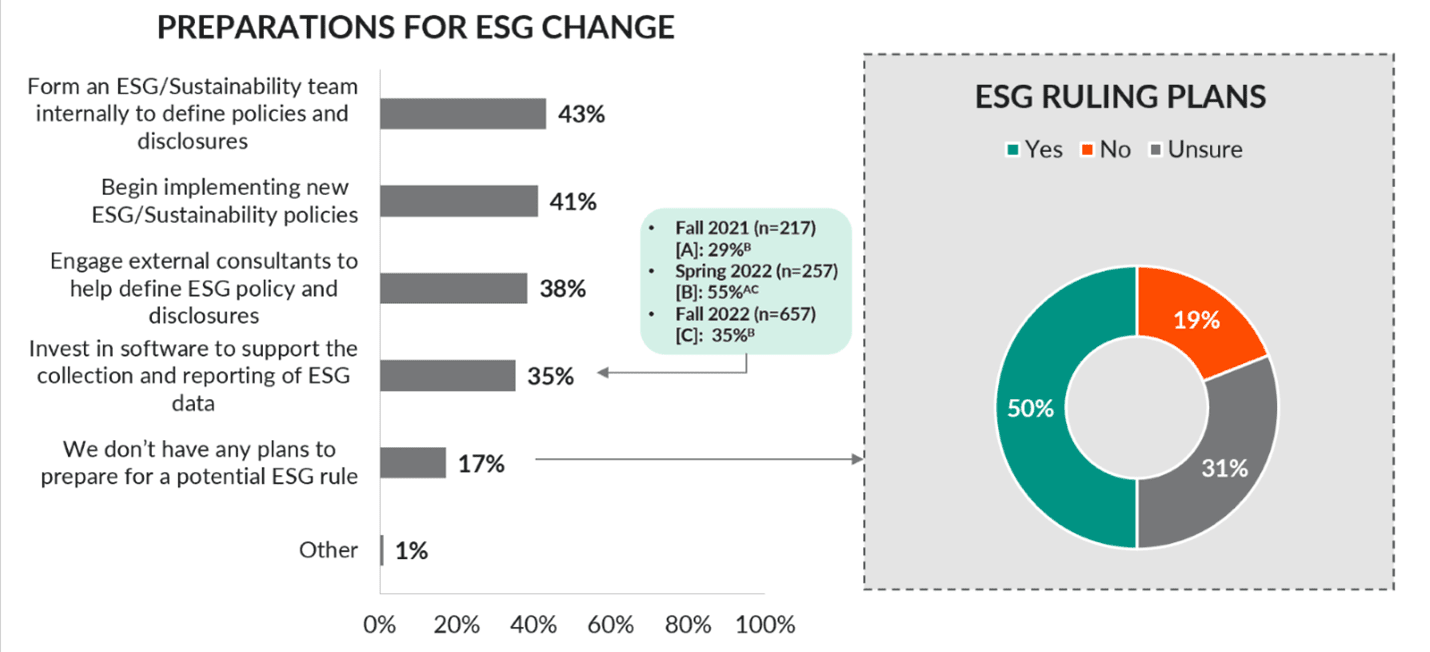

Regarding plans to prepare for changing ESG reporting requirements, just under half of financial executives surveyed have already started or plan to start forming an internal ESG/Sustainability team to define policies and disclosures. A similar proportion (41%) will begin (or have already begun) implementing new ESG/sustainability policies. Compared to the Spring 2022 survey, fewer are planning to invest in software to support ESG data collection and reporting. Among those who currently don’t have a plan in place, half (50%) indicate they may implement a plan if ESG reporting mandates impact their organizations (see Figure 2).

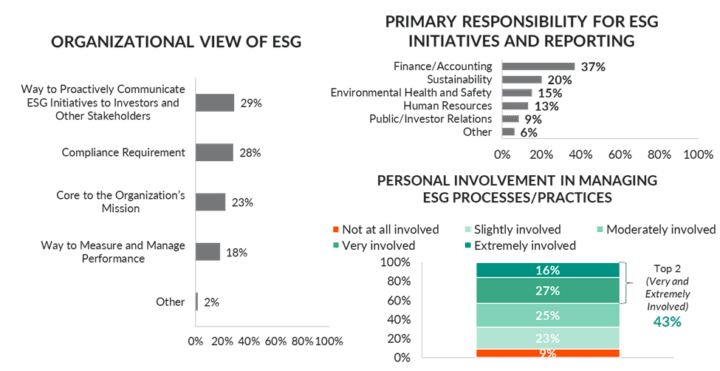

Organizational views of and financial leaders’ involvement in ESG initiatives vary, based on the survey. Only a quarter (23%) view ESG as being core to the organizational mission. Meanwhile, almost one-third view ESG as either a way to proactively communicate initiatives to investors and stakeholders (29%) or a compliance requirement (28%).

