Profitability analysis is an important and powerful tool for Financial Planning & Analysis (FP&A) professionals looking to drive business results. Such analysis not only shows what business units or product lines within an organization are profitable, but also helps model what-if scenarios – such as how pricing, new products and mix changes would impact customer and line-of-business profitability. In short, profitability analysis generates important data about the performance of business units, product lines, strategic initiatives and more to enable collaboration required for effective decision-making.

Profitability Analysis for Analyzing Business Results and Modeling Future Scenarios

Simply put, profit is defined as revenue minus expenses. Despite being a common area of interest to Finance, revenue is not always the best metric for the health of a product line or business unit. Profitability analysis, however, can help the organization understand what areas are performing well and which may need more attention or need to be reevaluated.

Using profitability analysis not only shows how these areas are performing today and how they have historically performed, but also models strategies for the future. Profitability analysis can model what-if scenarios to determine how price changes, new products and mix changes could impact customer and line-of-business profitability. The impact these changes have on the P&L, balance sheet and cash flow statements can be modeled and reviewed across the organization. By pairing profitability analysis with powerful reporting and analytics capabilities, Finance can quickly monitor dashboards and easily share results of the analysis with key stakeholders to make better-informed decisions and adjust strategies ahead of month-end close when results impact the financials.

Profitability Analysis for Better Financial Results

Understanding what business units, product lines, and initiatives within an organization are profitable and which are struggling is key to efficiently and effectively allocating resources across the organization.

By analyzing the profitability of different product lines or business segments, for example, FP&A teams can determine which products and services are most profitable, leading to better resource allocation to continue to drive profit in areas generating it while helping areas that are lagging. Additionally, profitability analysis can help identify cost-saving opportunities by identifying where to reduce expenses or when to negotiate better terms with suppliers.

