As organizations race to modernize their enterprise performance management (EPM) capability and enable Finance teams to focus on driving business value versus wrangling data, the EPM software market continues to grow and gain coverage from an expanding set of IT industry analyst firms. The most recent example is The Hackett Group®, who entered the fray in early 2024, publishing its first research study evaluating EPM software providers.

Defining Digital World Class®

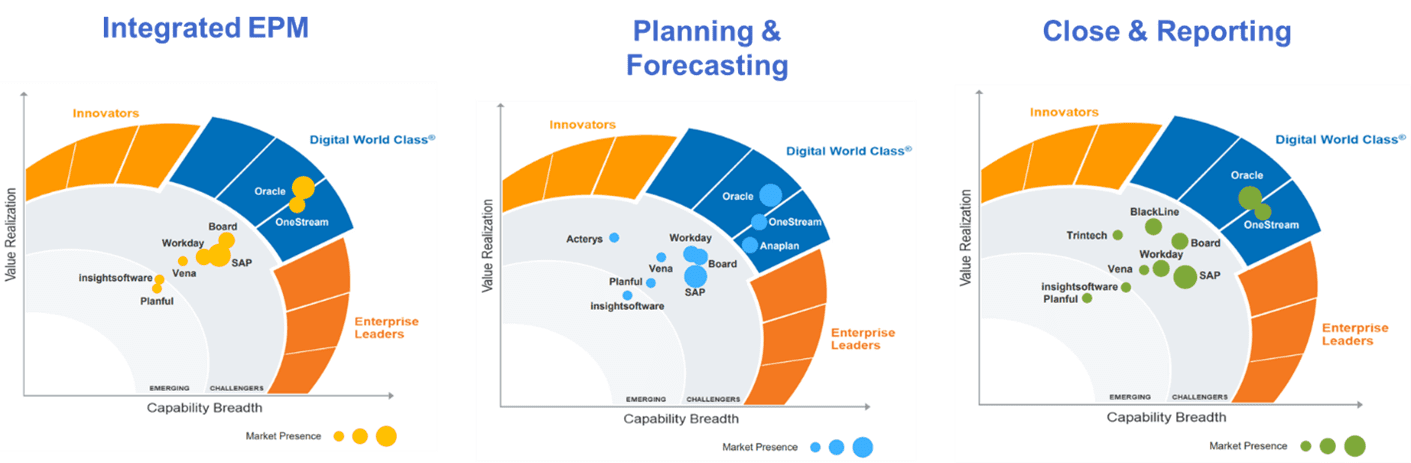

With many years of experience in best practices research covering Finance and other business areas, The Hackett Group’s Digital World Class Matrix™ report covering EPM software providers evaluated and ranked 12 EPM vendors based on breadth of capabilities vs. value realization for customers.

According to The Hackett Group, Digital World Class means greater insight, value and agility delivered faster and at a lower cost. In this study, they found that modern, cloud-based EPM solutions deliver far greater value realization than legacy systems, with approximately 94% of companies being satisfied to extremely satisfied with their deployments.

While some analyst firms evaluate the EPM software market as a whole, and others evaluate the planning vs. financial close segments separately, The Hackett Group took a unique approach and pursued both approaches. The result is an EPM report that separates into three unique matrices based on the nature of capabilities provided across the current vendor landscape:

- Integrated Enterprise Performance Management

- Enterprise Planning and Forecasting

- Enterprise Close and External Reporting

Based on the capabilities of each vendor, they are positioned in applicable matrices and categorized into one of the following areas:

- Digital World Class

- Innovators

- Enterprise Leaders

- Challengers

- Emerging

The size of each vendor’s “bubble” symbolizes their market presence, which is determined through the number of years in the EPM market, and the revenue generated for EPM services delivered.

OneStream Recognized as Digital World Class

Based on a rigorous RFI response, vendor briefings and demonstrations, as well as customer reference checks I’m pleased to report that OneStream was one of only 2 vendors out of 12 evaluated, that was recognized as Digital World Class in all three segments of the The Hackett Group EPM report. (see figure 1 below)

Figure 1 – The Hackett Group Digital World Class Matrices for EPM Software

OneStream is pleased to be recognized by The Hackett Group as Digital World Class in all three categories as this is a testament to the breadth and depth of capabilities our platform provides across Financial Close & Consolidation, Planning & Forecasting, Reporting and Analytics with the ability to address the complex requirements of the world’s largest global enterprises.

In the report, The Hackett Group’s analyst team highlighted the following capabilities of OneStream:

- OneStream’s unified EPM platform with robust financial intelligence and relational blending provides a unique opportunity for finance to fully align/govern data and improve processes from corporate to business units.

- Relational and periodic data blending via extensible dimensionality and advanced consolidation logic with auditability features improve accuracy.

- Built-in financial intelligence with standard configurable solutions (“Solution Exchange”) accelerates implementation speed and scale for time to value.

- Strong customer feedback with very high satisfaction levels and exceptional vendor engagement.

In describing what it means to be a vendor categorized as Digital World Class, The Hackett Group said the following:

“Digital World Class companies provide top performance in business value and operational excellence and support multiple customers in attaining Digital World Class performance. These companies have an expanded mix of solution capabilities and are achieving high customer satisfaction ratings in value realized.”

The Hackett Group

Learn More

In addition to evaluating and ranking 12 EPM software providers, The Hackett Group’s Digital World Class Matrix for EPM Software report also documents the characteristics of top-performing EPM functions based on extensive customer survey data collected. To learn more, download a free copy of the report, and contact OneStream if your organization is ready to take Finance further and embark on a journey to Digital World Class!

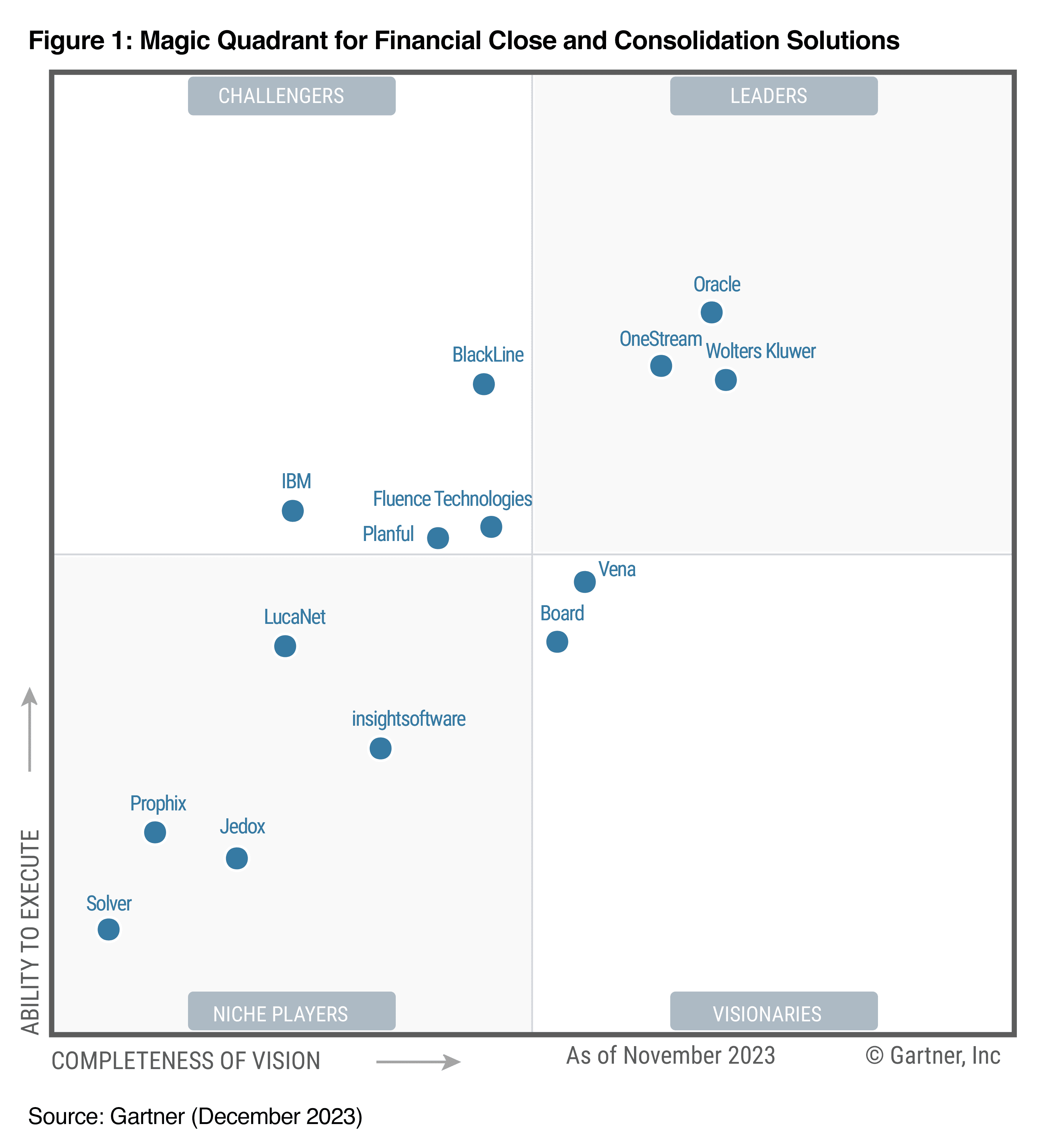

Download the ReportGartner recently published two magic quadrant reports, one covering financial close and consolidation and the other covering financial planning software. Both areas represent critical financial processes that are key to effective corporate performance management (CPM). Read on to learn why OneStream was recognized as a leader in both reports and what this means for customers.

