Efficient account reconciliation is crucial for the financial health of businesses. To streamline this process, organizations turn to the best account reconciliation software. These tools offer a variety of features – such as automation, reporting and integrations – to ensure accurate and timely reconciliations. Here, we’ve curated the top five account reconciliation software solutions based on their features, customer reviews and industry recognition.

To compile this best of list, we’ve considered software that meets the following qualifications:

- Earns at least 4.0/5.0 stars on reputable review platforms such as Gartner Peer Insights.

- Offers comprehensive reconciliation features.

- Provides reliable customer support.

What Is Account Reconciliation Software?

Account reconciliation software plays a pivotal role in maintaining the accuracy and integrity of financial data within organizations. With a robust account reconciliation software, businesses can compare various financial records, such as bank statements and transaction logs, to identify discrepancies and ensure compliance with regulations.

Common features across account reconciliation software options include automation of reconciliation workflows, real-time syncing of transactions, customizable reporting and robust security measures. By leveraging these features, organizations can streamline reconciliation processes, minimize errors and make well-informed financial decisions.

Not sure what account reconciliation tool best suits your organization? You’re in the right place!

In the comparative analysis that follows, we’ll explore the features and functionalities of five leading account reconciliation software solutions: OneStream Software Account Reconciliation, BlackLine, Trintech Cadency, Oracle Account Reconciliation Cloud and Excel.

The Best Account Reconciliation Software

1. OneStream Software Account Reconciliation

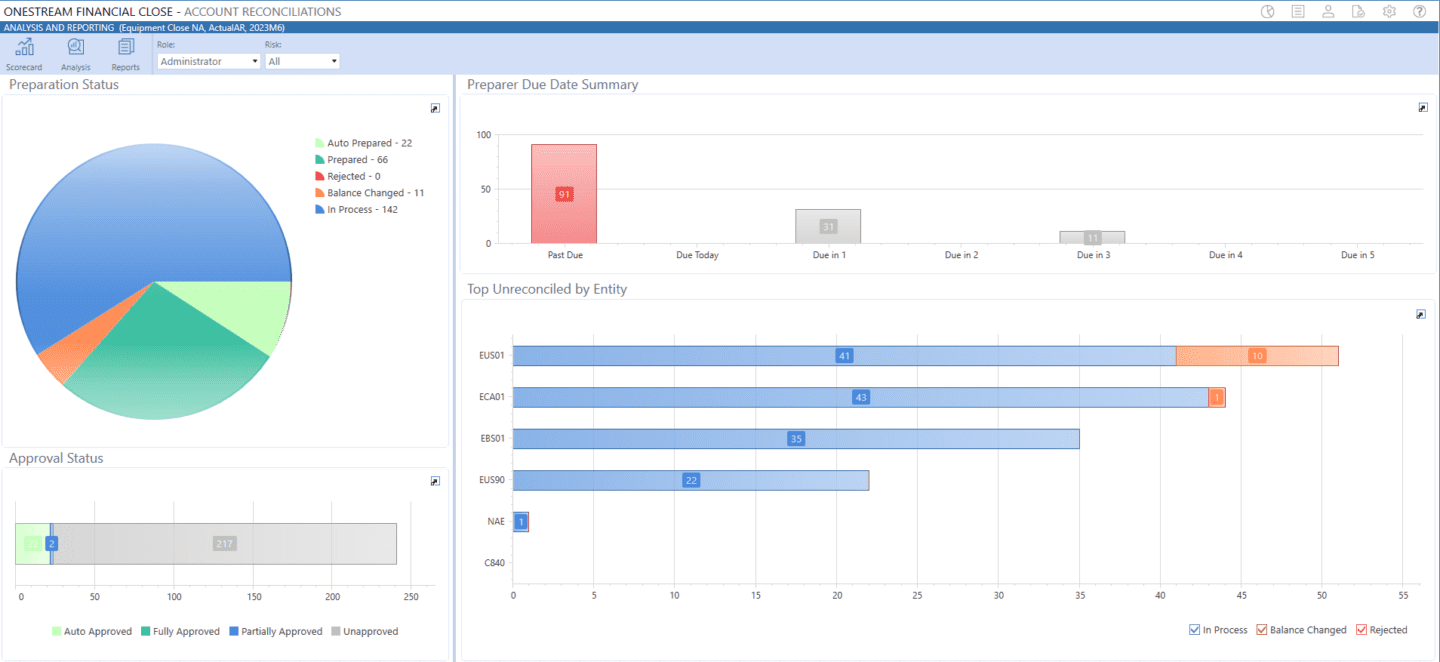

OneStream is a leading account reconciliation platform trusted by organizations worldwide. It offers a comprehensive platform that combines financial consolidation, planning, reporting and analysis in a unified solution. With robust reconciliation features, OneStream streamlines the reconciliation process, enabling organizations to achieve greater accuracy and efficiency.

Pros:

- Advanced automation capabilities streamline reconciliation workflows and reduce manual effort and errors in reconciliation.

- Unified platform eliminates data integrity gaps and provides a single source of truth and a unified experience across the Office of the CFO.