Although Finance/Accounting departments are most commonly responsible for ESG initiatives and reporting, this assignment of responsibility is still only the case for about two in five businesses (37%). Similarly, less than half (43%) of the financial leaders themselves are highly involved in managing the ESG process or practices (see Figure 3).

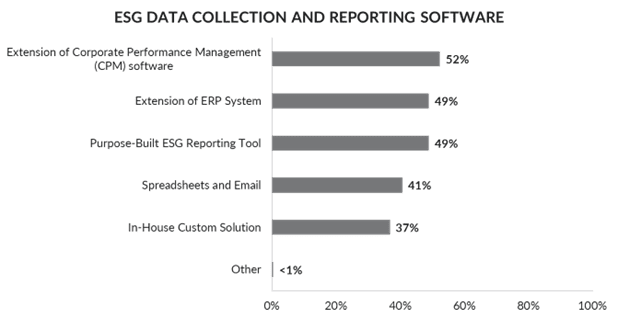

When financial decision-makers were asked about what type of software is currently being used or planned to be used to support ESG reporting, extensions of CPM software were reported as the most cited software for supporting the collection and reporting of ESG data. Extensions of ERP systems and purpose-built ESG reporting tools are also both cited by half of organizations (49% each) (see Figure 4).

Summary

The mandatory ESG disclosures being proposed by the US SEC & European Union are driving many organizations to invest in their ESG processes and software. Those investments will help with not only reporting compliance, but also planning and managing ESG initiatives. And there’s more good news – today’s cloud-based CPM and analytical software technologies are seeing increased adoption and proving their worth. How? By helping Finance teams become more efficient effectively plan and navigate the volatile economic landscape, which increases Finance’s agility to respond.

Learn More

To learn more, read the detailed survey report and visit our website at www.onestream.com. Need help conquering the complexities of ESG reporting in the current economic landscape? Contact OneStream today!

Effective budgeting and planning are crucial for the success of any organization, and higher education institutions are no exception. This reality is particularly true as Finance teams of higher education institutions focus on improving their planning, budgeting and forecasting processes while navigating current trends. Such trends can include staffing issues, changing enrollment demographics and highly demanding board members.

However, the variety of entities within these institutions and the distributed nature of those entities pose a challenge to effectively managing budgets and plans. To manage both, higher education Finance teams must successfully accommodate the varied requirements of each entity within the organization and the requirements of the combined organization.

The Challenges of Institution Complexity and Variety

How do some of the challenges of institution complexity and variety manifest? To illustrate, we’ll look at the following three fictional individuals responsible for distinct aspects of a large higher education institution’s financial and operations management:

- Sandeep is the VP of Finance and CFO of the institution.

- Kyle is the Executive Director of Housing.

- Stephanie is the Executive Director of the Bookstore.

As the CFO, Sandeep provides reporting to the institution’s stakeholders (e.g., board of directors) to give them a comprehensive, holistic view of institutional finances and operations. To deliver this reporting and ensure that the institution’s financial goals and objectives are met, he requires visibility into the financial operations of all departments, including Housing and the Bookstore.

To manage the Housing’s financial operations, including budgeting and forecasting, Kyle requires visibility into occupancy rates, housing expenses and revenue streams. That visibility helps with making informed decisions and ensuring the housing operations remain financially sustainable.

While Stephanie’s budgeting and forecasting responsibilities resemble Kyle’s, her requirements are naturally different since she manages revenue streams and expenses related to the Bookstore. Stephanie requires visibility into inventory levels, pricing strategies and multiple revenue streams. That visibility helps with making informed decisions and ensuring the Bookstore operations remain financially sustainable.