Gartner Evaluates Two Key Software Segments

The Gartner Magic Quadrants are one of the most respected industry analyst reports and are highly influential in helping guide evaluation teams in identifying their shortlist of vendors to investigate.

In Q3 of 2023, Gartner published two Magic Quadrant reports that are important for evaluators in the office of Finance. This includes:

- Gartner® Magic Quadrant™ for Financial Close and Consolidation Solutions1

- Gartner® Magic Quadrant™ for Financial Planning Software2

The research across these two areas covered a broad range of functional requirements and was based on extensive RFIs, product demonstrations and customer references. And I’m happy to report that OneStream was named as a Leader in both reports. Why?

In the reports, the Gartner analysts recognized our broad capabilities provided through OneStream’s Intelligent Finance Platform as well as the ability for customers to extend the platform with additional solutions available from our Solutions Exchange such as Workforce Planning, Capital Planning, Account Reconciliations, Transaction Matching, ESG Reporting and more. Key strengths that were called out include our data integration capabilities, Extensible Dimensionality®, advanced financial intelligence, scalability and innovation.

So why is this important to buyers? It’s important, and valuable to buyers because with OneStream they can get best in class capabilities in a single solution vs. having to implement and integrate multiple software products to support these critical financial processes. Conversely, customers don’t have to compromise on functionality to have a unified platform supporting these critical financial processes.

Unifying Corporate Performance Management Processes

While Gartner evaluates Financial Close and Consolidation vs. Financial Planning as two separate software categories, the reality is that enterprises need to align these processes and their data to have an effective corporate performance management (CPM) process.

This process includes goal setting, modeling, planning, consolidating, reporting and analyzing financial and operational results and continuously refining plans and resource allocations to optimize performance. If the data required to execute the CPM process lives in two or more systems, with different meta data structures and levels of detail, then it must be exported and imported between systems, reconciled and aligned – which takes a lot of time, effort and resources.

Because of this, most enterprises are now adopting cloud-based CPM software solutions that can support their financial close, consolidation and reporting, as well as financial budgeting, planning and forecasting processes, and more.

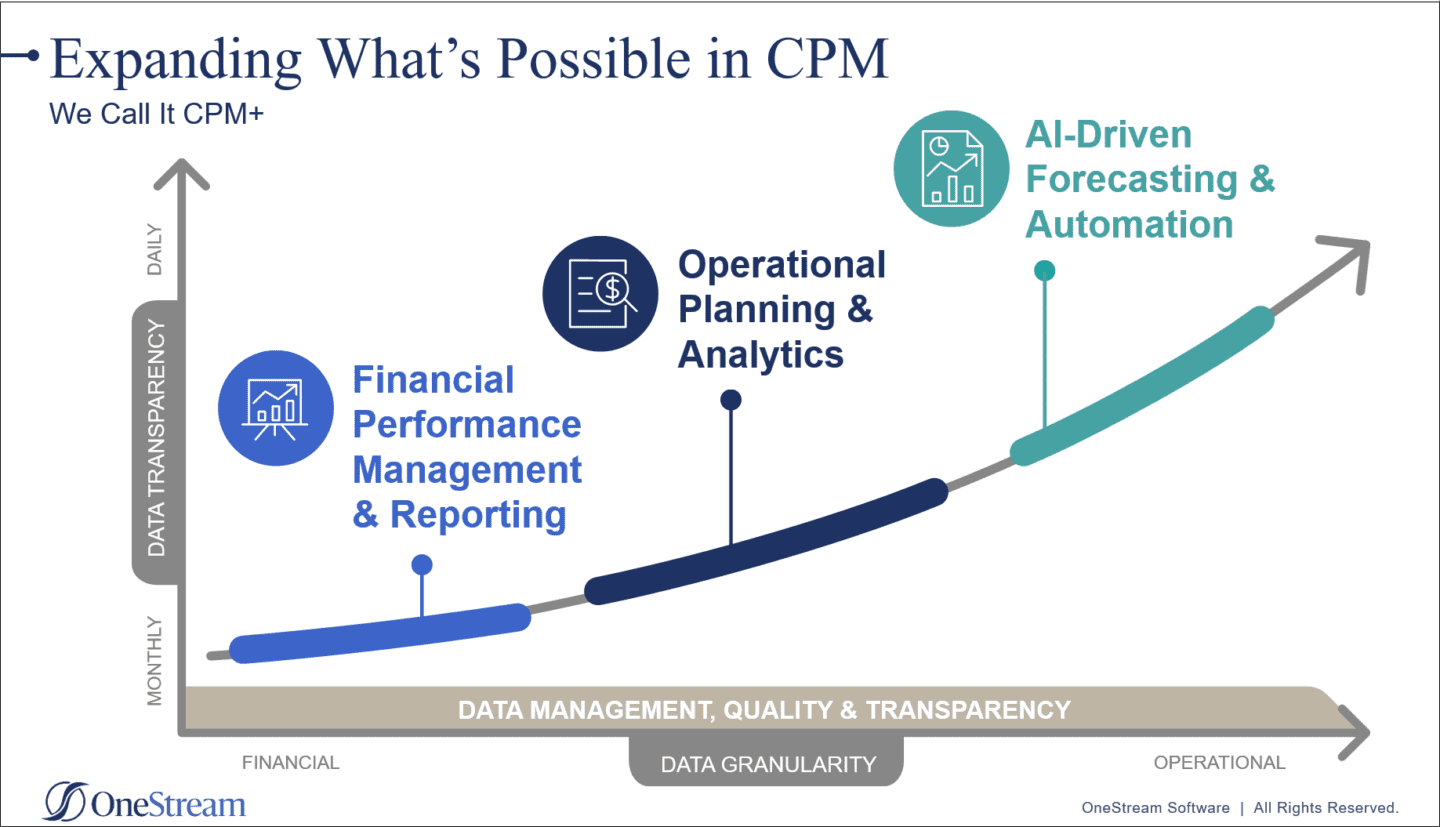

Taking CPM to the Next Level

While many enterprises are working to migrate from legacy CPM applications and spreadsheets to modern, cloud-based CPM solutions, most OneStream customers have already made the leap and are leveraging our unified platform to support their core financial performance management requirements around financial close and consolidation as well as planning, budgeting and forecasting.

Many OneStream customers are extending their investment and leveraging the platform to support operational planning and analytics, not just monthly, but on a weekly or daily basis. And a growing number are taking the next step, embracing AI-driven forecasting to increase the speed and accuracy of their demand planning and revenue forecasting to support more agile decision-making. We call this concept CPM+.

Delivering Exponential Customer Value

As depicted in the graphic above, as enterprises move through the process of extending their CPM processes and OneStream platform investment from financial to operational areas of the business, and from monthly to weekly or daily iterations, they deliver a higher degree of value to the business. Here are a few customer examples:

BDO – in addition to using OneStream for month-end reporting and planning, BDO integrates detailed transactional data with their summarized financial data to empower over 5,000 managers with critical insights on a daily and weekly basis. This includes critical data about their clients, projects, resources, billings, DSO and other metrics that help them guide the business.

Teledyne Technologies – after completing the implementation of OneStream for financial close, reporting and planning, Teledyne extended their implementation to encompass reporting and analysis of operational data. This includes Strategic Sourcing and Procurement across the enterprise, providing managers visibility into their spend across over 300 entities has enabled them to reduce the number of suppliers they are using, negotiate better terms with vendors, and save a substantial amount of spend.

Polaris Inc. – implemented OneStream for financial consolidations, reporting, and planning as well as analyzing weekly product sales at the VIN and customer level. They then became an early adopter of OneStream’s Sensible Machine Learning solution for demand forecasting in their North American Off-Road Products GBU. In addition to improving the accuracy and speed of their forecasting, (reducing the cycle from days to hours) Polaris now has more transparency into what’s behind the ML models, including insights into the key forecast drivers for more informed decision-making.

Learn More

To have an effective corporate performance management (CPM) process, organizations need to align financial close, consolidation and reporting with financial planning and operational planning and analytics processes. This alignment is easier to achieve with a unified software solution vs. implementing and connecting multiple, best of breed products. OneStream is one of only 3 software vendors recognized by Gartner as a leader in both Financial Close and Consolidation as well as Financial Planning software.

To learn more, visit our Analyst Reports page or contact OneStream if your organization is ready to unify your CPM processes and enable more confident decision-making!

Visit our Analyst ReportsThe need for software tools that enable finance and business leaders to navigate today’s challenging economic landscape and vast array of enterprise-level risks with predictive insights and agility couldn’t be greater. This is driving demand for modern, cloud-based financial planning software applications that can replace spreadsheets and legacy planning applications and enable more confident decision-making.