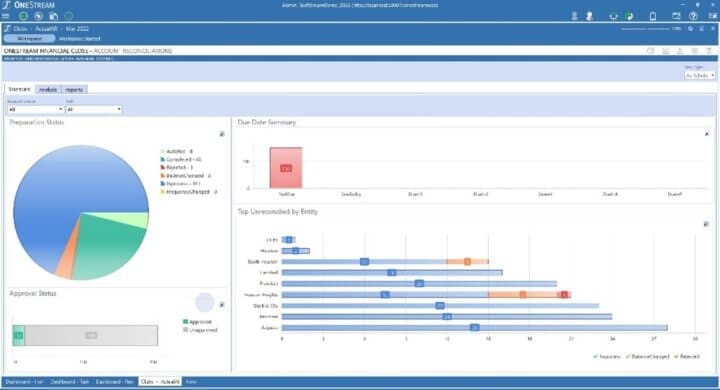

- Customizable dashboards provide real-time insights into financial performance.

- No cost for transactions in transaction matching.

- Seamless integrations with ERP systems ensure data consistency and accuracy and ability to drill-back/drill-through to the source data without leaving OneStream.

Cons:

- Implementation may require significant time and resources, depending on complexity.

- Pricing may be prohibitive for small businesses.

2. BlackLine

BlackLine offers a financial close solution with account reconciliation features. Designed for enterprise-level organizations, BlackLine streamlines reconciliation processes and enhances visibility and control over financial data.

Pros:

- Reconciliations can be set up in many different ways.

- Automation tools help reduce manual effort and errors in reconciliation.

- Audit trail functionality ensures transparency and accountability.

Cons:

- Higher cost may be prohibitive for smaller businesses.

- Implementation complexity may require significant resources.

- Deleting/removing tasks or duplicate reconciliation accounts is not always easy to do, and requires someone with quite a bit of knowledge of the admin side to walk someone through it.

- Solution isn’t a platform approach capable of covering the needs for the entire Office of the CFO.

3. Trintech Cadency

Trintech Cadency is a financial close and automation application that includes account reconciliation capabilities. It streamlines the financial close process – from account reconciliations to journal entries and offers reporting and analytics features.

Pros:

- Automation streamlines the financial close process, improving efficiency and accuracy.

- Reporting and analytics provide insights into financial performance and trends.

- Scalable application accommodates the needs of selective organizations of varying sizes.

Cons:

- Implementation may require significant time and resources.

- High cost may be prohibitive for smaller businesses.

- No ability to direct connect with drill-through to ERP data without third-party bots.

- No ability to see invoice level detail from ERP while in Cadency.

- Dashboards and workflows are static which leads to many workarounds or companies abandoning the use of their Balance Sheet Overview dashboard all together

4. Oracle Account Reconciliation Cloud Service

Oracle Account Reconciliation Cloud is a cloud-based reconciliation solution that helps organizations automate and streamline reconciliation processes. It offers features for matching, exception handling and reporting.

Pros:

- Automation capabilities streamline reconciliation workflows.

- Real-time data syncing to Oracle ERP ensures accuracy and timeliness.

- Security measures safeguard sensitive financial information.

Cons:

- High cost may be prohibitive for small businesses.

- Charges for transactions in transaction matching which is cost prohibitive in all sizes of companies.

- Implementation may require additional time and resources.

- Expertise in Oracle systems is required for optimal utilization.

- Charges for transactions in transaction matching which is cost prohibitive in all sizes of companies.

5. Excel®

Excel remains a popular tool for account reconciliation due to its familiarity and flexibility. While lacking some of the advanced features found in dedicated reconciliation software, Excel can still be an effective solution for small businesses with simpler reconciliation needs.

Pros:

- Familiar interface reduces the learning curve for users.

- High customization allows tailoring to specific reconciliation requirements.

- Microsoft Office users incur no additional costs.

Cons:

- Manual data entry increases the risk of errors.

- Limited scalability can’t meet the needs of growing organizations with complex reconciliation needs.

- Features lack the real-time collaboration capabilities found in other cloud-based solutions and is very time consuming with no ability to audit changes in cells and limited visibility and limited controls.

Conclusion

Choosing the best account reconciliation software is essential for businesses seeking to optimize their financial operations. Each of the Top 5 solutions compared in this post offers unique features and benefits, catering to the diverse needs of organizations across industries. To learn more about how these software solutions can streamline your reconciliation process, explore our comprehensive guide on financial software selection.

Learn More

To learn more about OneStream’s best-in-class account reconciliation solution, click here to check out our eBook on account reconciliations.

Download the eBookIntercompany reconciliations are a key step in the creation of consolidated financial statements. The objective is to ensure the consolidated financial statements present an accurate picture of revenues, expenses, assets, liabilities, and equity – ensuring they aren’t inflated due to transactions occurring between subsidiaries or companies in the group.