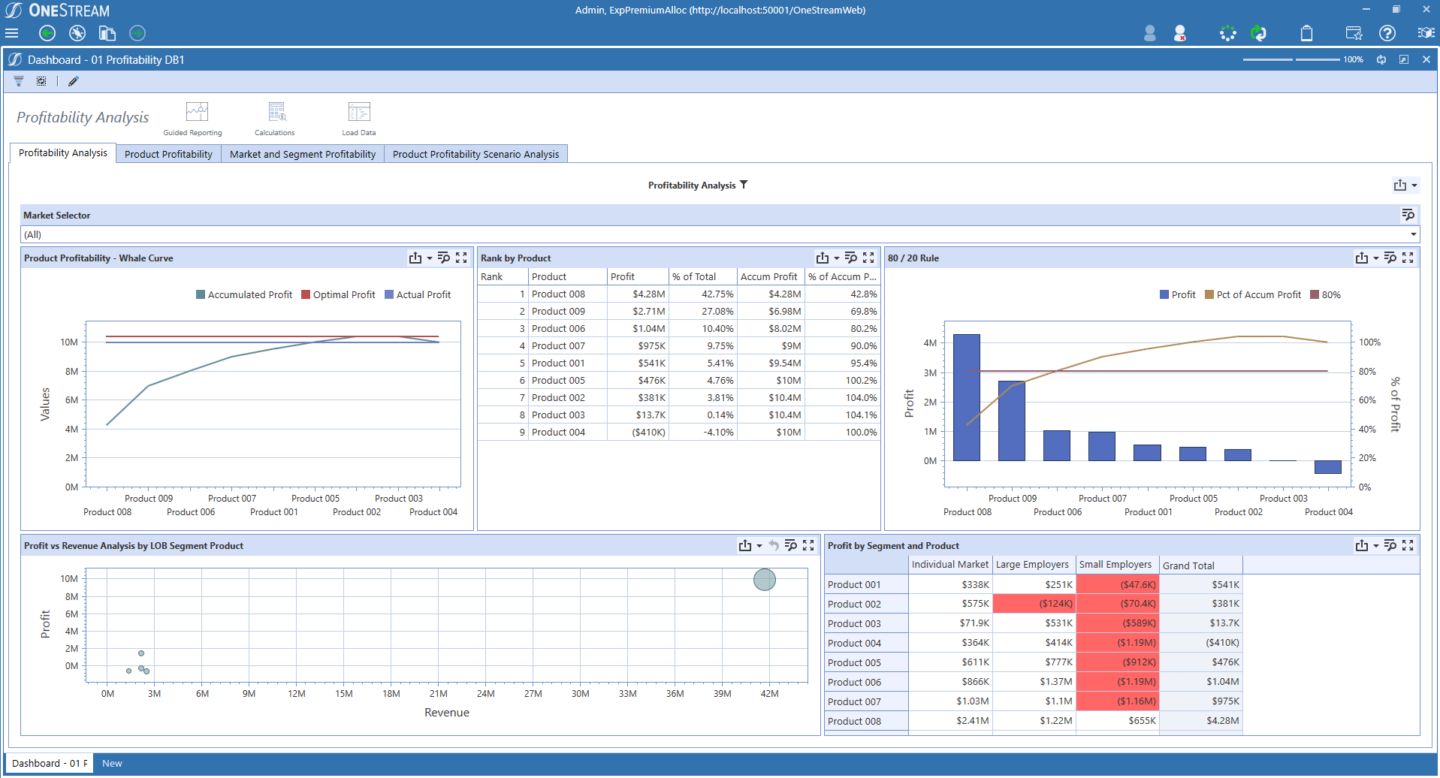

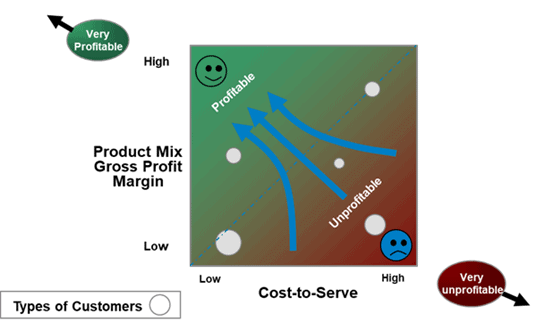

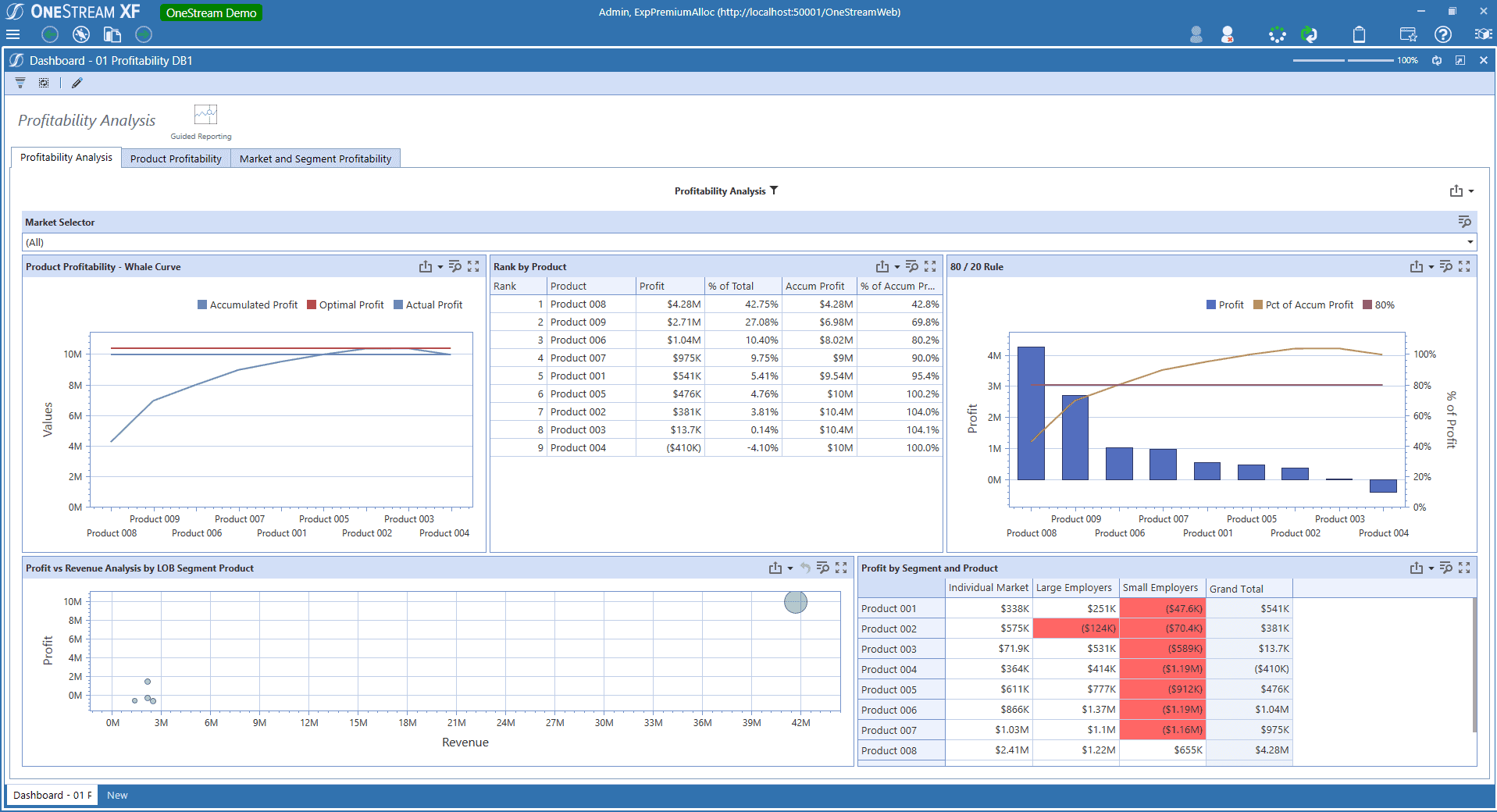

Analyzing which areas constitute the top 80% of profitability performance (Figure 1) can help an organization better understand the drivers in the business and then allocate resources accordingly.

Profitability Analysis for Aligning Strategic Initiatives and Enterprise Goals with Profitability Results

In addition to showing which product lines and business units are performing – and where efforts are falling below expectations – profitability analysis can help FP&A teams understand the performance of strategic initiatives. For example, the results of a new marketing initiative can be analyzed using profitability analysis to understand what’s working and what’s not. Finance can then make adjustments to improve performance.