So it’s timely that the 2023 Gartner® Magic Quadrant™ for Financial Planning Software1 was recently published, in which OneStream was recognized as a leader for the second year in a row. Read on to hear the highlights of the report and why OneStream was named a leader.

Assessing the Planning Software Vendor Landscape

In the 2023 MQ for Financial Planning Software, the Gartner analyst team evaluated 16 software vendors based on their ability to execute and completeness of vision, including market understanding, offering strategy, innovation and geographic strategy. Based on their evaluation, OneStream was recognized as a Leader for the 2nd year in a row in this report. This comes on the heels of OneStream recently being recognized as a Leader in the Gartner Magic Quadrant for Financial Close and Consolidation Solutions2.

Why was OneStream recognized as a Leader in the report? I suggest reading the entire report to get the full story, but a few strengths highlighted in the report are:

- Data volumes: OneStream was cited as having one of the fastest data transfer times and user concurrency levels among vendors.

- Innovation: OneStream’s Sensible ML solution was called out as a key innovation, along with our strong roadmap and plans for leveraging Generative AI within our platform.

- Solutions exchange: The OneStream Solution Exchange was highlighted providing customers with access to 75+ add-on productivity and business solutions developed by OneStream, partners and customers to quickly address new requirements.

We believe this recognition underscores our continued momentum in the market, innovation we are driving with our AI/ML strategy, and the value that OneStream’s unified platform delivers to customers, enabling agile financial and operational planning and reporting processes.

Organizations that have adopted OneStream for FP&A are streamlining their budgeting, planning and forecasting processes by an average of 58%, aligning financial and operational planning across the enterprise, and are using our built-in Analytic Services to report and analyze daily and weekly financial and operational signals and trends by integrating large volumes of transactional data. A growing number of customers are leveraging our Sensible ML solution to deliver faster and more accurate demand and revenue forecasts to support more confident decision-making. Here are a few examples:

Polaris – leveraging Sensible ML, Polaris is reducing forecasting cycle times and improving the accuracy of their demand forecasts. The Finance team also has more insights into the key forecast drivers, helping drive more informed decision-making.

Autoliv – leveraging Sensible ML’s capabilities to produce detailed, granular forecasts at a daily level, Autoliv was able to create forecasts to match the granularity of their demand planning. In addition, Sensible ML can produce more accurate and more frequent forecasts at scale and at a fraction of the time and cost.

AI-Powered Planning Goes Mainstream

In the report, Gartner highlighted several key market trends that are driving rapid growth in the FP&A software market. This includes the following:

- The market continues to invest in AI-powered Finance solutions, with new capabilities that are significantly enhancing adoption and operational efficiency.

- Greater transparency in AI/ML predictive results is accelerating adoption.

- Enhanced Integrated Business Planning (IBP) as vendors advance their ability to extend financial planning processes across the enterprise to align with operational planning.

- The evolution of Natural Language Processing (NLP) can help FP&A leaders make more informed decisions by automatically processing and summarizing textual information as well as providing context to the numerical data displayed in dashboards.

- Stronger cross-functional collaboration is increasingly a key priority for organizations, and important in driving more meaningful forecasting and planning efforts.

And as mentioned in prior reports, the transition from on-premises to cloud-based financial planning software reflects a broader trend toward SaaS offerings, facilitating faster implementation, improved ease of use and reduced dependence on IT staff for management. Additionally, these solutions provide adaptability and collaboration for tighter operational and financial performance feedback loops, extending their adoption across the enterprise.

Learn More

To learn more about the key market trends, and how OneStream compares to the other vendors in the financial planning software market, download the Gartner MQ report and contact OneStream if your organization is ready to reduce reliance on spreadsheets and legacy applications and maximize business impact!

Download the ReportSources:

1Gartner Magic Quadrant for Financial Planning Software, Regina Crowder, Matthew Mowrey, Vaughan Archer 5 December 2023

2Gartner Magic Quadrant for Financial Close and Consolidation Solutions, Nisha Bhandare, Permjeet Gale, Jeffrin Francis, Renata Viana, 27 November 2023

GARTNER is a registered trademark and service mark of Gartner and Magic Quadrant is a registered trademark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and are used herein with permission. All rights reserved.

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

Financial close, consolidation and reporting are critical processes that most organizations perform on a monthly, quarterly and annual basis to deliver their financial results to internal and external stakeholders. These processes can be challenging to execute, especially in larger enterprises with multiple ERP/GLs to consolidate, complex organizational structures, increasing regulatory compliance requirements, and a limited and mostly remote workforce.

Purpose-built software applications to support these processes have been available for over 25 years, but today’s cloud-based financial close and consolidation software (FCCS) solutions offer new capabilities that can help organizations streamline these processes to ensure more timely and accurate delivery of financial results.

Gartner’s View of the Market

This was the focus of the recently published Gartner® Magic Quadrant™ for Financial Close and Consolidation Solutions1 where OneStream was named as one of only three leaders. (see figure 1).

In the report, the Gartner analyst team recognized our broad capabilities provided through OneStream’s Intelligent Finance Platform as well as additional solutions available from our Solutions Exchange such as Account Reconciliations, Transaction Matching, ESG Reporting Blueprint and Tax Provision.

Key strengths for OneStream that were highlighted in the report include:

- Financial Consolidation – including broad capabilities, Extensible Dimensionality®, guided workflow and advanced financial intelligence.

- Data Integration – with the ability to integrate data from a wide variety of source systems, with error-handing, validations and notifications provided through our built-in Financial Data Quality Management.

- Sales Pricing – with a flexible, user-based pricing model.

Overall, we are pleased to be recognized as a Leader in this Gartner Magic Quadrant report and we believe this is well-deserved based on the breadth and depth of capabilities that we offer, and our strong momentum in the market. Over 1300 organizations globally have chosen OneStream as a replacement for legacy applications such as Oracle HFM, Oracle FCCS, SAP BPC and BFC, IBM/Cognos Controller, Longview and Infor as well as point solutions such as Blackline and Trintech for account reconciliations. And we’ve replaced thousands of Excel spreadsheets as well!

Delivering Positive Business Impact

Organizations that have adopted OneStream for financial close, consolidation and reporting have improved consolidation performance vs. legacy products, while handling much larger data volumes than they could with their prior solutions. They have shortened their period-end close processes by several days and are delivering more timely and accurate financial results to stakeholders. And they have reduced technical debt, saving millions of dollars per year in IT and admin costs.

Here are some examples:

Costco Wholesale: Replaced Oracle HFM and Excel with OneStream for OneStream for financial close, consolidation, reporting, cashflow, and budgeting. Their financial close process was reduced from 2-3 days to 1.5 days and eliminating Excel enabled the Costco team to re-allocate 25% of FTE time to value added work.

Terex: Replaced Oracle HFM, FDMEE, Prophix and Excel with OneStream for financial close, consolidation, reporting and planning. Integrating data from 28 ERPs, full system consolidation time has decreased from up to 20 hours to less than 30 minutes with OneStream. Eliminating multiple point solutions has improved data quality and also yielded significant cost savings.

Lindsay Corp: Replaced Microsoft Excel with OneStream for financial close, consolidation, reporting, planning and forecasting. Their monthly close process was shortened by 25%, and the company is also saving 2 days per month on forecasting.

These and other customer successes have translated to a 4.8 out of 5 rating and 95% “willing to recommend” score for OneStream for financial close and consolidation on Gartner® Peer Insights™.

Key Market Requirements and Evaluation Criteria

For those new to the Magic Quadrant process, Gartner defines FCCS solutions as “applications that enable corporate controllers and their teams to manage the organization’s group close, consolidation and reporting processes.” The most common business challenges, or use cases, that Gartner identifies for FCCS include enabling efficiency, driving regulatory compliance and supporting a complex business environment.

In evaluating the various software solutions available to support FCCS, Gartner identifies the “must-have” capabilities as:

- Financial Close Management

- Financial Consolidation

- Financial Reporting

Additional standard and optional capabilities identified by Gartner include:

- Financial Statement Reconciliation

- Journal Entry Processing

- Financial Reporting Risk Management

- Disclosure Management

To be included in the Gartner FCCS Magic Quadrant, vendors must support all the must-have capabilities mentioned above, and these must-have capabilities should be available within the native vendor solutions and not offered through partnerships with other vendors. In addition, the vendors must operate in at least two global geographies, the software must be deployed as a cloud service and be available as a standalone solution, devoid of any bundling with ERP suites.

Learn More

Financial close, consolidation and reporting are critical processes that shouldn’t be managed with legacy applications, point solutions or spreadsheets that lack the capabilities required to meet today’s complex business requirements. If your organization is ready to make the leap to a modern, cloud-based solution, download the Gartner Magic Quadrant report to learn more about the key market requirements and why OneStream was named as a Leader.

Download the ReportSources: 1 Gartner Magic Quadrant for Financial Close and Consolidation Solutions, Nisha Bhandare, Permjeet Gale, Jeffrin Francis, Renata Viana, 27 November 2023

Gartner Disclaimer

GARTNER is a registered trademark and service mark of Gartner and Magic Quadrant is a registered trademark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and are used herein with permission. All rights reserved.