Several types of intercompany (IC) reconciliations must occur to ensure the accuracy of consolidated financial statements. Some examples are;

- Intercompany revenue and expenses: The intercompany elimination of the sale of goods or services from one entity to another within the enterprise or group. The related revenues, cost of goods sold, and profits must all be eliminated.

- Intercompany debt: The intercompany elimination of any loans made from one entity to another within the enterprise or group since they only result in offsetting notes payable and receivable, and offsetting interest expense and interest income.

- Intercompany stock ownership: The intercompany elimination of the parent company’s ownership interest in its subsidiaries, or ownership across subsidiaries.

For sophisticated organizations, intercompany transaction volume can be significant and difficult to identify. To ensure all this activity is identified, eliminated, and documented correctly for auditors requires a detailed system of controls. Managing and eliminating intercompany activity via Excel spreadsheets and email is not a recommended approach for large global enterprises with a significant number of IC transactions.

Not All Consolidation Software Is Equal

Most financial consolidation software packages provide core functionality to address requirements, such as currency translation, intercompany reconciliations, journal adjustments and partial ownership of entities. But not all packages are created equal – not all of them provide the same level of functionality in each area, and they may utilize different approaches to intercompany reconciliations.

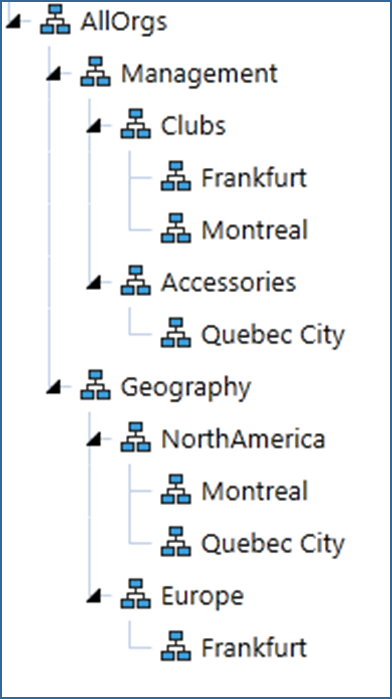

One example is the requirement to write custom business rules to consolidate data vs. using a consolidation hierarchy. Software packages that require custom business rules to consolidate data require more work to set up initially and to maintain going forward. The use of consolidation hierarchies, however, makes the system easier to configure and maintain for both single and multiple consolidation hierarchies.

Another example is the use of “elimination entities” vs. an intercompany dimension to identify and manage intercompany reconciliations across existing entities. Software packages that rely on creating multiple elimination entities to capture IC activity require more work to set up and maintain. The better approach is systems that leverage an IC dimension to identify, match and analyze intercompany transactions between existing entities and an elimination member to capture direct and indirect eliminations to make sure they never disappear as they eliminate up the consolidation hierarchy.

Also, when IC entities are used, users lose visibility into the individual intercompany balances and only see the totals in the IC entities. This makes it difficult to understand the where the out of balance condition resides, and what needs to be addressed and by what party. An IC dimension captures all party-counter-party balances and provides complete visibility into what is in and out of balance. This allows business users to identify and correct the discrepancies quickly and easily.

Another example is systems that actually store consolidated balances and intercompany elimination entries in a database vs. those that only consolidate and expose intercompany eliminations when reports are run.

Systems that store consolidated data and intercompany elimination entries in a database provide a big advantage when auditing financial statements – detailing the original source of the data, currency translations, eliminations and any other adjustments that resulted in the consolidated accounts. Systems that calculate and consolidate data only when reports are run are less trusted by auditors since the numbers can change and there is no record of what the number was previously.

And yet another approach is systems that duplicate base entities and their data vs. those that leverage a single shared base entity that can be rolled up in infinite hierarchies – for example, to consolidate based on a management view of the organization vs. a legal or statutory view. The former approach requires the administrator to identify IC relationships in each entity structure vs. setting this up and managing it in one place. The risk of this approach is that it requires the administrator to ensure the data which has been loaded multiple times is the same each time it is loaded.

If you’re considering a financial consolidation system, you should be asking these questions:

- How simple is it to set up basic intercompany reconciliations?

- Can the system handle complex eliminations?

- How robust is the reporting?

- Are eliminations handled at the first common parent or at some other level?

- How simple is a reorganization?

The OneStream Approach to Intercompany Reconciliations

The good news is, there is a better approach. Enterprise-class consolidation software applications provide intercompany eliminations that are powerful enough to handle sophisticated business needs yet allow for easy reconciliation.

The OneStream team has developed the most advanced financial consolidation, reporting and data quality solution in the market. This includes providing powerful intercompany elimination capabilities that can handle sophisticated business needs yet allow for easy reconciliation.

To improve and streamline the management of complex intercompany reconciliations, OneStream’s Intelligent Finance platform includes:

- Prebuilt and easily configurable dimensions

- Ability to handle the most sophisticated intercompany eliminations

- Ability to dynamically limit entry to avoid mistakes

- Multiple prebuilt and custom report options to help users proactively communicate and resolve issues

Combined with OneStream’s ability to drill down into transactional details and relational blending capabilities, OneStream provides an unmatched ability to see and manage intercompany activity.

