In recent years, Financial Planning and Analysis (FP&A) providers have seen a relative explosion in the number of AI software solutions. AI software for FP&A is gaining importance because it significantly enhances the efficiency and accuracy of financial analysis. In fact, the best AI software solutions for FP&A enable organizations to quickly analyze vast amounts of financial data, identify patterns and generate insights.

AI helps automate routine tasks, freeing up Finance professionals to focus on the more strategic aspects of financial planning. Overall, the integration of AI in FP&A contributes to resource optimization, efficiency, agility and better-informed decision-making.

In this blog post, we examine the Top 5 AI software solutions for FP&A in 2024 using our own interpretation of their relative offerings. We only include software that meets the following non-negotiable qualifications:

- Earned at least 4.5/5 stars on Gartner Peer Reviews – Financial Planning Software

- Listed in the Budgeting Section on Capterra

- Offers a wider EPM offering

What Is AI Software for FP&A?

AI software for FP&A enables Finance teams to move beyond historical reporting and embrace machine learning (ML)-backed predictive analytics. By analyzing historical data patterns, AI algorithms can more accurately forecast future trends. Those trends then help organizations make more informed financial decisions. For example, AI can analyze customer behavior, purchase history and market trends to predict the ideal price point for each product or service. This personalized approach maximizes both revenue and customer satisfaction, paving the way for sustainable growth.

As FP&A teams continue to embrace AI, adopting a sensible approach to ML – one that balances automation with transparency and human insight – has become increasingly important. After all, effective planning is critical for businesses to remain competitive and adapt to changing market conditions.

Common features across AI software solutions for FP&A include the following capabilities:

- Easy-to-access interactive dashboards that FP&A teams can use to discern financial trends.

- Enhanced forecast accuracy by generating more precise analysis using business intuition or external factors within forecasts.

- Easily visualized impact of planning decisions on profitability and margins with “What-if” driver-based planning.

- Reduced forecast bias within scenarios, compare against human forecasting to drive better dialogue and collaboration.

By leveraging these features and others, organizations can transform the FP&A function, plan with confidence, gain insights and forecast more accurately.

This comparative analysis explores the features and functionalities of 5 leading AI software solutions for FP&A: OneStream, Planful, Board, Workday Adaptive and Wolters Kluwer CCH Tagetik.

The Best AI Software for FP&A

1. OneStream

OneStream is how finance teams can stop wrangling data and start making more of an impact on the business. It’s the only enterprise finance platform that unifies all your financial and operational data, embeds AI for better decisions and productivity, and lets you keep adding capabilities without adding technical debt.

Pros

- Enables users to create thousands of highly accurate daily and/or weekly ML forecasts across products and locations via the unique “Model Arena” concept where models compete to win the most accurate forecast for each individual team.

- Allows the capture of business intuition such as promotions, events and other external factors within ML forecasts.

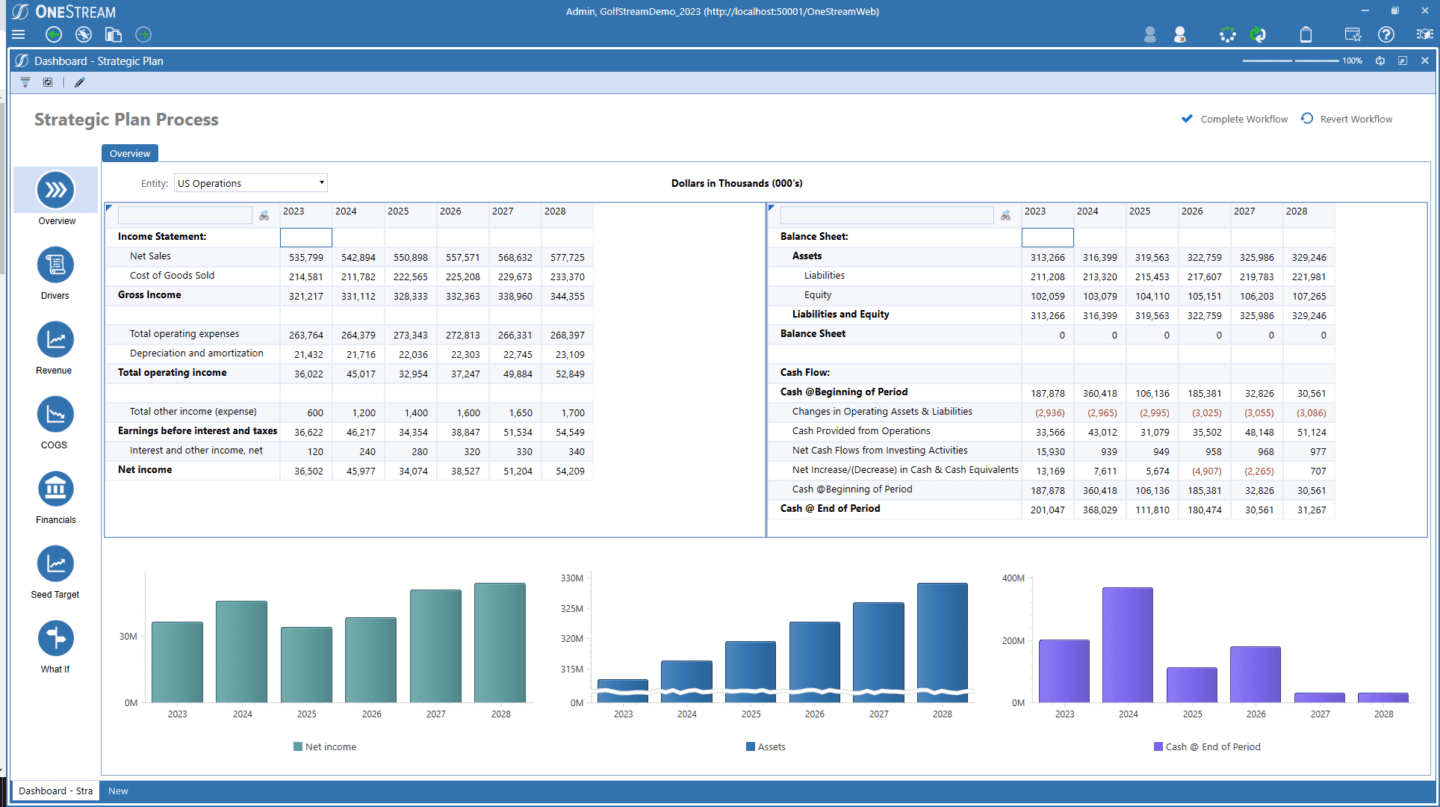

- Fully unifies and aligns demand forecasts with driver-based sales, material costs, inventory and labor plans across financial statements including the P&L, Balance Sheet and Cash Flow.

Cons

- Tailored implementation process potentially requiring additional configuration time to meet customers’ unique business requirements.

- Potentially prohibitive pricing, especially for smaller businesses.

- Smaller but growing market presence compared to other alternatives – despite growing popularity and having 1,300+ customers across the globe.

2. Planful

Founded in 2001, Planful is a private company supported by private equity firm Vector Capital. The Planful platform aims to streamline diverse business processes, such as planning, budgeting, consolidations, reporting and analytics. Used globally, this platform acts as a tool for Finance, Accounting, and Business users to improve their planning, reporting and closing processes. Planful’s ultimate stated aim with its AI software for FP&A tool is to accelerate process cycles, boost productivity and enhance overall accuracy.

Pros

- Offers very user-friendly, adaptable interface (i.e., functions in both web and Excel interfaces) that requires little IT help and has syntax similar to Excel.

- Allows customers to only buy what they need since Planful is sold as modules.

- Receives very highly rated customer service within public reviews.

Cons

- Difficult-to-detect seasonality due to the lowest granularity being monthly.

- Inability to allow capture of business intuition such as promotions, events and other external factors within predictive forecasts.

- Limited scale as users are constrained to running only 10 models at one time.

- Data integration delivered using a third-party solution – not developed by Planful.

3. Board

Board was founded in 1994 in Chiasso, Switzerland, and has headquarters in both Boston and London. While the overall product is marketed as integrated business intelligence reporting and analytics with enterprise scalability, Board markets its planning solution as Intelligent Planning for FP&A teams. Board is a private company with customers worldwide, the highest percentage in Europe.

Pros

- Employs a model competition concept where models compete to win the most accurate forecast for each individual line item – enabling users to create thousands of highly accurate daily and/or weekly ML forecasts across products and locations.

- Provides prebuilt integrators with ERPs and over 270 APIs to multiple source systems that import GL and transactional information.

- Offers visually appealing UI with tight connection between the presentation layer and back-end.

Cons

- Ongoing maintenance required as everything must be built, meaning little pre-built functionality exists.

- No ability to allow capture of business intuition such as promotions, events and other external factors within predictive forecasts.

- Limited accuracy improvements due to only statistical models vs. machine learning models being available.

- No health monitoring of models and auto-rebuilds to maintain accuracy of models.

4. Workday Adaptive

Workday is a leading provider of enterprise cloud applications for Finance and Human Resources. Founded in 2005, Workday delivers financial management, human capital management and analytics applications. Workday Adaptive Planning originates from the acquisition of Adaptive Insights in 2018. Marketed as enterprise planning software, the Workday solution helps Finance create budgets and forecasts with more speed, flexibility, collaboration and accuracy.

Pros

- Provides Finance-focused planning solution with strong market awareness, especially in the US.

- Uses automation and connectivity to Excel through Office connect, ensuring ease of use.

- Offers outlier reporting and anomaly detection, allowing for quick analysis and plan comparison.

Cons

- Limited accuracy improvements due to a single model applied across all line items or product-location combinations vs. a specific model application for each line item, which can be achieved through a Model Arena.

- No ability to allow capture of business intuition such as promotions, events and other external factors within predictive forecasts.

- No health monitoring of models and auto-rebuilds to maintain accuracy of models.