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

Gartner® and Peer Insights™ are trademarks of Gartner, Inc. and/or its affiliates. All rights reserved. Gartner Peer Insights content consists of the opinions of individual end users based on their own experiences, and should not be construed as statements of fact, nor do they represent the views of Gartner or its affiliates. Gartner does not endorse any vendor, product or service depicted in this content nor makes any warranties, expressed or implied, with respect to this content, about its accuracy or completeness, including any warranties of merchantability or fitness for a particular purpose.

The post-pandemic global economy continues to provide challenges for CFOs and Finance teams as they navigate rising interest rates, volatile oil prices, continued geopolitical instability and supply chain disruptions. These challenging times require enterprises to have access to near real-time insights and the ability to make agile and informed decision-making. It’s with this backdrop the Forrester Research recently released their landscape report on Digital Operations Planning and Analytics (DOP&A) software solutions. Read on to learn what Forrester defines as the key market requirements and trends and how they view the vendor landscape for this category of software.

Optimizing Performance in a Digital-First World

Forrester defines Digital Operations Planning and Analytics as: “An applications category comprising an integrated set of reporting, analytical, and planning applications that helps organizations develop growth strategies and optimize business performance in a digital-first world.”

According to Forrester, DOP&A tools are critical for running a successful and profitable business because they let you accurately analyze and plan revenue and profits. They also acknowledge that the category is similar to and is also referred to as enterprise performance management (EPM), corporate performance management (CPM), financial planning and analytics (FP&A), and/or eXtended planning & analytics (xP&A). Forrester sees organizations implementing DOP&A solutions to accomplish three main objectives:

- Gain better insights into past business performance.

- Plan for the future with versatile modeling capabilities.

- Ensure accurate reporting and regulatory compliance.

Whereas other IT industry analyst firms often carve up EPM/CPM solutions into separate categories and reports such as Financia Planning vs. Financial Close, Consolidation and Reporting, Forrester recognizes the challenges this fragmented approach has posed for enterprises and promotes the need for holistic DOP&A solutions that can effectively address all requirements.

Key Market Trends

With a long history that stretches back to the 1980’s, Forrester comments on the evolution and maturity that has occurred – creating a new generation of DOP&A solutions, based in the cloud, that can transform how enterprises make business decisions by making sophisticated data analysis more accessible to anyone in finance and beyond. According to Forrester, DOP&A has evolved into an established market that is:

- Hitting its cloud inflection point – with most vendors leading with cloud-based offerings and enterprises migrating from on-premises solutions to modern cloud solutions.

- Broadening beyond its finance-centric roots. While the market interest and solutions were mainly targeted for finance-related activities related to budgeting and planning, DOP&A solutions are expanding into total business operations planning — spanning areas such as workforce, sales, and marketing.

- Leveraging advanced AI. This is not a “nice to have,” solutions in this category are already incorporating AI and machine learning and the race is now on to do this in real time with more advanced data sets and capabilities based on generative AI.

Dynamic Vendor Landscape

With increasing market demand, Forrester highlights how the software vendor landscape for DOP&A solutions has become very dynamic in recent years. This has included investments and acquisitions by private equity firms, acquisitions by ERP vendors, vendor consolidation and many new entrants coming into the market.

Given the wide variety of vendor options available, Forrester recommends buyers pay attention to the following dynamics:

- Planning is becoming more holistic, more enterprise wide, and more frequent in this fast-paced and dynamic world. Although finance touches all money in the business, individual business units need detailed insight into business performance — and all this must connect rather than operate in silos.

- Poor data quality will cripple DOP&A success, as the old adage of “garbage in, garbage out” applies. There’s no silver bullet: Good data hygiene and financial data quality and governance must be in play through the software and implementation services.

- Disruption. This market is seeing a major shake-up, with private equity, large software vendors, and startups vying for success. Forrester sees an active market with many entrants and changes to the established choices.

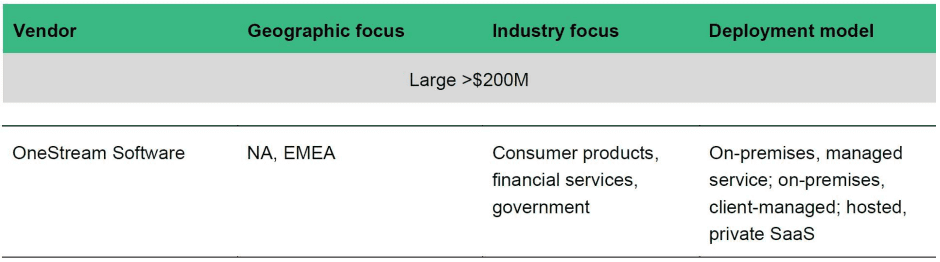

In the report, Forrester lays out the vendor landscape based on DOP&A category revenue generated by company – with large vendors having over $200 million, medium vendors having from $50 million to $200 million, and small vendors having $10 million to $50 million in category revenue. They recommend buyers also take into consideration the geographic and industry focus of various vendors in the market as well as the software deployment model.

Based on our revenue generated in this category, OneStream was listed in the Large >$200M category along with some information about our industry and geographic focus as well as deployment capabilities. (see figure 1 below)

Figure 1 – OneStream Vendor Profile

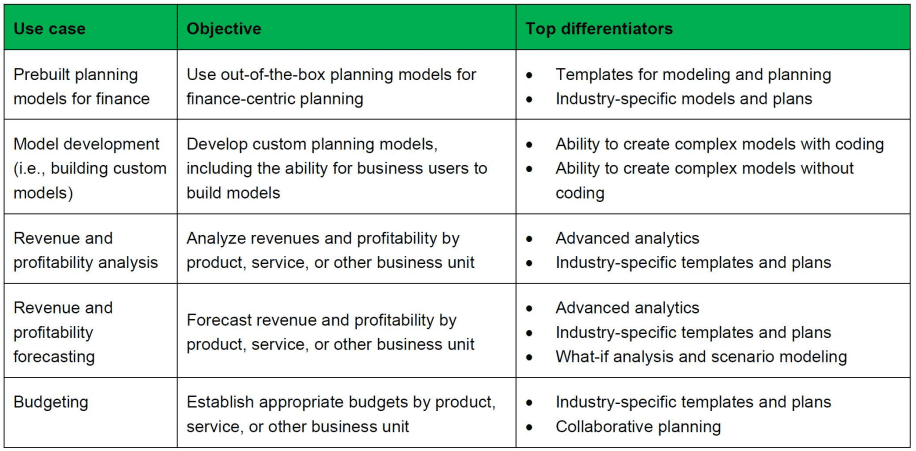

Following this initial grouping of the 25+ vendors covered in the report, Forrester also

highlighted the top use cases for DOP&A supported by the various vendors. This includes

commonly requested use cases such as budgeting, prebuilt planning models for finance, custom

model development, revenue and profitability analysis and forecasting. (See figure 2 below)

Figure 2 – Common Use Cases for DOP&A

Forrester also highlights vendor support for extended use cases, including prebuilt planning models outside finance (e.g., sales, marketing, workforce), financial consolidation, financial reporting, board reporting, and external and regulatory reporting. OneStream’s Intelligent Finance Platform provides strong support for all the core and extended use cases identified by Forrester.

Learn More

We are seeing increased IT industry analyst coverage of CPM/EPM software, and it’s great to see Forrester Research covering this market again, under the DOP&A moniker, after a 5-year hiatus. To learn more, visit Forrester’s web site and contact OneStream if your organization is ready to make the leap from spreadsheets or fragmented legacy CPM applications to a modern, extensible platform designed for the future.

Just as a consumer would consult reviews before purchasing a car, appliance or electronic equipment, software peer reviews are becoming key resources to facilitate the decision-making process for corporate performance management (CPM) software evaluations.

Gartner Peer Insights is one of the most popular and trusted peer review sites in enterprise software, offering free peer reviews and ratings designed for enterprise software and services decision makers. According to Gartner, reviews are rigorously vetted to deliver actionable, objective insight to executives and their teams. Gartner Peer Insights offers over 515,000 Gartner-verified ratings and reviews and over 175,000 verified reviewers.

In the Financial Planning Software market, Gartner Peer Insights has published 1,036 reviews and ratings in the 18-month period ending March 31, 2023. Read on to learn about the findings of the recently published Gartner Peer Insights Voice of the Customer report on Financial Planning Software.

Behind the Voice of the Customer

The “Voice of the Customer” is a document that synthesizes Gartner Peer Insights’ reviews into insights for IT decision-makers. This aggregated peer perspective, along with individual detailed reviews, is complementary to Gartner expert research, such as the Magic Quadrants and Critical Capabilities reports, and can play a key role in the buying process as it focuses on direct peer experiences of implementing and operating a solution.

Vendors placed in the upper-right quadrant of the “Voice of the Customer” quadrants are recognized with the Gartner Peer Insights Customers’ Choice distinction, denoted with a Customers’ Choice badge. The recognized vendors meet or exceed both the market average Overall Experience and the market average User Interest and Adoption.