With well-designed, pre-built and easily customizable dimensions, OneStream consolidates data based on organizational hierarchies and automatically eliminates intercompany transactions and balances at the first common parent – in all hierarchies (e.g., management, legal, tax, etc.) This is done without the creation of specific intercompany elimination rules or relationships within hierarchies, which makes the system much easier to maintain vs. other systems in the market.

Plus, OneStream has an incredibly powerful rules engine that will address any exceptions or more complex eliminations. Here are some of the common eliminations that require rules:

- Investments in subsidiaries

- Profit in inventory eliminations

- Certain statutory eliminations

The configuration of these eliminations allows for something very powerful if you ever have to reorganize the company structure. You can simply move the entities and reconsolidate – done!

The Secret Sauce in OneStream

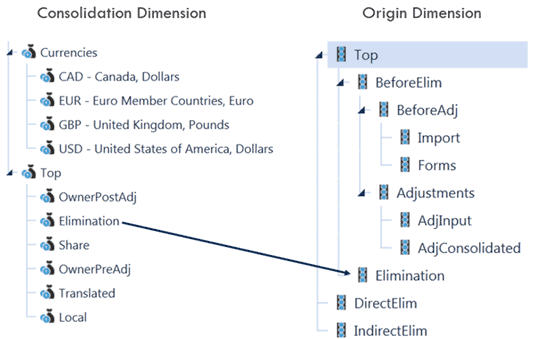

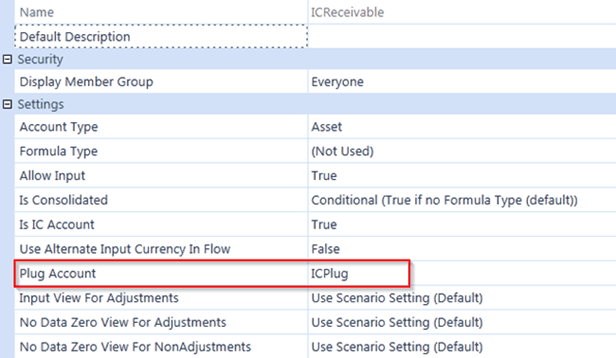

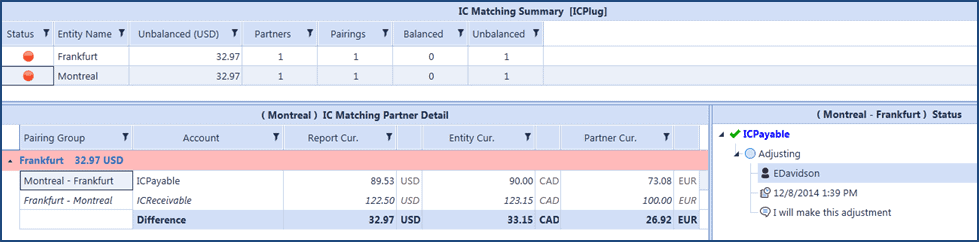

OneStream includes a number of pre-built dimensions that provide the power to handle sophisticated financial consolidation and elimination requirements. Specifically, OneStream uses the Account, the Intercompany and the Origin dimension to process IC matching and eliminations. This functionality does the following:

- Matches values between IC accounts that share a common suspense account (a.k.a. plug account)

- Automatically creates eliminations at the proper entity levels for each IC account

- Writes unresolved differences into the specified suspense account (plug account)

This functionality creates something called the “first common parent rule.” That means the eliminations are calculated at every consolidation point. Each intercompany has an “in and out” – for example, when you match a receivable and payable, they both offset through a common account.

Some consolidation applications will try to calculate IC eliminations at base entities. Others will require users to recreate eliminations for each rollup of entities. The most powerful applications all have “first common parent functionality.” It’s a basic requirement.

For each eliminating IC transaction, OneStream will create both sides of the entry that offsets the data value from the IC account and IC partner. That offsetting amount is written to the plug account. If the entries do in fact match, then the debit and credit for each side of the intercompany match would net to zero.

For example, if you had one entity with an IC payable and one with an IC receivable, when each entity reaches the common parent, when the elimination should take place, there’s an entry in the Origin dimension for that account that offsets the amount in the account that requires eliminating. At the same time, OneStream also writes a value for each offset it created, to the suspense account or plug account.

Setting this up is simple. Each IC account must be flagged for intercompany, each entity that is booking IC activity must be flagged and, finally, each combination of IC matching counts must have a corresponding plug account.

The IC dimension represents the IC Partners, which as an originating entity can post an entry against (for Intercompany flagged accounts). This is a reserved dimension that’s used by OneStream to track and eliminate intercompany details across the Account dimension and related User Defined dimensions.

Some features simplify the process out of the box – for example, the ability to limit the intercompany partner so that they must either enter a partner or not choose themselves.

While the settings address most basic eliminations, OneStream has an incredibly powerful rules engine that will address any exceptions or more complex eliminations. Here are some of the common eliminations that require rules:

- Investments in subsidiaries

- Profit in inventory eliminations

- Certain statutory eliminations

These are often not supported at all in other consolidation applications.