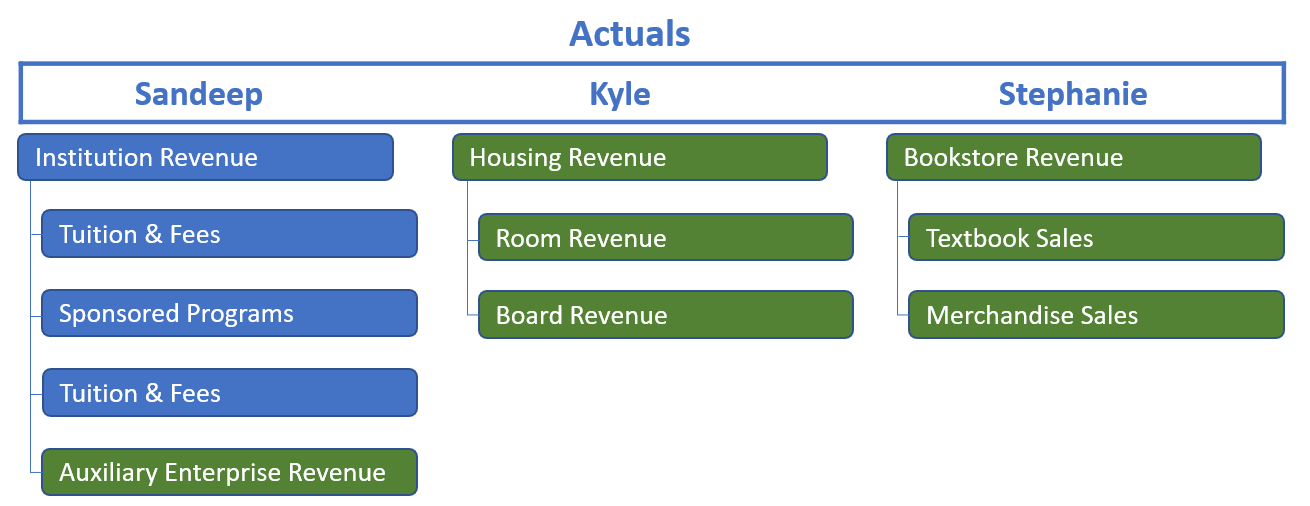

But just how different are the reporting needs for Sandeep, Stephanic and Kyle? Well, we can see a simple example by looking at the chart of accounts dimension (see Figure 1).

At the institution level, Sandeep tracks revenue for both Housing and the Bookstore in a single account, Auxiliary Enterprise Revenue, which falls under Institution Revenue. Kyle tracks Housing revenue in separate accounts, including Room Revenue and Board Revenue. And finally, Stephanie tracks revenue for the Bookstore with accounts for Textbook Sales and Merchandise Sales.

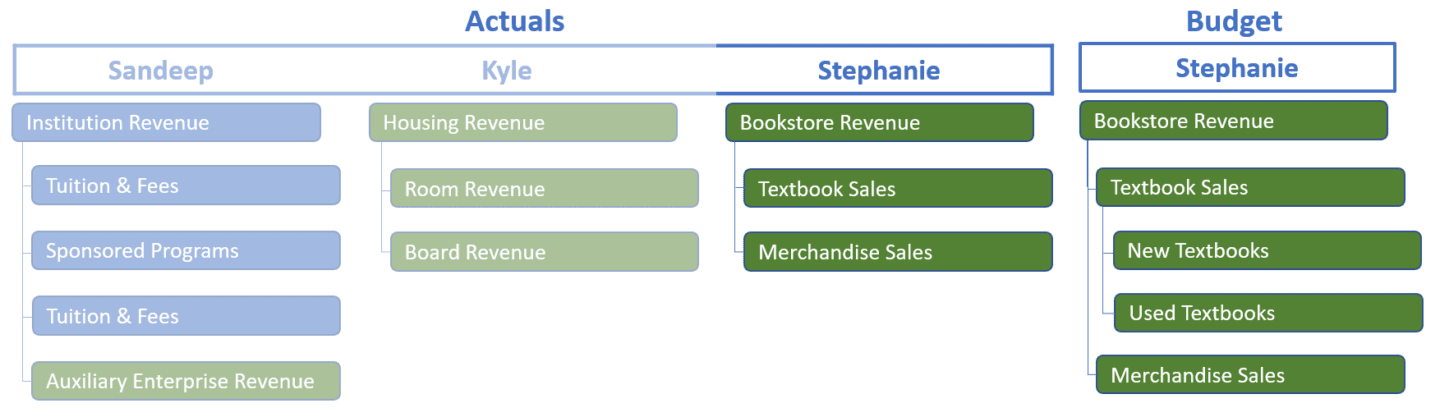

This situation gets even more complicated because Stephanie needs to budget more granularly than Kyle. She reports revenue for textbook sales overall, but to plan properly, she must separately account for new and used textbook sales (see Figure 2).