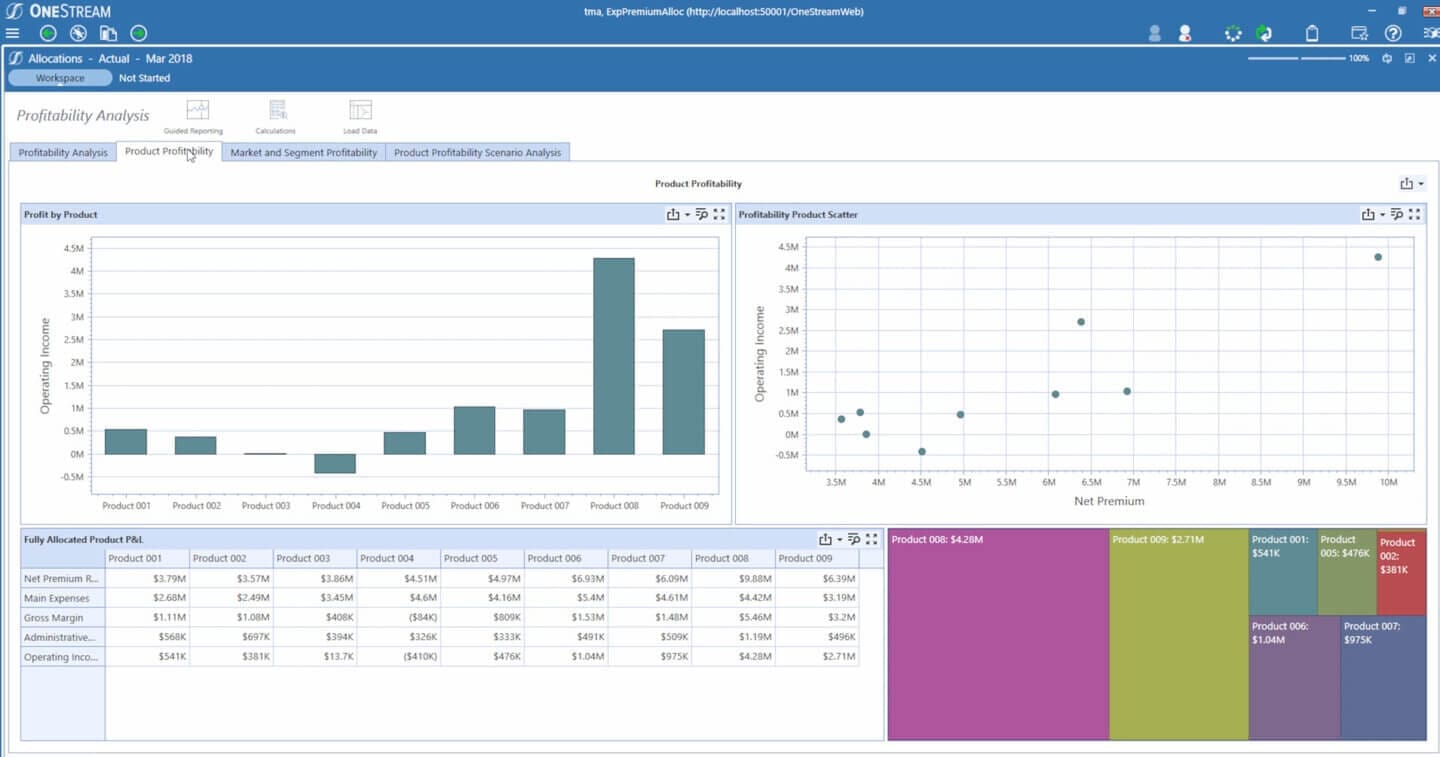

Additionally, profitability analysis can be used in the planning, budgeting and forecasting cycles by helping to identify the key drivers that forecast future financial performance. By analyzing past trends and identifying the drivers of profitability (Figure 2), Finance can more accurately forecast revenues, costs and profits.

By improving forecast accuracy and focusing efforts in the right areas, Finance provides a better guide for long-term planning and decision-making within an organization.

Profitability analysis is also an important tool for measuring a company’s overall financial health. A business unit or product line showing increased revenue does not always indicate increased profitability. By analyzing key financial metrics such as gross margin, operating margin and return on investment (ROI), Finance can determine the overall profitability of business segments, product lines and initiative across an organization. These metrics can also be used to benchmark the company’s performance against competitors, providing valuable insights into the company’s market position.

Conclusion

By analyzing profitability, Finance can identify which areas of the business are performing well and which areas need improvement. Additionally, profitability analysis can help evaluate the effectiveness of different strategies and tactics, forecast future financial performance and measure a company’s overall financial health. Ultimately, then, profitability analysis matters because it identifies what segments of the business and product lines are actually profitable, not just generating revenue.

Learn More

Want to learn more about OneStream’s profitability analysis offerings? Check out our solution brief about Conquering Complexity in Profitability Analysis.

Why are visibility and agility so important in today’s business environment? Because these are critical factors for success – they enable quick decision-making, drive resilience and are essential for enterprises in navigating a complex, fast-paced world. Driving visibility and agility to scale across the enterprise is essential for businesses looking to digitally transform. Creating an agile, digital business environment affects the entire enterprise, allowing employees to cohesively work together and freeing up time from manual tasks to allow for more analysis and innovation.

Read on to learn how Ingram Micro embarked on their own finance transformation journey with OneStream’s unified corporate performance management (CPM) platform. After facing the challenges of integrating multiple ERP systems into several different Oracle Hyperion applications Ingram Micro implemented OneStream to streamline its complex financial processes and improve visibility into profitability across products and customers. The result? Hours-long processes shortened to just minutes, better visibility into what drives the business and increased business agility. Let’s dive in!

Driving Finance Transformation

Ingram Micro is one of the world’s largest technology distributors, helping businesses realize the promise of technology. Based in Irvine, CA, Ingram Micro employs over 29K people and has an annual revenue of approximately $54B. Ingram Micro had multiple ERP systems and an extensive Oracle Hyperion footprint for financial consolidation, budgeting and management reporting, including Hyperion Financial Management (HFM), Hyperion Planning, Essbase, and Hyperion Profitability and Cost Management (HPCM). Additionally, Ingram Micro was using Trintech for account reconciliations and Qlik for reporting.