The configuration of these eliminations allows for something very powerful if you ever have to reorganize the company structure. You can simply move the entities and reconsolidate – done! Any system that’s using journals or manual entries or that doesn’t have shared members – will require significant work to accomplish this type of change.

Reporting on Intercompany Activity

In addition to the capabilities described above, there are some great reports that are ready to view “right out of the box” with OneStream. For example, OneStream has a focused intercompany elimination “grid” that appears in the workflow. This allows users to comment and communicate with other users regarding intercompany balances.

The power of these IC system reports is that they ignore security for the intercompany accounts. This feature helps get users to take ownership of the intercompany matching process, by allowing each intercompany trading partner to see matching balances across entities, and in multiple currencies.

The advanced architectural design of OneStream, combined with its reporting and the ability for users to drill down into transactional details, provides an unmatched ability to see and resolve intercompany balances and rapidly close the books at period-end.

Learn More

Are you considering a financial consolidation and reporting platform to help your company manage complex intercompany activity? Check out our video on automating intercompany. To learn how one of our customers is benefiting from these advanced capabilities, check out the Alterra Mountain Company case study.

If you’re ready to learn more about the power of an Intelligent Finance platform, contact us today to take a deeper look at the OneStream approach to handling intercompany reconciliations.

Learn MoreIn order to stay lean and mean in today’s challenging economic environment, Finance teams need to invest in and leverage technology that can automate tedious processes, increase efficiency, and free up Finance staff to focus on more value-added activities.

At OneStream’s Splash user conference in San Antonio, I had a chance to interview Jon Goldin, Director of Accounting and Financial Systems at the mortgage insurance division of Arch Capital Group to learn about their journey with OneStream. Read on to learn how Arch MI implemented OneStream for financial consolidation and reporting, then leveraged the Account Reconciliations solution from the OneStream MarketPlace to replace Blackline, reduce costs, streamline account reconciliations, and improve the productivity of its Finance team

Streamlining Financial Consolidations with OneStream

Arch Capital Group had implemented OneStream for financial consolidation and reporting, replacing an outdated legacy application. The mortgage insurance division (Arch MI) was looking for a replacement for Oracle Essbase for financial reporting, which was being sunset. After a failed POC with an Oracle Cloud Solution, Arch MI evaluated OneStream and found that it could easily address their requirements.

Their initial need was for financial consolidation and reporting, providing the ability to integrate and consolidate data from their two ERPs, and provide users the ability to slice and dice financial information to support their analytical needs through an intuitive Excel interface.

Arch MI has two different ERP systems feeding into OneStream through direct connections that can automatically pull data into OneStream at any point in time during the close process. Each of the business segments loads their data separately, leveraging OneStream’s Extensible Dimensionality® to capture the level of detail need for segment-level reporting and analysis, while meeting Arch Capital Group’s corporate reporting requirements.

With OneStream, the financial close and consolidation process improved dramatically, and everyone is getting the level of information required for their reporting requirements.

Replacing Blackline for Account Reconciliations

Once OneStream was up and running for financial consolidation and reporting, Arch MI decided to evaluate the Account Reconciliations solution from the OneStream MarketPlace as a potential replacement for Blackline.

According to Jon Goldin, Director of Accounting and Financial Systems “This is something that I like to tout, and I challenge any other OneStream customer to try to beat. But from design up and through go-live, we were able to convert our Blackline information into OneStream and go live with it within two weeks.”

Mr. Goldin continued, “After those two weeks we went live with OneStream for account reconciliations, and it took very little time train people to use the tool. Since they were already familiar with Blackline, there was very little of a learning curve for them to go through and we were very impressed with its capabilities. With its audit tracing, its ability to extract data for all of our SOX requirements, and when we had substantive testing, that we could be able to generate the zip files that had all the information there – your certifications, your timestamps, your supporting documentation – all in one simple zip file that you can send to anybody upon request, even your external auditors.”

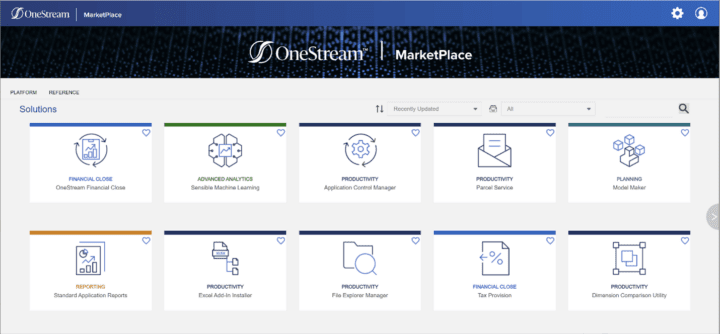

Leveraging the Power of the OneStream MarketPlace

Arch MI has become a true believer in the power of the OneStream MarketPlace. Said Mr. Goldin, “I was very pleasantly surprised with the ease and capability that a OneStream system admin has to go to the MarketPlace and look at all the 50 plus different solutions that are out there.”