Visualizing all these dynamics on paper is easy enough, so what makes managing everything so difficult? Well, many higher education institutions are limited by spreadsheets or legacy finance tools in how they can present dimensions such as the chart of accounts to the various users in the organization. These tools only provide a single chart of accounts across all entities and cannot accommodate different granularity needs for budgeting and planning at the entity level.

As a result, when Kyle looks at the chart of accounts, he sees a lengthy list of all revenue accounts for every institution entity. In the simple example above, when working within his legacy tool, he will see his Housing revenue accounts cluttered with the Bookstore accounts.

Stephanie will have the same crowded list of accounts in her system. But adding to her frustration, she will not be able to plan within the legacy system at the level the Bookstore requires. Instead, she will need a separate tool or, most typically, will resort to siloed spreadsheets to plan at the required lower level of granularity.

Of course, these variations become much more complex given all the possible variations in dimensionality across these two entities – not to mention across all the other entities within the institution. Those entities can include medical centers, different colleges, research facilities and more.

How do many Finance teams and entity managers work around these legacy limitations? Typically, a patchwork approach develops with separate systems and stand-alone spreadsheets to accommodate requirements. And just as typically, this patchwork approach leads to abundant headaches for the Finance team as they must now waste time wrangling disconnected data to provide comprehensive financial reporting, planning, budgeting and forecasting. The above situation is untenable. Risks, costs and performance issues abound when using extensive manual processes and patchwork connections between financial systems and spreadsheet silos. Further, the massive effort higher education Finance teams expend managing these processes robs Finance of the opportunity to focus on providing financial insight and institutional decision guidance.

Conquering Complexity for Higher Education Finance Teams

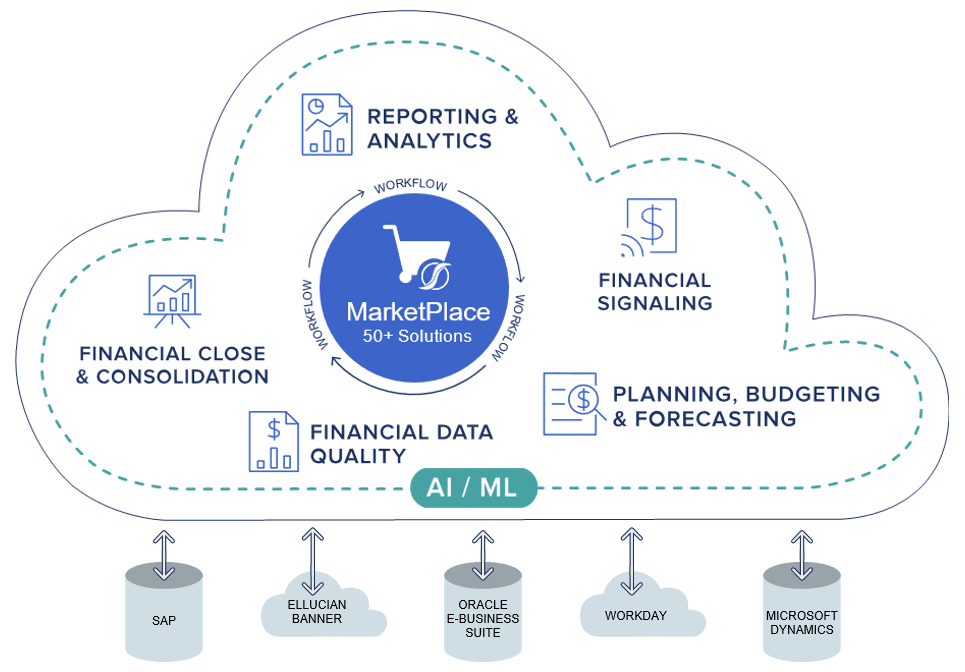

At OneStream, we understand the complexities, frustrations and struggles involved when trying to accurately manage disconnected information. And that understanding is exactly why we built the OneStream Intelligent Finance Platform (see Figure 3). The platform has the capability to gracefully support and enforce institution standards and controls, but also support the more detailed requirements of individual units. How is this possible?