5. Wolters Kluwer CCH Tagetik

Wolters Kluwer is a global entity specializing in professional data, application solutions and services. The company targets sectors such as healthcare; taxation and accounting; corporate and financial compliance; legal and regulation; and corporate performance and ESG. Originally developed in 2005 to deliver trusted, comprehensive and scalable CPM solutions globally, CCH Tagetik was acquired by Wolters Kluwer in 2017.

Pros

- Surfaces drivers impacting the business.

- Shows accuracy uplift with forecast comparison of statistical predictive vs. baseline forecasts.

- Offers unified platform approach that differs from multi-solution approaches (e.g., SAP and Oracle).

Cons

- Separate ML product requiring integration, administration and, therefore, unification and transparency.

- Limited accuracy improvements due to a single model applied across all line items or product-location combinations vs. a specific model application for each line item.

- Limited accuracy improvements due to only statistical models vs. machine learning models being available.

Conclusion

Choosing the right AI software for FP&A is essential for organizations seeking to move away from unreliable, inadequate EPM applications and/or spreadsheets and instead evolve to a modern AI-driven EPM solution.

Each of the Top 5 solutions featured in this blog post offers unique features and benefits, catering to the diverse needs of organizations across industries. Ultimately, however, if you’re looking to streamline your key Finance processes and significantly increase confidence in your reporting, OneStream is the best AI software for FP&A to handle all your needs, no matter how complex.

Learn More

To learn more about how organizations are managing the complexity in their financial planning and analysis by using AI, check out our whitepaper titled “Revolutionize Your Planning with Sensible ML.” And if you’re ready to take the leap from spreadsheets or legacy EPM solutions and start your Finance Transformation with OneStream, let’s chat!

Download the White PaperThere’s no question that Financial Planning and Analysis (FP&A) has a profound impact on organizational success. From the budgeting, planning and forecasting process to the planning and execution of strategic goals and initiatives, FP&A is uniquely positioned to guide the business through market fluctuations and competitive challenges and position the organization for success in the face of whatever change may occur. Most of the common planning processes, however, focus on a near-term horizon. Long-range planning (LRP) builds on budgeting, planning, and forecasting processes by focusing on longer-term financial goals and key initiatives that are 5-10 years or more in the future.

Leveraging an effective FP&A software solution to plan, track and achieve longer-term financial plans and goals is, therefore, key to an effective LRP process.

Why Long-Range Planning Matters

With all the volatility in markets and global economies due to the pandemic, it’s no wonder that looking ahead with an LRP process can feel daunting. Why? Well, getting a handle on what’s going to happen tomorrow or next week is tough enough, so understanding what might happen in 1-2 years – or in 5 years – seems nearly impossible.

And if the planning process is happening in offline spreadsheets – that’s an even bigger headache. Putting together a plan that truly represents a vision of the future requires inputs from across the organization, so having to combine various spreadsheets that lack data quality and consistency controls can make any planning process a tedious and time-consuming task.

Despite the above challenges, long-range planning is an important tool for mapping out not only the vision for the future but also the related goals and plans to execute on those goals. Capturing the inputs within FP&A software brings that vision of the future together into one long-range plan – one the entire organization can work toward achieving.

What Is Long-Range Planning?

Long-range planning typically spans a 5- to the 10-year period. The LRP process differs from not only the near-term budgeting and forecasting activities (e.g., rolling forecasts) that typically span a year, but also the mid-range strategic planning processes. Essentially, a long-range plan looks to align long-term goals with action plans to execute the strategic planning. Understanding the strategic direction of the organization helps FP&A craft a vision of the future, and vision forms the long-range plan.

Notably, beyond just Finance inputs, the long-range planning process requires inputs from many different stakeholders in the business. Here are a few examples:

- Operations: Makes strategic decisions about the overhead and personnel required to meet organizational goals.

- Supply Chain: Understands the costs and availability of the materials needed to execute the long-range plan, and makes decisions about alternative suppliers or potential supply disruptions in the future.

- Manufacturing: Look at equipment and machinery purchases, maintenance, and what needs to happen on the production floor to achieve the LRP vision.

For the long-range plan to be successful, those implementing it must understand not only what the plan incorporates as goals, outlooks, and financial impacts, but also how everything will be accomplished.

Key Elements in the Long-Range Planning Process

The ability to understand and align financial and operational goals will ultimately help craft a united vision for the future – one that spans across the organization. Here are just a few examples of useful components of the long-range plan:

- Mission Statement and Company Vision – What is the company’s mission? Understanding where the company currently stands compared to its longer-term mission and vision will inform future direction.

- SWOT Analysis – A strengths, weaknesses, opportunities, and threats (SWOT) analysis helps define current internal strengths and weaknesses in the business to better understand what can be improved as part of the long-range plan and what should be avoided. By focusing on both external opportunities and threats, FP&A teams can help drive a dialogue with key executives, one focused on key areas to consider outside the 4 walls of the organization.

- Sales and Operational Goals – Understanding both the sales and operational goals helps lend insight into the LRP to identify activities that help increase revenue, profits, and production rates to drive overall business performance.

How Financial Software Enables an Effective Long-Range Planning Process

One common pitfall of the traditional long-range planning process is the reliance on manual modeling in custom Excel spreadsheets – a headache to which any financial analyst can relate. Using spreadsheets means spending hours creating, distributing, collecting, and rolling-up complicated Excel models only to suffer from data inaccuracies, quality issues, and non-conformance problems. After all, without traceability to the data sources and what’s driving the data in the Excel file, there’s no authority in the numbers. And absolutely no one enjoys standing up and presenting numbers that just can’t be backed up.

Additionally, there’s an inability to adapt the plan as changes occur. In today’s volatile market conditions, reacting and adapting to change with speed and accuracy is critical to driving performance. Disjointed Excel models simply don’t allow for the type of on-the-fly, what-if modeling or changes that are so crucial to success in modern planning.

Instead, utilizing FP&A software for the long-range planning process has many benefits:

- Saves time in the planning process by providing access to all the data in one place. Providing all the key stakeholders with access to the same data eliminates offline spreadsheets and siloed processes that create more work to aggregate and validate the data.

- Opportunity to incorporate predictive analytics and machine learning to use internal/external insights and data to better understand future fluctuations and changes. Bringing in both internal data and external trends can layer in additional insights that guide future decision-making and future-proof the plan via the ability to sense fluctuations sooner.

