The life of FP&A professionals doesn’t have to mean collating reports and files from different sources to get the right data and information. In fact, FP&A should move away from spending time on data integration, cleansing and harmonization tasks and instead spend more time on applying the team’s knowledge to build the right insights to make timely decisions with agility. The latter drives business performance.

A day in the life of an FP&A team working with fragmented systems and a look under the hood of Enterprise Performance Management (EPM) systems both underscore why the integrated data that comes with Intelligent Finance helps teams elevate their game.

Monday Again! A Day in the Life of a Finance Planning and Analysis Team

It’s 9:00 am on Monday. Loria di Frangelico – a fictional character profiling a diligent FP&A leader of a large corporation – reviews the week’s goals and prepares the actions and schedule for the coming days. Trying to get the 3+9 Forecast with actuals that includes the previous week’s data has always been a hassle. Loria calls Joe Murphy, the FP&A Analyst: “Joe, I’d love to get the figures earlier this time, on Wednesday.”

Joe responds: “Of course, Loria, you know we get the product line information automatically from the ERP with little manual enrichment. But for the services lines, we depend on getting the data files extracted by IT. Let me reach out to them now to get that going!”

On Wednesday, Loria follows up with Joe, and he responds: “The IT folks had a data integration issue. They’re still cleansing the data and reviewing the mappings since the data transfer didn’t go as expected. However, I can get you the product lines information now.”

Thursday arrives, and Joe finally provides a complete forecast consolidated on a spreadsheet. Loria not only wishes she could have gotten the information earlier in the week but also expects the information to be accurate. Yet Joe’s file shows a $250K variance in the service line! Joe is requesting clarifications from the field service department, but Loria gave up the fight with IT a long time ago. With no time left, she’ll need to just report the inaccurate figures to her boss and take the criticism that will surely follow.

A Look under the Hood

Arguably, the narrative above isn’t a one-off story for FP&A teams since getting good information on time is often a drag. Why? Well, the analyst is almost always juggling miscellaneous data sets, files and systems. This struggle occurs in almost every organization with complex product portfolios and diverse business models. But a look under the hood that shelters the EPM activities of many organizations offers some insights on what can go wrong:

- The existing EPM solution landscape is fragmented with different tools and showing different levels of granularity into the data: Oracle EssBase, SAP BPC, Hyperion Financial Management (HFM), Hyperion Planning, ERP modules, spreadsheets, etc.

- Custom-build applications and system add-ons have been layered upon this patchwork architecture. That approach resolves specific business needs but slows down the performance and makes the overall EPM architecture difficult to maintain and scale.

- System and data integration is too often manual, and the data mappings are sometimes faulty – creating heavy dependencies with scarce technical resources. And that environment makes it impossible for IT to commit to a delivery schedule.

- Data under these circumstances is compromised, making it less available, less credible or both. Poor data then feeds the information and insights that crafts (equally poor) strategic decision-making.

If the goal is to provide best-in-class products and services, why should an organization live with underperforming processes and archaic technology? The answer? It shouldn’t. Getting the right data, at the right time should be an instant process that makes data available to the FP&A analyst whenever required. A unified EPM platform minimizes system and data integration needs and empowers the FP&A team to provide better insights and more agility to critical decision making.

A Better Performance: Breaking Away from the EPM Toolkit Chaos

FP&A teams at organizations with under-performing processes and out of date technology face a reality much like Joe Murphy in the narrative above – drowning in an ocean of reports, files and spreadsheets. Such professionals accept their fate because they don’t understand the root cause of this chaos, let alone imagine a better way.

One of the main issues – the EPM Toolkit chaos (i.e., the complex IT infrastructure that supports these essential process) – lies buried six feet under, unseen by them and those who most need to see it.

Organizational and process changes circumvent this complex infrastructure but don’t really try to fix it – yet doing so is a necessity for modern FP&A teams. After all, getting the right system setup ought to be a priority for organizations that aspire to be quicker at reacting to new market dynamics.

Today, organizations can replace complex EPM infrastructures with one single platform.