Well, the secret sauce for helping Finance teams meet the demands of diverse units while supporting institutional standards is Extensible Dimensionality®. This unique capability enables a higher education institution to leverage the same dimension for differing requirements – without having to create separate connected Finance applications.

And it’s only possible with OneStream. So, with OneStream, Kyle will only see the Housing accounts and Stephanie only the Bookstore accounts. In addition, Stephanie can plan at the lower granular level of detail the Bookstore requires. To both Kyle and Stephanie, OneStream feels like it was set up just for them. And Sandeep and his team can see the complete picture without having to manage manual processes to combine the data from separate entities. As a unified solution, the OneStream platform empowers higher education Finance and Operations teams to collaborate by creating a single source of truth and user experience for planning, financial close & consolidation, and reporting and analytics.

Learn More

Extensible Dimensionality® is just one reason higher education Finance teams are turning to OneStream to conquer complexity in their financial processes. Click here to learn how one large state university modernized Finance with OneStream to reduce budget completion and reporting times.

Conquering Supply Chain Disruptions

Prior to the supply chain disruptions of recent years, Polaris Inc., a leading provider of powersports equipment, forecasted production and shipments based on innovation and market demand. However, since these disruptions occurred, the business environment became constrained by supply. Recognizing a need for more speed and agility across planning processes, the Polaris Finance team turned to the power of OneStream’s Sensible Machine Learning (Sensible ML) solution to assist with demand forecasting.

In previous years, Polaris’ business units had relied on a highly manual financial planning model with inputs such as SIOP-generated shipped unit forecasts by product, product costs and MSRPs, freight cost, and dealer discounts to arrive at a gross margin view. This model was referred to as the “Driver-Based Revenue Model,” and it provided the perfect opportunity to incorporate machine learning-driven forecasting and transition to a unified planning process within OneStream.

Putting Sensible ML to the Test

Polaris decided to focus their Sensible ML project on their North American Off-Road Products GBU, looking at a 12-month forecasting time horizon with a focus on variables impacting their Shipped Units forecast. These variables included Commodity Prices, Presold Orders, “Clean Build” Percentage and Build-to-Ship Durations. Historic data representing these variables would be combined with historic shipped units to generate the ML models and their forward-looking forecasts.

The historic data model covered 181 products, with weekly units sold from 2016 through 2022. Sensible ML crunched through this data, combined with commodity prices for steel and aluminum, factored in events such as holidays, and generated over 2,800 models for comparison. The OneStream ML models proved to be the most accurate, based on the historic data. The ML forecasts were run monthly and were incorporated into a driver-based forecast.

Faster, More Accurate Forecasts and More

The results were impressive. Not only were the forecasts more accurate than with prior approaches, but with Sensible ML, Polaris added speed and efficiency to their forecasting processes, reducing forecasting cycles from days to hours. Polaris also now has more transparency into what’s behind the ML models, including insights into the key forecast drivers for more informed decision-making.

It provides a finance-run ML forecasting process that integrates seamlessly across planning and forecasting processes in the same user experience used for financial close and consolidations, account reconciliations and reporting.

“The ability to quickly generate driver-based forecasts is essential to adapting to our changing business conditions,” said Melanie Hermann, Director, Finance Process & Systems at Polaris Industries. “Incorporating AI into our planning and forecasting through the OneStream Sensible ML solution accelerates the forecasting process and further elevates it with powerful ML data-driven forecasts. Sensible ML forecasts have shown to be more accurate, and the Value-Add Dashboard provides the business users with insights into the key features driving the forecast to easily manage, improve and enhance the model.”

The Polaris Data Science team was impressed with the process and results. “Sensible ML commoditizes the part of my job that can be commoditized and allows me to focus on where I can add value… with the output that Sensible ML provides,” said Luke Bunge, Manager Data Science Product. “It’s an incredible timesaver and gets you to the best answer possible. The team did a great job immersing us in the tool…as opposed to turning it into a black box.”