Ingram Micro was challenged by this complex environment of fragmented solutions. The company set out on a mission to replace the Hyperion suite, with the speed of profitability allocations as a main driver. Other key measurements of success for Ingram Micro included managing margins, profitability analysis and impact on working capital. However, Ingram Micro has many ERP systems with different instances around the world, making it difficult to get data from those systems into the profitabiltiy solution.

Financial reporting was also an issue as countries had to wait between two and four hours after posting a journal in the general ledger to see the data in Hyperion. “We have an annual CFO conference where financial directors from all countries came together in Irvine,” said Jan de Leeuw, Director of Financial Systems at Ingram Micro. “Normally I present there, and I was always apologizing about challenges with our data in Hyperion. It felt like nobody was happy with me during the first three years that I was working in this role. We needed a better way to understand profitability for a customer to evaluate new opportunities.”

Selecting a Modern CPM System

Ingram Micro was concerned about their profitability solution and was careful in their decision to explore the market as the company operates globally in 62 countries, with approximately 200 entities. Ingram Micro initially tried the Oracle EPM Cloud solution, but upon testing saw it resulted in a very slow allocation process and the numbers didn’t reconcile.

“Oracle simply couldn’t handle our performance needs — it was not the right solution for Ingram,” said de Leeuw. “From there we had many conversations with OneStream about the solution’s ability to handle large volumes of data. We looked at our current processes and future goals and felt confident that OneStream could handle it. We put a lot of trust in OneStream and took a step in the dark, which in the end was very successful. We have a high boosted environment right now with over 1,000 users currently, which is expected to grow to 1,100 by the end of the year.”

Ingram Micro went live with OneStream in the Microsoft Azure cloud for financial consolidation and budgeting in 2021. The company further extended their investment in the platform, adding People Planning, Capital Planning and Account Reconciliation solutions from the OneStream™ MarketPlace.

Streamlined Financial Operations & Profitability Models

Because of Ingram Micro’s complex ERP landscape and with multiple Hyperion applications, everything was batch driven. Users were pushing the data every two hours into Hyperion, creating delays with consolidation and management reporting. Now with OneStream’s unified CPM software, it is an on-demand process where users can push the data in whenever the country is ready. The timeline between the journal posting in the ERP to it landing in the consolidation system shortened from two hours to five minutes.

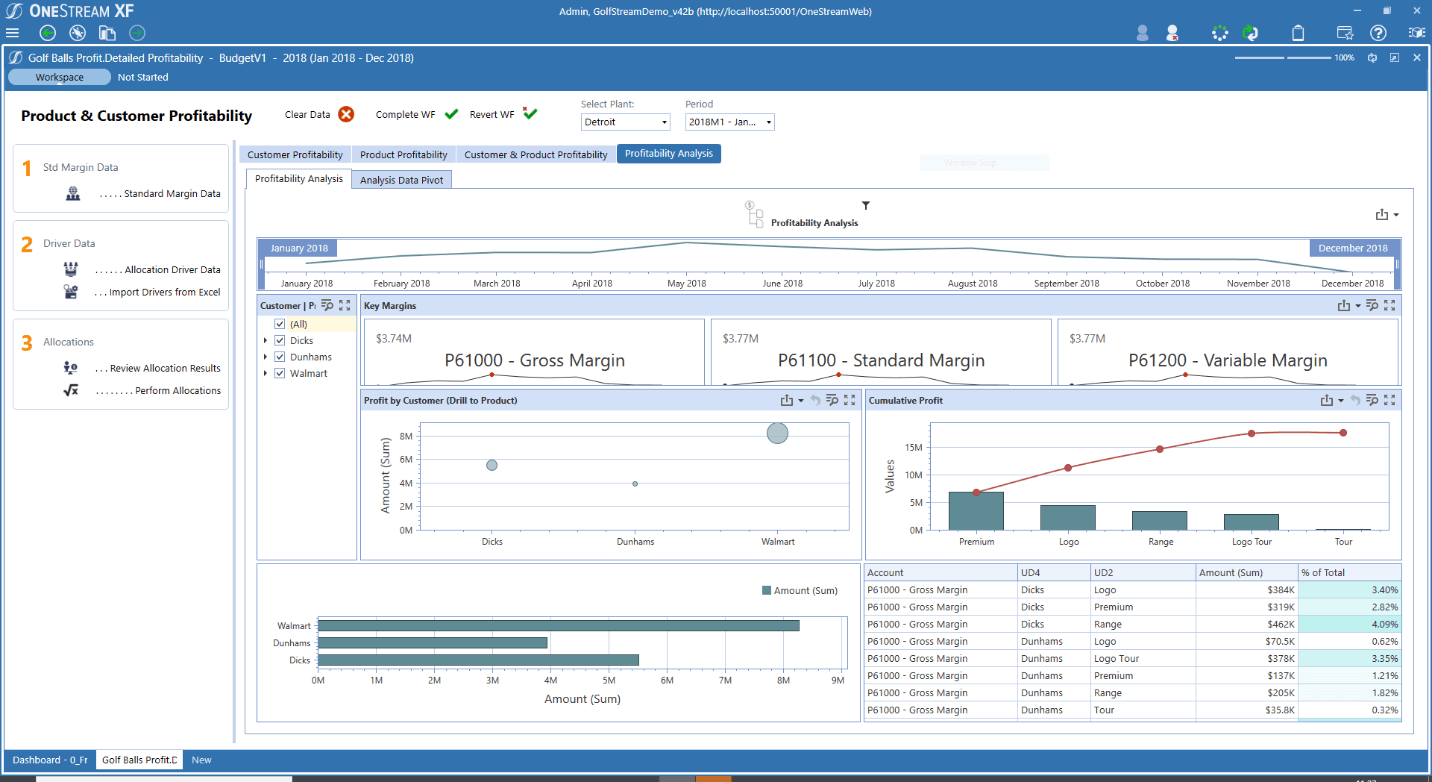

“The OneStream dashboarding is strong, with the ability to give every country one standard way of starting their analysis, plus the ability to play with the data for their own needs,” said de Leeuw. “On the budgeting side, we are leveraging OneStream for the annual budget, quarterly forecasting, and some monthly forecasting. We look forward to implementing weekly forecast soon.”