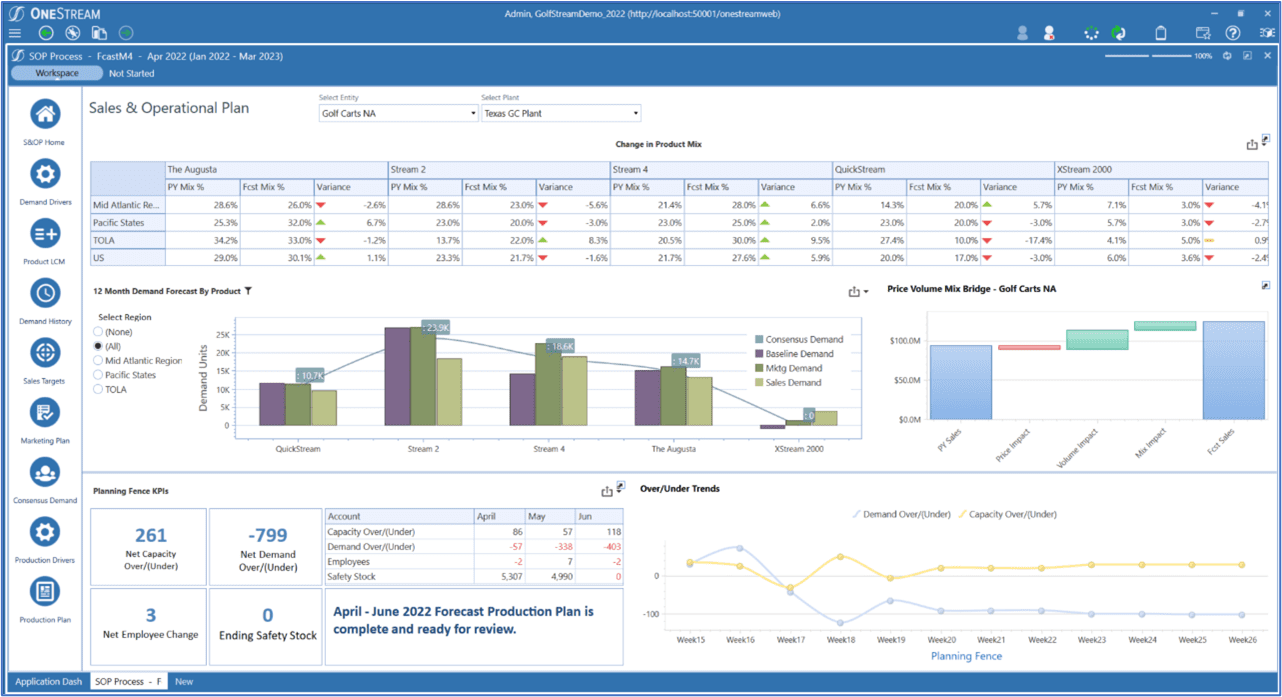

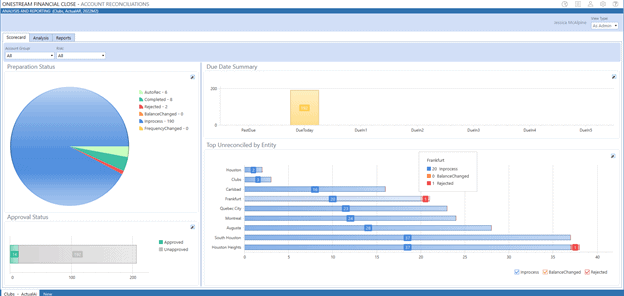

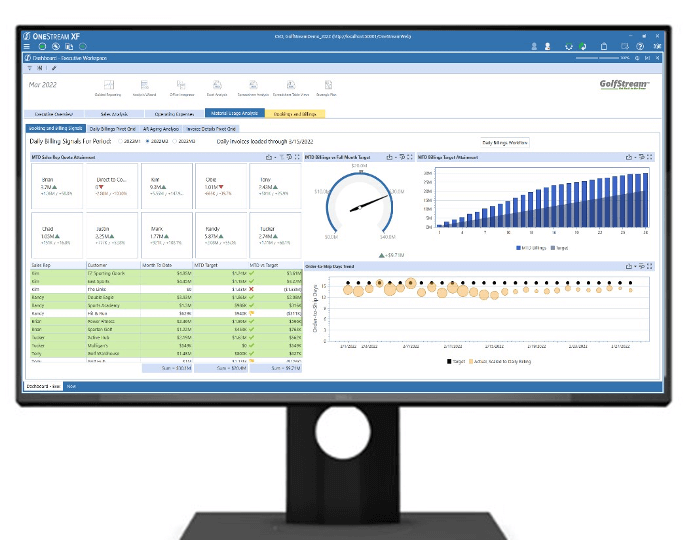

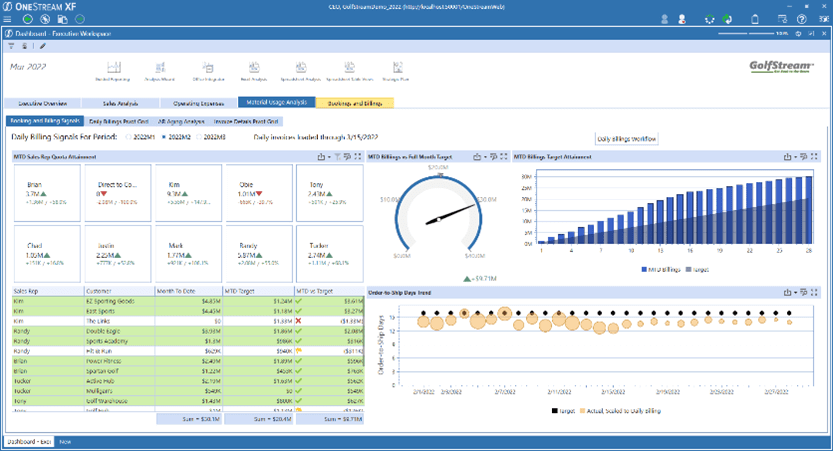

- Provides detailed reporting and analytics that can help guide decision-making with a varied audience. Visualizing the data trends quickly with dashboards and reports that are easily and quickly updated enables better and quicker decision-making (Figure 1).

- Improves data quality and accuracy that redirects the time and effort spent from managing manual processes toward better strategic and tactical decision-making.

- Allows leaders to model what-if scenarios and make ad-hoc changes as the plan is executed. An important aspect of the long-range planning process is managing an ever-changing plan in a fast-paced business landscape. Managing that plan as conditions change and being able to dynamically update for the changes is crucial to long-term success.

Figure 1: Data visualizations enable faster insights and changes in response to fluctuations in the market and financial results

All these improvements ultimately make long-range planning easier, quicker, and more accurate than a siloed planning process taking place in disjointed Excel spreadsheets. And that means less of a headache for the financial analysts tasked with putting the plan together. The improvements also allow leadership to focus more on strategy and execution – and less on worrying about the credibility of data or the reliability of Excel models.

FP&A teams must therefore use processes like LRP to help elevate Finance as a strategic business partner and earn that much-desired seat at the strategy table. And the first step of achieving those goals requires moving the Finance role past data aggregators and cleansers of complex and messy Excel spreadsheets. Leveraging effective software to do just that enables the transition into the next stage of Finance.

Conclusion

Long-range planning is an important piece of the financial planning scope – and one that informs tactical budgeting and forecasting cycles and strategic mid-range planning to drive towards future business performance. In the process, being able to leverage reliable and flexible FP&A software not only improves the quality of life for those tasked with putting together and executing the plan but also allows the organization to remain focused on strategic initiatives and the continued success of the business through uncertain times.

Bringing all of these processes together is what allows Finance to take finance further.

Learn More

To learn more about how your organization can take steps forward with long-range planning, click here to download our solution brief How Long-Range Planning Prioritizes Strategic Initiatives and Achieves Financial Goals.

Financial close, consolidation and reporting are critical processes that most organizations perform on a monthly, quarterly and annual basis to deliver their financial results to internal and external stakeholders. These processes can be challenging to execute, especially in larger enterprises with multiple ERP/GLs to consolidate, complex organizational structures, increasing regulatory compliance requirements, and a limited and mostly remote workforce.

Purpose-built software applications to support these processes have been available for over 25 years, but today’s cloud-based financial close and consolidation software (FCCS) solutions offer new capabilities that can help organizations streamline these processes to ensure more timely and accurate delivery of financial results.

Gartner’s View of the Market

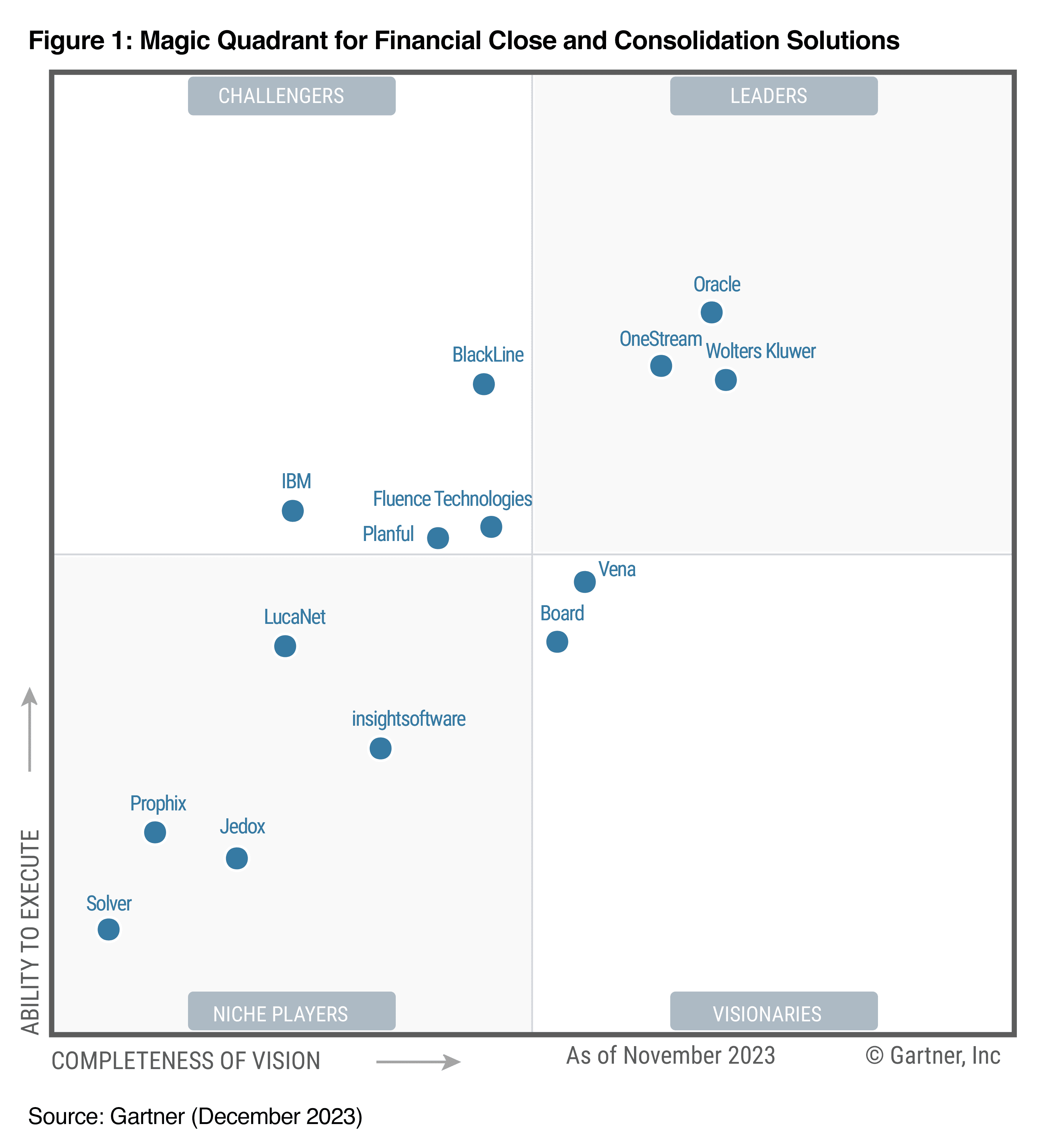

This was the focus of the recently published Gartner® Magic Quadrant™ for Financial Close and Consolidation Solutions1 where OneStream was named as one of only three leaders. (see figure 1).

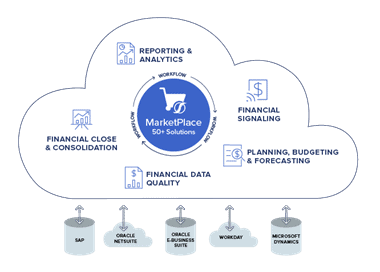

In the report, the Gartner analyst team recognized our broad capabilities provided through OneStream’s Intelligent Finance Platform as well as additional solutions available from our Solutions Exchange such as Account Reconciliations, Transaction Matching, ESG Reporting Blueprint and Tax Provision.

Key strengths for OneStream that were highlighted in the report include:

- Financial Consolidation – including broad capabilities, Extensible Dimensionality®, guided workflow and advanced financial intelligence.

- Data Integration – with the ability to integrate data from a wide variety of source systems, with error-handing, validations and notifications provided through our built-in Financial Data Quality Management.

- Sales Pricing – with a flexible, user-based pricing model.

Overall, we are pleased to be recognized as a Leader in this Gartner Magic Quadrant report and we believe this is well-deserved based on the breadth and depth of capabilities that we offer, and our strong momentum in the market. Over 1300 organizations globally have chosen OneStream as a replacement for legacy applications such as Oracle HFM, Oracle FCCS, SAP BPC and BFC, IBM/Cognos Controller, Longview and Infor as well as point solutions such as Blackline and Trintech for account reconciliations. And we’ve replaced thousands of Excel spreadsheets as well!