Learn More

For companies across fast-changing industries such as CPG manufacturing, retail and hospitality, Sensible ML reduces the traditional barriers to ML forecasting and improves both the speed and accuracy of demand planning. This enables organizations to fine-tune production plans, optimize inventories as well as reduce volatility and fluctuations in labor planning.

To lean more, download the Polaris Inc. case study and contact OneStream if you are ready to learn how your organization can take advantage of the power of machine learning.

Last February, we held our first annual Partner Appreciation Month to celebrate and spotlight all the great achievements within our partner community. Based off its success, I’m happy to announce we will be hosting our second annual Partner Appreciation Month!

At OneStream, we firmly believe that it takes a village in all that we do and accomplish. And our village would not be complete without our partner network, which now encompasses over 240 partners around the globe. The role each partner plays in helping us attract and sell to prospects and customers, implement our Intelligent Finance platform, as well as provide stellar customer service is invaluable and a continuation of our mission and vision to be the operation system for the modern business.

Incentives During Partner Appreciation Month

Throughout the month, we will celebrate our partners’ many contributions and achievements with great incentives, including a chance to win a FREE ticket to Splash in North America or EMEA, as well as a chance to win an autographed hat by OneStream’s Brand Ambassador and PGA Tour Pro, Sepp Straka. Additionally, hear directly from some of our global partners on why they chose to work with OneStream and what the partnership means to them.

Why the OneStream Partner Community is Successful

Also, our sales leaders will talk about partners as our strongest allies and why OneStream is stronger than our competition. The OneStream partner community is successful because of the full support of the entire OneStream organization. The relationship between our partners and each OneStream team is based on mutual trust, open communication and transparency. Collectively, this results in a unified effort and cohesive message when speaking with customers and prospects, ensuring the highest level of customer success in all we do.

Conclusion/Learn More

During this month, I ask that if you are in contact with our partners, wish them a great appreciation month and thank them for the wonderful job they do in assisting our customers and us every day.

Thank you again, and Happy Partner Appreciation Month! Interested in joining the OneStream partner ecosystem? join here.

Stephanie Cramp, Sr. Vice President, Global Alliances, OneStream Software

This year has been truly unprecedented. While there’s no need to name some of the events, suffice to say they’ve been significant and life-changing for many people, companies and even countries! The many organisations closing out the year thus have a lot to be positive about. And now is a good time to not only reflect on the past year but also look ahead and determine what actions today will help the organisation streamline financial close and consolidation processes to weather the storms ahead.

Year-End Challenges

Many Finance organisations are still bogged down by inefficiencies in routine processes within the period-end financial close and reporting cycle. And that situation makes it difficult to shift time to value-added analysis and decision support. In fact, many organisations are still closing the books much in the same way they did 10-15 years ago. Even those organisations that have changed and updated over time can still struggle with routine period-end processes.

Here are some of the reasons organisations are still struggling with financial close and consolidation processes:

- Outdated Finance Processes – Too many manual activities and not enough automation

- Increasing Complexity – More regulation, including ESG, growth and a changing competitive environment

- Management of increasing volumes of data – Data-driven decision-making, now critical, requires more granular details and increased focus on cost containment to drive deeper analysis

- Shifts in business strategy – M&As or leadership changes that impact reporting and KPIs requires accommodating strategy shifts

- People Management – Retaining talent and motivating people to be more efficient are both becoming increasingly challenging