Ingram Micro also built dashboards to provide the company’s users with improved visibility into profitability across 170K customers and 1,500 vendor partners. De Leeuw added, “We now have much more insight into performance and profitability by customer, item and country. It’s one of our most important instruments.”

Benefits of OneStream

Since implementing OneStream, the speed of allocations has significantly improved, shortening the cycle from eight hours down to 10-20 minutes. Users can check the data, adjust and complete allocations within minutes, instead of waiting overnight. According to de Leeuw, “Rapid refresh was not possible in Hyperion, and it took 56 hours from beginning to end to run the process. We were able to reduce that process to eight hours and now users can run it whenever they want, and it takes only 20 minutes to refresh. That’s a huge game changer for everyone that’s working with the data.”

Scalability has also significantly improved with OneStream. In HPCM, onboarding new countries would take three to four months to build a new application. With OneStream, the information is already there so users can simply add the vendors and customers of that specific country and they are on board.

“There are so many things I like about OneStream,” said de Leeuw. “Speed, speed, speed, everything is faster. The users are happy and it’s easier to present. Support is fantastic, escalations are reduced to the minimum, and the technical reliability is amazing — which is something I never experienced with Hyperion. I like having the flexibility to build solutions out in the in the platform— the technology is very powerful. And the OneStream team listens and is always willing to help by continuing to develop things that are beneficial for companies like Ingram Micro. It’s been tremendous.”

Looking Ahead

Ingram Micro is exploring additional opportunities to automate their budget process and implement new MarketPlace solutions. The company hopes to do a 6-12 months trend analysis in the platform. But high on their list of plans is exploring OneStream’s Sensible Machine Learning solution.

Learn More

To learn more about Ingram Micro’s journey from Oracle Hyperion to OneStream, check out the case study for more information. If your organization is ready for a finance transformation, contact OneStream today.

In today’s competitive global market, providing managers with accurate insights into profitability by products, standard service lines, distribution channels, customers and other dimensions of business is essential to agile and effective decision-making. Yet many organizations struggle to create the visibility and transparency for these insights either due to the lack of time, technology, perceptions it is too complex to do, or executive support.

Addressing this challenge was the focus of a recent OneStream-sponsored webinar titled “How to Enhance Business Insights and Agility with Effective Profitability Management.” The featured speakers were Gary Cokins, Founder and CEO, Analytics-Based Performance Management LLC and Linda Hellebuyck, Corporate Controller at Henniges Automotive. Read on to hear the highlights of the webinar or watch the replay to see the details.

Cost Allocations and Profitability Management Best Practices

Gary Cokins is an internationally recognized expert, author and speaker on enterprise and corporate performance management (EPM/CPM) methods including measuring and managing customer profitability (using activity-based costing principles). He has over 30 years of experience in the field and has authored several books on these topics.

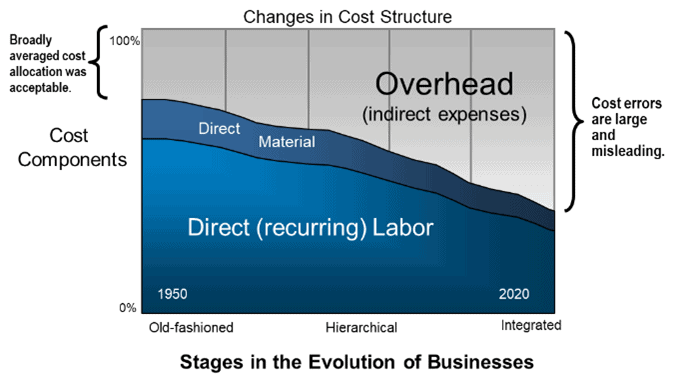

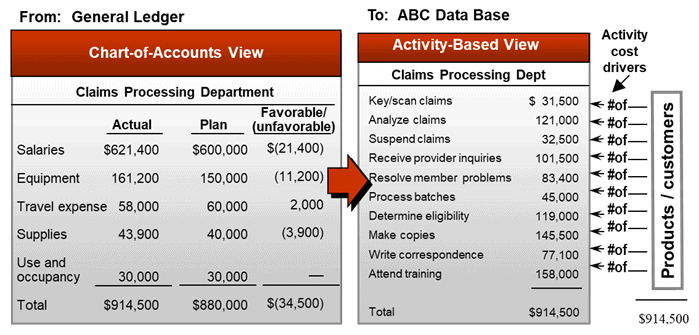

Mr. Cokins started his presentation off with a review of the basics of activity-based costing (ABC). His key message here is that when CFOs and Finance teams “allocate” indirect expenses (i.e., overhead) to products and standard service-lines, they spread it like “butter across bread”. And in doing so, CFOs violate cost accounting’s universal “causality principle.” Activity-based costing (ABC) resolves this by “tracing and assigning” expenses based on cause-and-effect relationships for how products and service lines consume work activities, which in turn consume the expenses of resources (e.g., salaries, supplies, utilities, etc.).