Mr. Goldin continued, “And if you’re curious about a solution you can click into it, you can get a good overview of what that solution has, its capabilities, what it does. You have some screenshots that give you a visualization of what that solution can do. And if you’re further curious to see how something actually works in your dev environment, you can download the solution from a copy of your actual production application and configure it. It’s really very simple steps.”

Benefits of OneStream

Arch MI is seeing a lot of value from having one system, one source of the truth for its users for all of their financial information. User adoption has been rapid based on the training that’s available and the intuitiveness of the platform. Said Mr. Goldin, “OneStream is very intuitive as far as how it looks and how it operates. It’s user friendly and that’s important because a lot of users vary in skill as far as working with applications.”

With their transition from Blackline to OneStream for account reconciliations, Arch MI had a realized savings of $60,000 a year in licensing fees. According to Mr. Goldin, “That was huge – that was a big win.” The company has also seen tremendous efficiency improvements with the OneStream Account Reconciliations solution.

Mr. Goldin commented, “We have been targeting account reconciliations for systemic automation for certifications end to end. Today 85% of our reconciliations are fully automated end to end. My manager was in disbelief and wanted me to pull all the details to show them that it was truly 85% of our records were automated. Our goal is to get above 90%, and I’m trying to shoot for 100%.”

Based on that automation improvement, Arch MI has been able to save at least 1800 hours of time, per year, by their preparers and approvers in the account reconciliations process. Said Mr. Goldin, “That doesn’t quantify to dollars savings, but more importantly, that time productivity savings can now be put in other areas. So by taking out the redundancies, automating processes, now we’re taking our compilation and manual efforts and we’re reducing that.”

He continued, “And what we’re doing is giving the business back the opportunity to increase their analytical needs, which is so important, because we’re all being pressed to be able to close quicker, to be able to analyze our information faster, to get that information quicker to our executives for us to make those best decisions going forward.”

Learn More

To learn more, watch the Arch Capital Group video testimonial and contact OneStream if your organization is ready to conquer the complexities of account reconciliations, align it with financial reporting, and provide more time for your Finance team to spend more time on value-added analysis so they can lead at speed!

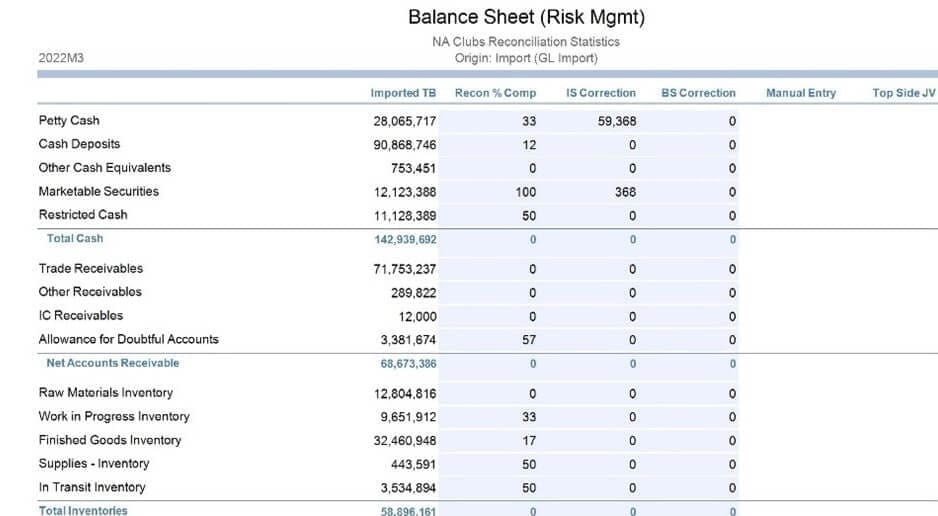

In the typical financial period, account reconciliations are performed after the close. Accountants first review each account in the financial statements and then verify the accuracy of each balance listed. This process often involves comparing the financial statement balance to another source of information – for example, comparing the balance for the Cash account to an external bank statement. Other examples of critical accounts requiring reconciliation include Accounts Payable (compared to the AP sub-ledger) or Accounts receivable (compared to the AR sub-ledger).

Account reconciliations are primarily performed to ensure consistency and accuracy in financial reporting. And for publicly held companies that need to report financial results to external stakeholders, account reconciliations are a key internal control, one where detailed audit trails need to be available to back up all account balances.

What Happens When Account Reconciliations Aren’t Aligned?

For many organisations, the account reconciliations process not only involves manual, time-consuming work but also causes significant delays in the financial close process. Why? Well, most medium- to large-sized global companies must reconcile hundreds to thousands of accounts during the quarter-end or month-end close across the parent company and various subsidiaries. Something else also relates to this process: the need to reconcile data between multiple software applications used to run the business. The more systems, the more reconciliations required.