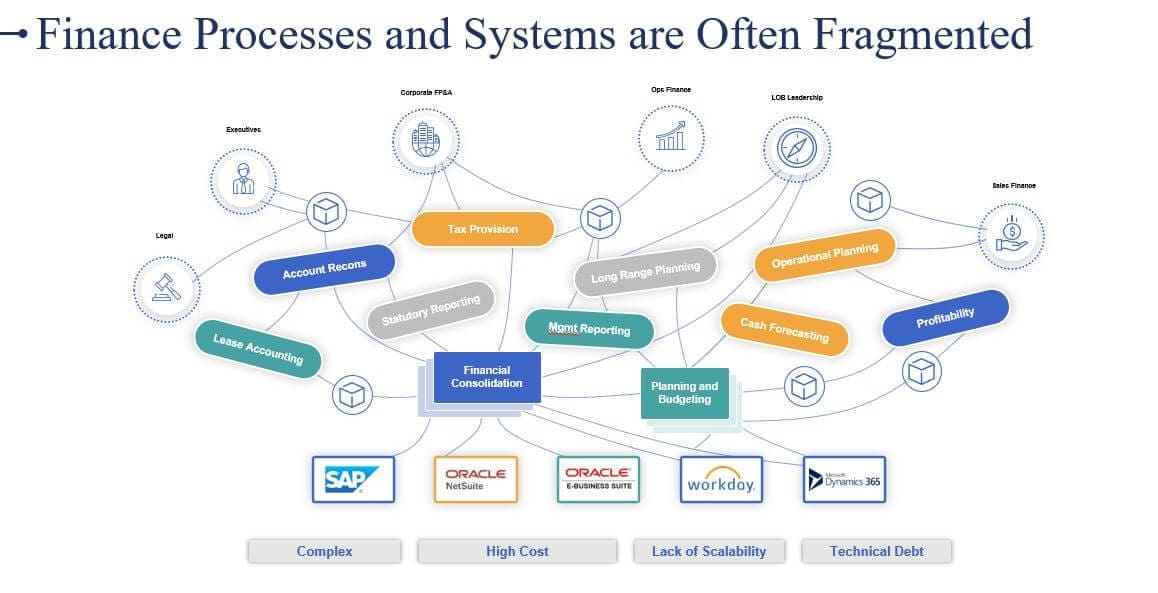

- Silos of Systems and Tools – Lots of moving data around, investing in multiple software tools and synchronising/aligning creates fragmentation (see Figure 1)

Collectively, the above aspects dilute the ability of Finance teams to focus on driving performance and supporting critical decision-making. These problems are then only further compounded when key functionality isn’t in place to deal effectively with the increasingly complex requirements and common challenges across the financial close process.

An inefficient financial close process can have a material impact on Finance team members or – worse – negatively impact organisational performance. How? Here are just a few examples:

- Delays in the release of financials

- Issues identified during internal or external audits that must be resolved

- Finance staff working very long hours and/or weekends

- Significant manual activities (journal adjustments, moving data or copying/pasting to reports)

- Lack of adherence to any kind of financial close calendar

- Lack of a standard chart of accounts across divisions/business units

- More time spent on talking about the past than the future

- Continued discussion about the prior month close to the end of the current month

And the best way for organisations to avoid those pitfalls year after year?

Make New Year’s resolutions related to financial close and consolidation processes.

New Year’s Resolutions

A good way to define such New Year’s resolutions is to focus on the desired outcomes. These outcomes could include the desire to react faster to changes, increase visibility and transparency, save time through automation, or reduce the cost to report.

While those outcomes can change from one organisation to the next, successful organisations will have adopted many of the following outcome-based New Year’s resolutions:

- Define a close calendar to orchestrate and monitor the process on a day-by-day basis

- Provide clear audit trails and visibility to ensure accuracy and consistency

- Focus on an efficient repeatable process to eliminate risk by reducing manual movements of data and automating data feeds/validations

- Eliminate errors and drive standardisation by fully automating processes & reporting

- Take advantage of built-in financial intelligence to handle complex financial consolidation (e.g., intercompany eliminations, foreign currency exchange [FX], accounting for partial ownerships)

- Improve resource management by keeping a close eye on people-related issues and avoiding burnout by reducing and evenly distributing workloads

- Reduce silos of systems by adopting a modern, cloud-based solution such as OneStream for the financial close

The benefits of such New Year’s resolutions can be significant. How? Well, when more reliable financial information is available earlier, management can make prompt, informed and effective decisions. The early, effective external publication of financial results also indicates strong financial management and positively impacts the external stakeholder view of the organisation.

With a streamlined financial close and consolidation process, organisations can then better align Finance and the business with actual results and forward-looking strategies – opening-up significant new opportunities.

Organisations that successfully automate their financial close, consolidation and reporting have, in turn, been more successful at driving financial performance and delivering value. And perhaps most importantly, such organisations have gained the agility required to lead at speed, adapt to changing business and industry requirements, and weather whatever storms lie ahead.

Learn More

To learn more about how organisations are conquering the complexity in their financial close and consolidation processes, click here to read our whitepaper. And if you’re ready to take the leap from spreadsheets or legacy CPM solutions to start your Finance Transformation, let’s chat!