OneStream is Recognized as a Customers’ Choice in Financial Planning Software

Based on reviews posted over the past 18 months, OneStream has been recognized as a May 2023 Gartner Peer Insights Customers’ Choice for Financial Planning Software! This follows our recognition as a Leader in the Gartner Magic Quadrantfor Financial Planning Software in December 2022.

Based on 99 Gartner-verified customer reviews posted in the last 18 months, OneStream was rated 4.5 out of 5 – with a 91% Willingness to Recommend our product. In addition to the Voice of the Customer quadrant, the report also includes several charts highlighting the comparative scores for all of the Financial Planning Software vendors who were reviewed on Gartner Peer Insights. In the report, you’ll see that OneStream earned high ratings across every category, including:

- Overall Rating – 5 out of 5

- Willingness to Recommend – 91%

- Product Capabilities –7 out of 5

- Sales Experience –6 out of 5

- Deployment Experience – 5 out of 5

- Support Experience – 6 out of 5

Below are some of the headline comments and links to reviews that OneStream has received in Gartner Peer Insights over the past 18 months:

- “Truly integrated platform, allowing to create connected reporting and planning processes”

- “A lifesaver for a finance department in a large company”

- “Unified platform capabilities and commitment to customer success are awesome”

- “OneStream is the greatest all-purpose CPM tool for FP&A”

- “Fast and powerful financial consolidation and reporting”

In a press release announcing this recognition, OneStream CEO Tom Shea said, “Our mission is to deliver 100% customer success and we believe this recognition as a Gartner Peer Insight Customers’ Choice reinforces the value our customers gain from OneStream’s unified platform. As business leaders face the challenges of planning and forecasting in today’s rapidly changing business environment, OneStream helps organizations align financial and operational planning, in one unified cloud platform with one unified data model, while empowering leaders with near-real time insights that support confident, impactful decision making.”

Learn More

OneStream’s recognition as a Leader in the Magic Quadrant Report for Financial Planning Software, as well as being named a 2023 Customers’ Choice in this category, reinforces OneStream’s strength as a best-in-class FP&A solution in the market. OneStream’s Intelligent Finance platform enables customers to streamline planning and forecasting, with the ability to extend analysis deeper into the organization to support critical business decisions. In addition, since OneStream is a truly unified platform, it enables organizations to leverage equally strong financial close, consolidation and reporting capabilities along with financial and operational planning and forecasting.

To learn more, read the Voice of the Customer report and contact OneStream if you are looking for a unified platform to streamline complex financial processes and enable confident decision-making that maximizes business impact.

Gartner Disclaimer

Gartner Peer Insights Customers’ Choice constitute the subjective opinions of individual end-user reviews, ratings, and data applied against a documented methodology; they neither represent the views of, nor constitute an endorsement by, Gartner or its affiliates.

The global economic disruptions and turmoil of recent years have made it challenging for many enterprises to make informed decisions about hiring and overall investment plans. In this context, the ongoing planning, monitoring and management of financial and operating results have become critical to the success of organizations across the globe. As a result, many enterprises are increasing their investments in technologies that can help streamline financial management processes and support more informed, agile decision-making.

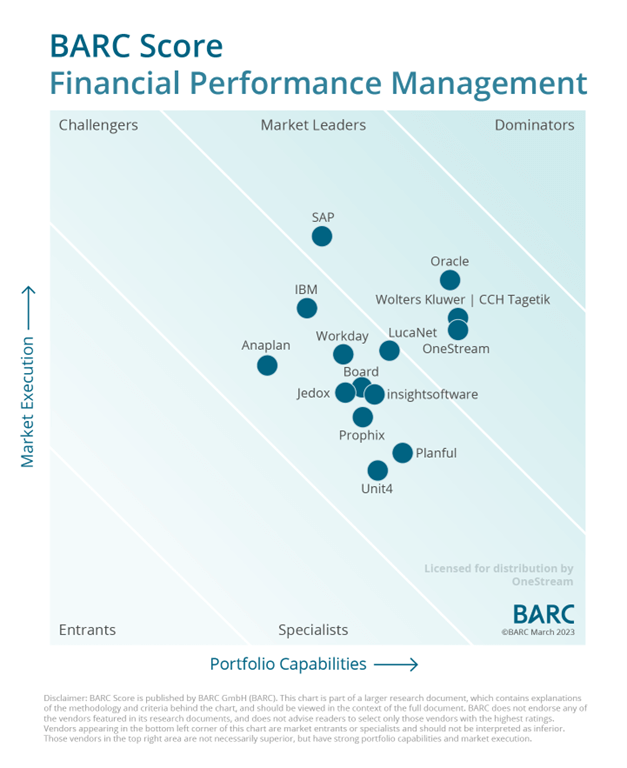

It’s with this backdrop that European market research firm BARC published their BARC Score report for Financial Performance Management (FPM) for 2023. Read on to learn about the latest market trends and why OneStream was recognized as a leader in the market for the 3rd year in a row.

FPM is About Looking Backward and Forward

While they call it financial performance management (FPM) and we call it corporate performance management (CPM), the analysts at BARC are spot on in recognizing the importance of having a performance management platform that looks back into the past (“what has happened”) as well as helps enterprises plan and manage the future (“what will happen”).

The 2023 BARC Score for FPM software evaluates vendors that provide integration of various financial processes in a common software platform – including planning, budgeting and forecasting, financial close and consolidation as well as reporting and analytics. Having these processes closely aligned is critical to effective decision-making and enabling high productivity for users in Finance and lines of business.

Some of the key market trends identified in the 2023 BARC Score FPM report include the following:

- An accelerated supply of information for decision-makers.

- Increasing consideration of internal and external data for decision-making.

- Greater use of data and analytics in decision-making and management processes.

- Short-term planning and forecasts with a higher updating frequency.

- Digitalization and greater software support for internal processes as an essential basis for their optimization and further automation.

According to BARC, support from modern and requirements-oriented software solutions is an essential element in achieving these goals. The BARC Score for FPM software analyzes the strengths and challenges of the leading FPM vendors in the market that should be considered by potential buyers.

Digging Into the BARC Score for FPM Software

Under the BARC Score methodology, every vendor is evaluated on two dimensions, Portfolio Capabilities and Market Execution. Each represents one axis on the BARC Score.

These two dimensions include the following sub-criteria:

- Portfolio Capabilities reflect functional and architectural criteria. A special emphasis is placed on ease of use for business users. Regarding the vendor ratings in this BARC Score, the focus is rather on the prebuilt business content and FPM solutions that the vendors provide and less on flexibility for individual applications that can be built with development environments.

This pre-built functionality is evaluated across Financial Planning, Financial Consolidation, Reporting, Analysis and Operational Planning and Forecasting.

- Market Execution rates the FPM vendors in this BARC Score on factors such as Product Strategy, Customer Satisfaction, Financials, Geographical Coverage, Ecosystem, Sales Strategy, Organizational Strength and Marketing Strategy.

Based on their scoring on these two dimensions, vendors are categorized into one of 5 regions: Dominators, Leaders, Challengers, Specialists and Entrants.

So the million-dollar question is – how was OneStream rated in the report?

OneStream is a Global Leader in FPM Software

For the 3rd year in a row, OneStream was recognized as a Leader in the BARC Score for FPM software report. In fact, our Leadership position improved slightly in the 2023 report, with OneStream now sharing the highest-rated Portfolio Capabilities and improving our rating on Market Execution. And it’s important to note that OneStream is recognized as a leader in both the global (see figure 1) and DACH versions of this report.

Looking at the key strengths highlighted by BARC in the report, OneStream was recognized as a leader in FPM software based on the following:

- Integrated CPM platform for financial consolidation and close, planning, budgeting and forecasting, reporting and analytics with built-in financial intelligence and financial data quality capabilities, available in the Microsoft Azure cloud.

- Integrated BI and analytics functionality for (print-oriented) production reporting, financial reporting (disclosure management) with self-service dashboards and visualizations, and ad hoc analysis via Microsoft Excel add-in.

- MarketPlace with more than 50 predefined business and productivity solutions.

- Excellent customer feedback in recent years for many important KPIs in BARC’s ‘The Planning Survey’ including customer satisfaction with vendor and product, price-to-value and functionality for workflows. Many customers say they would recommend the platform to other organizations.

Learn More

Being recognized as a Leader in the BARC Score for FPM software is important as BARC performs a very thorough evaluation of software vendors and is very influential with Finance and IT buyers especially in the DACH region, and across EMEA in general.

To learn more, download a complimentary copy of the BARC Score for FPM solutions and contact OneStream if your organization is ready to take the leap from spreadsheets and point solutions to a comprehensive CPM software platform that can help you make confident decisions that maximize business impact.

Evaluating and selecting financial planning software for an organization can be a challenging process. There are a wide variety of software vendors in the market to choose from, often with similar messaging and what can sound like similar capabilities. Best practice is to start by identifying your organization’s current and future business requirements today, and then compare your requirements to solution capabilities.