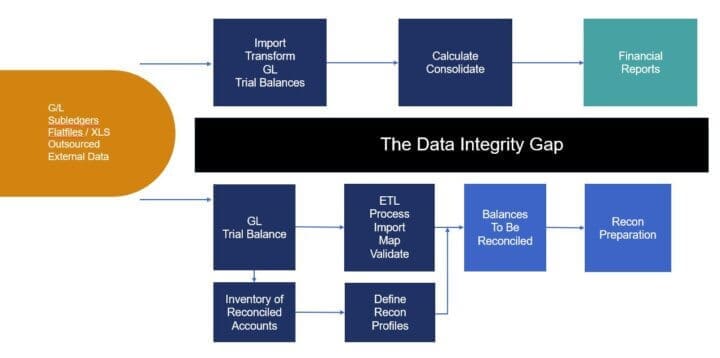

Leading Finance departments are attempting to eliminate the risks of manual processes. Those risks can include missing or lost reconciliations, unreconciled accounts, improper use of roll-forwards, and insufficient justification or documentation — and eliminating them helps protect organisations against costly mistakes. Many organisations have therefore adopted standalone account reconciliations software applications to deal with these issues.

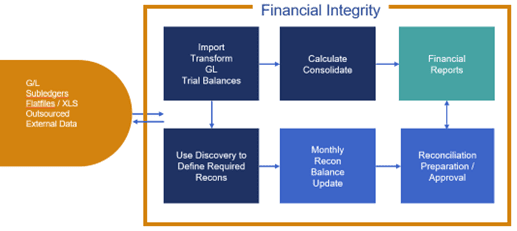

However, that solution is not always the right answer. Why? With standalone account reconciliations applications, a ‘data integrity gap’ (see Figure 1) exists between the account reconciliations and the financial statements. When accounts are reconciled in a system separate from the financial reporting process, out-of-sync data easily occurs, causing delays in the close process and issues with data integrity.

Figure 1: Standalone Account Reconciliation Applications

Why Align Account Reconciliations with Financial Reporting?

Aligning account reconciliations and financial reporting ultimately improves the integrity of financial results and gives Finance and stakeholders increased confidence. But even beyond those benefits, significant time and cost benefits can be realized. Increased levels of visibility and control can also be gained.

Not yet convinced of the benefits? Here are 5 key reasons to align account reconciliations with financial reporting:

- Eliminate duplicate data loads: Collapsing multiple feeds of source data into one single direct connection and then re-purposing the data for multiple processes eliminates duplicate data loads. Finance teams can load GL trial balances once into a single system for financial consolidations, reporting and account reconciliations – the data will then always be synchronised, and the close process will be faster and more efficient. Users get an immediate reconciliation status check alert if a previously reconciled balance has changed due to an updated trial balance import.

- Save time – begin recs before the close completes: Users can begin account reconciliations as soon as trial balances are submitted – no more waiting for the corporate close to complete. The data collection should be facilitated with workflows guiding users through their tasks. Typically, users can upload trial balances on their own vs. sending them to corporate, which speeds the process and ensures better data quality.

- Deliver risk management reporting on the balance sheet: Users should have access to an immediate view (see Figure 2) of the status of all high-risk reconciliations as they relate to the financial reports. As a result, users can easily understand the quality score of financial reports, gain increased confidence in their results and achieve true risk management.

- Benefit from real-time alerts – financial signaling: Automated alerts for changes to reconciled account balance statuses (see Figure 3) ensure confidence that reports are always aligned with reconciliations. With weekly or daily insights into the trends and signals inherent in reconciliations, users can immediately take action to proactively impact the results and limit any delays or errors.

- Gain line of sight – drill from reports to reconciliations: The ability to drill and audit from reports to supporting details provides a single ‘data value chain’. Organisations can seamlessly move through the reconciliation and attestation processes, to management reporting, and finally to consolidation and financial reporting – all with a single line of sight back to transactions. Importantly, users must be able to drill from the balance sheet directly to the details of the account reconciliations.

OneStream Truly Aligns Account Reconciliations with Financial Reporting

The key to more effective account reconciliations lies in not only automating the process but also fully unifying it with the financial close and reporting. If GL trial balances are loaded into a single system for financial consolidation, reporting, and account reconciliations, then the data will always be synchronised. The close process will also be faster and more efficient. Importantly, one single trial balance load can, in parallel, feed all reporting processes – including account reconciliations – from the same source. That ability reduces the risk of differences and speeds the close.

If the process is fully automated and unified, then the benefits of leveraging the same trial balances across the close and compliance processes become very clear. How? Well, data often changes constantly in the close process due to eliminations and other adjustments. Such updates, in an automated system, continue to get reflected across processes without having to physically move data between separate connected Finance solutions. And that automation eliminates the data integrity gap (see Figure 4).

OneStream is the ONLY solution that can provide a link from reported balances to reconciled accounts. Users can instantly drill to reconciliation from financial reports in one unified system. This capability provides 100% visibility from reports to data sources – meaning all financial and operational data is clearly visible and easily accessible.

Delivering 100% Customer Success

The capability to unify financial close processes in parallel and without complexity gives OneStream the ability to replace multiple legacy or connected Finance applications and spreadsheets. And it’s a big opportunity for organisations to drive total cost-of-ownership savings and generate return from the investment in OneStream.