If we roll back the clock to the 1950’s, when direct labor and materials represented the majority of expenses in an enterprise, broadly averaged cost allocations for the indirect expenses was acceptable. But in today’s world, where indirect expenses represent most of the expenses in an enterprise, the averaged cost allocation approach can lead to large flawed and misleading cost errors.

Mr. Cokins went on to highlight the value of ABC in service-based industries, such as insurance and banking. Allocating expenses such as salaries, equipment, travel, supplies and occupancy to the various costs of work activities that occur in a department, such as claims processing, enables a clear view into which groups of customers are consuming relatively more versus less resources and their expenses.

He then reviewed the steps required to effectively implement ABC – allocating expenses from resources (e.g., GL accounts), to the costs of activities, and then to cost objects such as products, service lines, projects, and customers. While applying an ABC-based approach to cost allocations can take more time and effort than performing the traditional but simplistic cost allocations, the benefits are worth it. ABC provides CFOs and Finance teams, and more importantly line managers, with a clear view into which products or services are truly adding to bottom-line profits and which are detracting from profitability – and also a view to what are the drives causing the costs.

The Power of Customer Profitability

Mr. Cokins went on to highlight the importance of understanding distribution channel and customer profitability. The value of a company is a function of the value it gets from its customers – therefore understanding which customers, or segments of customers, are adding value versus reducing value is critical to driving long-term stakeholder financial value including for shareholders and business owners. Citing several examples from Jeffrey Colvin’s book “Angel Customers vs. Demon Customers,” his message is that by fully understanding customer profitability, CFO’s can help Sales and Marketing to better target customers. This means answering questions like:

- Which type of customer is attractive to newly acquire, retain, grow, or win back? And which types are not?

- How much should we optimally spend attracting, retaining, growing, or recovering each customer micro-segment?

When these questions are answered, organizations can more effectively target the types of customers they want to retain, grow, and acquire; and also make the pricing or customer services changes required to convert less profitable and even unprofitable customers to be profitable customers.

In concluding his presentation, Mr. Cokins provided some guidance on how organizations can overcome the resistance they may encounter when implementing ABC, including technical, misperceptions of excess complexity of ABC, and organizational behavioral barriers. He said, “It is better to be approximately correct than precisely inaccurate”.

Product and Customer Profitability at Henniges Automotive

After a brief introduction to the capabilities OneStream’s Intelligent Finance platform provides to support customer and product profitability, Linda Hellebuyck joined the discussion to highlight the approach Henniges Automotive has taken to understand product and customer profitability.

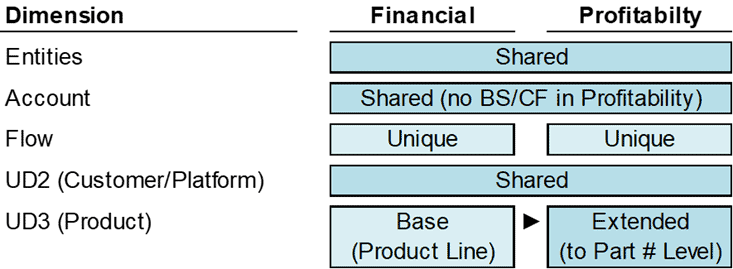

Henniges Automotive is Leading global supplier of highly-engineered automotive sealing and anti-vibration systems with operations in 8 countries, including 19 manufacturing plants and 4 technical centers. After selecting and implementing OneStream to replace Hyperion Enterprise for financial close, consolidation and reporting – the Henniges team extended their use of the OneStream platform into several additional processes, including Product Line Reporting.

The challenge here is that Henniges produces thousands of automotive products that are very customer and vehicle specific, and as a result, profitability can vary significantly between products. So it’s critical to understand profitability at a customer, platform (vehicle), and product level. Using manual processes and Excel spreadsheets for this type of analysis was very painful, with 80% of the effort going into collecting the data and 20% on analyzing it.

By moving this process into OneStream, Henniges was able to harmonize, store, allocate, and aggregate the data at a detailed (part number) level enabling the Finance team to:

- Produce a summarized P&L (thru EBITDA) for any part, platform(vehicle), product, or customer

- Enable end-user assignment of specific variances (scrap/freight)

- Perform system-generated allocations of other variances

- Identify InterCompany Sales (and Profit) with the ultimate end customer/platform/product

To accomplish this, the Henniges team leveraged many capabilities within the OneStream platform, including its extensibility. This enabled the team to set up two cubes within a single application, one for financial reporting and another for profitability reporting. While the two cubes share several common dimensions, the Profitability Cube has additional dimensions such as Customers, Products, Parts, and Platforms designed to support profitability reporting and analysis.

According to Ms. Hellebuyck, “Because it’s one application, we can share both metadata and data across the two cubes, making cross-cube comparisons easy. In other multi-product solutions, marrying the consolidations data with the part-level analytical data would be significantly more complex.”

Learn More

Leveraging OneStream for financial and profitability reporting has yielded several business benefits to Henniges, and other customers. This includes the ability to collect data faster and on a more frequent basis – moving profitability reporting from an annual to quarterly or even a monthly exercise. The solution provides deeper insight into what pieces of the business are producing (or not producing) bottom-line profits – and to why. This insight helps managers make more informed decisions in areas such as quoting, commercial negotiations, rationalizing which customers to devote more effort on, and implementing cost improvement initiatives.