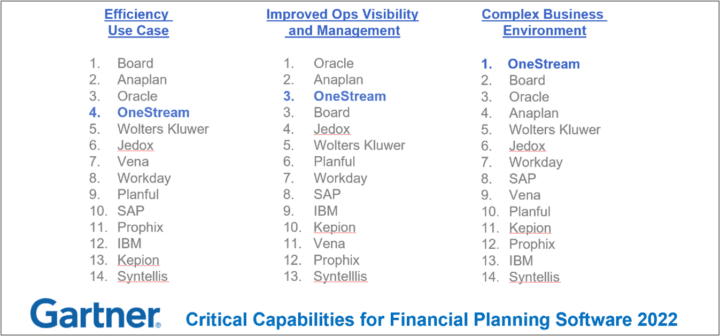

Industry analyst reports such as the Gartner® Magic Quadrants™ and Critical Capabilities™ Reports can help organizations generate a shortlist of vendors to evaluate, based on an assessment of their technical fit, business fit and usability. Read on to learn what the findings were in the 2022 Gartner® Critical Capabilities® for Financial Planning Software1 report.

Sorting Out the Vendor Landscape

Gartner predicts that the financial planning software market will change dramatically over the next five years, with added emphasis on AI to help identify trends and patterns across large datasets. AI will also be applied to predictive forecasts to maximize operational efficiency, reduce labor costs and produce real-time forecasts and scenarios, thus helping CFOs respond with agility.

Gartner also predicts that the importance of financial planning solutions will continue to increase as CFOs assume a leading role in driving more agile and continuous enterprise-wide planning in a rapidly changing business environment.

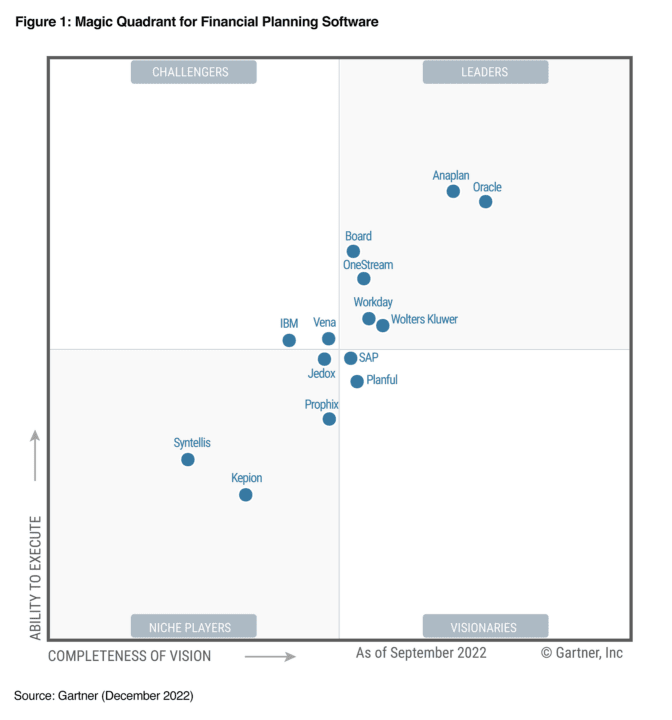

In December of 2022, Gartner published their Magic Quadrant® for Financial Planning Software2 report, which provided an assessment of the top 14 vendors in the market. The Magic Quadrant report categorizes vendors as Leaders, Visionaries, Challenges and Niche players and can be useful in identifying a shortlist of vendors to evaluate.

OneStream was recognized as one of the Leaders in this report.

The Magic Quadrant report was followed by the release of the Gartner Critical Capabilities for Financial Planning Software report in late December. The purpose of the Gartner Critical Capabilities report is to complement the Magic Quadrants by scoring vendors against specific capabilities and customer use cases, to help customers better select vendors that might match their requirements.

Critical Capabilities for Financial Planning

So what were the “critical capabilities” the Gartner analyst team used for their assessment of vendors in the Magic Quadrant and Critical Capabilities reports? For FP&A software, the 8 capabilities evaluated were:

- Configurable Models – focuses on a provider’s ability to create flexible models that align with buyers’ requirements, with the goal of optimizing financial outcomes.

- Scenario Modeling – helps finance teams evaluate the efficacy of strategies, tactics and plans for a range of scenarios.

- Data Integration – focuses on the provider’s primary data integration capabilities, such as the ability to connect to both source ERP and non-ERP systems.

- Advanced Analytics – ability to generate analytic insights and present them via a user-friendly dashboard that emphasizes predictive reporting outputs and the business relevance of insights.

- Capacity – focuses on the software’s ability to support a high number of concurrent users without compromising system performance.

- Workflow Automation – ensures that planning cycles are governed, planning contributors are tracked, authorization rules are followed, and bottlenecks are identified and resolved.

- User Experience/Governance – requires every aspect of a provider’s application to deliver a high quality user experience.

- Implementation Strategy – demands that the provider have an established implementation strategy, connectors and templates that help clients facilitate implementation of its product.

Gartner then weights each capability for 3 different customer use cases that were identified, including:

- Efficiency – This use case focuses on the goal of increasing efficiency and productivity within an organization’s planning, budgeting and forecasting processes.

- Improve Operational Visibility and Management – This use case focuses on the organization’s primary goal of improving operational visibility and management through the use of financial planning software.

- Complex Business Environment – This use case relates to organizations with a complex scope that require advanced data integrations and support for a large number of concurrent users and large data volumes.

OneStream’s Rankings

Below is a summary of OneStream’s rankings vs. other vendors in this report, across the three use cases. As you’ll see, OneStream was ranked #1 in the Complex Business Environments use case, while also being ranked in the top 4 vendors in Efficiency Use Case and tied for 3rd in the Improved Operational Visibility and Management User Case.

We believe that OneStream being ranked #1 for Complex Business Environments demonstrates that we are a great choice for mid-sized to larger organizations with complex requirements, the need to integrate data from multiple ERP systems and other sources, and who need to support a large number of concurrent users and large data volumes. At the same time, we believe OneStream should also be considered for other use cases where customers are looking to Increase Efficiency in their planning process or Improved Operational Visibility and Management (e.g., Effectiveness).

Regarding the need for efficiency, for true enterprise planning, OneStream suggests organizations consider how they can create value and efficiency by leveraging a unified CPM software platform with an extensible data model for both financial and operational planning, that eliminates the need for separate products or to “connect” multiple planning models.

OneStream’s Intelligent Finance Platform also delivers improved operational visibility and management by aligning financial and operational planning, reporting and analytics in a single application that supports intelligent decision-making across the enterprise.

Learn More

Being recognized by Gartner as a Leader in the Magic Quadrant for Financial Planning Software was important for us as a company. But equally important is being highly ranked in all use cases in the Critical Capabilities report. To learn more, download a complimentary copy of the Gartner Critical Capabilities Report for Financial Planning Software and contact OneStream if you would like to evaluate how we can address your organization’s business requirements.

1Gartner Critical Capabilities for Financial Planning Software, Regina Crowder, Matthew Mowrey, Farrah Watson 19 December 2022

2Gartner Magic Quadrant for Financial Planning Software, Regina Crowder, Matthew Mowrey, Farrah Watson 14 December 2022

GARTNER is a registered trademark and service mark of Gartner and Magic Quadrant is a registered trademark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and are used herein with permission. All rights reserved.

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

Having near real-time visibility into key financial and operating metrics, and the ability to support agile planning and forecasting are essential capabilities for navigating today’s volatile global economy. The pandemic and post-pandemic economic volatility have been a wake-up call for organizations that have been relying on spreadsheets or aging planning applications that hinder agility and the ability of CFOs and their teams to partner with business leaders to react quickly to impact bottom-line performance under rapidly changing conditions. And it’s driving demand for modern, cloud-based financial planning software applications.

So it’s timely that the 2022 Gartner® Magic Quadrant™ report for Financial Planning Software1 was recently published, highlighting key market trends and providing an assessment of the top 14 vendors in the market. Read on to hear the highlights of the report.

Planning in the Cloud

According to Gartner, “Financial planning software is at the forefront of finance modernization efforts. It has taken this prominent position as CFOs and FP&A leaders assume a leading role in driving more agile, accurate and continuous companywide planning, with the aspiration to become valued strategic business partners to the rest of the enterprise.”

In the Gartner Magic Quadrant for Financial Planning Software, published in December 2022, the analyst firm highlighted how the financial planning software market has shifted from on-premises deployment to cloud, with most migrations and new implementations deployed as SaaS/cloud offerings. Why is this?

The reason is that cloud solutions are faster to deploy, easier to implement, use and maintain with little need for IT staff. They also lend themselves to broader adoption through self-service and user-friendly reporting and analytics. They support modern planning requirements such as rolling forecasts, driver-based planning and scenario modeling. And finally, cloud-based planning solutions support improved collaboration and alignment across the enterprise and between finance and operations teams.

AI-Powered Planning Will Become Mainstream

In the report, Gartner highlighted several key market trends that are driving rapid growth in the FP&A software market. This includes the following:

- CFOs are playing a more strategic role in enterprise-wide decision support

- The need to execute planning and forecasting more efficiently through automation

- Demand for improved alignment of financial plans with operational plans in IT, HR, Sales, Marketing, Supply Chain and other functions.

- Interest in predictive forecasting and tapping into larger volumes of data available from enterprise systems.

- Demand for AI and Machine Learning (ML) models that can combine internal and external data to support more intelligent forecasting and decision-making.