Below are a few examples of customers we have worked with and the benefits they’ve achieved with OneStream.

TerraForm Power decided to take a new “cloud first” approach to their software implementation strategy. Their system landscape included multiple legacy applications which were cumbersome and created challenges for TerraForm Power’s finance and IT teams. There was also a heavy reliance on Excel®, which lacked audit trails and posed risks for the company.

After implementing OneStream, the realisation of benefits has been significant. Having standardised reporting has helped TerraForm Power to close the books quicker and more accurately while getting through audits more reliably. Interactions across the team are improved with a single version of the truth. By bringing account reconciliations into OneStream the number of accounts has reduced from 700 to 150. As a replacement to Blackline, TerraForm Power is now saving roughly $100K per year on licensing.

West Bend Mutual Insurance (WBMI) previously used Microsoft Excel® spreadsheets as a data collection and reporting tool for their month-end close process. Allocations were performed in a different software tool that had size processing constraints. Inconsistencies in data collection via Excel® spreadsheets created a labour-intensive and error-prone close process. Further, the transparency by operations to financial detail was limited.

WBMI has experienced many benefits from implementing the unified OneStream™ solution. The largest benefit comes in the form of a consistent, stable allocation process eliminating the tedious time it took to do reconciliations. The combined time savings for these activities totals more than two days per month. The two days’ savings were the result of reduced time waiting for data loads and refreshing reports throughout the month.

Like TerraForm Power and WBMI, your organisation can also achieve a new level of risk, conquer complexity and improve the integrity of financial results by aligning account reconciliations with financial reporting. How? Replace your spreadsheets or standalone accounts reconciliation software solutions with a unified CPM software platform.

Learn More

Want to learn more about how organisations are successfully adopting modern, cloud-based solutions for financial close, consolidation, and reporting? Click here to access OneStream’s ‘Conquering Complexity in the Financial Close’ whitepaper.

Well 2020 was a year we all won’t soon forget. While it was a year of disruption for many, the OneStream engineering teams were busy delivering a steady stream of innovations to the OneStream Platform and MarketPlace solutions. Here’s a quick recap of what new capabilities were delivered in 2020 and how they are helping our customers conquer new challenges and lead their organizations at the speed of business.

Having an efficient financial close process is essential to producing timely results to internal and external stakeholders. And thanks to increasing use of technology, the financial close process continues to improve. According to the 2019 Office of Finance Benchmark research by Ventana Research, 46 percent of companies close their monthly books within four business days compared to 29 percent in their 2014 study. Despite the improvement, Ventana Research still concludes that most organizations continue to be laggards in adopting technology that measurably improves effectiveness.

Even the smallest numbers in a balance sheet can have a huge impact on business. And properly analyzing financial statements is crucial when decisions are to be made. As the biggest buyer of petroleum coke in the world, Oxbow Carbon is a leading industrial commodity logistics company for steel, aluminum and other industrial manufacturing.

When engaging in M&A activity, it is imperative that organizations are able to easily adapt to changing business conditions. However, it is common for the office of finance to get derailed while integrating the financial systems and operational process of a newly acquired business. And this is a challenge that was all too familiar for Prince Corporation.

Finance leaders are continually striving for a quicker month-end close. But when organizations use bulky spreadsheets for financial close, consolidation, and reporting they are only creating additional stress on accounting teams. As West Bend Mutual Insurance (WBMI) learned, an Excel-based financial reporting process is tedious to manage, inflexible, and prone to manual errors. That’s why, to keep their finance teams from late nights of reconciling and posting journal entries, WBMI made the switch to a modern and unified corporate performance management (CPM) platform. The result has been a more efficient financial statement preparation process, a shorter month-end close, and a less stressed finance team. Let’s take a look at their unique OneStream story.

Account reconciliations is the process of ensuring financial statement account balances are correct at the end of an accounting period. It’s a process that uses two sets of records to ensure figures are correct and in agreement. And if they are not in agreement, making necessary adjustments or identifying and explaining differences.

Modernizing finance across a global organization requires a high amount of focus on unifying the data. To create the most effective financial consolidation and reporting process, you must bridge the gap between ERPs, various operational systems, and corporate performance management (CPM) software. Increasingly more organizations with fragmented ERP systems are taking the leap from fragmented spreadsheets and legacy CPM products to a unified CPM platform that supports faster, more informed decision-making. Read on to discover how a global supplier of chemical and water treatments discovered the path to modern finance with OneStream Cloud.

As a former accountant, I spent several years of my life back in the 1980’s working at a multi-national company where we spent 3 weeks of every month collecting trial balances from remote locations, consolidating the financial results, and generating reports for management and our parent company. Of course, back then we were working with arcane technology – including faxed trial balances, Lotus 123 spreadsheets to handle currency conversions, and a mainframe GL for financial consolidation and reporting. Unfortunately, this lengthy process left only a couple of days per month for higher-value work, then it was back into another month-end close. I felt like the proverbial hamster on the wheel.