To learn more, watch the replay of the webinar or contact OneStream if your organization is ready to raise its game when it comes to understanding profitability by products, customers, channels or other dimensions of your business.

“Setting profitability objectives is not the same as managing profitability”, said Robert Kugel from Ventana Research in his 2020 analyst perspective1. And he’s right. In practical terms, there’s a very distinct difference between the two. Why? Because companies that can navigate the increasing complexity in their businesses by understanding revenues and costs across their products, customers, markets or channels will – and do – gain significant competitive advantages.

This level of analysis involved with several layers of complex allocations can be difficult for some organizations – especially those with disparate corporate performance management (CPM) legacy systems or those working in Excel, given the widely known limitations of spreadsheets. For many, the indirect costs (e.g. Rents, Utilities and Marketing) as a share of overall costs are growing, particularly for organizations with shared services models. The focus on customer service and experience has also become imperative, especially because maximizing customer satisfaction can result in some businesses losing control over direct costs.

In essence, to preserve margins and ensure profitability and longevity, organizations must have the right tools in place to fully understand and continuously monitor their business processes.

According to FSN’s 2020 report on The Future of Analytics in the Finance Function, as many as 40% of organizations are technology constrained and lack the analytical tools to fully exploit their existing data. OneStream has the power to release those constraints. How? By unleashing Finance teams from fragmented CPM and manual processes. More specifically, OneStream offers profitability management as part of a unified, Intelligent Finance platform that supports financial consolidation, financial, statutory, and management reporting, planning, forecasting and analysis.

Align Customer & Product Analytics with Financial Results

OneStream’s Intelligent Finance platform blends financial and operational data to enable users to create and share insights into key drivers, such as customer and product profitability (see Figure 1). The platform also allows users to see how profitability varies by region or channel.

Using built-in, self-service reporting and analytics, users can leverage OneStream’s integrated allocation model to identify which areas of the organization are adding value vs. which are detracting value. This model, through those capabilities, immediately empowers Finance teams and their business partners with the insights and awareness required to effectively take action and ensure the optimal financial outcome.

Here are a few of OneStream’s key capabilities for profitability management:

- Powerful, Multi-Step Allocations with Audit Trails

- Complete transparency and auditability into profitability drivers, which builds confidence in the data and allows for collaborating with key business partners.

- A single source of truth across key stakeholder groups.

- Built in Reporting & Analytics (See Figure 2)

- Ability to identify key business trends and gain insights into product performance and customer performance.

- What-If Scenario Modeling

- Ability to dynamically manage and track multiple scenarios to identify and build customer or product-specific action plans to drive profitability.

Profitability Management in Action

Global automotive parts manufacturer Henniges implemented OneStream to meet all its financial reporting & analysis requirements – including those for profitability management – in one application. Leveraging the OneStream platform, Henniges can now collect data more quickly (day 4 vs. day 16) and more frequently allowing them to shift from quarterly profitability reporting to a monthly process. The OneStream solution also provides Henniges management with deeper insight into what pieces of the business are producing (or not producing) bottom-line profits.

Key Takeaway

Profitability management is a crucial component of effectively managing and driving the performance of your organization. In times of increasing complexity, it’s more important than ever for your organization to have an in-depth and full understanding of all revenue and cost drivers.

OneStream will empower your Finance team with the detailed insights required to lead at speed, drive decision-making and deliver sustained profitability across the enterprise.

Learn More

To learn more, click here to download our Conquering Complexity in Profitability Management Solution Brief. And feel free to contact us if you are ready to gain improved analytical insights into your business.

1 – Robert Kugel’s Analyst Perspectives – Profitability Management is a CFO Imperative

Providing strategic insight into profitability for P&L owners is a primary focus for enterprise Finance leaders. This includes visibility of where costs are excessive, where the margins are largest and where opportunities exist to increase revenue. Unfortunately, this is not always as straightforward as Finance and business unit leaders would like it to be.

Legacy Solutions Increase Complexity and Reduce Accuracy

Why is this? Well, many organizations currently use spreadsheets or fragmented, legacy applications to analyze their profitability. Managing profitability across an organization with these fragmented tools is challenging and complicated by multiple factors such as significant differences per region or business unit. Without a single source of truth, there is a significant risk of error and this risk is especially prominent when disparate spreadsheets are used to collect and analyze profitability information.

When developing and managing profitability models, these complexities make it difficult to change parameters or adjust the analysis and frequently limit the extensiveness and accuracy of the model. Finance teams are often forced to spend excessive time administering and maintaining models which limits their availability to focus on business decision guidance.

Conquering Complexity in Profitability Analysis

At Agium EPM, we have developed a profitability analysis model in OneStream’s Intelligent Finance platform that conquers the complexity Finance teams face in their analysis. Our main goal was to provide a flexible, user-friendly interface that empowers users to easily adjust and update their information to achieve higher accuracy and deliver powerful profitability insights. To enhance this ease-of-use, model calculations are built-into the system, so business-level users do not have to interact directly with the calculations and are protected from making changes to the model itself. With this method, profitability analysis modeling can be more sophisticated than with other tools while preserving an elegant user experience.