The report highlights that today, these more advanced forms of analytics are innovative in modern planning solutions, but Gartner predicts they will become more of a standard expectation as additional vendors include them in their offerings.

Assessing the Vendor Landscape

Of course, the key focus of any Gartner Magic Quadrant report is the assessment and grouping of the various vendors in the market as Leaders, Visionaries, Challengers or Niche vendors. So what was Gartner’s assessment of the Financial Planning software vendor landscape in 2022? Well – I am pleased to report that OneStream is positioned as a Leader, along with Oracle, Anaplan, Workday, Wolters Kluwer and Board (see figure 1).

Why was OneStream recognized as a Leader in the report? I suggest reading the entire report to get the full story, but a few strengths highlighted in the report are:

- Robust product that can collect data at different levels of granularity and connect to a wide variety of data sources.

- Extensive user capacity and performance, with the ability to support a large number of concurrent users and with our Extensible Dimensionality®

- OneStream™ MarketPlace which provides customers with access to over 50 productivity tools and business solutions they can download, configure and deploy to quickly address new requirements.

In a press release announcing OneStream being recognized again by Gartner as a leader, OneStream CEO Tom Shea commented, “We believe this recognition reflects our strong momentum in the market and the value customers gain by adopting OneStream’s unified, extensible platform to streamline their complex financial processes across planning, reporting and analytics. As Finance leaders navigate today’s complex and changing business environment, OneStream provides the trusted data-backed insights for rapid decision making and improved financial and operational performance.”

Learn More

To learn more about the key market trends, and how OneStream compares to the other vendors in the financial planning software market, download the Gartner MQ report and contact OneStream if your organization is ready to reduce reliance on spreadsheets and legacy applications and lead at speed!

1Gartner Magic Quadrant for Financial Planning Software, Regina Crowder, Matthew Mowrey, Farrah Watson 14 December 2022

GARTNER is a registered trademark and service mark of Gartner and Magic Quadrant is a registered trademark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and are used herein with permission. All rights reserved.

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

Planning and budgeting for 2023 may be one of the biggest challenges organizations have faced in many years. The global economic landscape includes many complexities such as ongoing inflation and rising interest rates, volatile gas and oil prices, continued supply chain bottlenecks, and geo-political instability. In order to navigate through these challenges, it’s imperative that organizations have agile planning, budgeting and forecasting processes and systems that can align finance and operations across the enterprise.

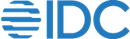

It’s with this backdrop that International Data Corporation (IDC) recently published their MarketScape report for Worldwide Enterprise Planning, Budgeting and Forecasting Applications. Read on to learn about the key market trends highlighted in the report and why OneStream was recognized as a Leader in the market.

A Snapshot of the Enterprise Planning Applications Landscape

IDC has published MarketScape reports covering the Enterprise Performance Management (EPM) software market for several years now. For 2022, IDC focused the MarketScape report on enterprise planning, budgeting, and forecasting software applications that combine data ingestion, modeling, analysis, and visualization functionality along with built-in functionality for collaboration, knowledge sharing, and workflow management.

These applications are a subset of the broader EPM software applications market, which in addition to the above mentioned functionality, incorporates functionality for financial close and consolidation, financial reporting, cross-functional risk management, and various performance management methodologies, such as objectives and key results.

Advanced Analytics and Automation at the Forefront

According to IDC, modern applications in the enterprise planning market are cloud-based and incorporate advanced analytics, artificial intelligence (AI) or machine learning (ML) to augment or automate processes involved in financial analysis, budgeting, forecasting single or cross-functional planning, and scenario analysis. Other key trends identified in the report include the following:

- The market disruptions enterprises are facing have increased the differentiating value of decision making and planning agility.

- This is driving demand for functionality for cross-functional and continuous planning, contingency planning, scenario planning, and constraint-based analysis.

- In additional to planning agility, organizations are seeking greater automation of tasks within these processes.

- Some of the latest developments in this software market are:

- Incorporation of AI/ML to support predictive forecasting, anomaly detection, and scenario analysis.

- The build-out of more industry and business function content to accelerate time to software deployment and support specialized needs across the organization.

- Increased functionality for in-software asynchronous and synchronous collaboration and knowledge creation, retention, and sharing.

- Scalability and performance improvements through a new generation of cloud-based applications.

IDC expects rapid innovation in this software market to continue as technology providers are reacting to demand driven by continued market volatility and as private equity investors inject new capital into this market segment.

Evaluating the Players

A key focus of the IDC MarketScape methodology is the vendor assessment. This assessment examines both quantitative and qualitative characteristics of the top 13 vendors in the Enterprise Planning, Budgeting and Forecasting Applications market along two MarketScape dimensions: Capabilities and Strategies.

The size of the vendor “bubbles” in the MarketScape graphic represent the relative market share of the vendors based on total software revenue, which includes both cloud subscriptions as well as maintenance revenue from legacy on-premise EPM applications.

So what were the results of the vendor assessment for the 2022 report? Well, I’m pleased to report that IDC recognized OneStream as one of the Leaders in the market, along with Oracle, SAP, IBM, Anaplan and Workday (see figure 1).

Figure 1: IDC MarketScape for Enterprise Planning, Budgeting and Forecasting Applications 2022 IDC MarketScape vendor analysis model is designed to provide an overview of the competitive fitness of ICT suppliers in a given market. The research methodology utilizes a rigorous scoring methodology based on both qualitative and quantitative criteria that results in a single graphical illustration of each vendor’s position within a given market. The Capabilities score measures vendor product, go-to-market and business execution in the short-term. The Strategy score measures alignment of vendor strategies with customer requirements in a 3-5-year timeframe. Vendor market share is represented by the size of the icons.

Key strengths of OneStream highlighted in the report include:

- Modern and appealing user interface that supports workflows through visual cues

- Solid integration with other business applications

- Comprehensive solution to customers’ EPM needs

- Business rules are easy to define

- Ease of maintenance and upgrades

- Extensible and flexible dimension management

IDC also commented that OneStream is ideal for customers that have complex multi-ERP environments and need a tool for unifying multiple legacy EPM apps into one platform.

Learn More

If your organization is already using OneStream for EPM, this recognition of OneStream as a leader in the market is validation that you made a great decision. If your organization is evaluating enterprise planning applications, you’ll want to make sure OneStream is on your shortlist. To learn more, download the 2022 IDC MarketScape report and contact OneStream if you are interested in seeing a live demonstration

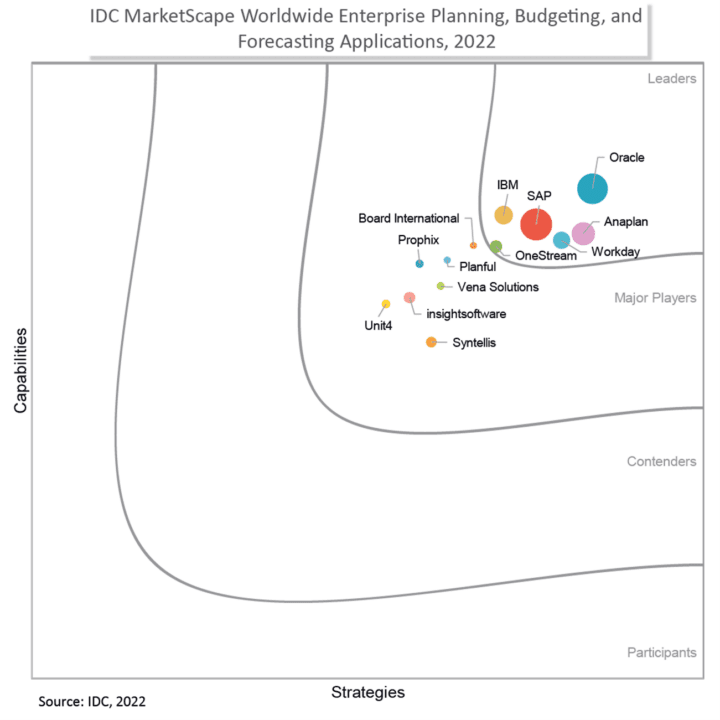

2022 has been a challenging year for individuals and corporations. Geo-political instability due to the war in Ukraine has led the headlines for most of the year, along with higher fuel prices, widespread inflation, continued supply chain bottlenecks, rising interest rates and falling financial markets. With planning and budgeting season upon us, what assumptions are CFOs and Finance executives making about what lies ahead and how is that impacting corporate financial planning for 2023?

Taking the Pulse of Financial Leaders

To understand how financial leaders are planning for 2023, OneStream Software sponsored a Hanover Research survey of over 650 Financial Decision Makers in the North America, as well as EMEA. The goal of the survey was to understand financial leaders’ expectations for 2023 regarding inflation, potential recession, supply chain disruptions, talent management, ESG and DEI initiatives, and technology investments. Read on to learn the results of the Fall 2022 Financial Decision Makers Outlook survey.

Economic Headwinds Persist

According to the Fall 2022 survey, economic disruptions/recession are still the top concern for nearly half of organizations for 2023, far outdistancing concerns about talent shortages, cybersecurity, supply chain disruption, and geopolitical disruption. This was also the top concern earlier this year at 30%; however, in the Fall 2022 survey, this rose to 47% of respondents (see figure 1).