Delivering Positive Business Impact

Organizations that have adopted OneStream for financial close, consolidation and reporting have improved consolidation performance vs. legacy products, while handling much larger data volumes than they could with their prior solutions. They have shortened their period-end close processes by several days and are delivering more timely and accurate financial results to stakeholders. And they have reduced technical debt, saving millions of dollars per year in IT and admin costs.

Here are some examples:

Costco Wholesale: Replaced Oracle HFM and Excel with OneStream for OneStream for financial close, consolidation, reporting, cashflow, and budgeting. Their financial close process was reduced from 2-3 days to 1.5 days and eliminating Excel enabled the Costco team to re-allocate 25% of FTE time to value added work.

Terex: Replaced Oracle HFM, FDMEE, Prophix and Excel with OneStream for financial close, consolidation, reporting and planning. Integrating data from 28 ERPs, full system consolidation time has decreased from up to 20 hours to less than 30 minutes with OneStream. Eliminating multiple point solutions has improved data quality and also yielded significant cost savings.

Lindsay Corp: Replaced Microsoft Excel with OneStream for financial close, consolidation, reporting, planning and forecasting. Their monthly close process was shortened by 25%, and the company is also saving 2 days per month on forecasting.

These and other customer successes have translated to a 4.8 out of 5 rating and 95% “willing to recommend” score for OneStream for financial close and consolidation on Gartner® Peer Insights™.

Key Market Requirements and Evaluation Criteria

For those new to the Magic Quadrant process, Gartner defines FCCS solutions as “applications that enable corporate controllers and their teams to manage the organization’s group close, consolidation and reporting processes.” The most common business challenges, or use cases, that Gartner identifies for FCCS include enabling efficiency, driving regulatory compliance and supporting a complex business environment.

In evaluating the various software solutions available to support FCCS, Gartner identifies the “must-have” capabilities as:

- Financial Close Management

- Financial Consolidation

- Financial Reporting

Additional standard and optional capabilities identified by Gartner include:

- Financial Statement Reconciliation

- Journal Entry Processing

- Financial Reporting Risk Management

- Disclosure Management

To be included in the Gartner FCCS Magic Quadrant, vendors must support all the must-have capabilities mentioned above, and these must-have capabilities should be available within the native vendor solutions and not offered through partnerships with other vendors. In addition, the vendors must operate in at least two global geographies, the software must be deployed as a cloud service and be available as a standalone solution, devoid of any bundling with ERP suites.

Learn More

Financial close, consolidation and reporting are critical processes that shouldn’t be managed with legacy applications, point solutions or spreadsheets that lack the capabilities required to meet today’s complex business requirements. If your organization is ready to make the leap to a modern, cloud-based solution, download the Gartner Magic Quadrant report to learn more about the key market requirements and why OneStream was named as a Leader.

Download the ReportSources: 1 Gartner Magic Quadrant for Financial Close and Consolidation Solutions, Nisha Bhandare, Permjeet Gale, Jeffrin Francis, Renata Viana, 27 November 2023

Gartner Disclaimer

GARTNER is a registered trademark and service mark of Gartner and Magic Quadrant is a registered trademark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and are used herein with permission. All rights reserved.

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

Gartner® and Peer Insights™ are trademarks of Gartner, Inc. and/or its affiliates. All rights reserved. Gartner Peer Insights content consists of the opinions of individual end users based on their own experiences, and should not be construed as statements of fact, nor do they represent the views of Gartner or its affiliates. Gartner does not endorse any vendor, product or service depicted in this content nor makes any warranties, expressed or implied, with respect to this content, about its accuracy or completeness, including any warranties of merchantability or fitness for a particular purpose.

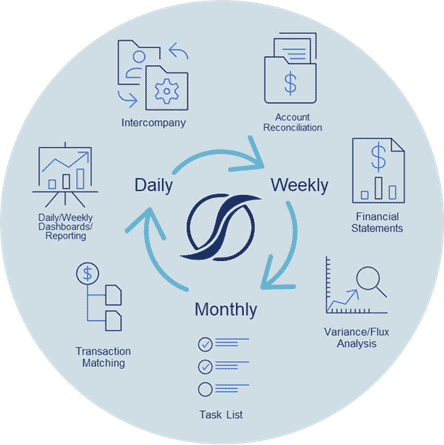

At OneStream, we realize that delivering timely and accurate consolidated financial statements is just a part of the period-end financial close process. We see the Financial Close as a comprehensive and continuous cycle that involves managing the close process and all related tasks. It includes collecting and consolidating data from multiple sources, matching transactional detail to eliminate misstatements, reconciling intercompany balances, and utilizing matched data and reconciled intercompany balances to reconcile account balances required to publish consolidated financial statements.

OneStream is the only corporate performance management (CPM) platform on the market that supports the entire financial close process within one, unified application (see Figure 1). It’s this capability to unify all of these processes in parallel and without complexity that gives OneStream the ability to replace multiple legacy or connected finance applications as well as spreadsheets. This approach not only drives speed and accuracy in the close process, but it’s a huge opportunity for organizations to drive total cost of ownership savings and generate a high return from their OneStream investment.

What’s New?

OneStream continually looks for ways to help customers get the most from the platform and has just announced the release of the OneStream Financial Close MarketPlace solution which streamlines and simplifies existing customers’ access to our Account Reconciliations and Transaction Matching solutions.

The OneStream Financial Close (OFC) solution fully unifies the ability to use Transaction Matching detail to support Account Reconciliation balances. Integration between these solutions is optional allowing each solution to also be used independently. The solutions included within OFC require the same minimum OneStream platform version which always ensures alignment between these critical processes.

Here are a few of the benefits of OneStream’s Financial Close (see Figure 2) solution:

- Single downloadable solution with single install and uninstall, with one source of the truth and one point of maintenance.

- Effortlessly unify and maintain Account Reconciliations and Transaction Matching Integration by leveraging existing dimensionality to identify which transactions relate to corresponding reconciliations.

- Transactional level support may be created from Transaction Matching and pushed to multiple reconciliations, OR detail specific to a reconciliation may be pulled from Transaction Matching to a reconciliation.

- Aggregated transactional level detail such as transaction date to provide aging information with the ability to drill back directly to detail information.

- Create and unify tables for Account Reconciliations and Transaction Matching in parallel.

Learn More

Hundreds of OneStream customers have implemented our platform to streamline their financial close, consolidation, and reporting process – replacing spreadsheets and multiple legacy applications. And many have extended their investment with the OneStream Account Reconciliations and Transaction Matching MarketPlace solutions. This has enabled them to reduce data latency and further streamline the close process while eliminating risky spreadsheets and standalone point solutions. To learn more about OneStream’s Financial Close Suite please visit our website or contact your OneStream account representative. If you are a current OneStream customer, you can download the OneStream Financial Close solution directly from the OneStream Solution Exchange.

2022 has been a challenging year for individuals and corporations. Geo-political instability due to the war in Ukraine has led the headlines for most of the year, along with higher fuel prices, widespread inflation, continued supply chain bottlenecks, rising interest rates and falling financial markets. With planning and budgeting season upon us, what assumptions are CFOs and Finance executives making about what lies ahead and how is that impacting corporate financial planning for 2023?

Taking the Pulse of Financial Leaders

To understand how financial leaders are planning for 2023, OneStream Software sponsored a Hanover Research survey of over 650 Financial Decision Makers in the North America, as well as EMEA. The goal of the survey was to understand financial leaders’ expectations for 2023 regarding inflation, potential recession, supply chain disruptions, talent management, ESG and DEI initiatives, and technology investments. Read on to learn the results of the Fall 2022 Financial Decision Makers Outlook survey.

Economic Headwinds Persist

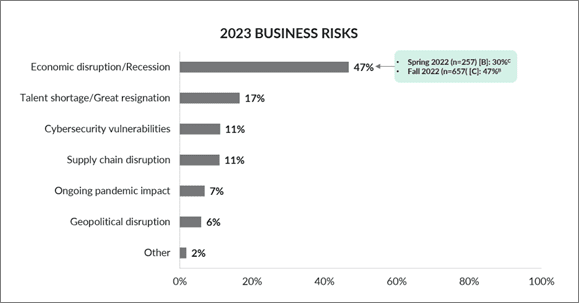

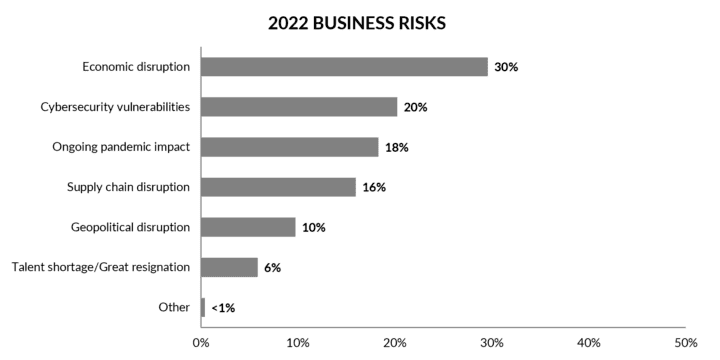

According to the Fall 2022 survey, economic disruptions/recession are still the top concern for nearly half of organizations for 2023, far outdistancing concerns about talent shortages, cybersecurity, supply chain disruption, and geopolitical disruption. This was also the top concern earlier this year at 30%; however, in the Fall 2022 survey, this rose to 47% of respondents (see figure 1).