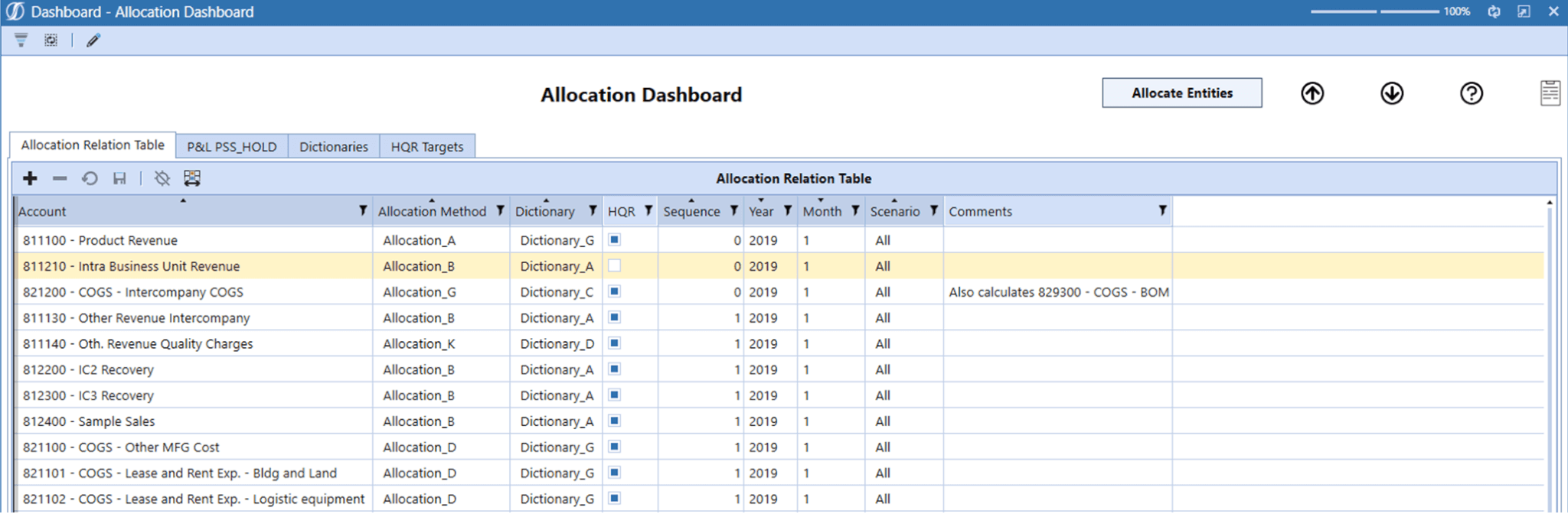

Figure 1 – Allocation Dashboard

Empower Business Users with the Profitability Analysis Dashboard

The interface consists of a dashboard (see Figure 1) where predefined parameters can be adjusted. Depending on the business requirements, these can vary from one parameter to a completely driver-based model. However, this is all configured to be easily manageable by users with access to the Profitability Analysis Dashboard in OneStream.

The organization can choose to either provide this level of access for headquarters only or to the lowest level of the business unit. This flexibility enables organizations to empower business unit leaders and provide them more tools to accurately analyze their profitability.

Integrate Profitability Analysis with Financial Reporting

While the solution can be a standalone model, it can also be integrated with financial reporting. In that way, the analysis can be done on the latest actuals and can be used to generate best/worst case scenario comparisons. Allocations can be executed on demand by users or be calculated along with the regular consolidation process of the organization.

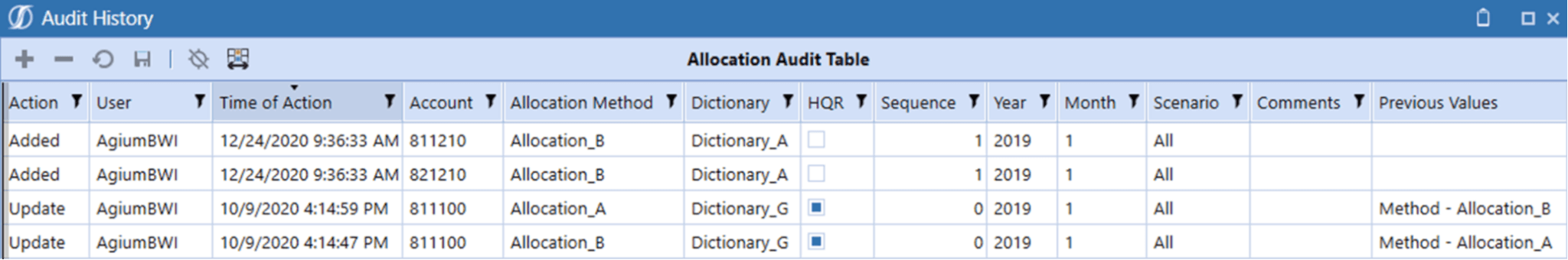

Figure 2 – Allocation Audit Table

Either way, you always have the latest outcomes and up-to-date actuals. This speed in analysis enables relevant outcomes for decision-makers. Additionally, the model can be extended with audit trails (see Figure 2), specific security settings and additional reports.

Lead at Speed with Profitability Insights

With the profitability analysis model completely configured and integrated into the OneStream platform, users can conquer complexity in profitability management. They can easily change parameters via dropdowns and are empowered with an in-depth understanding of the profitability impact of changes in pricing, sourcing, service lines and product mix strategies when conducting profitability analysis and what-if scenarios.

For example, our client Carbery Food Ingredients implemented OneStream and Agium’s profitability analysis model to replace more than 15 spreadsheets that were linked together to produce management reports. And they did this while creating a process that is completely transparent, using the OneStream Marketplace solution Workflows. This project management solution enables Carbery’s Finance team to delegate tasks, manage progress and provides complete accountability with built-in audit trails.

To learn more about Agium’s profitability analysis model and how customers are empowered in profitability management, visit the Agium Profitability & Management Reporting page. To learn more about how the OneStream platform empowers Finance teams to lead at speed contact OneStream today.