Figure 1 – Top Business Risks for 2023

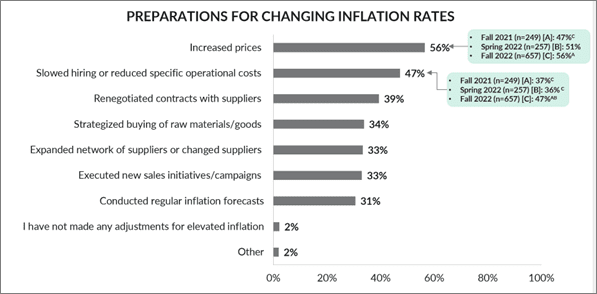

With inflation continuing to plague both individuals and enterprises, price increases are the number one way that businesses have dealt with inflation (56%), followed by slowed hiring or reduced specific operational costs (47%). Nearly half of businesses have slowed hiring or reduced specific operational costs, another significant increase from a year ago (see figure 2).

Figure 2 – Preparations for Changing Inflation Rates

With regards to the potential for recession, similarly, two-thirds of financial leaders expect a recession to occur and last until late 2023 or later. Three-quarters of financial leaders also expect the pandemic-related supply chain issues to continue into 2023; however, very few (8%) expect it to extend beyond 2023. Most financial leaders (85%) have made at least slight alterations to their 2023 forecasts and strategies in preparation of an impending recession, according to the survey.

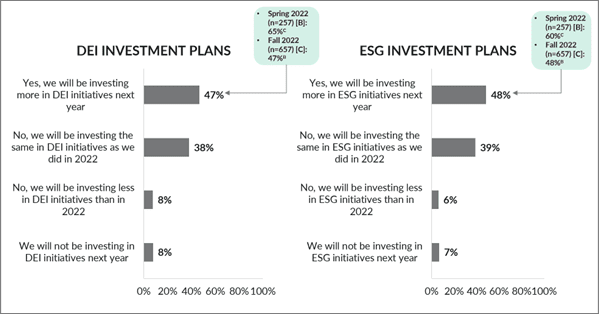

DEI and ESG Initiatives Still in Focus

Despite the economic headwinds that are predicted, and with the new mandatory disclosure requirements being proposed by the US SEC and regulators in other countries, investments in ESG and DEI remain a priority. Half of organizations surveyed expect to invest more in DEI and ESG goals and Initiatives in 2023 than in 2022. This is a significant drop compared to expectations from earlier this year (65% in DEI and 60% in ESG). Still, over a third of enterprises expect to invest the same in DEI and ESG in 2023 (38% and 39%, respectively) (see figure 3).

Figure 3 – DEI and ESG Investment Plans

When asked about their plans to prepare for changing ESG Reporting requirements, nearly half of financial executives surveyed have started or plan to start forming an internal ESG/Sustainability team to define policies and disclosures. A similar proportion (41%) will begin (or have already begun) implementing new ESG/sustainability policies. Compared to earlier this year, fewer are planning to invest in software to support ESG data collection and reporting. Among those who currently don’t have a plan in place, half (50%) indicate they may implement a plan if ESG reporting mandates impact their organizations.

When asked about what type of software is currently being used or planned to be used to support ESG reporting, extensions of CPM software (52%) are the most used software for supporting the collection and reporting of ESG data.

Investments in Cloud Planning and Analysis Tools Increasing

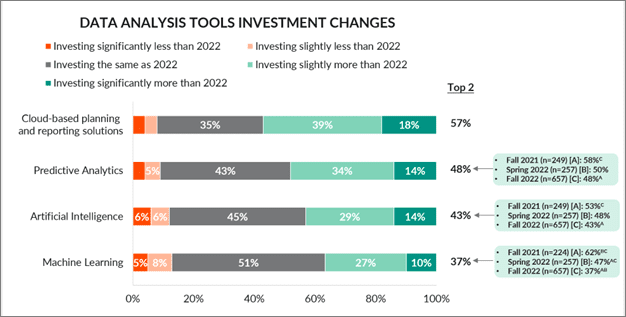

The economic uncertainty and potential recession that’s predicted for 2023 will require Finance teams to do more with the same or less resources, which also points to the need for more automation and digital technologies to help streamline planning, reporting and analysis processes.

According to the Fall 2022 survey, over half of financial leaders predict investing more in cloud-based planning and reporting solutions in 2023 than in 2022. Meanwhile, only one-third of companies (37%) predict investing more on machine learning. This is significantly fewer than predicted both last fall and earlier this year (see figure 4).

Figure 4 – Expected Investment in Data Analysis Tools

When asked about the top use cases for artificial intelligence or machine learning, surprisingly, financial reporting is the top opportunity identified by financial leaders in the Fall 2022 survey. This was followed by sales/revenue forecasting (41%) and demand planning (39%) as the second and third largest opportunity for organizations. Very few financial leaders (3%) do not see any opportunities for AI/machine learning to help their business.

Learn More

The results of the Fall 2022 Financial Decision Makers Survey highlighted the ongoing business challenges CFOs and Finance leaders face as they exit 2022 and plan for what’s ahead in 2023. Inflation, higher interest rates, supply chain bottlenecks, and recession are here to stay in 2022 and most Finance executives expect them to continue into 2023. The mandatory ESG disclosures being proposed by the US SEC are driving many organizations to invest in their ESG processes and software to help not only with reporting compliance, but also with planning and managing ESG and DEI initiatives.

The good news is that today’s cloud-based analytical software technologies are seeing increased adoption and are proving their worth in helping Finance teams become more efficient, plan and navigate a volatile economic landscape and increase their agility to respond. Artificial intelligence and machine learning adoption lags more mainstream planning and predictive analytics tools, but as these capabilities are embedded into modern planning, reporting and analytical software applications, Finance adoption is poised to expand rapidly.

To learn more, download the Hanover Research Fall 2022 Finance Leaders Outlook report and contact OneStream if your organization needs help conquering the complexities of today’s economic landscape.

Finance leaders continue to face ongoing challenges and economic disruption in 2022. From inflation and supply chain challenges to the war on talent stemming from The Great Resignation, finance teams are tasked with navigating a constantly changing landscape. Using the right tools for their organization’s unique needs can be the make-or-break factor to drive long-term success and differentiate from the competition.

But there is no one-size-fits-all solution. With so many options in the marketplace, how can you cut through the clutter to find the option that works best for your organization? Enter: The BARC Planning Survey 22, which leverages the feedback and experiences of your trusted peers in Corporate Finance to help you determine which solution best suits your organization’s unique needs.

More About BARC: The Business Application Research Center

The Business Application Research Center (BARC) is an industry analyst and consulting firm for business software. BARC analysts have supported companies through strategy, organization, architecture, and software evaluations for more than 20 years. For more information, visit www.barc-research.com

To support Corporate Finance teams, BARC covers the following critical areas:

- Business intelligence/analytics

- Data management

- Enterprise content management (ECM)

- Customer relationship management

- Enterprise resource planning (ERP)

BARC Planning Survey 22

The Planning Survey 22 is based on findings from the world’s largest and most comprehensive survey of planning software users, examining user feedback on planning processes and product selection. Conducted from November 2021 to February 2022, The Planning Survey compiles responses from 1,325 individuals analyzing 19 products or groups of products in detail.

Specifically, the survey examines user feedback on planning product selection and usage across 33 key performance indicators (KPIs) including

For more information on the survey, visit The BARC Survey website.

Laser-Focused on Customer Success

OneStream’s corporate mission is to deliver customer success, ensuring every customer is a reference – one success at a time. As we remain dedicated to this mission, we’re honored to earn a 100% recommendation score from all surveyed users for the second consecutive year.

Furthermore, OneStream earned 15 top rankings (see Figure 1) across four different peer groups. The company was measured across several different KPIs, including:

- Vendor support

- Price to value

- Workflow

- Functionality

- Competitive win rate

- Data integration

- Planning content

- Forecasting

- Reporting & analysis

Additionally, OneStream earned 33 leading positions across its four peer groups, including product satisfaction, customer satisfaction, flexibility, workflow, recommendation, simulation, cloud planning, and financial consolidation.

“OneStream’s outstanding performance in this year’s Planning Survey reinforces the vendor’s dedication to delivering 100% customer success. As a market-leading CPM platform, OneStream helps organizations improve employee productivity, increase the transparency of planning and improve the integration of planning with reporting and analysis. The platform’s comprehensive capabilities for financial consolidation and close, planning, budgeting and forecasting, reporting, analysis, and financial data quality management – all in a single application – makes OneStream a modern, future-proof solution for organizations seeking digital transformation,” said Dr. Christian Fuchs, Senior Vice-President and Head of Data & Analytics Research at BARC.

Learn More

OneStream is honored to receive standout results this year in The BARC Planning Survey. The report recognizes OneStream’s capabilities across financial close, consolidation, planning, and analysis as a best-in-class platform. The recognition is all the more meaningful as the rankings come directly from our committed customers and users across the globe.

To learn more about OneStream’s results, click here to download the full BARC Planning Survey 22.