Figure 1 – Top Business Risks for 2023

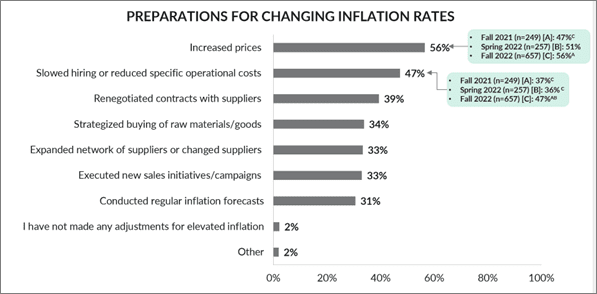

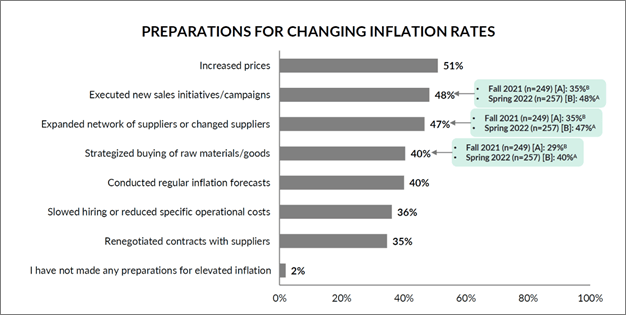

With inflation continuing to plague both individuals and enterprises, price increases are the number one way that businesses have dealt with inflation (56%), followed by slowed hiring or reduced specific operational costs (47%). Nearly half of businesses have slowed hiring or reduced specific operational costs, another significant increase from a year ago (see figure 2).

Figure 2 – Preparations for Changing Inflation Rates

With regards to the potential for recession, similarly, two-thirds of financial leaders expect a recession to occur and last until late 2023 or later. Three-quarters of financial leaders also expect the pandemic-related supply chain issues to continue into 2023; however, very few (8%) expect it to extend beyond 2023. Most financial leaders (85%) have made at least slight alterations to their 2023 forecasts and strategies in preparation of an impending recession, according to the survey.

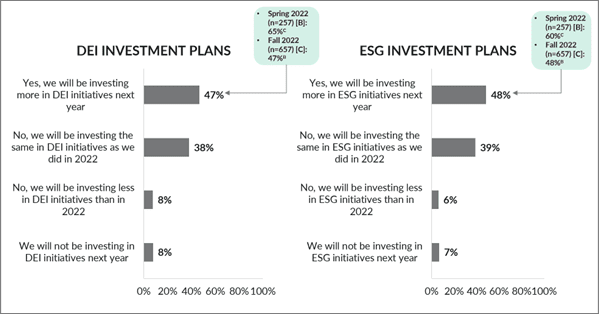

DEI and ESG Initiatives Still in Focus

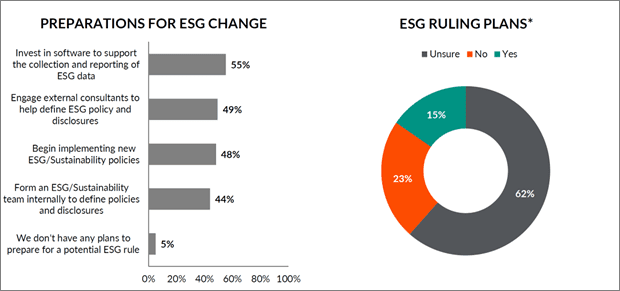

Despite the economic headwinds that are predicted, and with the new mandatory disclosure requirements being proposed by the US SEC and regulators in other countries, investments in ESG and DEI remain a priority. Half of organizations surveyed expect to invest more in DEI and ESG goals and Initiatives in 2023 than in 2022. This is a significant drop compared to expectations from earlier this year (65% in DEI and 60% in ESG). Still, over a third of enterprises expect to invest the same in DEI and ESG in 2023 (38% and 39%, respectively) (see figure 3).

Figure 3 – DEI and ESG Investment Plans

When asked about their plans to prepare for changing ESG Reporting requirements, nearly half of financial executives surveyed have started or plan to start forming an internal ESG/Sustainability team to define policies and disclosures. A similar proportion (41%) will begin (or have already begun) implementing new ESG/sustainability policies. Compared to earlier this year, fewer are planning to invest in software to support ESG data collection and reporting. Among those who currently don’t have a plan in place, half (50%) indicate they may implement a plan if ESG reporting mandates impact their organizations.

When asked about what type of software is currently being used or planned to be used to support ESG reporting, extensions of CPM software (52%) are the most used software for supporting the collection and reporting of ESG data.

Investments in Cloud Planning and Analysis Tools Increasing

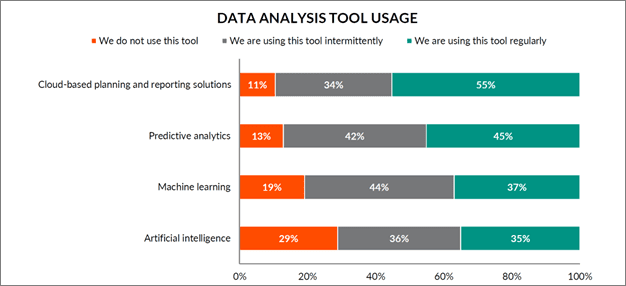

The economic uncertainty and potential recession that’s predicted for 2023 will require Finance teams to do more with the same or less resources, which also points to the need for more automation and digital technologies to help streamline planning, reporting and analysis processes.

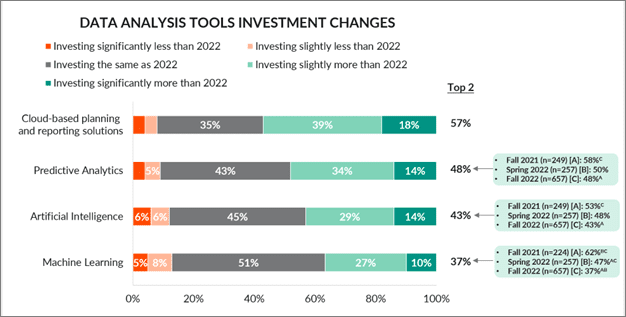

According to the Fall 2022 survey, over half of financial leaders predict investing more in cloud-based planning and reporting solutions in 2023 than in 2022. Meanwhile, only one-third of companies (37%) predict investing more on machine learning. This is significantly fewer than predicted both last fall and earlier this year (see figure 4).

Figure 4 – Expected Investment in Data Analysis Tools

When asked about the top use cases for artificial intelligence or machine learning, surprisingly, financial reporting is the top opportunity identified by financial leaders in the Fall 2022 survey. This was followed by sales/revenue forecasting (41%) and demand planning (39%) as the second and third largest opportunity for organizations. Very few financial leaders (3%) do not see any opportunities for AI/machine learning to help their business.

Learn More

The results of the Fall 2022 Financial Decision Makers Survey highlighted the ongoing business challenges CFOs and Finance leaders face as they exit 2022 and plan for what’s ahead in 2023. Inflation, higher interest rates, supply chain bottlenecks, and recession are here to stay in 2022 and most Finance executives expect them to continue into 2023. The mandatory ESG disclosures being proposed by the US SEC are driving many organizations to invest in their ESG processes and software to help not only with reporting compliance, but also with planning and managing ESG and DEI initiatives.

The good news is that today’s cloud-based analytical software technologies are seeing increased adoption and are proving their worth in helping Finance teams become more efficient, plan and navigate a volatile economic landscape and increase their agility to respond. Artificial intelligence and machine learning adoption lags more mainstream planning and predictive analytics tools, but as these capabilities are embedded into modern planning, reporting and analytical software applications, Finance adoption is poised to expand rapidly.

To learn more, download the Hanover Research Fall 2022 Finance Leaders Outlook report and contact OneStream if your organization needs help conquering the complexities of today’s economic landscape.

Scenario planning is a powerful tool that helps Finance professionals create agility in the financial planning and forecasting process. Through modeling different scenarios and assessing the associated risks and opportunities, Financial Planning and Analysis (FP&A) can future-proof the financial planning process. How? By ensuring that many of the what-ifs associated with the current market volatility are addressed and putting in place action plans to address whatever might arise.

Scenario Planning Enables Agility in Financial Forecasting

Most people regularly engage in some form of scenario planning. Whether it involves bringing a jacket to dinner because it might get chilly outside or carrying jumper cables in the car in the event of a dead battery, scenario planning is the process of thinking through and preparing for various possible scenarios.

From a financial planning perspective, scenario planning helps Finance professionals think through different variables that may affect the business. Why is this important? Well, it helps with identifying warning signs that indicate potential disaster and allows the business to be more agile in reacting and adjusting to change. As most Finance professionals know, by the time the financial plan is finalized, it has already become outdated given the pace at which things change in the marketplace today.

As the pace of change increases – and disruption and uncertainty become more commonplace – it becomes increasingly critical that organizations not only recognize the signs that indicate change but also put in place a plan to react to the possible scenarios that result from any changes. Scenario planning provides a consistent process, framework and collaborative environment that enables organizations to react with agility and certainty in the face of uncertainty and constant change and disruption.

Here are ways to monitor for three signs that financial disruption may be on the horizon:

- Supply Chain Disruption: Monitor for supply chain disruptions – such as the lack of availability of raw materials, labor shortages, shipping delays and more – that can wreak havoc to avoid expensive shipping fees, spot procurement rates or other costly issues by reacting sooner to the disruption and having a mitigation plan in place.

- Demand Sensing: Detect changes in customer habits and demand (e.g., from seasonality trends to competitor trends) that impact manufacturing and avoid costly mistakes like having too much product that won’t sell or not enough stock of an item in high demand.

- Economic Factors: Identify and track economic metrics relevant to the business – such as COVID-19 cases, interest rates, unemployment claims, and tourism and travel cancelations – to adapt accordingly as is relevant to the line of business.

Scenario Planning Identifies Best- and Worst-Case Scenarios

Scenario analysis looks to identify the baseline scenario, which is the base financial plan, and then identify the best- and worst-case scenarios. By assigning risk and opportunity factors to the baseline plan, the best- and worst-case scenarios take shape. Decision-makers are also empowered with the information necessary to take advantage of available opportunities while mitigating risks to financial performance.

By driving a continuous process of assessment to the financial plan, scenario planning elevates FP&A. Specifically, FP&A shifts from being a backward-looking process – one that involves developing a plan and then assessing where it fell short or performed better than expected – to one that can be predictive.

Benefits to Scenario Planning

Having a scenario planning process in place drives collaboration between key stakeholders in the investments and outcomes that move the needle for organizations. How? By ensuring these items are continually being talked about and getting the attention they deserve. Being proactive about these risks and opportunities therefore ensures that the financial planning process isn’t static. Instead, the process is set up for success no matter the outcome.