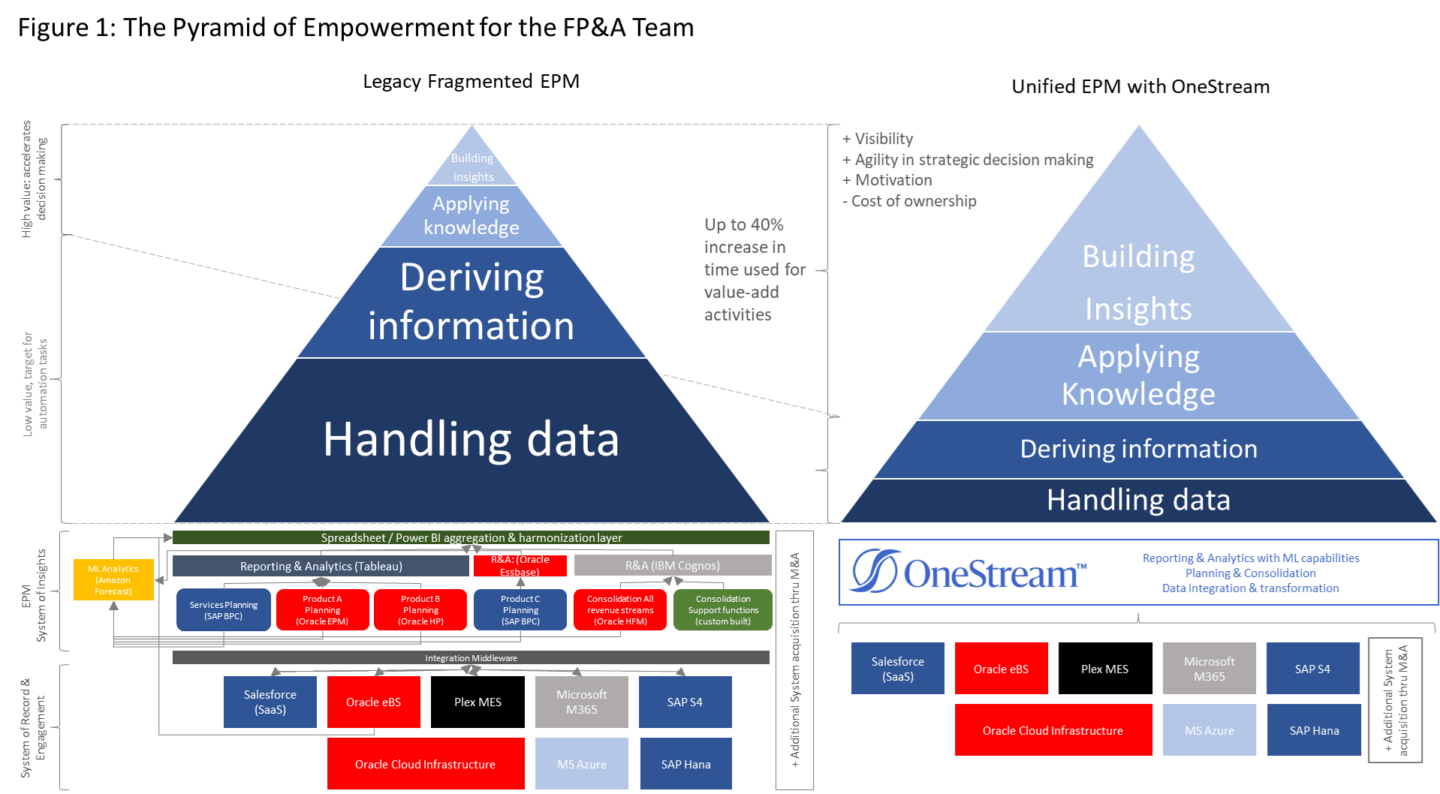

Figure 1 (The Pyramid of Empowerment for the FP&A Team) shows how such an integrated system is possible and the benefits that flow through to the daily job of planners and analysts. By having one platform that directly connects to the systems of record (ERP/MES) and systems of engagement (CRM), the platform can natively load and transform the data just once and supports all the planning and consolidation requirements of modern organizations, including the ability to support M&A activities without adding complexity.

The result is impressive: analysts and planners are empowered to apply their knowledge and expertise to build sensible insights. And the business benefits for the organization are ample:

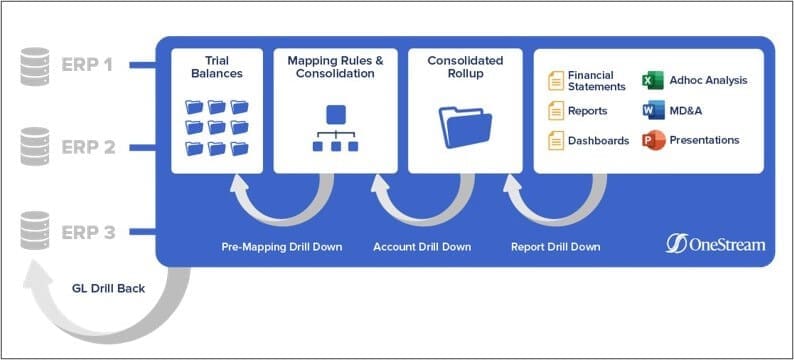

- Enhanced visibility to what’s happening with minimal data integration. Financial and operational data is relatable because it lives in the same place. In fact, the platform supplies with one version of the truth for planners and analysts from any business unit or function and it allows to inquiry the source systems for additional detail (see Figure 2).

- More agility in strategic decision-making. Data handling friction is removed, and with applied financial intelligence and machine-learning capabilities native to the platform, high-quality information is made available to planners, analysts and business leaders.

- Motivation to planners and analysts when they can spend more time on intellectual, forward-looking activity. As a result, they quickly realize they can apply their knowledge to shape the course of business and finance.

- Lower cost of ownership by replacing limited solutions with one platform. The low-hanging fruit is getting rid of all that infrastructure, but the value comes when IT resources are freed up to adopt new technologies or support other projects.

Contrarily, those organizations that choose to stay with silos of planning and analysis tools and models are facing the hidden costs of a fragmented EPM landscape.

Conclusion

The need for data integration isn’t going away for FP&A teams – but the process can be greatly simplified. Doing so just requires adopting a well-reasoned strategy and investing in an EPM solution that reduces the dependence of systems and data-handling activities to give more time back to analysts and planners. Organizations with scattered and complex EPM landscapes should consider investing in a solution with embedded capabilities to handle data and information from the source systems. When choosing a solution, organizations should also consider the following key considerations (among others):

- Offers a one-stop shop for data management to simplify the collection, consolidation, transformation and certification of data coming from various disparate systems and sources.

- Secures the timeliness and completeness of data, both financial and operational.

- Reduces costs of ownership by unifying all planning processes into one.

- Secures compliance, internal controls and audit requirements because the data can be traced back to the source system or file.

- Includes purpose-built financial intelligence capabilities in the platform to improve confidence in forecasting and planning activities.

A solution of this kind increases transparency in the information and takes planning, analysis and strategic decision-making to the highest level.

At OneStream, we call this Intelligent Finance.

Learn More

Want to learn more about industry-leading data integration practices for EPM? Click here to see how OneStream can help you take things to the next level.

Get Started With a Personal Demo