Here are some key benefits of scenario planning:

- Future-Proof the Financial Plan: Set up the organization to react swiftly and decisively to change. After all, change is an inevitable byproduct of growth, and by accounting for various scenarios, the organization is set up to react with agility and certainty when facing volatile market conditions. Scenario planning helps not only identify possible points of risk or failure in the future, but also calculates for unknowns like labor shortages and supply and demand changes. By having a plan in place to react to these aspects, the organization can respond swiftly and with certainty to avoid potential disaster

- Assess Risks and Failures: Account for possible risks and failures before they materialize and impact the P&L and balance sheet. In essence, the organization avoids potential disaster by preemptively assessing the risks and developing action plans and mitigation activities. Risks and opportunities analyses happen as a continuous collaboration process to assess the baseline plan and adjust forecasts. This process can account for opportunities such as early shipments from suppliers or risks like late deliveries due to supplier shortages or shipment issues.

- Maximize Financial Outcomes: Calculate gains and losses on investments in real estate, machinery or manufacturing facilities, and provide a framework to track risks and opportunities. To do so, the organization must drive a process of continuous monitoring and collaboration and provide KPIs to regularly track and measure the success of the scenario planning process. Organizations can then sense and react to impending risks and offset them with available opportunities (e.g., investments in process improvements or capital investments) that will result in measurable financial savings.

FP&A Is the Ideal Leader for Scenario Planning

As a strategic business partner to Sales, Supply Chain, HR and IT groups, FP&A has the unique opportunity to elevate the value of scenario planning. How? By incorporating scenario planning not as a one-time ask, but rather by making scenario planning part of day-to-day collaboration and continuous eXtended Planning & Analysis (xP&A) cycles.

In doing so, FP&A can leverage scenario plans as a key input to measure and maintain organizational financial health and profitability – and partner with line-of-business leaders to drive performance.

Learn More

Want to learn more about how scenario planning creates agility in the financial forecasting process? Check out our solution brief on Rapid-Response Finance.

The global economic landscape in 2022 has created challenges for CFOs and Finance teams around the world. Just when we thought we might get a break from the pandemic that has besieged the world since 2020, new variants have emerged and have driven continued surges in the virus in China, Europe, and many parts of the US. Supply chain disruptions that started during the pandemic have continued to plague many industries and have driven inflation to the highest levels in 40 years.

Moreover, the war in Ukraine has created increasing pressure on global oil and natural gas prices, which are rippling through the global economy, impacting individual consumers and enterprises alike. So how are CFOs and other Finance executives planning for the remainder of 2022 and 2023? Read on to learn the results of the May 2022 Financial Decision-Maker Outlook survey, sponsored by OneStream Software.

Getting Inside the Heads of Finance Executives

For the past few years, OneStream Software has sponsored surveys of Finance executives to gain a better understanding of how they are helping their organizations navigate the complexities of today’s economic landscape. In the Spring of 2022, Hanover Research surveyed 257 Financial Decision Makers in North America to understand their views on inflation, supply chain disruptions, tax reform, talent management, ESG, and DEI initiatives, and technology investments.

According to the survey, the impact of ongoing global disruption, such as supply chains, inflation, the war on talent, and the Great Resignation, still pose significant challenges. As finance leaders forecast and plan for the future amid this new reality, they must remain agile to survive and thrive. Almost three-quarters of finance leaders expect inflation and supply chain disruption to extend into 2023, with more than half needing to increase prices to offset the impact on their business.

As they continue to navigate the uncertainty of the current economic landscape, 30 percent of finance leaders identified economic disruption as the largest threat to business in 2022. When asked about current business drivers and plans for the coming 12-18 months, CFOs and other financial leaders were heavily focused on economic disruption and other key factors.

Economic Disruption Surpasses Cybersecurity as Largest Threat to Business in 2022

The current financial climate has CFOs and finance leaders predicting inflation and supply chain challenges will extend through mid-2023, forcing organizations to implement new practices to manage the impact on business. About half of respondents polled noted they are increasing prices (51 percent), leveraging new sales initiatives and campaigns (48 percent, a 13 percent increase from the Fall 2021 survey), and expanding their supplier network (47 percent, a 12 percent increase from the Fall 2021 survey) as a result.

Tax reform and planning are on the radar of almost all finance decision-makers as potential new U.S. global tax policies are on the horizon that may impose a minimum tax rate. Half of the organizations polled will need to update their 2022 strategies, including tax planning and provisioning processes (64 percent), and 45 percent said tax changes would significantly alter their 2022 forecasts.

Organizations are Prioritizing DEI Initiatives and ESG Investments

With ESG reporting guidelines converging and new mandatory disclosure requirements being proposed by the US SEC and regulators in other countries, investments in ESG and DEI remain a priority. These findings align closely with the Spring 2021 survey, as 60 percent committed to investing more in DEI and ESG initiatives this year. While two-thirds of respondents report uncertainty around planning for new ESG guidelines and disclosure requirements, almost all (95 percent) are preparing for this change either by implementing new ESG/sustainability policies, engaging consultants, or investing in software to capture and report ESG data.

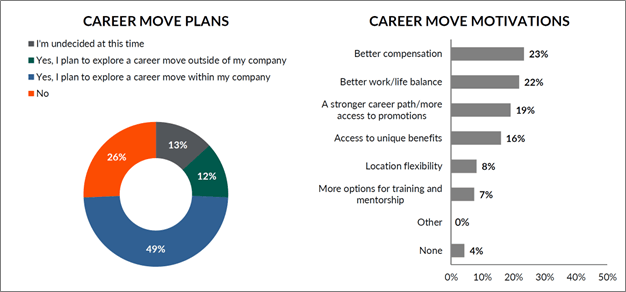

CFOs Target Investment in Talent to Combat Great Resignation

The Great Resignation and war on talent continue to support an employees’ market, challenging organizations to revisit their approach to talent acquisition and retention and expand recruitment practices to remain competitive. In the quest for talent, finance leaders are investing in training and employee development (56 percent), improving internal and external workspaces (52 percent), and building company culture (47 percent), among other efforts. When asked if they plan to make a career change of their own this year, almost half confirmed yes, but within their existing organization.

Increased Investments in Predictive Technology, Especially Machine Learning (ML)

With almost half (47 percent) of organizations planning to increase investment in ML this year, and the majority (63 percent) already seeing a return on their investment, it’s clear this technology is serving finance leaders and their teams well. In fact, 87 percent of respondents have either adopted, or are in the process of adopting, an AutoML solution to support intelligent process automation, data center optimization, customer service, and sales/marketing optimizations, among other use cases.

Cloud-based solutions and predictive analytics are also popular among the majority of finance leaders, with one-third saying they use the technology regularly. These solutions will receive increased investment in 2022 than in previous years, with 22 percent of respondents planning to invest more in cloud-based software and 21 percent investing more in predictive analytics. When asked about roadblocks to technology investment this year, 42 percent responded that cost was a factor, in addition to cybersecurity concerns (38 percent) and the technical skill gap of employees (38 percent).

Learn More

The results of the Spring 2022 Financial Decision Makers Survey validated what OneStream Software is seeing and hearing from our customers in terms of the business challenges they face. Inflation and supply chain disruption is here to stay in 2022 and most Finance executives expect them to continue into 2023. The mandatory ESG disclosures being proposed by the US SEC are driving many organizations to invest in their ESG processes and software to help not only with reporting compliance but also with planning and managing ESG and DEI initiatives.

The good news is that today’s cloud-based analytical software technologies are proving their worth in helping organizations plan and navigate a volatile economic landscape and increase their agility to respond. Other surveys show Finance departments lagging other parts of the enterprise in the adoption of AI and ML tools, but as these capabilities are embedded into modern planning, reporting, and analytical software applications, Finance adoption is poised to expand rapidly.

To learn more, download a copy of the May 2022 Financial Decision Makers Survey and contact OneStream if your organization needs help conquering the complexities of today’s economic landscape

As modern Finance leaders learn how to adapt to global shockwaves, clarity about the future of Financial Planning & Analysis (FP&A) gets increasingly more defined. At the forefront is a push toward coordinated planning to achieve greater alignment between Strategy, Finance, and Operations. But a few years ago, the promise of transforming financial and operational planning into one cohesive ecosystem fell short due to the limited availability of technology. Once again, planning process advancements outpaced the supporting technology – or at least that’s what you’ve been told.

Join us to learn the truth: your organization has a choice – unify connected planning or face the hidden costs.

Due to becoming increasingly sophisticated, organizations continue to face challenges when leveraging technology to support Finance. And the additional pressures of volatile revenue streams mean Finance leaders must still manage growth, optimize emerging technologies, address increased needs for globalization, evolve target operating models, and enable mobile employees. Those same leaders must also find new ways to increase productivity, optimize costs and maximize relationship value.

This concept of connecting all business planning processes into one seamless, integrated solution is on the mind of many Finance leaders. And it’s especially on the minds of those seeking to improve organizational collaboration and decision-making.

Why? Because Finance must cope with the fallout of a global pandemic, nationwide staffing shortages, endless supply chain disruptions, and unforeseen geopolitical pressures thousands of miles away. To stay ahead of these disruptions, leaders must extend planning beyond the traditional Financial Planning & Analysis (FP&A) group and instead partner with Sales, Supply Chain, HR, and other functions to quickly re-plan and re-forecast without adding complexity or overhead.

And despite the challenges, many organizations are still dependent on multiple connected legacy corporate performance management (CPM) tools or even spreadsheets to manage critical financial and operational processes. Many CPM modeling and planning toolkits – such as Anaplan, Board, or Essbase –tout flexibility and speed for departmental planning needs. But these toolkits are not designed to unify connected planning processes across the enterprise.

Why? Because rather than leveraging a unified, extensible architecture, modeling toolkits instead rely on a series of individual planning models that must be “connected” together. Having disparate models not only creates data latency, risk, and chaos, but also makes the planning process maintenance-intensive, difficult to access, slow to consolidate, and inconsistent. Not to mention, such chaos is prone to user errors and comes with a high cost for data movement.

Now Is the Time to Unify Connected Planning or Face the Hidden Costs

Over the coming weeks, we’ll share a four-part blog series discussing the path toward unifying connected planning through digital transformation. Here’s a sneak peek of the key topics in our Unify Connected Planning series:

- Part 1: 5 Signs It’s Time to Scale Connected Planning

- Part 2: 4 Hidden Costs of Modeling Toolkits

- Part 3: Moving Beyond Modeling Toolkit Chaos

- Part 4: AI-Enabled FP&A

Regardless of where you are in your finance journey, our Unify Connected Planning series is designed to share insights from the experience of OneStream’s team of industry experts. We recognize, of course, that every organization is unique – so please assess what’s most important to you based on the specific needs of your organization.

Conclusion

The aspiration of unifying connected plans is nothing new. But to remain competitive amidst the increasing pace of change and technology disruption, Finance leaders must think differently to finally conquer the complexities inherent in fragmented point solutions and disconnected modeling toolkits for enterprise planning.

Still, the introduction of eXtended Planning & Analysis (xP&A) puts Finance in the driver’s seat to inspire a digitally ready, data-driven, and performance-focused culture across the entire organization to help realize the promise of true integrated business planning (IBP). To provide the operational relevance and flexibility required for Line-of-Business groups AND Finance. To enable the organization with controls and the governance required to not only evolve and scale but also continue the endless journey of unleashing the true value and potential of the Finance team and beyond. And through it all, there’s one shared goal – to drive performance and inspire a new standard for corporate performance management.

At OneStream, we call this standard Intelligent Finance.

Learn More

To learn more about the value of unifying connected planning, download our whitepaper titled “Unify Connected Planning or Face the Hidden Cost” by clicking here. And don’t forget to tune in for additional posts from our Unify Connected Planning blog series!

Financial reporting is an essential function of any Finance organization. It provides stakeholders with a snapshot of the financial results and financial position of the enterprise. You may think that financial reporting is mainly a function of the Accounting group within the Office of Finance, however financial reporting and the related analysis of financial results is an important function of most Financial Planning & Analysis (FP&A) departments. Financial reporting capabilities are also an important feature to evaluate when selecting a software package to support FP&A as well as the Accounting team. Read on to learn more.

What is Financial Reporting?

Financial reporting refers to processes and practices that provide stakeholders an accurate depiction of the finances of an enterprise, including its revenues, expenses, profits, capital, and cash flow. The enterprise could be a private or public company, non-profit, government agency, higher education institution, or other organization.

The primary financial statements that are produced through the financial reporting process include the following:

- Balance Sheet – Provides a consolidated view of the assets, liabilities, and capital of the enterprise at a specific point in time. The balance sheet is typically produced at month-end, quarter-end, and year-end.

- Income Statement – Also known as profit and loss, an income statement is a financial report that summarizes the enterprise’s income, expenses, and profits or losses over a specific period of time. Income statements are typically produced for a specific month, quarter, full year, or on a year-to-date basis.

- Cash Flow Statement – The cash flow statement summarizes the amount of cash that the enterprise has generated (sources) and how the cash is being spent (uses). It contains elements of both the income statement and the balance sheet, and it is critical to the successful financial management of an enterprise.

Key Stakeholders and Their Requirements

Financial reporting needs to inform and serve the needs of a variety of stakeholders. This can include external stakeholders such as investors, owners, bankers, public markets, regulators, and boards of directors – who all need to understand the financial performance of the enterprise to guide investment decisions, levy taxes, ensure compliance, and provide advice to executive management.

External stakeholders are typically most interested in the key financial statements mentioned in the prior section, as well as supporting details, schedules, and commentary (e.g., management discussion and analysis) about the financial performance of the enterprise.

Financial reports are also essential tools for informing internal stakeholders about the financial performance of the enterprise. This can include the CEO, CFO, and senior management team, as well as managers across the enterprise who need to understand how their particular subsidiary, department, business unit, or function is performing in relation to the overall enterprise. Internal stakeholders are typically most interested in the consolidated income statement of the enterprise, as well as profit and loss reports for their specific area of responsibility. This is where financial reporting expands to include financial analysis. This financial analysis delivered as part of internal management reporting may include the following:

- Comparisons of the financial results to the original budget for the period showing positive and negative variances that should be analyzed.

- Comparisons against prior period performance (e.g., prior quarter or same quarter in the prior year)

- Comparisons of revenue, expenses, and profit or loss across subsidiaries, business units, departments, or product lines.

The form these internal financial management reports may take can vary based on the preferences of the internal stakeholders. Some may prefer printed financial reports or books of reports. Some may prefer electronic access to financial reports via email delivery, while others may prefer to review financial results through an interactive dashboard (see figure 1), with the ability to drill into key performance indicators (KPIs) or values on financial reports. Financial and operational analysts may prefer to have access to financial and operational results via an Excel spreadsheet so they can slice and dice the data and perform scenario analysis as needed.

The Financial Reporting Gap

Given the demanding requirements of internal stakeholders when it comes to financial reporting and analysis, you might be wondering how well enterprises are doing in meeting the needs of this audience. Unfortunately, despite the explosion of data across organizations, many organizations still struggle to meet the information requirements of executives and managers because they just don’t have the right tools for the job.

In fact, according to the FSN Future of Analytics in the Finance Function survey from 2020, only 14% of Finance leaders consider their reporting and analytics insightful. That means 86% of reporting and analytic effort is missing the mark. Why is this? Because most enterprises are relying on fragmented silos of spreadsheets, legacy ERP and corporate performance management (CPM) software, data lakes, and BI tool for their reporting needs, which force Finance teams to build disjointed processes around their technology and are not organized in a way they understand.

Reporting and Analytics in CPM Software

Today’s modern CPM software solutions offer a number of advantages over legacy CPM solutions. They are most often deployed in the cloud enabling faster time to benefit. They offer specific functionality designed to address the financial close, consolidation, planning, reporting, and analysis needs of enterprises. And most include robust, built-in reporting and analysis capabilities. If this isn’t part of the CPM solution you are selecting, then you’ll need to augment the solution with 3rd party BI and reporting tools.

For example, with a broad range of reporting and analytics capabilities, OneStream helps reduce reliance on spreadsheets and fragmented reporting tools to increase the speed, scope, and accuracy of reporting across the organization. OneStream’s Intelligent Finance Platform (see figure 2) unifies finance processes across the office of the CFO while enabling the organization with self-service, easy-to-use financial reporting software for a variety of stakeholder groups. OneStream’s reporting and analysis capabilities include the following:

- Guided Reporting for rapid creation of financial statements

- Production Reporting for pixel-perfect operational reporting

- Interactive Dashboards with sophisticated data visualizations

- Analytic Blend engine which combines detailed operational data with summarized financial data so managers can identify daily and weekly trends and financial signals

- Microsoft Excel® integration for data entry, reporting, and analysis

- Microsoft Office® integration including Word and PowerPoint

Learn More

Financial reporting is an essential function for both Accounting and FP&A functions, and these capabilities are an important factor to consider when enterprises are evaluating CPM solutions for financial close, consolidation, planning, and forecasting.

Over 1,000 enterprises have chosen OneStream’s unified Intelligent Finance platform to support their financial close, consolidation, planning, reporting, and analysis requirements and to deliver timely, accurate financial and operational results to internal and external stakeholders. To learn more, check out our interactive eBook and contact OneStream if we can be of assistance.

The year 2020 was one that anyone who has experienced it will not soon forget. After starting off the year with great expectations about the decade ahead, by March the global COVID-19 pandemic had put a wrench in just about every organization’s plans for the year and cast a major blow to the global economy. Fast forward to 2022 and the situation has improved drastically. The global availability of several vaccines and advanced treatments has reduced the risk of severe illness or death as we transition to the endemic stage of COVID-19 and its variants.

But we have seen continued disruptions of global economies and supply chains, as well as increasing inflation as a result of the pandemic and as geopolitical challenges. All of these forces have become a true wake-up call for any organization that hasn’t undergone a digital transformation of its business and finance processes. Why? Because digital finance transformation is critical to creating the agility required to navigate disruption and conquer the complexities of operating in today’s dynamic global economy.

Leading at Speed Starts with Conquering Complexity

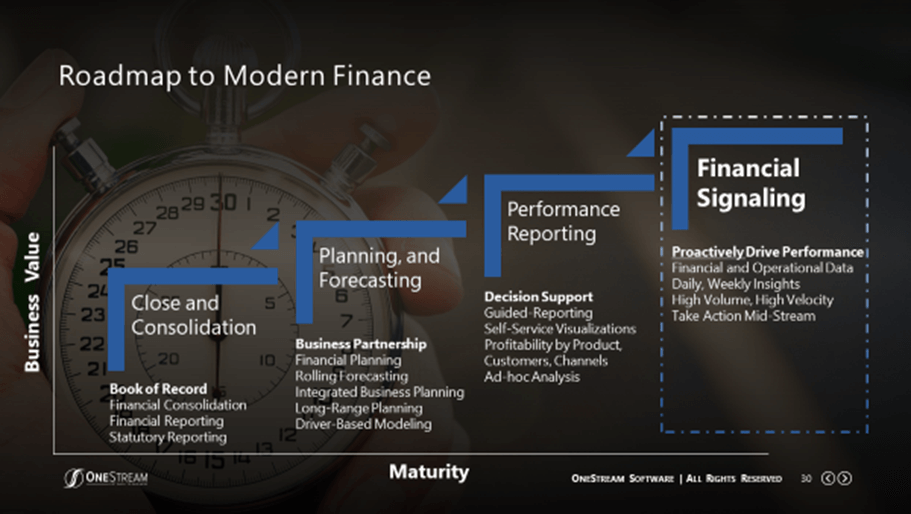

In October of 2020, I published a blog post titled “Finance in the 2020s – How to Conquer Complexity and Lead at Speed.” In that article, I described a Modern Finance Maturity Model that provided a roadmap to conquering the complexity of critical finance processes and enabling CFOs and Finance teams to operate with more agility.

The key message was that Finance executives and teams need to master the basic finance processes, then layer on more advanced capabilities that can drive digital transformation. (see figure 1)

Mastering the basic finance processes includes streamlining and simplifying book of record financial reporting and implementing agile planning and forecasting. With these processes running efficiently, Finance teams can then support strategic decision-making across the enterprise through period-end performance reporting, then move into the more advanced process of financial signaling.

Sounds simple right? Not really. There’s a lot of work that is required, but it doesn’t have to all be accomplished in one fell swoop. The best path to success is to think big — but start small and incrementally build a path to leading at speed through the adoption of modern, digital technologies.

6 Steps to Leading at Speed

Here are six steps successful finance organizations are taking to conquer complexity and put themselves in a position to lead at speed. The order of the steps described here is not carved in stone, it can vary depending on the challenges and requirements of a particular organization. The 6 steps include the following:

- Drive Simplicity and Efficiency in IT Systems

- Implement a Fast and Accurate Financial Close Process

- Align Strategic, Financial, and Operational Planning

- Empower Managers with Financial and Operational Data and Metrics

- Leverage Advanced Analytics Such as Predictive Forecasting Artificial Intelligence, and Machine Learning

- Ensure Internal Systems and Processes are Poised to Support Growth and Expansion

These steps are described in more detail in a white paper titled: “6 Steps to Leading at Speed”, which you can download here. In summary, in order to lead at speed, organizations need efficiency in IT systems, agile business processes, and the ability to deliver timely and accurate financial and operational results to executives and decision-makers across the enterprise.

This can only be accomplished with a unified, CPM software platform that can conquer the complexity of these finance processes and enable CFOs and finance teams to lead at speed.

Leading at Speed in Action

As mentioned above, the order of the steps described here isn’t carved in stone, nor should an organization try to accomplish all of these steps at one time. Where a particular organization decides to focus its efforts should be driven by business needs and priorities. But as the organization accomplishes these steps, the business benefits will begin to accumulate.

OneStream has worked with hundreds of organizations to help Finance teams conquer the complexity of their finance processes, unleash the value of their finance teams, and empower the enterprise with financial and operational insights. Download the “6 Steps to Leading at Speed” white paper to learn how these organizations have simplified their IT landscapes and reduced TCO for Finance applications. You can also learn how they increased Finance team productivity, shifted more time to partner with a line of business leaders, and increased their business agility. Now that’s leading at speed!

On 6 April, OneStream’s EMEA Managing Director Matt Rodgers had the privilege of hosting a conversation between tennis Brand Ambassador Jamie Murray and our Chief Financial Officer Bill Koefoed. They explored a variety of topics that cut across the worlds of tennis and modern Finance including agility, performance optimisation, and harnessing technology to lead at speed. Read on to hear the highlights of their conversation.

Ready for Change

Court surfaces, weather conditions, and even time zones – the life and career of a professional tennis player must by nature anticipate the unpredictable. Such factors not only impact players’ performance, but also the game itself down to ball speed and bounce. Jamie Murray emphasised how important it is for players to be adaptable and agile if they want to stay on top of their game. By developing muscle memory, a fundamental strategy will be in place and ready to adapt as needed in competition. As well as strategy and tools, the right people need to be in the team or organisation in order to survive and thrive. For Jamie, the broader support team is essential: playing partner, coach, trainers, and even family.

Bill Koefoed joined OneStream as CFO in November 2019, mere months before the Covid-19 pandemic shut down the world. The bulk of his experience as a Finance leader at OneStream has been to lead the organisation and its people through massive disruption as well as rapid growth. He agreed with Mr. Murray that strong teams are important, as well as visibility into the organisation and key metrics. Leadership and success come through agility and being able to plan for different scenarios. To achieve this, CFOs need to track KPIs, goals, and data more frequently than ever across Finance and Operations.

Measuring Performance and Leading at Speed through Technology

Similarly, Mr. Murray sets goals at the start of each season. By tracking results and analysing KPIs for each match he can identify what is or isn’t working well, identify opportunities for improvement, and adapt mid-season. In tennis not only has data analysis evolved but there have been fundamental changes in technology. Gone are the days of wooden racquets. Today’s lightweight racquets and synthetic strings enable players to increase power, speed, and control. According to Mr. Koefoed, Finance leaders cannot lead at speed with the equivalent of wooden racquets. Old technology is limiting, lacking basic foundations for true agility in the face of disruption that characterizes the new normal. Data lives in siloes, and manual processes lead to risk and wasted time that does not add value to the organisation. Modern Finance tools enable more advanced capabilities that give a Finance department unparalleled insight and transform them into a true business partner.

The Future of the Game

Mr. Murray commented that in tennis, as in all professional sports, advancements in science and technology, training and nutrition are helping players have longer careers. As a business, professional sports continue to grow with the financial rewards massively increasing over time. This increases exposure of the game and encourages a healthy interest in sport for the next generation. Mr. Murray left us with some words of wisdom about not only physical health, but also mental health, and the need for all people to develop strength and resilience through the highs and lows of life whatever career we are in.

Said Mr. Koefoed, the Finance game has evolved too. As the world moves faster, organisations must be ready to adapt on a continual basis. With the right people, processes and technology in place, even the most complex organisations can be ready to truly lead at speed.

The recording of the full conversation with Jamie Murray and Bill Koefoed is available here.

About Jamie Murray

To date Jamie Murray has claimed 26 ATP doubles titles, including two men’s Grand Slams: the Australian Open and the US Open. He won a further five mixed doubles titles at Wimbledon and the US Open and is currently ranked #20 in the world.

About Bill Koefoed

Bill Koefoed, Chief Financial Officer of OneStream Software, has more than 25 years of experience in Finance leadership. Before joining OneStream, he served as CFO for online retailer Blue Nile, and prior to that was in senior Finance leadership and investor relations at Microsoft.

As we near 2022, uncertainty remains a steady theme for the year ahead. Finance leaders are looking to become more strategic with decision making and planning to get ahead of the uncertainty. While also driving connectivity among teams through a hybrid work environment. In OneStream’s third Women in Finance webinar, we discussed how women in finance can empower one another to serve as leaders to drive connections.

Moderated by Pam McIntyre, Corporate Controller at OneStream, the webinar featured a panel of three innovative leaders across various industries. The panelists include Moonsun Park, CFO at Sharp Electronics; Beth Elwell, VP of Financial Planning & Analysis at Trane Technologies; and Amy Corbin, CFO at Surescripts. Below are highlights from the panel discussion, including the importance of connection and driving productivity through flexibility.

Creating Lasting Connections in a Remote Environment

The Women in Finance webinar kicked off with questions on the importance of mentorship and making connections in today’s hybrid work environment.

Moonsun Park highlighted the importance of mentorship and having an advocate in the development of her career. She credits her mentor as a sounding board for her both professionally and personally.

Beth Elwell discussed the importance of connecting with individuals outside of your job function. Her mentor was a leader within her organization outside of finance. Elwell explained how her mentor served as an incredible resource and friend in her career. “Business partnership is so important. Just because someone isn’t in your function doesn’t mean they’re not going to help you in your career. You never know what door they’re going to open,” said Elwell.

Amy Corbin encouraged listeners to think of mentors as influencers. “Sometimes you need someone to connect you with someone else in your organization or within the community,” she said. “Look through the lens of who is connecting you and who is influencing you.”

Empowering Women in Finance

The panelists provide a piece of advice they have for women aiming for the top of their careers, while facing the challenge of an environment where access to leaders is more restricted.

Corbin encouraged women in finance to reduce reliance on talking purely about numbers. Instead, turn it into a business conversation. “To go far in your career, make yourself relevant to the business in the business’s language. Stakeholders are looking for a business partner, not a numbers person,” she said.

Focusing on connectivity, Elwell recommends that women build relationships across team members, managers, customers, and mentors. To build these connections in a hybrid work environment, Elwell said “Don’t underestimate the power of video. Communicating through video allows people to be more engaged in the conversation, creating more powerful and lasting connections.”

Park added to Elwell’s perspective, “Be visible and be present as much as possible.”

Beating Burnout Through Flexibility

The panelists discuss how they balance the demand of work with the flexibility to prevent burnout. Park encourages her teams to take time off and to focus on delivering the quality of work versus the quantity. She credits OneStream’s unified and scalable CPM technology as “a huge benefit in terms of time savings.” Park believes turning manual processes into more automated ones has enabled her team to do more value-added activities as business partners.

“The key to this balance is prioritization,” adds Elwell. She advised teams to focus on understanding what the customer needs in terms of data when they need it. “It’s important to understand dependency and making sure management reporting is streamlined as much as possible to eliminate waste,” she said.

Corbin shared the importance of remaining flexible in meeting stakeholders where they are. “It’s about setting realistic timeframes and being realistic about turnaround,” she said. Corbin also emphasized the importance of being open to change. “It’s ok to try something new, possibly make a mistake and try again.”

Advocating for Yourself and Empowering the Next Generation

The conversation then focused on best tips for how women can advocate for themselves, while also considering the next generation of women. Corbin advises that “It starts with making yourself invaluable to an area of business and being known for some area of expertise.” She also urges listeners to take any and every volunteer opportunity to try something new and to be willing to take a risk.

Empower you teams to share their ideas, accomplishments, and the work they’re doing to help with driving connectivity. Elwell adds, “Diversity is top of mind for companies right now, so opportunities are more abundant than ever before – but we have to make the opportunities continue to be abundant.” She also encouraged leaders to act as role models for younger generations. “As leaders, we should create safe environments for people to take risks,” she said.

Park recommended that women reach out to leaders within the organization. She adds, “If we don’t know you, we won’t have visibility into what you do unless you make that conscious effort.” She also leverages her position within the company to bring people into meetings while sharing individuals’ accomplishments to the rest of the company.

Learn More and Get Involved

To hear the full Women in Finance discussion, check out the full webinar replay. Continue the conversation and stay connected with the Women in Finance community by joining our new LinkedIn group and stay up to date on future events.